Ravi Sinha is a principal at Cornerstone Research. This post is based on a Cornerstone publication by Mr. Sinha. This post is part of the Delaware law series; links to other posts in the series are available here.

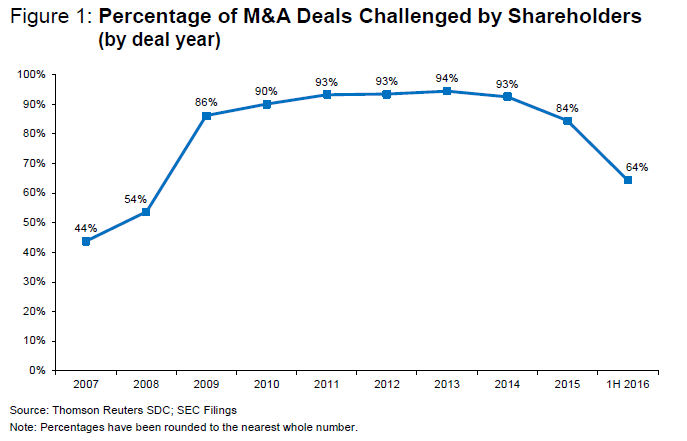

For the first time since 2009, the percentage of M&A deals valued over $100 million that were subject to shareholder litigation declined to below 90 percent in 2015 and so far in 2016. The lower rate in late 2015 and the first half of 2016 may be due to the impact of the January 2016 Trulia ruling that diminished the acceptability of disclosure-only settlements. In addition, a smaller number of competing lawsuits were filed for the same deal and in fewer competing jurisdictions. Lawsuits were less likely to be filed in the Delaware Court of Chancery than in previous years.

- In 2015 and the first half of 2016, 84 and 64 percent of M&A deals valued over $100 million were litigated, respectively. This is the first time since 2009 that the rate has dipped under 90 percent. (Figure 1)

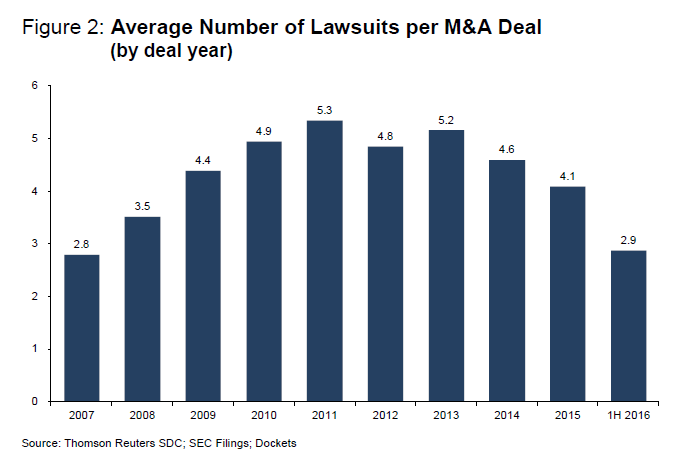

- The average number of lawsuits per deal declined, from 4.6 in 2014 to 4.1 in 2015 and 2.9 in 1H 2016.

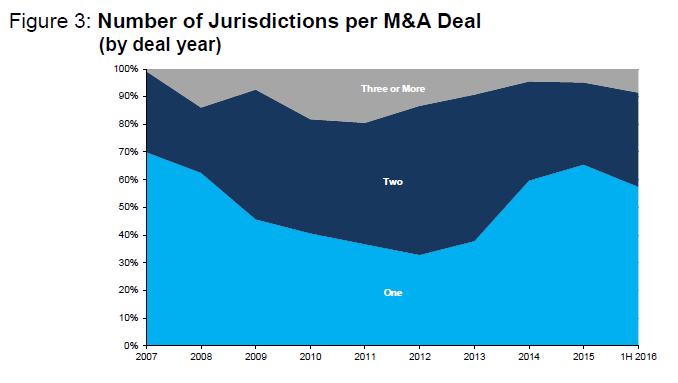

- The majority of litigation for 2015 deals was filed in only one jurisdiction (65 percent). The same is true for the first half of 2016 (57 percent).

- In 2014, 75 percent of lawsuits were resolved before deals closed. This compares to 57 percent in 2015 and 56 percent in 1H 2016.

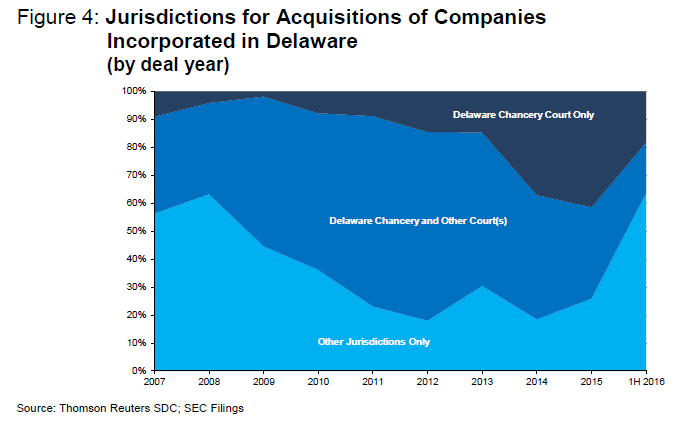

- While disclosure-only settlements are less likely to be approved by the Delaware Court of Chancery, it remains to be seen whether other venues will continue to grant them. Early anecdotal evidence indicates that it is possible that they will. This has led to cases being litigated with increasing frequency outside Delaware.

Filings

- The rate of M&A litigation has declined substantially since the Delaware Court of Chancery’s decision in Trulia.

- Plaintiff attorneys filed lawsuits in 84 percent of all M&A deals announced in 2015 and valued over $100 million. A total of 174 M&A deals had associated lawsuits in 2015.

- Lawsuits were filed in 64 percent of all M&A deals announced in 1H 2016 and valued over $100 million. There were 47 M&A deals with associated lawsuits during the first half of the year.

- The average number of lawsuits per deal declined from 4.6 in 2014 to 4.1 and 2.9 in 2015 and 1H 2016, respectively (Figure 2).

- The number of deals with more than 10 filings decreased, from nine in 2014 to six in 2015. There were no deals with more than seven lawsuits filed in 1H 2016.

- Lawsuits were filed more slowly in 2015 and 1H 2016. During that period, the first lawsuit was filed an average of 22 days after the deal announcement, compared with 14 days in 2014. If this trend of increasing lag time continues, the 64 percent litigation rate seen in 1H 2016 may rise over time as these lawsuits are filed.

Jurisdictions

- Recent trends indicate that the Delaware Court of Chancery is becoming less common as a filing destination. This is likely due to the impact of the Trulia decision. The majority of M&A litigation in 2015 and 1H 2016 was filed in only one venue, continuing a trend that began in 2014 (Figure 3).

- For 2015 deals, 65 percent of M&A litigation was filed in one jurisdiction, with only 5 percent of the deals challenged in three or more courts. In the first half of 2016, the respective figures are 57 percent and 9 percent.

- Plaintiffs filed in Delaware for 61 percent of the litigated deals over the first three quarters of 2015 but only 26 percent of litigated deals in 4Q 2015 and 1H 2016.

- For litigation in which the acquired company was incorporated in Delaware, plaintiffs filed in Delaware for 74 percent of litigated deals in 2015. In 1H 2016, this rate was 36 percent. (Figure 4)

Litigation Outcomes

- From 2009 to 2014, between 74 and 78 percent of M&A litigation was resolved before the deal closed. This figure declined to 57 percent in 2015 and to 56 percent in 1H 2016. This is potentially a result of the increased difficulty in obtaining disclosure-only settlements.

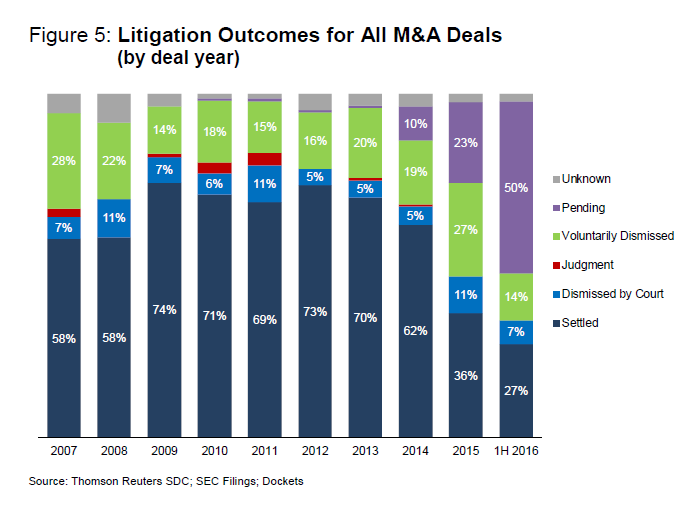

- Unlike prior years, settlements in 2015 accounted for less than half of all litigation outcomes (Figure 5). These rates, particularly the 1H 2016 figure, may increase as more pending cases are resolved.

- Historically, of litigation that was resolved before deal closing, approximately 80 to 90 percent settled, and the remainder was either withdrawn by plaintiffs or dismissed by courts. In cases for which litigation was resolved after a merger closing, only 6 to 21 percent reached a settlement; the majority was either dropped by plaintiffs or dismissed by the courts.

Settlements

- Monetary consideration paid to shareholders has remained relatively rare—there were only a handful of monetary awards and settlements reached in 2015 and 1H 2016.

- The short-term reaction following the Trulia decision indicates both a lower rate of merger litigation and a lower share of such litigation in the Delaware Court of Chancery. It remains to be seen whether such shifts are sustainable. Over the next several months, courts in other jurisdictions will have the opportunity to either adopt or disregard the Trulia standard for disclosure-only settlements. If the Trulia standard becomes universal, the share of merger litigation in Delaware may revert to historical levels.

- To date, a small number of disclosure-only settlements have been approved in various state courts post-Trulia in cases where the settlement was reached before the Trulia decision. It is not yet clear whether such approvals will continue to occur in cases where the settlement was reached after the Trulia decision.

- As more post-Trulia cases are resolved, a future report will focus on settlements and plaintiff attorney fees.

Print

Print