Matteo Tonello is managing director at The Conference Board, Inc. This post relates to an issue of The Conference Board’s Director Notes series by Michael Jung, James Naughton, Ahmed Tahoun, and Clare Wang.

While companies devote considerable effort to creating and managing social media presences, little is known about how they use social media to communicate financial information to investors. This report examines the use of social media by S&P 1500 companies to disseminate financial information and the response from investors and traditional media. The findings show that companies use social media to overcome a perceived lack of traditional media attention and that social media usage improves the company’s information environment. There is also evidence that, in contrast with other types of company communications, the beneficial effects of social media on the company’s information environment are offset when the investor-focused social media communications are disseminated by other social media users. The findings are relevant for managers and boards establishing corporate social media disclosure policies, since they suggest that companies may benefit from developing different approaches to disseminating positive versus negative earnings news.

Social media has transformed communications in many sectors of the US economy. It is now used for disaster preparation and emergency response, security at major events, and public agencies are researching new uses in geolocation, law enforcement, court decisions, and military intelligence. Internationally, social media is credited for organizing political protests across the Middle East and a revolution in Egypt. In the business world, social media has revolutionized sales and marketing practices and developed into a powerful recruiting and networking channel.

Conventionally, if a company wanted to publicize investor-related information such as an earnings announcement, it would do so by sending a press release to intermediaries such as newswire services, equity research databases, and brokerage firms. A company would not know if or when any of its existing or prospective investors received the information. In contrast, with social media platforms such as Twitter, a company can send one or more short messages directly to a known number of followers with a link to a press release on its corporate website. As such, a company can use Twitter to target its news dissemination, increase the speed and flexibility of the news dissemination, and reduce information acquisition costs for its investors and the traditional media outlets that follow it.

Little research exists, however, on how firms use social media to communicate financial information to investors and how investors respond to information disseminated through social media, despite firms devoting considerable effort to creating and managing social media presences directed at investors. While social media is generally viewed as an opportunity to improve investor communications and increase visibility, the authors hypothesize that disseminating investor communications via social media could also result in the company not retaining full control over its financial communications. This concern stems from the viral nature of social media—even though social media allows a company to connect more easily with its investors, it also allows investors to connect more easily with the company, with each other, and with individuals who do not directly follow the company and are likely less informed about the company’s prior financial communications. As a result, a company’s investor communications via social media can potentially spread to uniformed individuals in a way that creates adverse consequences for the company.

The Adoption Rate of Social Media to Disseminate Information to Investors

To collect data on social media usage, the authors identify whether each company in the S&P 1500 Index had a social media presence on Twitter, Facebook, LinkedIn, Pinterest, YouTube, and Google+ as of January 2013 by visiting each corporate website and looking for icons or links to the company’s social media sites. Twitter and Facebook are the two most frequently adopted social media platforms for corporations. The data show that adoption of Twitter and Facebook exceeds 47 percent and 44 percent, respectively, and is highest for customer-facing industries such as meals, retail, books and services (each over 65 percent) and lowest for industrial sectors such as oil (roughly 20 percent) and steel (roughly 14 percent). Corporate adoption is much lower for the other social media platforms, suggesting that they are less conducive for delivering typical corporate communications.

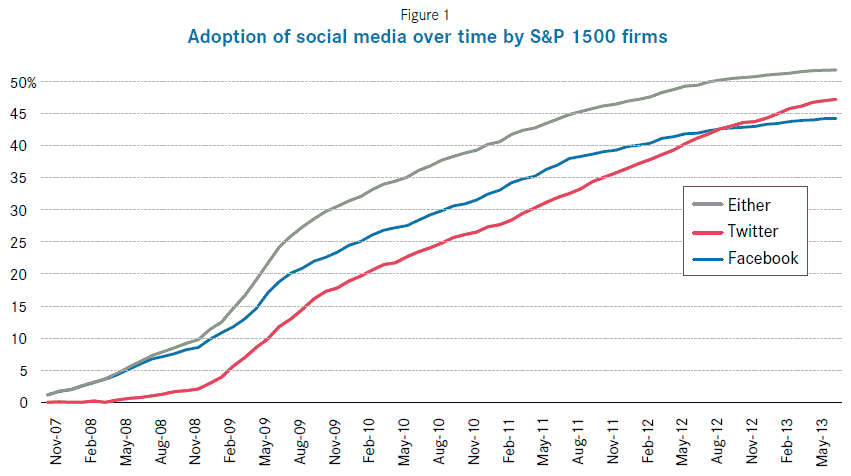

The authors also collect data on when companies joined Twitter or Facebook by searching for the earliest tweets or posts. The time trend in corporate social media adoption for Facebook and Twitter is illustrated in Figure 1. The earliest adopters of Facebook joined in November 2007 and the first set of firms to create Twitter accounts did so in May 2008. By early 2013, the corporate adoption rate of Twitter surpassed the rate for Facebook. By the end of the data collection period, 51 percent of the S&P 1500 companies had adopted one or the other, with Twitter appearing to edge out Facebook slightly as the preferred social media platform for companies.

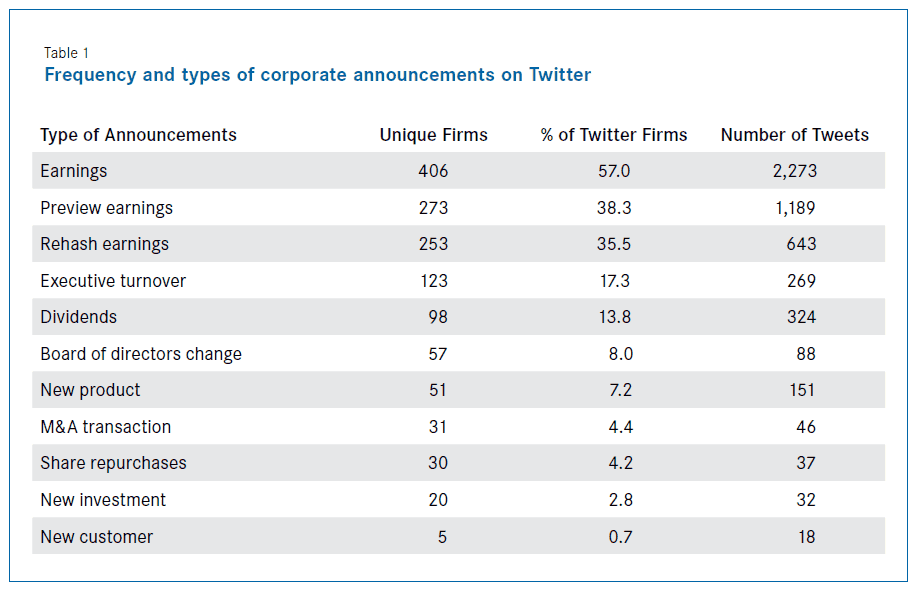

Since social media adoption does not necessarily imply that social media is used to disseminate information to investors, which is the focus of the study, the next step is to analyze what types of investor-focused information are disseminated over social media. Since the data suggest that Twitter is the preferred social media platform, it is the focus of this analysis. Quarterly earnings-related tweets are the most prevalent type of investor-focused tweets, far outnumbering tweets related to executive turnover, dividends, board of directors, and even new products and customers. The frequency of each type of investor-related tweet is summarized in Table 1.

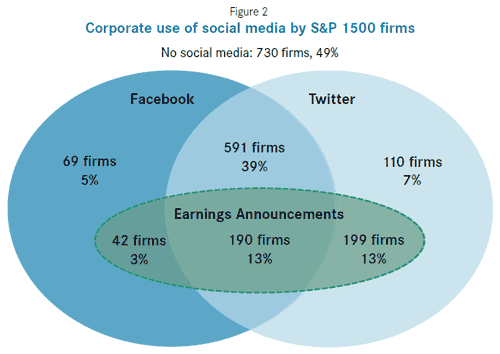

The number of firm-quarters with earnings announcements on Facebook (5.7 percent) is approximately half the number on Twitter (11.8 percent), suggesting that the preference for Twitter is even stronger when it comes to earnings news. An overview of the corporate use of Twitter and Facebook is illustrated in Figure 2.

Which Companies Use Social Media and What Is The Capital Market Response?

The consequences of social media usage are identified by combining the detailed information on Twitter usage with other data on stock market outcomes and financial statement data. Using Twitter, rather than other social media data, is advantageous because 1) earnings announcements have been shown in prior work to be of first-order importance to investors, 2) the information content of earnings announcements can be controlled for more effectively than the information content of other financial disclosures, and 3) the precise time that earnings announcements were disseminated through Twitter can be identified. The analyses address four related research questions, which are described in the following subsections:

What Types of Companies Disseminate Earnings through Social Media?

An investigation of the factors associated with the choice to disseminate earnings news through Twitter finds that companies that tweet earnings have less traditional media coverage and tend to issue more press releases than those that do not use Twitter. These findings suggest that companies use social media along with other firm-initiated communications in response to a perceived lack of traditional media coverage. The analysis also shows that larger companies are more likely to use Twitter to disseminate earnings news, which is contrary to the notion that smaller companies benefit more from using social media.

Are Companies Strategic in their use of Social Media?

The authors investigate whether companies strategically disseminate earnings news using Twitter by examining whether there is differential usage of Twitter based on the direction of the earnings news (i.e., positive versus negative earnings news). They find that companies are less likely to disseminate earnings news through Twitter when the earnings miss the consensus forecast and the magnitude of the miss is larger. When the sample is split between companies that consistently use Twitter versus those that do not, these results are driven by this latter group. In other words, it appears that there is a subset of companies that are sporadic in their Twitter usage, and that these companies use Twitter strategically to disseminate positive earnings news.

How does the Capital Market Respond to the Corporate Use of Social Media?

The capital market response to social media dissemination is investigated by looking at intra-day and three-day changes in capital market measures related to price, volume, and spreads. There is a reduction in bid-ask spreads when the company tweets earnings news and when more followers receive the earnings announcement tweet. [1]

Modest price- and volume-based responses are found to earnings announcements disseminated over Twitter during three-day earnings announcement windows. However, when short-window intraday tests focused on companies that tweet earnings news during market hours are used, both trading volume and trade size respond to earnings tweets. There is a significant increase in the mean and median abnormal volume, primarily due to an increase in large trades. Therefore, while social media is commonly viewed as a dissemination channel that provides timely access to information for all investors, the results suggest that larger investors react more quickly to earnings-related tweets.

Does Social Media Influence Traditional Media Coverage?

The authors investigate whether there are adverse consequences to the company from non-firm initiated social media disseminations by examining whether retweets negatively affect the company’s information environment and its coverage by traditional media. In contrast with the evidence for tweets, there is an increase in information asymmetry when the company’s earnings announcement tweets are retweeted to individuals who do not follow the company (i.e., the follower’s followers). Media coverage is also adversely affected by retweet activity. While more retweets are associated with more coverage in traditional media, this association is entirely attributable to negative media coverage. This finding suggests that retweets of earnings information increase negative media coverage, but have no effect on positive media coverage.

Conclusion

The findings shows that the usage of social media by corporations has grown dramatically over a relatively short period of time, from less than 5 percent of S&P 1500 companies in 2008 to more than 50 percent in 2013. This trend suggests that social media usage for communicating with investors has the potential to become an integral part of many companies’ disclosure policies. The findings show that even in the absence of the Securities and Commission’s approval of social media as a channel for investor communication, companies used it to disseminate a variety of information, including earnings news, board and executive changes, new contracts, and dividends.

Overall, the findings demonstrate that social media usage improves the company’s information environment, consistent with the notion that it improves investor communications. However, the benefits are offset when the company’s disclosures are disseminated by other social media users, consistent with the notion that there are potential adverse consequences to the company’s information environment that derive from the viral nature of social media. This finding suggests that an appropriate social media policy for investor communications likely differs from social media usage for other business purposes, such as marketing campaigns, in which companies often want to generate viral reactions to social media dissemination. The results also suggest that companies that adopt social media disclosure policies benefit from developing different approaches to disseminating positive versus negative earnings news. These conclusions are relevant for companies, managers, and boards of directors that are establishing social media disclosure policies.

Endnotes:

[1] The bid-ask spread is the difference between the price that someone is willing to pay for a security at a specific point in time (the bid) and the price at which someone is willing to sell (the ask).

(go back)

Print

Print