Viraj Patel is Head of Operations at CMi2i Proxy. This post is based on a CMi2i publication by Mr. Patel, Tony Quinn, and Mark Simms.

In our 2017 Annual Corporate Governance Survey, we asked Institutional Investors who collectively represent over $5 Trillion of Assets under Management a series of questions relating to one theme: what do they believe will be the key Corporate Governance areas of focus for 2017 and beyond?

In keeping with Surveys from previous years, investors expect to see increased levels of engagement with issuers (“Listed Companies”)—with a clear majority of respondents (69%) now stating that they intend to step up the amount of engagement they undertake in 2017. Institutions are being encouraged to monitor the issuers in which they invest more closely. Pressure for this originates from three areas: their own clients, evolving best practice and increasing regulatory obligations in the form of stewardship codes.

In anticipation of this, we have included questions in the 2017 Survey to establish how institutional investors will react if their attempts at further engagement with a company are frustrated.

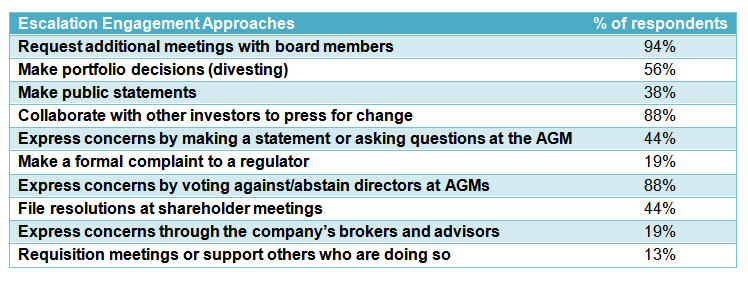

We asked specifically what approaches Institutional Investors will take to escalate engagement—and the steps they will employ if their attempts are not successful.

The research clearly demonstrates that, if issuers ignore requests for engagement or fail to provide adequate information and/or access to management, investors could take significant steps in response. (See table below for more details.) These measures include collaborating with other investors to try and force change—and may even ultimately trigger a disposal of the shares.

Have you used any of the approaches below to escalate engagement when you feel engagement efforts have not been successful?

One commonly cited escalation tactic is to collaborate with other investors. The fact that 94% of investors have already either led or supported collaborative engagement means Issuers need to recognise that shareholders are increasingly working together to encourage Issuers to follow best practice.

The research also identified that investors are increasingly concerned that Issuers are not properly prepared for meetings with them—with 51% stating that Issuers have “Limited” or “No” knowledge of their Voting Guidelines or Policies.

A consistent theme was that respondents felt Issuers were not fielding the right representatives in the meetings—and that they need better access to those responsible for making decisions about Corporate Governance policies and practices within the firm.

Respondents informed us that they often seek to engage with non-executive or outside directors, whilst their Portfolio Management colleagues sought parallel engagement with Executive Board members. The main reason stated was it would be inappropriate to have someone from the Executive Team present when discussing issues such as the company’s Remuneration Policy. However, respondents also stated that they are looking for any “inconsistency in the story” and to expose any differences between the “rhetoric and the practice”.

On the positive side, it is clear that Institutional Investors are not treating Corporate Governance as a “box ticking” exercise—but are actively looking to help improve the Issuers’ Corporate Governance standards.

81% stated that they “work with portfolio companies to help them understand their Environmental, Social and Governance risk and offer Corporate Governance advice”. When asked why, respondents echoed the sentiment that “Good Corporate Governance supports good returns”.

In fact, some respondents went further; they stated that they were working to actively identify and target Issuers with “poor ESG and Sustainability Policies” to help them improve CG performance “in order to unlock value”.

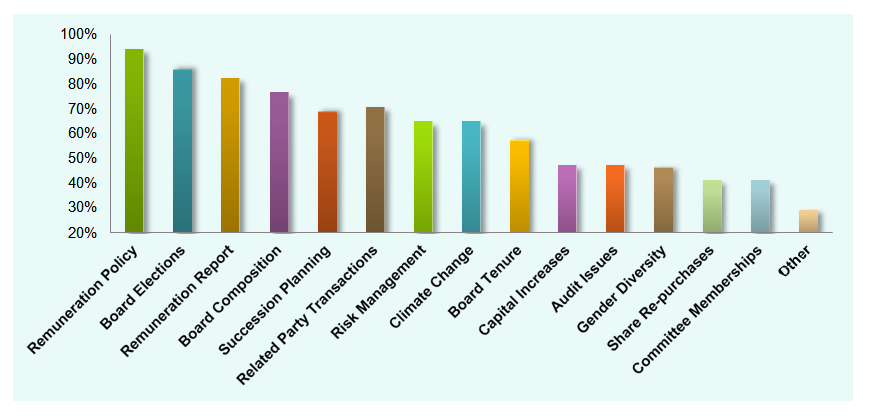

As before, the research identifies that this year’s Corporate Governance priorities include remuneration, corporate strategy and an understanding of any Risk Management Policies in place.

The issue of remuneration is particularly important for UK Listed companies as many will see their tri-annual binding vote on pay policy fall due in 2017.

Key Findings

Some of the key findings from the Report have been summarised below:

- Board Elections and Remuneration are the key corporate governance areas investors will pay particular attention to in 2017.

- There is a clear disconnect between the topics investors wish to discuss, compared to the topics on which companies prefer to engage.

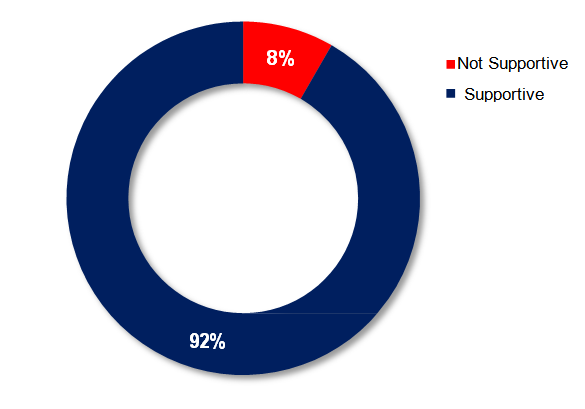

- 92% of respondents are supportive of an annual binding vote on UK remuneration policies from issuers.

- Shareholder engagement on corporate governance issues is expected to increase in 2017.

- Shareholders adopt various engagement escalation strategies. 56% of respondents have made portfolio decisions (divesting) when their portfolio companies have not reacted satisfactorily to engagement requests.

- Shareholders are collaborating with each other to enhance their influence on companies through dialogue; 94% of respondents have either led or supported collaborative engagement.

- There is a strong demand for better quality of disclosure across many corporate governance areas, including Remuneration, Board Evaluation reports and Succession Planning Process.

- 69% of Investors do not believe their portfolio companies have the relevant risk measures in place to deal with the increasing threat posed by Cybersecurity.

- Shareholders are demanding better standards of reporting on issues previously considered to be non-financial—particularly on Climate Change.

Outlook for 2017

Throughout 2016, director compensation received significant scrutiny from investors. This resulted in high levels of shareholder dissent over Board packages that were perceived to be excessive. Companies that experienced dissent included BP, Smith and Nephew, Weir Group, Renault and Deutsche Bank.

The CMi2i Report provides an insight into which areas of corporate governance investors will pay particular attention to in 2017. As with our previous reports, executive pay is expected to be at the forefront of investors’ focus. Other key areas include Board Elections and Board Composition.

Figure 1: Which corporate governance areas will you pay particular attention to in 2017?

Further Regulatory interventions are being considered around binding votes on executive pay—particularly in the U.K. and France—in an attempt to further align executive compensation with performance. The French National Assembly passed a draft bill (which has since been revised) providing shareholders with a vote on executive pay which will be binding.

The U.K. government has proposed corporate governance reforms—including implementation of an annual binding vote. The Department for Business, Energy & Industrial Strategy has published a Green Paper in the U.K. to stimulate debate in this area. The CMi2i Report sheds light on investors’ views on an annual binding vote; 92% of respondents being “strongly in favour”. On this matter, respondents stated that investors “should be able to voice and have an impact on the remuneration policy where they perceive disconnects with performance”. Other respondents argued that “investors already have the tools they require to impact remuneration policies, such as voting on the re-election of members of the remuneration committee—but these are not being used to the extent they could be.”

It will be interesting to see whether there will be increased levels of voting action taken against members of the remuneration committee in 2017.

Fig 2. Are you supportive of an annual binding vote on the remuneration policy?

In 2017, the U.K. market will witness the second cycle of binding votes on the remuneration policy—the regulation was introduced in 2013. A significant number of companies are expected to renew their remuneration policies, and given the current sensitivities around excessive Board pay, investors are likely to express any concerns either through engagement, or by taking voting action.

Companies outside of the U.K. should consider the impact this will have on their investors’ availability to engage during the 2017 proxy season.

The complete publication is available here.

Print

Print