Randall Morck is Professor of Finance at the University of Alberta. This post is based on an article authored by Professor Morck and Gloria Tian, Assistant Professor of Finance at the University of Lethbridge.

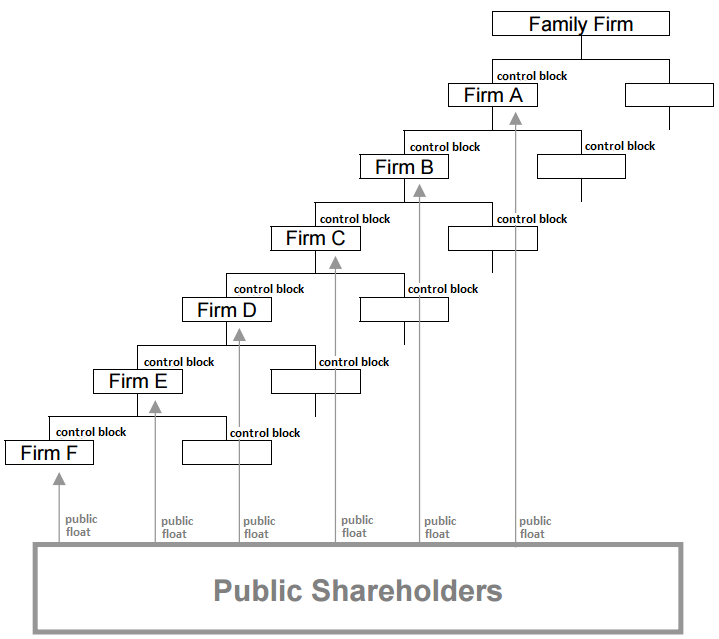

Outside the United States, seemingly independent listed firms can be controlled as a unit via pyramiding. Chart 1 illustrates: An apex firm, often a family firm, holds enough equity in each subsidiary to control its shareholder meeting, letting public shareholders own the rest (its public float). Because public shareholders rarely vote, the Canada Business Corporations Act infers control from 20% stakes, but recognizes de facto control from smaller stakes. Subsidiaries repeat this, as do their subsidiaries, their subsidiaries’ subsidiaries, and so on ad valorem. A large Canadian pyramid contained over 500 listed and unlisted firms in 16 tiers of subsidiaries at its peak around 1990.

Chart 1. A stylized pyramidal business group

Pyramidal groups are controversial because of corporate governance concerns (firms are controlled by people who own shares only very indirectly) and political economy concerns (pyramids let wealthy individuals or families control corporate empires vastly larger than their wealth). The US effectively deters pyramiding by taxing intercorporate dividends, regulating holding companies, and proscribing public utilities pyramids. Canada does not.

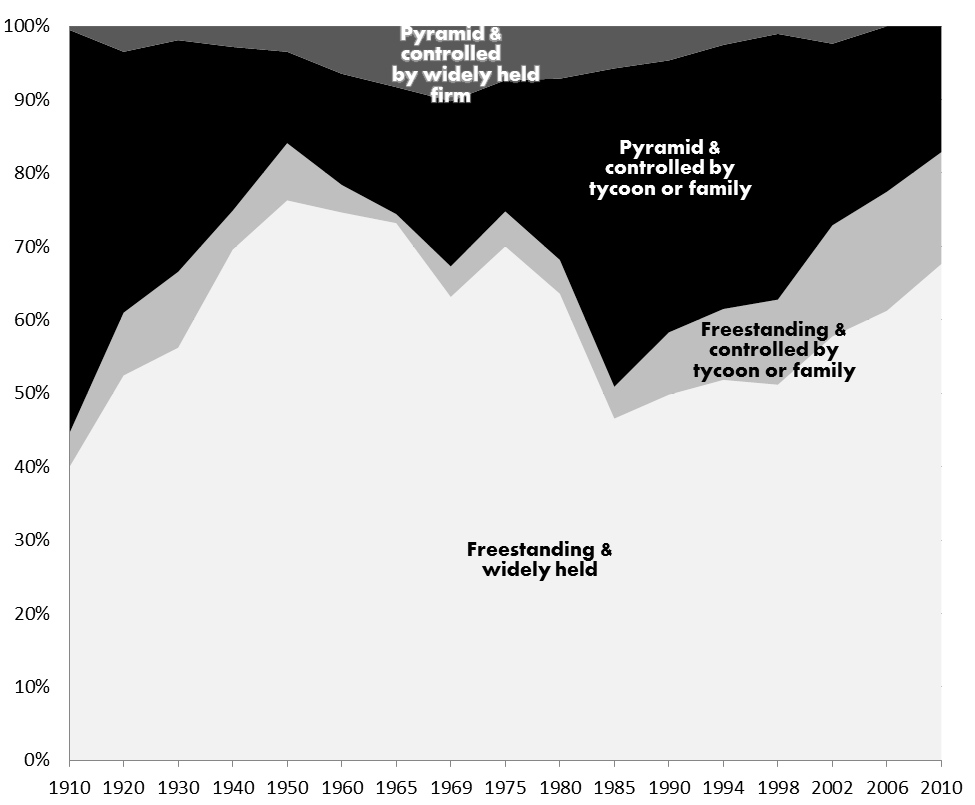

In our paper, Business Groups in Canada: Their Rise and Fall, and Rise and Fall Again, we examine the changing importance of pyramidal business groups in Canada. Canadian pyramidal business groups declined, rose, and declined again over the past century. Chart 2 shows that, in 1910, business group firms were roughly as important as free-standing widely held firms among listed firms. By mid-century, freestanding widely held firms predominated. In the 1970s, business groups resurged, regaining their 1910 prominence. They declined again in the 1990s and, by 2010, widely held and freestanding firms again predominated.

Chart 2. Size-weighted importance of pyramid membership versus freestanding status, and of family control versus dispersed ownership, among large private-sector domestically-owned firms, 1910 to 2010

The predominance of pyramidal business groups early in the 20th century accords with such groups arising naturally during rapid catch-up industrialization. Developing economies’ markets and governments are often dysfunctional, rendering both market forces and central planning inadequate to coordinating the technological upgrading and massive capital investment across multiple sectors needed industrialize an agricultural economy. Large, diversified pyramidal business groups are arguably better than either. They let one shareholder controlling vast risk-tolerant public equity capital to assemble and control a constellation of firms spanning multiple industries. The controlling shareholder can deter group firms from cheating each other, discipline managers, and deal with corrupt officials from a position of strength. Freestanding firms are vulnerable other firms’ deceptions, and hold-up strategies, their own managers’ self-interest, and extortion by corrupt officials. Pyramiding’s downside form is self-interested behavior by the controlling shareholder, but this may be the lesser evil in this phase of development.

After catch-up development ends, the downsides of pyramiding may well outweigh the advantages. Groups’ powerful controlling shareholders, foreseeing this, may use their political and economic power to stall development at the point where that power peaks. This may explain the Middle Income Trap puzzle: why are so many countries always developing, but never developed?

Canadian business groups in 1910 were widely industrially diversified, and often vertically integrated too. Many introduced new state-of-the art technologies. Most were controlled by wealthy tycoons or their heirs, though a few had widely held apex firms. After catch-up phase development ended (ca. World War I), these groups declined. Perhaps, having served their economic purpose, they made themselves obsolete.

The second wave of pyramiding corresponds to Canada’s transformation from a liberal democracy into a social democracy. The 1970s resurgence of business groups coincides with a succession of governments led by Pierre Trudeau, who met a surge of Quebecois nationalism with federal bilingualism and biculturalism policies designed to make Canada “more French”. French economic policy at the time was dirigisme: interventionist industrial policies allocating subsidies to select firms and intensely regulating whole industries. These became Canadian policies too. Nationalism, especially “Canadian control” of natural resources also grew politically salient, and regulations and subsidies favored Canadian controlled firms in those sectors.

From 1970 to 1985, pyramidal business groups expanded rapidly and regained their 1910 predominance. These were generally new groups, not resurrections from the first wave. We posit that the era’s highly interventionist governments made political connections more valuable, and that business groups had economies of scale and scope in political rent seeking (Morck and Yeung 2004). Canadian business groups expanded by acquiring foreign-controlled natural resources firms, which then gained subsidies, but also expanded far beyond those sectors. Their structures, disclosed since the mid-1970s, were multi-layered pyramids, as in Chart 1.

Second wave business groups were not especially vertically integrated, nor did they introduce new technologies of great importance. Rather, their structures suggest diversification to reduce risk. Member firms of the Bronfman and Reichmann groups, the era’s largest pyramids, grew highly levered, perhaps expecting diversification to reduce risk enough to make high debt sustainable. In fact, both groups collapsed when their key firms failed to make interest payments in the 1990s, amid a recession featuring an unprecedented interest rate spike (the prime lending rate for businesses reached 14% and the real rate exceeded 10%). The Canadian Pacific group reorganized itself into freestanding one-industry firms. The BCE group broke up amid the failure of Nortel, a major member firm. The Hollinger group collapsed; controlling shareholder, Conrad Black, imprisoned in the United States for obstruction of justice. The pyramids that survived this episode, the Desmarais and Weston groups, were then smaller and less levered, though both subsequently diversified and levered up.

From the 1990s on, Anglo-Saxon political economy concepts regained standing. Industrial policies were scrapped, and liberal economic policies took their place. We posit that business groups’ political rent-seeking advantages ebbed in this environment. The divested debris of defunct groups (and privatized state-owned enterprises) expanded the ranks of freestanding firms.

The full paper is available for download here.

Print

Print