Scott Hirst is a Lecturer on Law at Harvard Law School and Associate Director of the Harvard Law School Program on Corporate Governance. This post is based on a recent article by Dr. Hirst, forthcoming in the Journal of Corporation Law.

Shareholders exert significant influence on the social and environmental behavior of U.S. corporations. Shareholders vote on social responsibility resolutions that are put forward at corporations; their success or failure influences the social and environmental behavior of those corporations. The largest shareholders are institutional investors—mutual funds, investment advisers and pension funds. When they vote on social responsibility resolutions, they do so as fiduciaries for their own investors. In a new article, Social Responsibility Resolutions, forthcoming in the Journal of Corporation Law, I consider two questions: Do the votes of institutions on social responsibility resolutions follow the interests of their own investors? And do the votes of institutions on social responsibility resolutions follow the preferences of their own investors? I put forward evidence that many may not, and consider whether this is a problem, and if so, how it could be addressed. The stakes are high: if institutional investors voted on social responsibility proposals as their own investors preferred, corporate behavior on social and environmental matters might be much closer to what investors, and society, would prefer.

The overwhelming majority of investors in corporations do so through fiduciaries—mutual funds, investment advisers and pension funds. Because these intermediaries make voting decisions on their investors’ behalves, there is a possibility that the voting decisions may not reflect investors’ interests, or their preferences. In examining this issue, I focus on voting by mutual funds, which hold the largest proportion of equity of U.S. corporations, and are the only type of institution for which voting data is widely available. The fiduciary duties of mutual fund directors and investment advisers are generally interpreted as requiring them to vote on resolutions at portfolio corporations, in the best interests of their investors. I focus on their voting on social responsibility resolutions, resolutions requesting that corporations take certain actions on social and environmental matters.

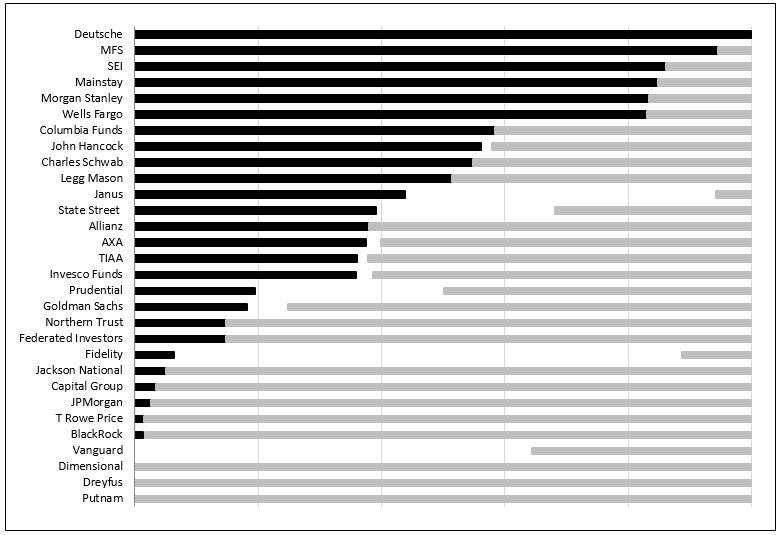

A consideration of the voting records of mutual funds suggests that some of their votes on social responsibility resolutions represent a distortion of either the interests or the preferences of their investors. The chart below presents data for votes by the largest 30 mutual fund families on political spending disclosure resolutions, in decreasing order of the percentage of fund-votes in favor (black denotes the proportion of fund-votes in favor, gray the proportion against, and white the proportion of fund-votes to abstain).

Largest Mutual Fund Family Voting on Resolutions regarding Political Spending Disclosure

Second, the way many of the funds in the chart above vote on political spending resolutions may differ from the views of a majority of their own investors. Two opinion polls considered in the essay suggest that the preferences of the funds’ investors may differ significantly from how most funds vote on resolutions concerning political spending disclosure. And because funds vote “all-or-nothing” for, against or abstain, even where funds vote the way a majority of their investors are likely to prefer, there will be a divergence from the preferences of a minority of their investors.

This data suggests two conclusions. First, votes of different mutual funds on social responsibility resolutions diverge widely, even among mutual funds that are likely to have very similar investors with very similar interests. Deutsche Asset Management voted 100% of its fund-votes in favor of political spending resolutions. Yet Dreyfus, Putnam and Dimensional voted 100% of their fund-votes against such resolutions. If there was likely to be significant variation in the investors served by these different fund families—e.g., if some were “socially responsible investment” funds—the variation might be explained by the fund following the preferences of their investors. However, all of these are large, mainstream mutual funds. Given the size and number of investors in these funds, the comparability of their mutual fund offerings, and the robust competition in the mutual fund market, it is likely that there is a significant overlap between the types of investors these funds cover. Funds that vote in radically different ways cannot all be right about which outcome would maximize shareholder value. If there is a way to vote on these resolutions that reflects the best interests of these investors, some mutual funds appear to be voting wrongly on many resolutions.

Even if this is the case, does it matter that mutual fund votes may not follow the preferences of their investors? This is open to debate. If mutual funds can determine better than their own investors what is in the interests of those investors, then this distortion may be optimal. If corporations can determine for themselves the actions that will maximize value on the matters being considered, then the preferences of their investors may be irrelevant. However, if it is considered valuable for corporations to follow the wishes of their investors, then these distortions may represent a significant problem, as they result in corporations being less likely to act as their ultimate investors would prefer. Many resolutions requesting action on environmental and social matters may fail where investors would prefer that they pass. Corporations are less likely to take requested actions where resolutions fail. And proponents are less likely to bring resolutions at other corporations, or bring other kinds of resolutions, given that such resolutions attract less support than they otherwise would. Public officials that consider the results of resolutions as a proxy for investor preferences on these matters will receive distorted information, and may be less likely to take action themselves.

I do not attempt to offer a conclusion regarding whether distortion constitutes a problem, or even whether it is taking place. However, in the event that distortion is taking place and is considered a problem, I consider the alternatives for resolving the problem. One possible solution is for investors to choose mutual funds that vote in the ways that they prefer. This already takes place to limited extent when investors invest in socially responsible investment funds. However, those funds represent a small percentage of aggregate funds invested, and there are significant impediments to widespread sorting among mutual funds, including very limited investor access to the information necessary to make such decisions. The alternative is for mutual funds to consider the preferences of their investors when determining voting policies and decisions. In order to represent investors with preferences representing a minority of investment in the fund as well as those representing a majority, mutual funds could adopt policies whereby they would split their vote in proportions consistent with the preferences of their investors. Vote splitting is currently rare, but as a practical matter it is likely to be relatively straightforward for these well-resourced institutions.

The next step in this debate should be for further consideration of the preferences of investors. The data I use to draw conclusions about investor preferences is limited and imperfect; the investment industry—with the encouragement of the Securities and Exchange Commission—should undertake their own analysis to determine whether their voting differs from how their investors would prefer, and whether this represents a problem.

The full article is available for download here.

Print

Print