Campbell R. Harvey is Professor of Finance at the Fuqua School of Business at Duke University. This post is largely based on a recent article, forthcoming in the Journal of International Business Studies, by Professor Harvey; Erasmo Giambona, the Michael Falcone Chair in Real Estate at the Whitman School of Management at Syracuse University; and John R. Graham, Professor of Finance at the Fuqua School of Business at Duke University. The complete article, including appendix, figures, and tables, is available here.

We explore a long standing prediction in the international business literature that managers’ subjective perceptions of political risk—not just the level of risk—are important for how firms manage political risk. The importance attributed to political risk by corporate executives has increased over the last 15 years and our results show that political risk is now considered more important than commodity (input) risk. Our analysis suggests that nearly 50% of firms avoid (not simply reduce) foreign direct investment because of political risk. Using a unique survey‐based psychometric evaluation of manager risk aversion, we show that firms with risk averse executives are more likely to avoid investment in politically risky countries—a key implication of behavioral models. This relation is economically stronger when agency problems are more likely to be severe: for example, when executives are less aligned with shareholder value maximization, and when executives are younger (and therefore might put their personal career’ concerns in front of shareholders’ interests). While numerous studies have shown that political risk affects foreign direct investment using objective measures of such risk (electoral uncertainty, conflicts, etc.), our study documents that executives’ subjective perceptions of political risk are also important for political risk management.

1. Introduction

How does political risk affect foreign direct investment (FDI)? In an influential study, Kobrin (1979) argues that political risk affects FDI by increasing the uncertainty that firms face in a foreign country. To investigate this relation empirically, researchers have traditionally used objective measures of political risk, including 1) electoral uncertainty 2) conflict risks, 3) social unrest, 4) corruption, 5) political instability, 6) quality of the institutions in the host country, 7) sovereign debt default risk, and 8) market imperfections. [1] In this post, we address a classic research challenge put forth by Kobrin (1979); namely, we attempt to directly assess “what affects managers’ subjective perceptions” of political risk. To overcome the difficulty in measuring subjective preferences, we administer a psychometric test to evaluate the risk aversion of individual executives. We show that the personal risk aversion of executives is a significant factor explaining how their companies respond to political risk.

We study these issues within the context of behavioral theory (e.g., Johnson and Tversky, 1983; Slovic, 1987) and agency theory (e.g., Stulz, 1984; and Smith and Stulz, 1985). Behavioral models predict that it is not just the level of political risk that is important, it is also the individual manager’s sensitivity to that risk that dictates the corporate response to political risk. According to agency theory, corporate decisions are more likely to reflect the best interests of executives (rather than the best interests of shareholders) when managers’ interests are less aligned with those of stockholders. Thus, corporate risk management decisions will reflect an executive’s personal sensitivity to political risk in firms in which executives indicate that they are less concerned about the interest of stockholders and in firms managed by younger executives—who put their own career concerns ahead of the interests of shareholders. We develop these two main hypotheses, one behavioral and one agency‐driven, in more detail in the next section.

In our empirical work, we find that nearly half of the executives in our sample say that they avoid investing in a risky country altogether as a way to manage political risk. Consistent with a behavioral prediction, we find that companies with highly risk‐averse financial executives are more likely to avoid investment in politically risky countries. That is, a manager’s subjective perception of political risk affects her firm’s decision to avoid investment in a politically risky country. Consistent with an agency theory prediction, we find that the effect of risk aversion on a firm’s decision to avoid investing in a politically risky country is stronger for executives who are less concerned about stockholder welfare, and is also stronger for younger executives.

While numerous studies have documented the effect political risk on FDI using objective measures of such risk (conflicts, social unrest, electoral uncertainty, etc.), our post documents that a manager’s subjective perception of political risk is also important for how firms manage political risk.

The post is organized as follows. We develop our hypotheses in section 2. The data are described in the third section. The fourth section presents empirical results. Some concluding remarks are made in the final section. The survey questions are in the appendix (available here).

2. Hypotheses’ Development

In this section, we develop the two hypotheses that we test in this study.

Behavioral‐Theory Hypothesis: All else equal, firms with risk averse executives are more likely to avoid investing in politically risky countries.

Traditional economic theory typically views managers as homogeneous and always making decisions in the best interest of shareholders. In contract, according to behavioral theory, the characteristics of the individual manager can affect how an executive manages her firm (Johnson and Tversky, 1983; Slovic, 1987; Gervais, Heaton, and Odean, 2011; Palomino and Sadrieh, 2011). Hence, behavioral theory predicts that firms with risk averse executives might adopt more conservative corporate policies because such policies fit the personal risk profiles of the executives.

Agency‐Theory Hypothesis: firms with risk averse executives are more likely to avoid investing in politically risky countries if the executives are less inclined to manage the firm in the interest of shareholders and if the executives are young.

Agency theory explores, among other things, conflicts that exist between managers and shareholders when their interests are not aligned. Agency theory suggests that the degree of misalignment between managers’ and shareholders’ incentives can exacerbate the degree to which managers make decisions more reflective of their own interests than those of shareholders. [2] For example, the degree to which risk averse executives implement corporate risk management according to their personal risk preferences is stronger when agency conflicts are particularly acute (Stulz, 1984; Smith and Stulz, 1985; Holmström and Ricart I Costa, 1986; and Ross, 2004). We quantify the degree of agency conflicts between managers and stockholders in two ways: 1) the degree to which executives indicate on a survey that they are relatively less concerned about the interest of stockholders (and relatively more concerned about other stakeholders), and 2) by the age of the executive (Gormley and Matsa (2016) show that younger executives are more likely to “play it safe” and make risk‐reducing investments due to agency‐driven career concerns).

We discuss tests related to these predictions in section 4.4.

3. Data

3.1. The Data Gathering Process

Our data are gathered from a large scale survey of financial executives around the globe. Emails were obtained from four different sources: CFO Magazine, International Swaps and Derivatives Association (ISDA), the Global Association of Risk Professionals (GARP), and Duke University. We invited financial executives to take part in the survey via emails sent in the last week of February 2010. Reminder emails were sent throughout March 2010. The survey closed at the end of April 2010.

The invitations were sent to about 29,000 executives and we gathered 1,161 responses. While the response rate seems low, we only asked a small subset of the 29,000 to respond—those that had decision‐making authority for risk management. For example, in the invitation sample, very few of the recipients for the ISDA and GARP lists had the authority of a Chief Financial Officer, Chief Risk Officer, Vice‐President‐Finance or Treasurer and therefore declined to participate. Below we examine the representativeness of our respondents.

Figure 1 of the complete paper (available here) shows the geographic distribution of the corporate headquarters for our sample, with the majority of respondents coming from North America and the rest from Europe and Asia. [3] In addition to obtaining information on the risk management practices at our sample firms, we also collect demographic information on company and risk manager characteristics.

3.2. The sample

We obtain data on political risk exposure from a corporate risk management survey that explores six different types of risk. [4] So as not to burden the respondents, the survey branched in a manner that no respondent was required to answer all the questions. The survey contains a set of common questions that all participants answer (such as demographic information). Given there are six areas of risk, we randomized the invitation so that each participant focused on three risk areas. [5] As a result, the political risk sample is smaller than the overall sample. The survey questions related to political risk are in the appendix.

In the survey, we focus on political risk broadly defined, which includes macro political risks (e.g., regime changes or nationwide security breakdowns), micro political risks (e.g., security problems arising in a certain region of a country or related to certain policies), and external political risk (which is related to tensions between countries).

We collect information on the following demographic characteristics. Risk aversion is an indicator equal to 1 if the CFO answers a series of questions indicating a preference for stable salary over riskier but higher expected value pay. [6] We rate the degree to which management is concerned in stockholder’s interest on a scale of 0 (the firm is not at all managed in the interest of stockholders) to 100 (firms is managed entirely in the interest of stockholders). Executive is Younger than 45 is an indicator for executives younger than age 45. Large is an indicator for firms with revenue greater than US$1 billion. Ratings is a zero‐one variable indicating whether the firm’s debt is rated. Dividend Payer is a dummy variable that takes on the value of one if the company regularly pays dividends. Profitable is an indicator for firms that reported a profit in the previous fiscal year. Cash Holdings is the ratio of cash and marketable securities scaled by total assets. Leverage is the ratio of total debt to total assets. Investment Prospects are rated on a scale of 0 (no growth prospects) to 100 (excellent prospects). Public is an indicator for firms traded on a stock exchange.

Table 1 of the complete paper (available here) presents summary statistics for the full sample. On average, executives rate their concern about the interests of stockholders at 61. About 44% of executives are younger than 45, 38% of our sample firms are large, 55% have rated debt, and 54% pay dividends regularly. Nearly four‐in‐five firms are profitable and the average investment prospects rating is 65.

Given this demographic information, we compare the public firms in our sample (567 firms) to a standard archival database, Global Compustat (23,700 companies analyzed at the time of the survey). Table 1 shows that our public sample firms are similar to this benchmark. For example, our sample has 56% large firms whereas Compustat has 48%. For both our sample and Compustat, 20% of firms report a loss in the previous year. The samples are roughly similar in terms of cash holdings and leverage.

Private firms make up half (51%) of our sample. The final column in Table 1 allows us to compare demographic characteristics of public and private firms. Private firms are similar to public firms for many of the key characteristics: cash holdings, leverage, profitability, and investment prospects. Private firms are less likely to pay a regular dividend. Unsurprisingly, private firms are smaller and they are less likely to have rated debt.

4. Results

4.1. Time‐Series of the Perceived Importance of Political Risk

Table 2 of the complete paper (available here) shows that the executives in our sample believe that the importance of political risk increased in the four years leading up to the survey. Panel A shows that 54% of participants believe political risk has increased, whereas only 8.4% believe it has decreased. We are, of course, measuring the perception of political risk. These perceptions are likely correlated with empirical proxies or risk realizations such as those used in Barro (1991). The advantage of our measure is that perceptions are likely aggregating information across many different risk factors whose importance may change through time. Panel B shows that active management of political risk has followed the increased exposure. Nearly 50% of executives have increased their management of political risk, whereas only 4% have decreased it. Both panels provide separate analyses by region and show that political risk has increased in every region and in response executives have increased the management of such risk.

4.2. Political Risk vs. Other Material Risks

How do financial executives perceive the importance of political risk compared to other material business risks? Panel A of Figure 2 shows that the three most important risks are interest rate risk, foreign exchange risk, and credit risk. Political risk ranks fourth. Interestingly, financial executives consider political risk to be more important than either commodity or energy risk.

Panel B of Figure 2 examines political risk exposure of companies headquartered in different regions of the world. While there is some variation by region, the broad message is that political risk exposures are similar across regions (U.S. 31%, Europe 33%, and Asia 26%). Figure 2 also indicates that financial firms indicate that they have higher exposure to political risk than non‐financial firms.

4.3. How Firms Manage Political Risk

In this section we study how firms manage political risk, which provides context for testing the hypotheses developed in Section 2. The most popular way to manage political risk is to simply avoid investing in risky countries (48.6% of respondents; see Table 3, available here). This evidence is consistent with theoretical predictions (e.g., Pastor and Veronesi, 2012, 2013; and Bernanke, 1983) and indicates that there are significant real effects associated with political risk. Moreover, because we ask CFOs directly whether they reduce investment in risky countries in response to political risk, we are able to establish a direct link between political risk and FDI. In contrast, archival data studies cannot determine whether political uncertainty is the outcome of (or the cause of) low growth, [7] which makes it difficult to identify whether the reduction in foreign direct investment is the consequence of political uncertainty. [8]

Firms that do invest take actions to mitigate the effect of political risk on FDI. Table 3 reveals that a sizable 40% of firms increase their due diligence before investing in risky countries, and another 40% actively diversify investment across countries. Firms use other methods to manage political risk, including, partnering with local firms (35% of respondents), increasing the hurdle rate (25%), [9] and relying on political risk insurance (15).

4.4. Behavioral Theory, Agency Effects, and Corporate Political Risk Management

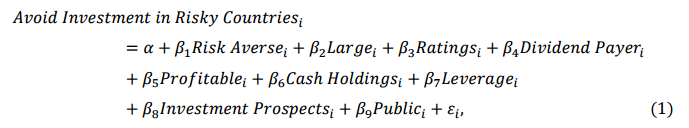

In this section, we explore our behavioral‐theory hypothesis by examining whether managerial risk aversion modifies the most popular approach (avoiding investment altogether) that firms use to manage political risk. Later, we also study a second (agency theory) hypothesis of whether this risk aversion/avoid investment relation is stronger when agency problems are more severe. We test these predictions by estimating the following probit model:

where Avoid Investment in Risky Countries is a 0/1 variable set to 1 when firm i indicates that it deals with the level of political risk by avoiding foreign direct investment in risky countries, and α is a constant. We account for heterogeneity across regions by including regional dummies in all regressions. All standard errors are heteroskedasticity consistent and clustered by region.

Table 4 (available here), column 1 presents results from the estimation of Eq. (1) for the sample of non‐financial firms. Consistent with our behavioral theory prediction, we find that the coefficient on Risk Averse is positive and statistically significant at the one percent level. The effect is also economically sizable. The marginal effect of 0.10 indicates that firms with risk averse executives are 10% more likely to avoid politically risky countries altogether. This finding documents the importance of executives’ subjective perceptions (as measured by their risk aversion) of political risk in modifying the degree to which their firms avoid investing in politically risk countries.

Turning to the control variables, Table 4 shows that large firms are more likely to deal with political risk by avoiding foreign direct investment in risky countries. This could occur because larger firms have the scale and the organizational structure necessary to relocate investment activities when political risk exceeds an acceptable threshold or pursue some of the other strategies documented in the article. Among non‐financial firms, dividend payers are more likely to avoid FDI in risky countries, while more profitable firms and those with higher cash holdings are less likely to do so.

Our agency theory prediction is that the effect of risk aversion on a firm’s decision to avoid politically risky investment is stronger when agency problems are more severe. To test this prediction, we ask executives to tell us on a scale from 0 to 100 to what extent they run the firm in the interest of shareholders (where 100 means the firm is run in the exclusive interest of shareholders). We then separate firms in two groups depending on whether the executive response is below or above the overall sample mean of 61. Separately, we partition firms in two groups depending on whether executives are younger or older than 45, to test whether subjective preferences are more relevant for younger executives; as stated above, the career concerns of younger executives might lead to more severe agency conflicts with shareholders. Table 4, columns 2–5, report results for these subsamples.

Consistent with our agency theory prediction, Risk Averse enters the probit estimation with a positively significant coefficient when agency problems are more severe: When executives rate the interest of shareholders below the sample mean (column 2) and for younger executives (column 5). Further, the marginal effects of 0.36 and 0.44 (columns 2 and 5) indicate that the effect of risk aversion on a firm’s decision to avoid investing in a risky country is economically sizable: Firms with risk averse executives and relatively worse agency issues are about 40% more likely to avoid investing politically risky countries. Conversely, risk aversion does not play a role in corporate decision‐making in firms with less severe agency issues by these measures (the insignificant coefficients in columns 3 and 5). [10]

Overall, the evidence in Tables 4 indicates that executives’ subjective perceptions of political risk have important consequences for political risk management via both behavioral and agency channels.

5. Conclusions

There is an abundant literature on the effect of political risk on foreign direct investment. The common denominator of these studies is that they rely on objective measures of political risk, such as conflicts, electoral uncertainty, social unrest, etc. According to theory, executives’ subjective perception of political risk affects how firms manage political risk. This idea was first posed as a research challenge in Kobrin (1979) but has gone untested until now because data on managerial risk perceptions are not readily available. In our article, we perform a psychometric test on sitting executives to obtain data on the personal risk aversion of executives.

Consistent with behavioral theory, we find that firms with risk averse executives are more likely to avoid investment in politically risky countries. We also find that the effect of risk aversion on a firm’s decision to avoid investing in politically risky countries is most evident when agency problems appear to be more severe.

Our study uncovers: (1) an important link between executive risk aversion and FDI and (2) the mechanisms through which the executives’ perceptions of political risk affect their firms’ political risk management. We hope our findings stimulate researchers to further explore the relation between executives’ personal characteristics and companies’ investment policies in politically risky countries.

The complete article, including appendix, figures, and tables, is available here.

Endnotes:

[1] Citations to this list of objective measures follow: 1) Vaaler, Schrage, and Block, 2005; Henisz and Zelner, 2010; and Julio and Yook, 2012; 2) Nigh, 1985; Barro, 1991; Globerman and Shapiro, 2003; and Darendeli and Hill, 2016; 3) Li and Resnick, 2003; 4) Wei, 2000; Habib and Zurawick, 2002; and Uhlenbruck, Rodriguez, Doh, and Eden, 2006; 5) Loree and Guisinger, 1995; Sethi, Gusinger, Phelan, and Berg, 2003; Baker, Bloom, and Davis, 2013; Brogaard and Detzel, 2012; and Brogaard, Dai, Ngo, and Zhang, 2014; 6) Alfaro, Kalemli‐Ozcan, and Volosovych, 2008, 7) Citron and Nickelsburg, 1987; and 8) Brewer, 1993.

(go back)

[2] Managers are exposed to the financial conditions of their firms through employment. As Eckbo, Thorburn, and Wang (2016) show, CEOs who lose their executive job because of bankruptcy suffer a long‐lasting compensation loss. These potential personal losses explain how the executives’ personal interests can influence corporate policies.

(go back)

[3] There are a small number of firms from other regions, including Australia and New Zealand, Latin America, the Middle East, and Africa.

(go back)

[4] In a companion paper, Bodnar, Giambona, Graham, Harvey, and Marston (2014) examine corporate risk management in the context of FX, interest rate, commodity, credit and energy risks.

(go back)

[5] The survey contained branches that were designed to obtain broad information without overly burdening respondents. All survey participants that indicated that they faced material foreign exchange risk answered FX questions and likewise for IR risk. With respect to political, energy, commodity, and credit risk, if a respondent indicated that her firm primarily faced material political risk from among these four categories, she answered just the political risk questions (and likewise for the other three categories). If the respondent chose multiple categories of material risk from among the four, she was randomly assigned to answer questions in the category among these four that had the least number of cumulative responses based on the choices made by previous respondents.

(go back)

[6] Following Graham, Harvey, and Puri (2013), and Bodnar, Giambona, Graham, and Harvey (2014), we ask CFOs that currently earn $X to choose between two new jobs: (1) 100% chance job pays $X for life; (2) 50% chance job pays $2X for life and 50% chance job pays $2/3 X for life. If the CFO selects (1), we ask her to choose between the two following job alternatives: (3) 100% chance job pays $X for life; (4) 50% chance job pays $2X for life and 50% chance job pays $4/5 X for life. To mitigate the “status quo bias” (Barsky, Kimball, Juster, and Shapiro, 1997), which could make individuals prefer the current job to avoid the costs involved with the search of a new job, we tell respondents that they have to move to a new location and change job because of health reasons. We categorize the financial executives that choose the sequence (1) and (3) as risk averse.

(go back)

[7] See, among others, Brewer, 1983, 1993; Habib and Zurawicki, 2002; Globerman and Shapiro, 2003; Alfaro, Kalemli‐Ozcan, and Volosovych, 2008; Anshuman, Martin, and Titman, 2011; Julio and Yook, 2012.

(go back)

[8] The finding that a large number of financial executives simply avoid investing in politically risky countries raises another potential econometric issue (selection bias) with archival‐data studies. Consider a politically risky country and assume that there are some firms investing in the country. There are also many other firms that avoid investing in the country because political risk is above their acceptable threshold. A regression analysis of FDI on political risk may underestimate the impact of changes in political risk if one were to focus on the sample of companies that are already present in the country. To see why, consider an improvement in political risk that takes the country across the investment threshold. The amount of investment would jump much more than predicted by the regression model because many new companies would enter the country. Our approach avoids this issue. Using simulated data, we find that FDI sensitivity to political risk is 50% higher in a scenario where new firms are allowed to enter a country if political risk falls below a certain threshold (which we note is very close to our survey data approach) compared to a scenario where the number of firms is fixed (which is very close to the archival research approach of focusing on the firms that are already present in the country).

(go back)

[9] Abuaf (2015) and Bekaert et al. (2014) are examples of recent papers linking hurdle rates to political risk.

(go back)

[10] As a robustness check, we also estimated each of the regressions without the control variables. The magnitude and statistical significance of the risk aversion variable is robust to this alternative specification.

(go back)

Print

Print