Yannick Ouaknine is a senior analyst with the Socially Responsible Investing group at Société Générale S.A. The following post is based on an SG publication by Mr. Ouaknine, Nimit Agarwal, and Niamh Whooley. This post relates to an SG publication titled “Corporate Governance,” issued January 3, 2017, available here.

Corporate governance has a wide scope but broadly it refers to the mechanisms, processes and relations by which companies are directed and controlled. Adopting both effective and efficient governance practices at the corporate level has become a priority.

The relevance of corporate governance principles for an organisation may be impacted by the size of the business and the industry or country in which it operates, with however “minimum” requirements. Governance principles are primarily influenced by the regulatory framework that applies to the company and by stakeholder scrutiny.

Over the last decade, there has been a significant improvement in corporate governance disclosure, transparency and communication, which has given rise to new concerns from an investor standpoint:

- What are the most relevant metrics?

- Are there any biases in such analyses?

- How should corporate governance metrics be weighted?

- Are there any red-flag indicators?

- Could companies possibly influence the results?

A careful review and assessment of a firm’s corporate governance set-up is essential as any unidentified weakness or flaw could result in a failure to comply with regulatory requirements or alignment with shareholder interests. This could negatively affect the way business is done and, ultimately, the share price performance.

In addition, for a growing number of investors, Engagement, the dialogue between investors and companies, is the pivotal tool to better understand companies’ management and mitigation of corporate governance risks.

While “Environmental” and “Social” risks are equally important risks that investors should examine, the purpose of the complete publication is to:

- Single out “relevant” corporate governance metrics,

- Create a quantitative screening tool helping us to flag “most at risk” companies (within the

Stoxx600 index), - Emphasise the need for qualitative assessment through shareholder engagement,

- Provide a sample of corporate governance questions to initiate a dialogue between investors and investee companies,

- Name sector-specific other engagement topics.

In conclusion, as the access to corporate governance data improves, we are witnessing a new trend towards the harmonisation of reported data. The challenge of discriminating between companies in this new environment can only be addressed through effective stakeholder engagement.

Key takeaways

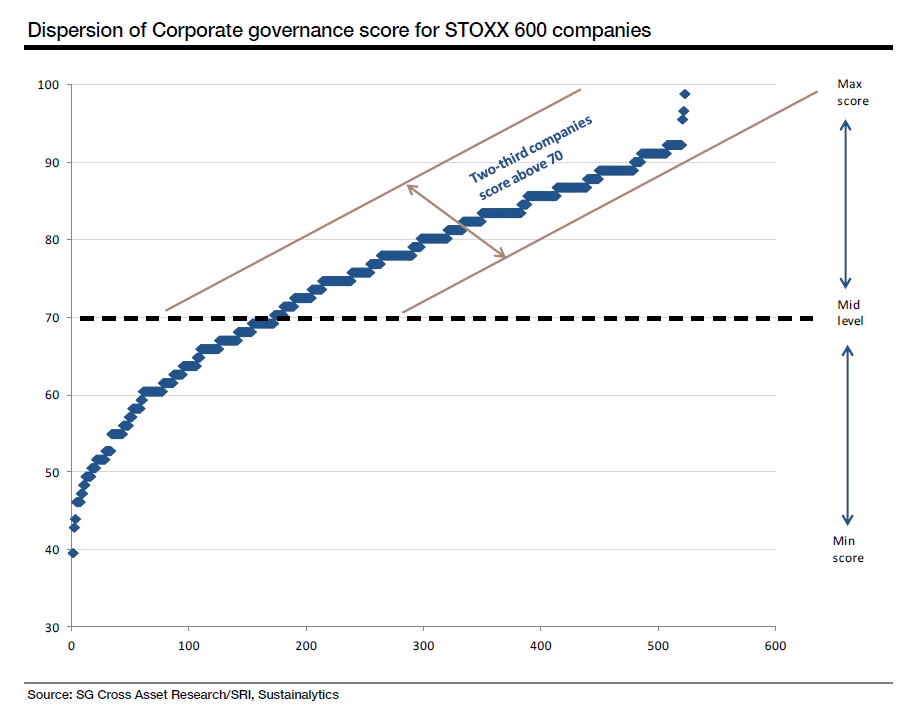

In this report we have developed a quantitative tool that seeks to provide a first impression as to whether a company is doing well or whether it still has room to implement sound governance practice. We perform a quantitative assessment of the corporate governance profile of the Stoxx600 based on four themes, ten indicators and 29 metrics, each highlighting a degree of “confidence” or “risk”. Our analysis indicates that two-thirds of companies are decently placed on their corporate governance performance. As depicted in chart below, most of the companies score higher than the mid-level ‘70’ score in our analysis. We also observe that results are skewed based on the country of domicile for the companies, as local regulations and practices impact the governance set-up, which suggests that the quantitative signal is not sufficient enough. When making a company assessment from a governance stand-point, there are many areas that can only be covered through interaction and engagement with the management of the respective organisations.

The second section of this report builds upon the quantitative data. It describes how engagement allows a better understanding of how companies manage corporate governance risks by employing some of the best engagement techniques. We outline the key techniques to conduct successful structured shareholder engagement to create the best environment to bring about ESG change.

The complete publication, including footnotes, is available here.

Print

Print