Matthew Goforth is Research Manager at Equilar, Inc. This post is based on an Equilar publication which originally appeared in the Winter 2017 issue of C-Suite magazine, available here.

Compensating employees with equity—particularly the C-suite—addresses several objectives for companies aiming to manage talent effectively and create shareholder value. A public company’s ability to recruit, promote, incentivize and retain the right people to formulate and execute strategic initiatives aimed at growing returns for shareholders is paramount, and therefore the invitation to share in the spoils of company success is a powerful tool. Consistent with these trends, the median salary of an S&P 500 CEO has climbed 10% since 2011, and while annual cash bonuses have been relatively flat, median stock-based pay increased 57%.

The nuances lie in creating a single compensation program that works for the key stakeholders—both employees and investors alike.

“Investors, proxy advisors, employees and companies have competing needs to satisfy,” said Carrie Kovac, senior vice president, relationship management at E*TRADE Financial Corporate Services Inc. “Tailoring the equity mix for the participants accordingly helps companies balance internal objectives to attract and retain talent with external factors.”

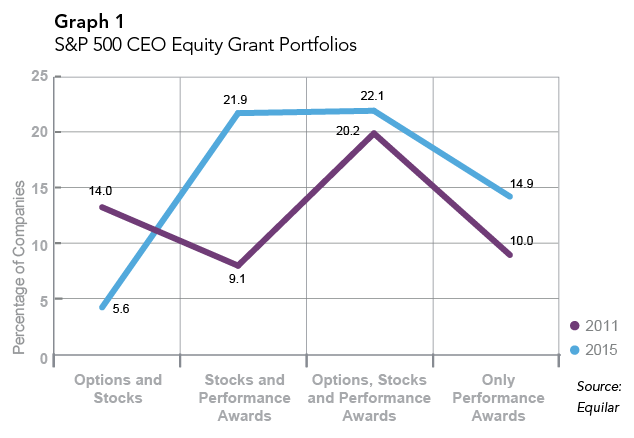

According to Equilar data, large-cap companies are adapting to the growing complexity in the compensation landscape. The combination of options, stock and performance awards continued to be the most popular equity grant portfolio for S&P 500 CEOs, while the combination of stock and performance awards overtook the grant portfolio of options and stock between 2011 and 2015.

“Probably the biggest factor driving trends has been Say on Pay,” said Russ Miller, CEO of ClearBridge Compensation Group LLC. “Options and stock are used for different purposes—stock is very attractive because of the value, though options provide a lot of upside, while blended programs are able to accomplish multiple objectives.”

While the use of stock options wanes, the structure of performance awards grows more complex and stakeholders voice their preferences, companies will continue to search for ways to use equity-based pay and address competing interests. A creative and effective equity plan offers opportunities to find competitive advantages in the market for talent and optimize the ways companies incentivize employees as well as drive long-term value creation to satisfy the desires of shareholders.

Paying for Performance

In executive compensation—specifically to the top-paid “named executive officers” reported in proxy statements, but also sometimes deeper in the organization—equity pay contingent on hitting performance goals is a primary measuring stick for alignment with shareholders. The concept of “pay for performance” gained even more traction after the financial crisis and the implementation of Say on Pay. According to the recent Equilar report, Equity Compensation Trends 2016, which featured commentary from E*TRADE Corporate Services, 80% of S&P 500 companies tied their executives’ equity pay to company performance in 2015, up from just 65% in 2011.

The popularization of performance-based equity as a means to compensate management teams has accompanied the growing influence of proxy advisors and investors over executive pay decisions. Not only do a strong majority of large-cap firms link executive pay to performance, typically over a period of three years for equity grants, but also more than 60% of the average pay mix of an S&P 500 CEO was awarded in the form of equity in 2015.

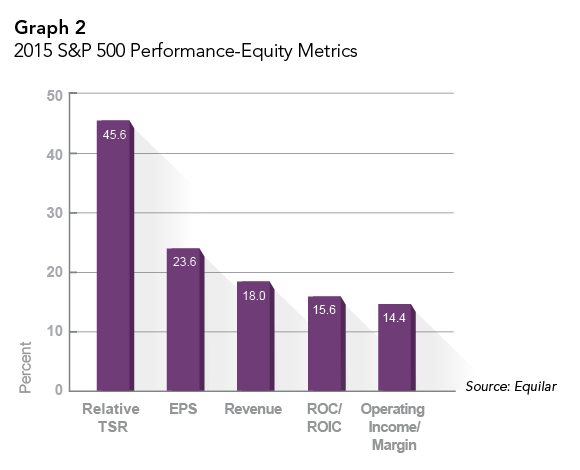

Companies are setting performance goals in several key areas that ultimately determine the amounts doled out to executives. By far, the most popular performance metric employed in S&P 500 incentive structures is relative total shareholder return (TSR), a measure of stock price appreciation and dividends paid to shareholders relative to a group of peer companies or market index. Nearly half the S&P 500 tied performance awards to relative TSR in 2015. Other common areas include profitability metrics, such as earnings per share (24% of S&P 500) and operating income or margin (14%), growth metrics (18% of companies utilized revenue as a metric), and other return metrics (16% tied performance awards to return on capital or invested capital)

While the use of stock options wanes, the structure of performance awards grows more complex and stakeholders voice their preferences, companies will continue to search for ways to use equity-based pay and address competing interests.

Because TSR measures an outcome that is the product of multiple inputs—many of which are outside management’s control—recipients of performance-based equity may lack the ability to pull the levers necessary to drive TSR upwards. Balancing performance awards linked to TSR performance with other metrics helps executives drive the financial, operational and strategic results needed to execute the business plan.

“Creating a culture of accountability is crucial,” Kovac said. “Executives need some line of sight on performance metrics and the ability to influence them to feel motivated by their grants.”

“The biggest challenge is performance awards inherently require some level of performance goal to be set,” Miller added. “Relative TSR avoids the need to set specific goals other than outperforming comparators.”

Dilution of Shareholder Value by Equity Compensation

Of the S&P 500 companies that granted stock-based compensation in fiscal 2015, the average granted 3.2 million shares of company stock, according to Equilar. Among those granting stock options, the average was 2.7 million. Given the value of these large-cap firms, it’s easy to imagine the cash savings represented by compensation paid in company stock and options. Nevertheless, these figures are down since 2011, when average stock and options granted were 4.1 and 3.7 million shares, respectively.

It is important to consider, however, what occurred between 2011 and 2015, namely the recovery of the stock market. Companies in today’s marketplace can grant fewer shares to deliver equal value. Shareholders encourage companies to keep equity granting practices in check to avoid dilution, which occurs when shares granted to company employees increase the total pool of common shares of the company’s stock, independent from any increase in the overall value of the company.

“Performance cures ills, especially as related to dilution, since a higher stock price requires fewer shares to achieve the same grant value,” said Miller.

Equity awards for senior management are reaching an all-time high.

While shareholders value alignment of employee interests with their own, too large a sacrifice in proportion of company ownership can result in discontent, and possibly worse, a shareholder vote against a company equity plan and its failed adoption. There are two key metrics that shareholders weigh in consideration of a new equity plan’s dilutive effects: Dilution overhang, which is a measure of unvested shares granted to employees as a percentage of the total common share pool, and run rate—the percentage of available shares in an equity plan actually granted to employees throughout the year.

Concerns over dilution are one reason why stock options have fallen out of favor with shareholders. According to Equity Compensation Trends 2016, dilution overhang in the S&P 500 has been falling over the last five years from a median 5% in 2011 to 3% in 2015, driven by dilution overhang from options dipping two percentage points, while overhang from stock remained steady at about 1%. More stock options are required to deliver the same value as fewer shares of stock, since options require recipients to purchase shares at a predetermined exercise price. Meanwhile, run rates have remained steady at a median around 1.5%, as fewer shares are needed to deliver value in a recovering stock market.

“Dilution is about participation—how deep in the organization is a company making grants—and the target values a company is trying to deliver,” Miller added. “Cash may be more effective [depending on the] values required to achieve company objectives of attraction and retention.”

Ultimately, equity plan designers now operate in an increasingly complex landscape framed by the interests of competing constituents.

“Equity awards for senior management are reaching an all-time high, and Say on Pay is driving more accountability in the C-suite,” added Kovac. “As long as companies are striving for balance in their plans, a culture of accountability and transparency lets employees and shareholders know exactly what needs to be achieved. The best thing a company can do is design an equity program that’s clear, accomplishes short and long-term objectives, and still meets the expectations of shareholders.”

Print

Print