Heidi Welsh is Executive Director at the Sustainable Investments Institute (Si2). This post is based on a Si2 report.

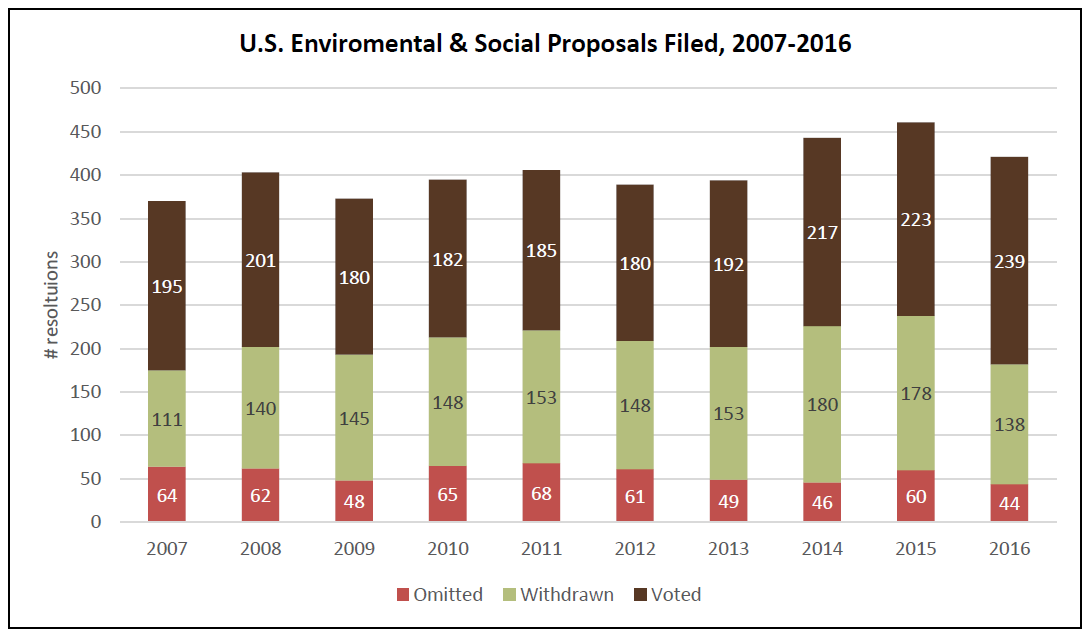

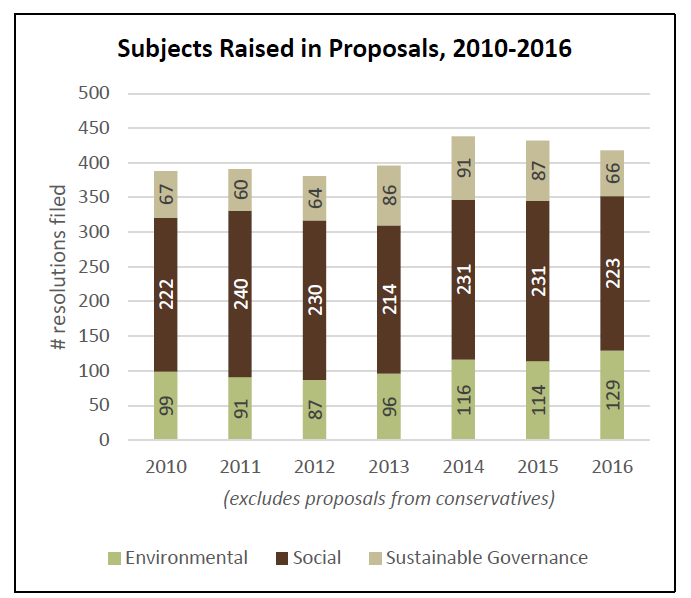

The total number of environmental and social policy shareholder resolutions filed in 2016 dropped to 431, down from 465 in 2015. But 239 went to votes, more than ever before, and the final tally included nine majority votes (including two not opposed by management). However, the number of withdrawn proposals dropped to the lowest level of the decade, suggesting that proponents and companies are simply not agreeing as much as in the past. Combined with the high votes, this seems to set the stage for more confrontation about the hard questions of sustainability and corporate responsibility in the coming year, as investors and companies prepare for the 2017 proxy season.

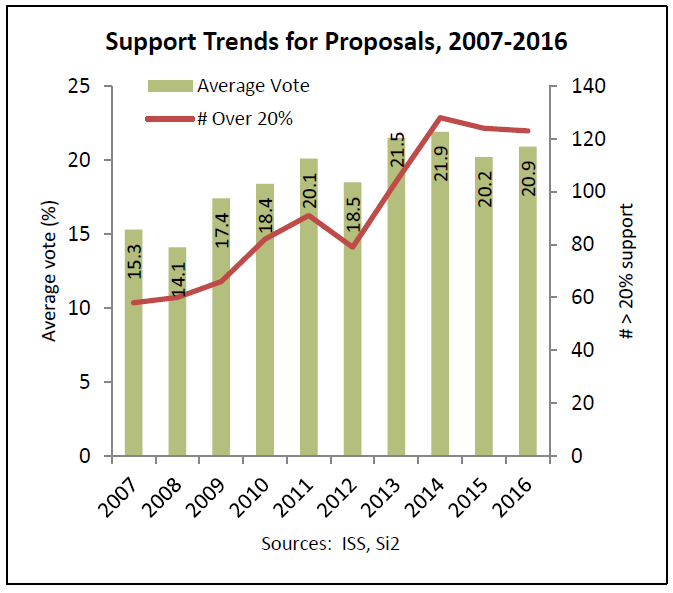

Average overall support was 20.9 percent (for resolutions opposed by management), compared with 20.3 percent last year. Notably, the proportion of resolutions withdrawn fell to its lowest level of the last 10 years—just one-third, and the proportion omitted because they failed to meet SEC standards for inclusion in proxy statements fell back to 10 percent again, another historic low matched only by the outcome in 2014.

Figure 1

Figure 2

Figure 3

The majority votes ran the gamut from the more expected—for political spending transparency (61.9 percent at Fluor and 50.3 percent at NiSource), LGBT rights (54.7 percent at J.B. Hunt Transport) and board diversity (72.4 percent at FleetCor Technologies and 52.4 percent at Joy Global)—to the unprecedented. Extraordinary results were the 60.8 percent vote for sustainability reporting at Clarcor, 51.2 percent for reporting on gender pay disparity at eBay and 50.8 percent for more transparency about methane emissions and targets at WPX Energy. Additional high votes were near majorities for more election spending reporting at NRG Energy (49.4 percent) and a climate change reporting request at Occidental Petroleum (49 percent). The latter was the highest vote ever on an environmental proposal at a leading energy company.

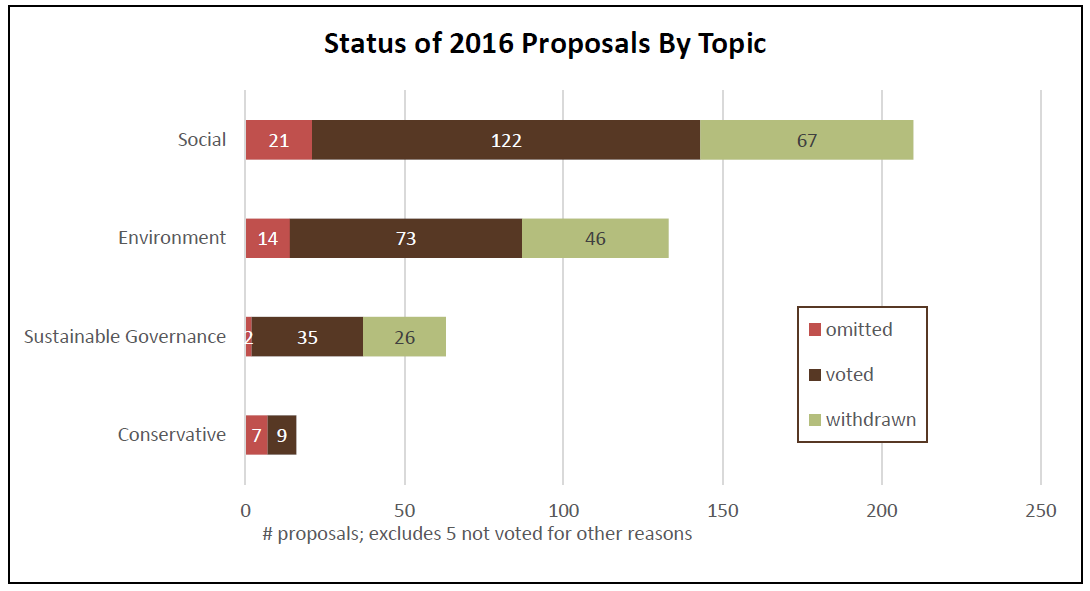

Proponents measure success not just by vote tallies, but also by negotiated withdrawals. Yet the number of withdrawals continued the drop begun last year, both in volume (138, down from 178 in 2015), but also as a proportion of those filed—32 percent, down from about 40 percent the two previous years. (See Figure 1) In 2016, proposals about sustainability were most likely to be withdrawn (41 percent of filings), while those on social issues and environmental matters less likely to be withdrawn (32 percent and 35 percent, respectively). No known proposals from conservatives were withdrawn, but there may have been some on resolutions that were not made public. (See Figure 4 for final status of proposals by topic areas.)

Figure 4

High scoring proposals: In addition to the majority votes, another 19 earned between 40 percent and 49 percent. More of the top-scorers related to the environment and sustainability (14) than any other categories, but eight concerned political activity and four were about diversity. A commendation about an animal welfare policy supported by management also earned top marks. (See table below.)

|

2016 Resolutions With More than 40 Percent Support |

|||

| Company | Proposal | Proponent | Vote (%) |

| Kellogg | Commend animal welfare policy | HSUS | 98.2* |

| FleetCor Technologies | Report on board diversity | NYSCRF | 72.4** |

| Fluor | Review/report on political spending | Phila. PERS | 61.9 |

| Clarcor | Publish sustainability report | Walden Asset Mgt. | 60.8 |

| J.B. Hunt Transport | Adopt sexual orientation/gender ID policy | Trillium Asset Mgt. | 54.7 |

| Joy Global | Adopt board diversity policy | Amalgamated Bank | 52.4 |

| eBay | Report on female pay disparity | Arjuna Capital | 51.2 |

| WPX Energy | Report on methane emissions & targets | CalSTRS | 50.8 |

| NiSource | Review/report on political spending | NYSCRF | 50.3 |

| NRG Energy | Report on political spending and lobbying | NYC pension funds | 49.4 |

| Occidental Petroleum | Report on climate change | Wespath Investments | 49.0 |

| Gulfport Energy | Report on methane emissions & targets | CalSTRS | 47.6 |

| Emerson Electric | Publish sustainability report | Mercy Investments | 47.3 |

| Travelers | Report on lobbying | FAFN | 43.9 |

| Chipotle Mexican Grill | Publish sustainability report | Domini Social Investments | 43.5 |

| Esco Technologies | Publish sustainability report | Walden Asset Mgt. | 43.5 |

| Range Resources | Review/report on political spending | Nathan Cummings Fndn | 43.3 |

| Fluor | Adopt GHG reduction targets | NYSCRF | 42.9 |

| NextEra Energy | Review/report on political spending | NYSCRF | 42.8 |

| PPL Corporation | Report on distributed energy | NYSCRF | 42.6 |

| AES | Report on climate change | Mercy Investments | 42.2 |

| Anadarko Petroleum | Report on stranded assets business risks | As You Sow | 42.0 |

| Western Union | Review/report on political spending | NYSCRF | 41.7 |

| HD Supply Holdings | Adopt GHG reduction targets | Calvert Investments | 41.5 |

| Chevron | Report on climate change strategy | Wespath Investments | 40.8 |

| PNM Resources | Publish sustainability report | Walden Asset Mgt. | 40.6 |

| Wyndham Worldwide | Review/report on political spending | Mercy Investments | 40.1 |

| *Supported by management **Not opposed by management

All votes figured as a percentage of shares cast in favor divided by those cast for and against; company voting calculations may vary based on their individual voting requirements for passage. |

|||

2016 Highlights and Synopsis

This section provides a brief synopsis of the topics raised in proxy season, highlighting new issues, continued big campaign and significant results. Six more resolutions remain pending (see table, below).

Environment

This post discusses environmental issues in the categories of climate change, environmental management (mostly recycling), toxics and industrial agriculture (including but not limited to animal welfare). A separate section on sustainable governance covers proposals that encompass elements of environmental issues as well as social impacts and related corporate governance.

Climate change and energy: More proposals than ever before addressed climate change—107 compared with 82 in 2015. Forty queried energy extractors and suppliers about how changing global temperatures will affect their operations and how they will respond to changes in government policies that aim to moderate these changes; the core question is how fast—or even if—legislative change will occur to implement the climate treaty signed in Paris last December.

Keeping track of carbon emissions—including those from methane releases associated with the U.S. gas boom—prompted 32 proposals, while 25 at utilities and retailers concerned renewable energy and new electricity generation business models. Ten more raised a range of old and new issues on the climate, including new angles on energy reserves accounting and ties to executive pay. Proponents this year were heavily focused on relatively near-term options that can change the U.S. energy mix, addressing energy demand as well as production.

Risk—Some of the climate risk votes were unprecedented. Most prominent were high votes on requests for assessments of the long term effects of new government climate policies, including a 49 percent vote at Occidental Petroleum (the highest-ever climate change vote), 41 percent at Chevron and 38 percent ExxonMobil (the highest votes to date at these companies). In what may be an important development, proponents withdrew when ConocoPhillips promised to provide more information in its sustainability report this year about carbon asset risk scenario planning. Among utilities, the highest vote was about planning to keep global warming to less than 2 degrees Celsius, with 42.2 percent at AES, which generates about 86 percent of its electricity from coal-fired plants. Key withdrawals occurred when American Electric Power and Great Plains Energy both said they would explain more about their plans for change, as aging coal plants are phasing out and the question is how much focus will be on renewable generation and how much energy will be provided by highly efficient natural gas plants that nonetheless emit carbon. Other votes at utilities were between 20 percent to 30 percent.

Accounting—For carbon accounting, with a few exceptions, votes were in the 30 percent to 40 percent range—showing a growing number of investors agree that keeping track of emissions so they can be more tightly managed is a good idea. The highest votes were 43 percent at engineering and construction company Fluor and 42 percent at industrial distributor HD Supply Holdings. Resolutions that broadly asked for emissions accounting got more support than those that requested accounting be extended to company products (at Chevron and Marathon Petroleum resolutions in the latter category got only 8 percent and 15 percent, respectively). A new proposal also asked retailers and industrial firm Deere how they might achieve net-zero greenhouse gas emissions but the two votes were only 7 percent. With regard to methane emissions management and goals setting, the votes were consistently higher and included a majority of 50.8 percent for a proposal at WPX Energy, an oil and gas exploration and services company, from the California State Teachers Retirement System (CalSTRS), a key player on this issue. Another of its proposals, at Gulfport Energy (another exploration firm), also got a near-majority of 47.6 percent. There was a single low vote of just 5.6 percent at Continental Resources, but insiders control nearly 80 percent of its stock. In a development to note, the SEC agreed that a methane report proposal at Dominion Resources was moot given current company reporting, showing proponents must carefully target their resolutions.

| Proposals Pending for Late 2016 Votes | |||

|---|---|---|---|

| Company | Proposal | Proponent | Meeting Date |

| Cisco Systems | Disclose workforce breakdown in Israel-Palestine | Holy Land Principles | (11/18/15) Sept. 28 |

| FedEx | Implement Holy Land Principles | Holy Land Principles | |

| Report on anti-gay law impacts | NorthStar Asset Mgt. | ||

| Report on lobbying | Green Century | ||

| NIKE | Review/report on political spending | Investor Voice | Sept. 22 |

| Procter & Gamble | Report on anti-gay law impacts | NorthStar Asset Mgt. | (10/23/15) |

Renewables—A key focus of the campaigns on renewable energy was on users of energy, as noted. Six retail, health and tech companies reached agreements with proponents, while the four votes on setting renewable energy use targets or reporting on them ranged from a low of 8 percent at PepsiCo to a high of 28 percent at Kroger. In an expanded set of resolutions about distributed energy at utilities, votes were consistently much higher than that, reaching at their apex 42.6 percent at PPL and 37 percent at Entergy. Ceres coalition members working with the Investor Network on Climate Risk plan to continue pushing utilities to increase non-carbon-emitting energy production going forward.

Other climate issues—This year other climate resolutions included several new angles, but did not get much affirmation from investors. These included those about calculating energy reserves in BTUs and altering executive bonuses tied to fossil fuel reserve accounting changes; resubmitted proposals addressed boosting dividends given purportedly stranded carbon assets and reporting on the lack of support for climate change shareholder resolutions at mutual funds. None of the eight votes on these issues was above 9 percent and most were lower.

Environmental management: A baker’s dozen of environmental management resolutions included familiar requests for more recycling, where the highest vote was on beverage container recycling at Dr Pepper Snapple Group of 37.8 percent. Otherwise, there was a low vote about nuclear plant permits at Dominion Resources of 4.3 percent. Three companies—Chipotle Mexican Grill, Dunkin’ Brands Group and Yum! Brands—agreed to cut their waste streams by encouraging on-site recycling of their food and drink packaging so As You Sow withdrew its proposals.

Toxics: Investors and the SEC have yet to warm up to proposals about nanomaterials in food products and gave a resolution about Good and Plenty candy at Hershey only 3.8 percent. But As You Sow did get J.M. Smucker to evaluate its use of nano-titanium dioxide and report—so withdrew. Other resolutions about PCBs in the Hudson River and BPA in packaging were omitted, though.

Industrial agriculture: The highest votes on industrial agriculture issues were 27.4 percent for water management at Sanderson Farms and 26.3 percent on antibiotics in the meat animal supply chain, at McDonald’s. Others dealt with genetically modified food, neonicotinoid pesticide use in the supply chain and animal welfare, but little stood out other than further examination by food companies about limiting antibiotic use.

Social Issues

Animals in entertainment: People for the Ethical Treatment of Animals (PETA) focused on orca breeding at SeaWorld Entertainment, and withdrew when it announced an end to this program, but another vote about promoting the use of animals in entertainment at online promoter Groupon earned almost no support (0.4 percent). Still, a resolution about how the Zika virus might spread via research monkeys housed outdoors in Texas, at Laboratory Corporation of America, provided food for thought and earned 5.3 percent. (The company says no such risk exists.)

Corporate political activity: About one-quarter of all social and environmental resolutions were on corporate political activity and more than half (65 proposals) related in some fashion to lobbying, while another 38 were on election spending. The number of resolutions fell this year to 105, down from a high of about 140 in 2014, but an increasing number of companies have adopted more robust oversight and disclosure. The critical sticking point stopping more accords between critics and companies is whether firms should be fully transparent about their contributions to intermediary groups like trade associations that spend on both elections and lobbying. New this year were about half a dozen resolutions about the revolving door between industry and government, from the AFL-CIO, but key coordinators remain the Center for Political Accountability (elections) and AFSCME, with Walden Asset Management (lobbying).

Lobbying—The highest votes were 49.4 percent for a resolution about both election and lobbying spending at NRG Energy, alongside 43.9 percent at Travelers for a lobbying-only disclosure proposal. Most votes were above 20 percent, with an average for the main lobbying resolution of about 24 percent. Seven companies reached agreements with proponents about more disclosure. The highest vote for the new revolving door resolution was 30.5 percent at Citigroup and Bank of America prompted a withdrawal on this issue when it said anyone who leaves to work for the government forfeits accelerated vesting of equity awards—the issue at stake in these resolutions.

Elections—There were two majority votes for the Center for Political Accountability’s resolutions—now more than a decade old—on oversight and disclosure of election spending: 61.9 percent at Fluor and 50.3 percent at NiSource. Five others earned more than 40 percent, at McKesson, NextEra Energy, Range Resources, Western Union and Wyndham Worldwide. For 14 of the 15 resolution withdrawals, companies and proponents reached agreements. The average CPA proposal earned 33 percent, a new high water mark.

Decent work: Popular concern about the high economic and social costs of economic inequality drove a slew of new proposals about gender pay equity, income inequality and workplace safety this proxy season. A third of the 30 proposals went to votes, a third were withdrawn after agreements and a third were omitted after SEC challenges.

Wages—A new resolution to a dozen low-wage sector companies about adopting principles for minimum wage reform fell to SEC challenges. On the more positive side, six of the tech companies that Arjuna Capital asked to boost the number of women and minorities who work for them agreed to do so. In a surprise development, one of these that did go to a vote earned a majority, at eBay (51.2 percent).

Safety—Workplace safety was at issue at both chicken processors and industrial firms, and earned the most at Du Pont (30 percent) and Sanderson Farms (24.9 percent, where an Oxfam report in October 2015 described problematic conditions for low-paid workers, mostly in the American South).

Diversity in the workplace: Resolutions seeking protections for lesbian, gay, bisexual and transgender (LGBT) employees continued to decline in number given recent legal affirmation of these rights and all but one were withdrawn after companies agreed to act. The one vote was a majority—54.7 percent at J.B. Hunt Transport, which since has agreed to put the requested policy in place. A new resolution that seeks company reporting on the impact of anti-gay laws may go to votes at FedEx and Procter & Gamble this fall, however; in August, the SEC rejected P&G’s contention it was too vague and dealt with ordinary business. Further scrutiny of LGBT protections up and down the value chain may be in the offing, as well, as reflected in a resolution that NorthStar Asset Management filed but then withdrew on this subject at Stryker.

Other equality proposals were on EEO disclosure and they earned in the mid- to high 20 percent range at American Express, Charles Schwab and Omnicom Group and were withdrawn after disclosure agreements at three more firms.

Health: The deadly national opioid epidemic partly inspired a novel new resolution from As You Sow at three drug companies (AbbVie, Johnson & Johnson and Merck), but it earned 7.5 percent or less. It sought to apply the principles of recycling to prescription drug take-backs, arguing this also could reduce environmental hazards associated with improper drug disposal in the consumer waste stream. None of three resolutions about tobacco advertising and childhood obesity went to a vote but there were two votes on tobacco policy, with the highest 8.2 percent at Philip Morris International on a proposal questioning the company’s efforts internationally to weaken tobacco control legislation.

Human rights: The most notable feature for human rights proposals in 2016 was the growing emphasis on the conflict between Palestinians and Israel. This accounted for 15 of the 44 proposals in the human rights category, with new proposals about business ties to Israeli settlements and the complicated issues they raise. Eight more resolutions sought implementation of the Holy Land Principles for fair employment. All the Israel-Palestinian conflict proposals earned low marks from investors, getting at the apex 8.6 percent for a Holy Land Principles fair employment resolution at United Parcel Service, and there were no publicly disclosed agreements.

The AFL-CIO went to tobacco and food companies to persuade them to use an international human rights mediation mechanism set up by the Organization for Economic Cooperation and Development; these earned only modest support at six companies, but PepsiCo said it would use the method and the union withdrew there. Proponents also withdrew four of six resolutions seeking human rights risk assessments called for by UN methodology and otherwise saw relatively high votes of about 25 percent at Amazon.com and Kroger. Four trucking companies and a casino company signed on to help stop human trafficking, prompting withdrawals in a success for members of the Interfaith Center on Corporate Responsibility and their continued campaign. The disparate slate of additional proposals included a handful about respecting indigenous rights, criminal justice and gun control and privacy, with notable votes of 21.5 percent at prison company GEO Group and 22 percent on government access to private information at American Express.

Sustainable Governance

Board diversity: The push for more women and minority board members continued from The 30 Percent Coalition, and 15 companies agreed to modify their governance procedures as requested. Two majority votes occurred: One was at FleetCor Technologies when the company did not make a recommendation on the proposal (72.4 percent) and the other at Joy Global (52.4 percent). At Apple, a new resolution from an individual called for greater diversity in upper management as well as on the board, but it earned only 5 percent after the company averred diversity was critical to the company’s success.

Board oversight: Resolutions covered in this report for the most part all seek greater corporate board oversight of environmental and social issues, but those that focus only on the mechanism of oversight tend to get little support, as they did this year, earning 6 percent or less in three instances. Proposals that sought environmental experts to be nominated as board members were more successful, with votes of 19 percent at Chevron and Dominion Resources and 21 percent at ExxonMobil.

The Board Room Accountability Project led by New York City Comptroller Scott Stringer, begun last year, gets to the heart of investor concerns about board oversight. It seeks the right for groups holding large stakes in companies to nominate directors on corporate-issued proxy statements—“proxy access.” The comptroller targeted companies with low levels of board diversity, high carbon intensity and low investor support for executive pay packages and filed resolutions at 75 companies in 2015 and 72 in 2016. As of June 2016, 230 companies have enacted what the comptroller’s office calls “meaningful proxy access,” a huge jump from only six at the start of the campaign in November 2014. Thirty-six of the proposals this year were resubmissions at companies that had yet to enact the requested reform, while 36 were new recipients. Full coverage of this issue is beyond the scope of this report but it will remain a matter of keen interest to many in the future, where for the first time in 2017 we may see large investor groups offer up their own board nominees on company proxy statements. Despite the rapid adoption of proxy access rights, not all is pacific: Reaction also includes a new set of principles this month from The Business Roundtable, the association of prominent CEOs, which asserts that investors should not use the shareholder proposal process to “pursue social or political agendas that are largely unrelated and/or immaterial to the company’s business, even if permitted by the proxy rules.”

Sustainability oversight and reporting: At the peak just three years ago in 2014, investors filed 54 resolutions asking companies to produce sustainability reports and/or link sustainability implementation to executive pay. The number fell to only 30 this year, with 18 asking for reports (down from 28 last year), and 12 seeking pay links. The pay links proposals included a new proposition that said falling oil prices and their impact on reserves accounting should be considered in executive pay calculations; it received 6.9 percent at ConocoPhillips and was withdrawn when Chevron said it already does this. Among others, a resolution at struggling Chipotle Mexican Grill earned the most, with 23.3 percent.

Conservatives

There were fewer proposals from political conservatives in 2016—16 instead of the 18 filed last year. The main actor, the National Center for Public Policy Research and its Free Enterprise Project, used a new human rights frame to question company operations in the Arab world, China and India, saying these were inconsistent with the values espoused by Apple and five other companies. It also used NorthStar Asset Management’s political spending values congruency approach from earlier proxy seasons to question other companies’ past support for climate change cap-and-trade and health care reform. Additional proposals from individuals sought to turn back LGBT rights protections. None of the votes was more than 4 percent.

Print

Print