Annette Nazareth is a partner in the Financial Institutions Group at Davis Polk & Wardwell LLP, and a former commissioner at the U.S. Securities and Exchange Commission; Margaret E. Tahyar is a partner in the Financial Institutions Group at Davis Polk & Wardwell LLP. The following post is based on the introduction to a Davis Polk visual memorandum; the full publication, including visuals, tables, and timelines, is available here. Related research from the Program on Corporate Governance includes Regulating Bankers’ Pay by Lucian Bebchuk and Holger Spamann (discussed on the Forum here); The Wages of Failure: Executive Compensation at Bear Stearns and Lehman 2000-2008 by Lucian Bebchuk, Alma Cohen, and Holger Spamann (discussed on the Forum here); How to Fix Bankers’ Pay by Lucian Bebchuk (discussed on the Forum here); and Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried.

- Four of the six Agencies have jointly issued a proposed rule implementing Dodd-Frank Act Section 956 regarding incentive compensation paid by covered financial institutions. An earlier version of the rule was proposed in 2011.

- A joint rule implies that interpretations and supervisory guidance will happen through an interagency working group.

- Joint FAQs may develop, as has been the practice with the Volcker Rule, which involves five Agencies (Federal Reserve, FDIC, OCC, SEC and CFTC).

- The proposed rule prohibits, for covered persons at covered institutions, incentive compensation that encourages inappropriate risks by providing excessive compensation or that could lead to material financial loss.

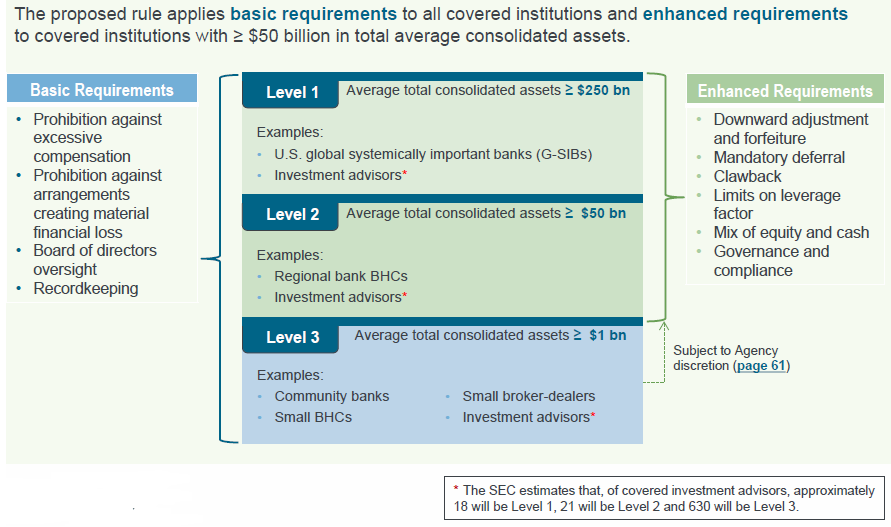

- The proposed rule uses a 3-tiered approach with requirements increasing in stringency with the size (average total assets) of the covered institution:

- Level 1: ≥ $250 billion; Level 2: ≥ $50 and less than $250 billion; Level 3: ≥$1 and less than $50 billion.

- Level 1 and Level 2 institutions must comply with enhanced requirements as to the structure of their incentive compensation for senior executive officers and significant risk-takers.

- Existing Compensation Requirements Continue. The proposed rule does not change the application of other compensation requirements found elsewhere in federal law, including the banking regulators’ safety and soundness standards, the OCC’s heightened standards or SEC rules regarding disclosure of executive compensation. Mortgage loan originators remain separately subject to CFPB rules restricting compensation.

- Delayed Effectiveness Date. The proposed rule will be effective on the first day of the calendar quarter 540 days (18 months) after the final rule is published in the Federal Register. We estimate that the earliest the rules will apply to compensation programs is 2019.

- Grandfathering. The rule will not apply to any incentive compensation plan with a performance period that began before the effective date.

- Comment deadline: July 22, 2016.

The proposed rule applies basic requirements to all covered institutions and enhanced requirements to covered institutions with ≥ $50 billion in total average consolidated assets.

The complete publication, including visuals, tables, and timelines, is available here.

Print

Print