The following post comes to us from Gibson, Dunn & Crutcher LLP and is based on a Gibson Dunn publication by Barbara L. Becker, Richard J. Birns, Dennis J. Friedman, Eduardo Gallardo, and Adam J. Brunk. Related research from the Program on Corporate Governance includes The Myth that Insulating Boards Serves Long-Term Value by Lucian Bebchuk (discussed on the Forum here), and The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here).

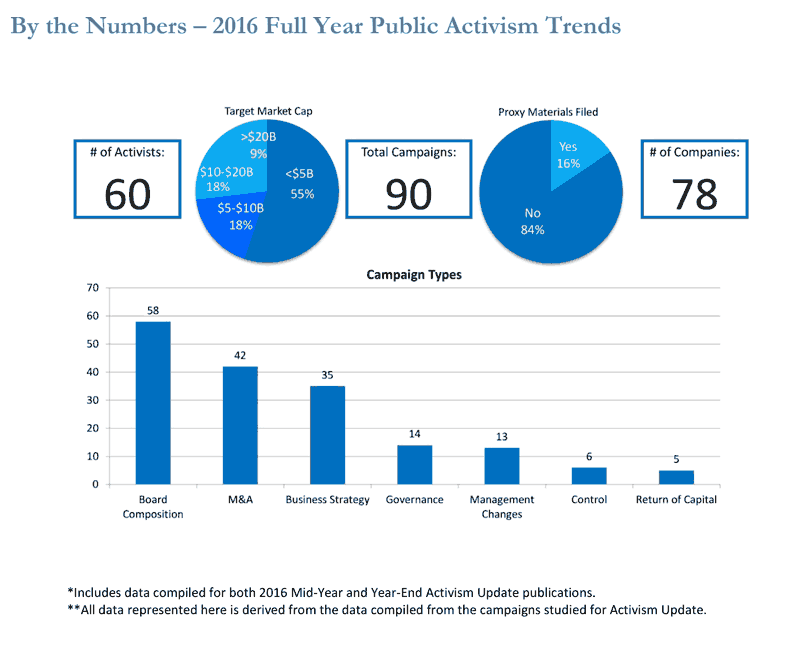

This post provides an update on shareholder activism activity involving domestically traded public companies with equity market capitalizations above $1 billion during the second half of 2016. Notwithstanding a difficult market backdrop in 2016, including the surprise “Brexit” vote, a bitterly fought U.S. presidential campaign, a significant decline in oil prices, and vigorous public debate on “short-termism,” activist investors continued to be busy across a wide range of industries (even if fewer campaigns made major headlines). Furthermore, in 2016 as compared to 2015, our survey found relative consistency in the total number of public activist actions (90 vs. 95), the number of activist investors involved in such actions (60 vs. 56), and the number of companies targeted by such actions (78 vs. 81).

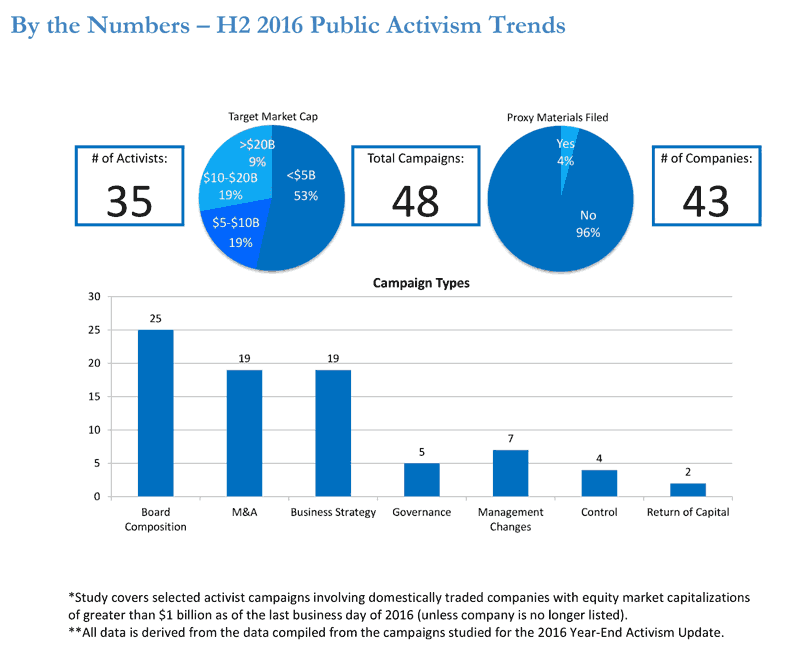

In the complete publication (available here) our survey covers 48 total public activist actions, involving 35 different activist investors and 43 companies targeted, during the period from July 1, 2016 to December 31, 2016. Four of those companies faced advances from multiple investors, including one company that faced actions by three investors and another company that saw two activists temporarily coordinate their efforts. Equity market capitalizations of the targets range from just above the $1 billion minimum covered by this survey to approximately $280 billion.

For the second half of 2016, changes to board composition, including gaining representation on the board, continued to be the most common objective of activist investors (52.1%). In addition to goals related to M&A, including pushing for spin-offs and advocating both for and against sales or acquisitions (39.6%), activist investors frequently took on target companies’ business strategy plans (39.6%). Large equity capitalization companies were infrequently targeted, as only 8.3% of the companies included in the complete publication had equity market capitalizations greater than $20 billion, while the majority of campaigns included in our survey involved small capitalization companies, as 53.5% of the companies in our survey had equity market capitalizations below $5 billion. The trend toward smaller targets continued from the first half of 2016 (for the first half of 2016, 10.5% of the companies were above $20 billion and 55.3% of the companies were below $5 billion).

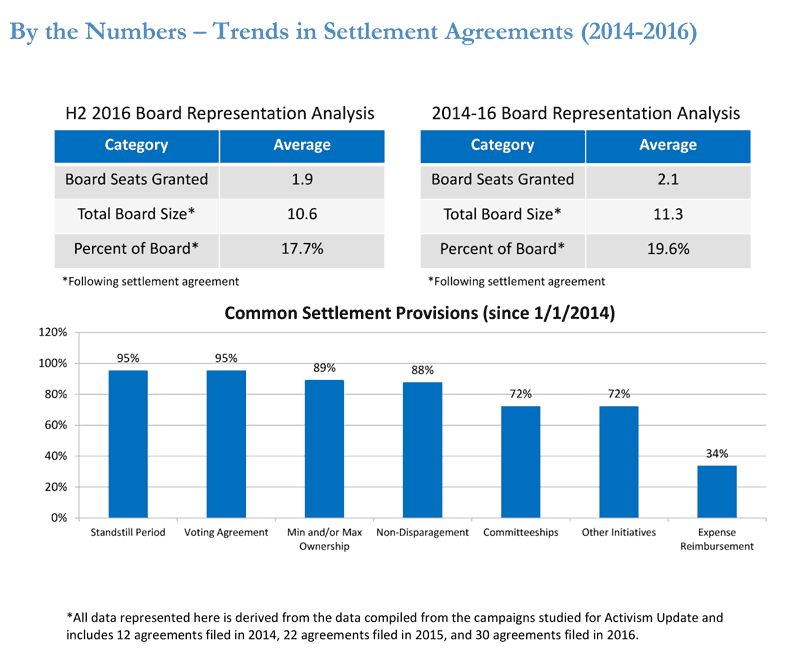

We also note an increase in publicly filed settlement agreements in 2016, as this survey covers 13 settlement agreements publicly filed in the second half of 2016, making it 30 total settlement agreements in 2016 compared to 22 such agreements in 2015. Within the settlement agreements publicly filed in the second half of 2016, standstill periods and voting agreements remain nearly ubiquitous, and the marked increase in the inclusion of other strategic initiatives (e.g., replacement of management, spin-off company governance, etc.) seen in the first half of 2016 continued through the second half of the year (92.3% in the second half of 2016 and 86.7% for 2016 in total). We delve further into the data and the details in the latter half of the complete publication, in which we have included a chart of the activist campaigns covered by the survey and statistical analyses of various trends for the second half of 2016, as well as a survey of settlement agreement terms with breakdowns of settlement agreements publicly filed during the second half of 2016 and updated statistics on key settlement terms from 2014 through 2016.

The complete publication is available here.

Print

Print