The following post comes to us from Institutional Shareholder Services, Inc. and is based on an ISS publication by Albertine d’Hoop-Azar, Katryna Martens, Peter Papolis, and Eduardo Sancho.

Perhaps no major issue in governance has risen up as ubiquitously across the globe as that of gender diversity in the boardroom. Board diversification has been embraced in principle by members of the issuer and investor communities alike—but in many countries, we’re clearly living in a “do as I say, not as I do” regime. The annual PwC director survey found 43 percent of directors surveyed believed that there should be equality or near-equality (41-50 percent women), and another 43 percent believed it should be 21-40 percent women. However, taking the United States as an example, ISS QualityScore data shows that among the Russell 3000, only 28 percent of boards have at least one-fifth of their respective seats held by women—and only 1.7 percent have at least two-fifths held by women.

Investors are beginning to take note, and gender representation on the board is already having a measurable impact on director election results. Utilizing ISS’ Voting Analytics database, we found a significant disparity in support for companies with at least one female director on the board versus companies with an all-male board. After analyzing almost 34,000 Russell 3000 director elections from July 2014 to June 2016, we found that average support for director nominees on boards with at least one female member stood at 96 percent. By comparison, average support for nominees at companies with all-male boards stood at 91 percent.

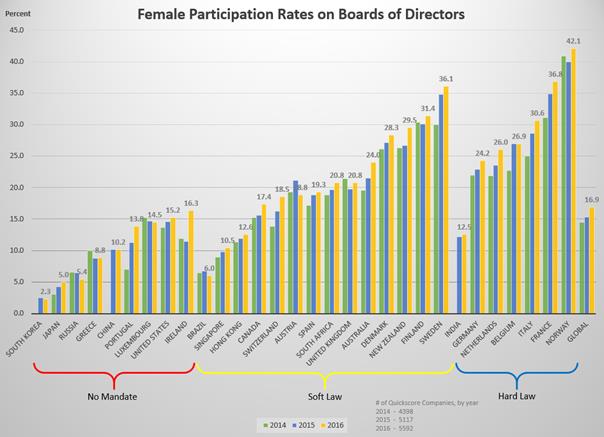

And while we are focusing on gender diversity here, we want to acknowledge that boardroom diversity can reference any number of attributes; tenure, age, experience and background, ethnicity, race, and gender are among the differences that boards often cite when seeking a diverse composition. Gender diversity has received the most attention recently, and progress is starting to be made. Current progress varies dramatically, with some countries, such as Norway, with an average of over 40-percent female board representation, down to South Korea’s 2.3 percent. A number of factors drive these differences.

Using data from ISS’ QualityScore, we looked at the average gender diversity on boards at companies in 30 countries around five continents. We compared the differences, and analyzed the drivers, including factors such as regulation and culture.

Global Trends in the Boardroom: Gender Diversity

Globally, the number of women on boards has been increasing for at least the last three years. According to ISS QualityScore data, overall female representation has increased on boards from 14.5 percent in 2014, to 15.3 percent in 2015, and 16.9 percent in 2016. While this is still a small proportion of all directorships, the 1.6 percentage point increase from last year through this year is a large jump, and also represents a significant number of global directorships now held by women.

At first glance, the greatest predictor of a more gender-diverse board seems to be the strength of any regulation mandating some minimum level of diversity. Stronger regulations with mandates for minimum gender representations are in place in many of the markets with the highest percentage of female directors, while markets with less stringent regulations or no mandates tend to have fewer female directors. However, this is somewhat of a simplistic approach; the reality is that social norms in various markets often drive the regulatory framework, and how that regulatory framework is fulfilled—and in some regions, social norms seem to have obviated the need for regulation entirely. For example, the Scandinavian countries Sweden and Finland are among the countries with the highest number of females on boards, whereas they have no targets regarding gender diversity.

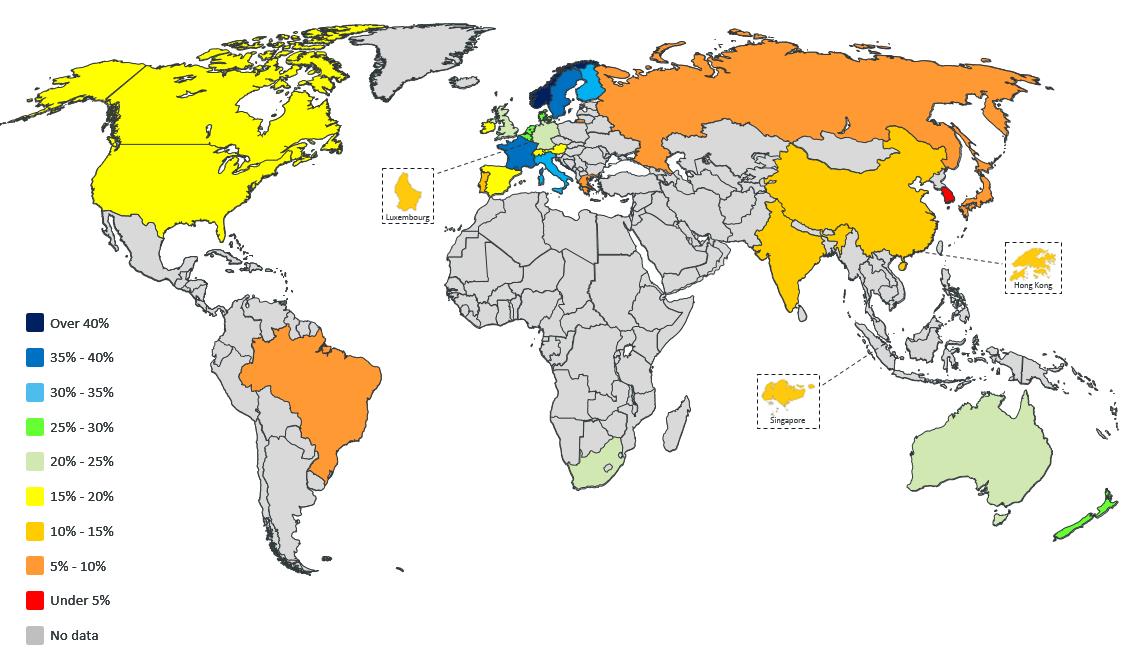

With this recognition, we’ll begin by examining the global regulatory framework for gender diversity—and then take a closer look at the impact of social norms. As a starting point, we’ve taken a snapshot, among companies covered by ISS QualityScore, at the level of gender diversity on boards in each region, as of fall 2016:

2016 Gender Diversity Percentage

Not All Regulation is Created Equal

The type of regulation has a significant impact on the rate of women on boards. Most of the countries of the world that have passed hard laws and hard gender quotas are in Europe. For example, Norwegian law defines precise and strict quotas that depend on the size of the board: (i) if the board of directors has two or three members, both sexes shall be represented; (ii) if the board of directors has four or five members, each sex shall be represented by at least two members; (iii) if the board of directors has six to eight members, each sex shall be represented by at least three members; (iv) if the board of directors has nine members, each sex shall be represented by at least four members, and if the board of directors has more members, each sex shall represent at least 40 percent of the members of the board; and (v) the rules apply correspondingly for elections of deputy members of the board of directors. This has resulted in an average of 42 percent diversity on Norwegian boards in 2016. India has a law mandating that at least one director be female. France’s regulation has gotten stricter over the past few years.

Many markets have guidance, a soft law, or a comply-or-explain provision. For example, while the U.K. does not have a hard law on the books, the U.K. government-backed 2011 Davies Review set a non-binding target of 25 percent women on the boards of directors of FTSE 100 companies by the end of 2015. Whereas the QualityScore data, which covers the FTSE All-Share (ex-investment trusts), shows that the current ratio of women is 20.8 percent as of Oct. 2016, all FTSE 100 boards have met the target of 25 percent, with an overall average of 26.7 female directors. Subsequently, in the five-year review, this target was raised to 33 percent on FTSE 350 boards by 2020.

Conversely, other markets demonstrate that the absence of any of sort regulations may prevent the country from progressing in gender diversity. This is the case in the United States, China, Russia, Greece, South Korea, and Japan; in a number of these countries, gender diversity remains very low.

South Africa’s female board representation currently hovers around 20 percent. In 2003, the South African government implemented the Broad-Based Black Economic Empowerment (B-BBEE) Act with the aims of combating systematic racism of its black citizens via economic empowerment. One of the objectives of this act is to increase “the extent to which black women own and manage existing and new enterprises, and increasing their access to economic activities, infrastructure and skills training.”

The Socio-Cultural Context

Why Regulation May Matter Less than the Attitudes Behind it

It is apparent that having a law requiring some mandatory minimum level of female board representation is effective in causing companies to bring female directors on at a rate that satisfies those legal requirements. It is also clear that countries without regulation tend to lag those with both hard and soft laws. However, the potency of these regulations, especially in terms of their ability to affect real change, is determined to a large degree by the general outlook of the locality where they are enacted. As mentioned above, Sweden has no quota for female board representation, but boards in Sweden are among the best in gender parity in the world. In fact, all the Nordic countries have much higher levels of female board representation than their global counterparts. Finland does not have a hard law, similar to Sweden, and so a willingness to comply with the soft law and enhance gender parity on boards is driving the relatively high number of female directors. Even in Norway, which does have a 40-percent minimum hard law, and has the highest degree of gender parity on boards in the world, the country was the first to pass a law—enacted in 2003 and enforced since 2006—reflecting a more progressive attitude toward female board representation. In addition, Scandinavian countries also have laws in place which facilitate women in combining professional careers and family life.

Contrast this with some of the lowest performing companies in terms of gender parity—for example, South Korea, where hermetically-sealed, family-contained chaebols run a significant number of companies, and traditional attitudes around gender roles run strong. South Korea has the lowest gender parity of any country in the ISS QualityScore universe. China, Russia, and Japan also fit this category. It is difficult to say if the fealty to the status quo is a result of a desire by executives and directors to maintain the control they have over these companies, as opposed to a traditionalist viewpoint that is skeptical of gender diversification, but the outcome of the resistance to change in these markets is clear in its impact on boardroom diversity.

Another category is countries where there is not yet regulation, but attitudes are changing, and the results reflect this. The United States is probably the best example of this. In the United States, the ratio of women on boards in the Russell 3000 index has risen from 13.6 percent in 2014 to 15.2 percent in 2016. There is no legal requirement nor code of best practice that specifically targets the participation of women on boards of U.S. companies, but several grass-roots campaigns have come about to accelerate the rate at which companies increase participation by women. For instance, 2020 Women on Boards is a national campaign to increase the percentage of women on U.S. company boards to 20 percent or greater by the year 2020, and the Thirty Percent Coalition is a national organization that is committed to the goal of women holding 30 percent of board seats across public companies. Another private sector initiative backed by the Center for Economic Development to increase gender diversity on U.S. boards is the Every Other One initiative aimed at getting companies to appoint a woman to every other board seat that opens up. Finally, 29 resolutions regarding this topic were filled by shareholders this year. Sometimes, as in the U.K. and Canada, changing attitudes in markets where there is no regulation, lead to the development of rules or guidance.

Finally, there are countries like India, where a law exists, but in name only in the case of many companies. In India, the law requires that every board have at least one female director, or risk paying a fine or worse penalties imposed by SEBI (the market regulator) for non-compliance. Virtually all Indian companies that fall under the ambit of this rule have complied. However, according to QualityScore data, the average board size in India is 9 directors. Given that just under 13 percent of directors in India are female, this strongly suggests that many companies in India are bringing on one female director to meet the minimum requirement. The average number of female directors in India is just over 1 per board, and just 16.5 percent of the 739 Indian companies under QualityScore coverage in 2016 have more than one female. Only 28 companies have more than 2 female directors, and only 2 companies have 4 female directors. Further, there are a number of companies where the female director is related to a member of the board. Stories about the chair bringing on his wife are readily found in the news, and female directors in India are only independent 59 percent of the time. Only 13 percent of female directors are executives at the company, suggesting that companies in India are bringing in female directors to meet the law’s minimum requirements, but who have significant ties to a male on the board.

Conclusion

Given the number of studies that strongly correlate more diverse boards with higher performance on any number of financial metrics, the pressure to continue to diversify the boardroom will likely continue to increase. And while progressive societal norms are the most effective way to build meaningful and impactful gender diversity on corporate boards, regulations also clearly have significant impact on increasing gender diversity levels in boardrooms. However, these laws generally take time to foment change, and this “brute force” method can have other potential drawbacks. In some countries where there is regulation but not societal acceptance, many companies fulfill the requirements at the absolute minimum level with little regard paid to creating any impetus for change. There is no “one size fits all” solution to increasing gender diversity; each region has different levels of societal acceptance for gender equality, and regulation would have different impacts in each region.

In other countries that have a high degree of success in increasing representation of males and females to near equal levels without regulations, a simple “guidance” for diversity can be enough. For the countries with more diverse boards, much of this is driven by cultural norms in that market, which are often reflected in policies and educational programs that are in place to facilitate female participation in the workforce.

This brief analysis of ISS QualityScore data shows us that there is clear progress being made in increasing gender diversity at the board level, and this holds true to some degree for most of the world. However, this is unfortunately not the case for CEOs. For instance, in the U.S., only 4 percent of S&P 500 CEOs are women. Among EU Stoxx 600 companies, only 3.5 percent of the CEOs are women.

Print

Print