Carol Bowie is Head of Americas Research at Institutional Shareholder Services (ISS). This post is based on a recent publication authored by ISS U.S. Research analyst Rob Yates.

Women corporate directors globally are showing greater proportional gains on occupying key board committees than on boards overall, according to a new analysis by leading governance and ESG data and analytics provider Institutional Shareholder Services.

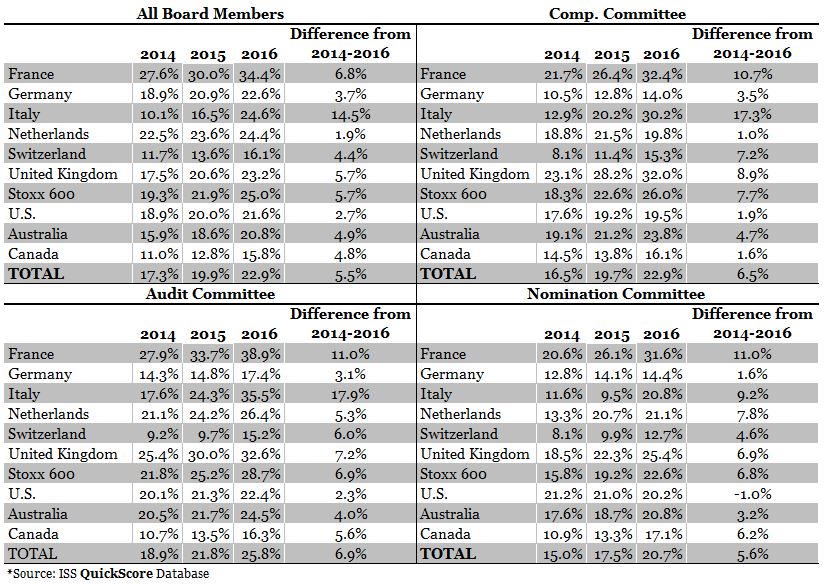

Between Jan. 1, 2014, and Jan. 1, 2016, the proportion of women directorships at companies across major markets and indices in Europe, the U.S., Australia, and Canada grew by 5.5 percentage points compared with 6.9 points for those on audit committees. Growth evidenced in the proportion of women on audit committees during that period included double digit gains at companies in Italy and France, 7.2 percentage points at U.K. companies, and 6 percentage points at Swiss companies. Meanwhile, the proportion of women on other key committees, including those addressing remuneration and nomination, similarly outpaced gains at the overall board levels, albeit less prominently, at 6.5 and 5.9 points, respectively.

“These findings suggest that at least the largest companies within these jurisdictions are looking for and appointing women directors with specific and relevant skill sets, potentially debunking the view that there is not a sufficient pool of qualified directors to draw from,” said Georgina Marshall, ISS’ Global Head of Research. “However, these numbers also suggest room for improvement in appointing women directors to nominating committees, which may help ensure the continued identification and selection of qualified female director candidates.”

In Europe, mandatory and recommended quotas have radically sharpened the focus on the issue of appointing women directors. Among markets outside Europe, boards of Australian companies showed the greatest proportional gains for overall female boardroom representation between 2014 and 2016 with a 4.9 percent increase, and with female directors now making up just under 21 percent of all directorships at those companies. Canadian companies analyzed saw the greatest growth outside of Europe in female representation on audit committees, jumping 5.6 percentage points during that same period.

The pace of change at U.S. companies is among the lowest of the jurisdictions examined, with overall boardroom representation inching up just 2.7 points from 2014 to 2016 and by 2.3 points for audit committees. Meanwhile, the proportion of women on U.S. nominating committees looked at between 2014 and 2016 shrank by one point to 20.2 percent, contrasting starkly with gains evidenced across the other markets studied that ranged from 1.2 to 11 points.

“Investors active on the issue of board gender diversity may well begin to scrutinize U.S. nominating committee makeup against the backdrop of this trend,” said Marshall.

For purposes of this analysis, ISS examined board profile data for French, German, Italian, Dutch, Swiss, and U.K. constituents of the STOXX 600; the full STOXX 600, S&P 500 companies in the U.S., TSX/Composite companies in Canada, and ASX 200 companies in Australia. Data is as of Jan. 1, 2014, 2015, and 2016.

Separately, ISS also examined the state of board gender diversity in Japan, where the number of female directorships grew from 2.2 percent of directors in 2014 to 4 percent in 2016 for Nikkei index companies. The vast majority of Japanese companies do not follow a three-committee system, however, resulting in their exclusion from the overall key committee comparative analysis.

Print

Print