Edward Kamonjoh is Executive Director of The 50/50 Climate Project. This post is based on a 50/50 Climate Project publication by Mr. Kamonjoh.

While shareholder resolutions calling on companies to proactively address the risks to investors from climate change received unprecedented levels of support last year, despite their mainstream acceptance by investors, asset managers including JP Morgan, Fidelity, Vanguard, BlackRock, and BNY Mellon frequently voted in favor of management and failed to support the resolutions.

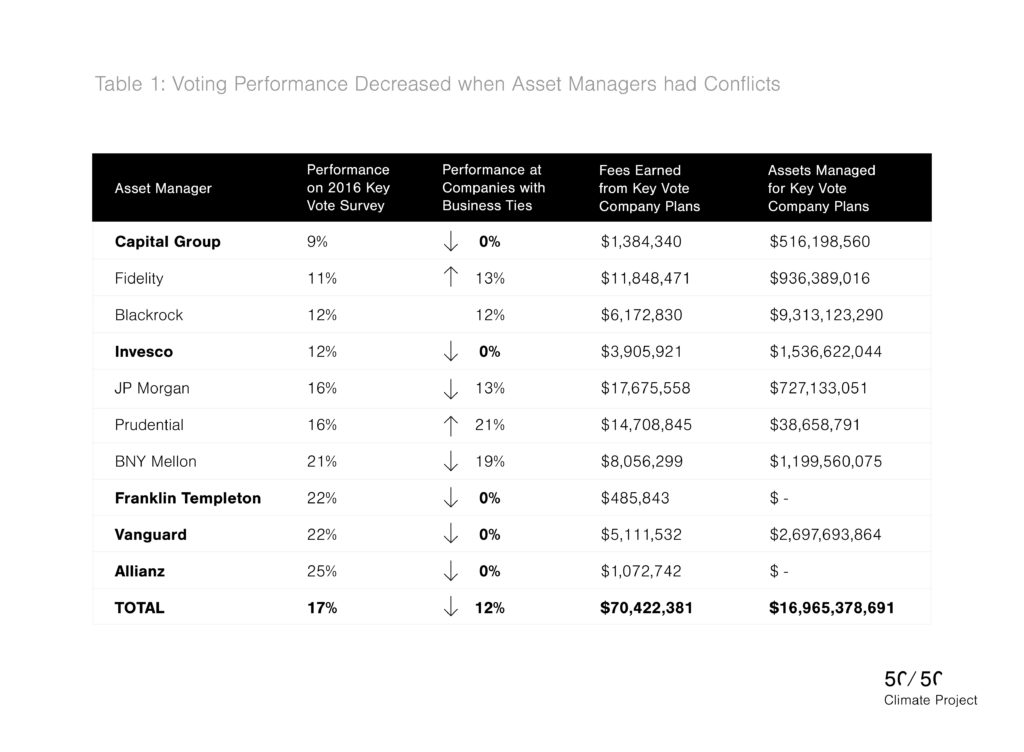

In a new report (available here), the 50/50 Climate Project, a non-profit shareholder resource and action center, finds that the managers who tended to vote in favor of management received more in fees and stewarded more assets than all other managers combined, and that their voting practices were even more management friendly at companies with which they had business relationships. The asset managers examined manage assets worth billions of dollars for the retirement plans sponsored by the portfolio companies at which they voted. The managers also receive millions of dollars in fees for managing such plans.

The report examines the conflicts of interest that large asset managers encounter when casting proxy votes on climate-related shareholder resolutions. It analyzes data from Form 5500 filings submitted to the Department of Labor by retirement plans sponsored by energy and utility companies, and compares this data to the publicly disclosed vote records of the top 30 managers by assets under management and how well the asset managers scored on the 50/50 Climate Project’s 2016 survey of shareholder votes on key climate-oriented proposals (“Key Vote Proposals”). Ten fund managers that supported 25 percent or fewer of the Key Vote Proposals are referred to as the “Low Scoring Managers.”

By quantifying, in dollar terms, the sizeable magnitude of business ties between managers and their portfolio companies, this report shines new light on competing and potentially conflicting interests. It provides a practical framework that investors can use to engage asset managers on mitigating conflicts of interest.

A summary of the report’s findings include:

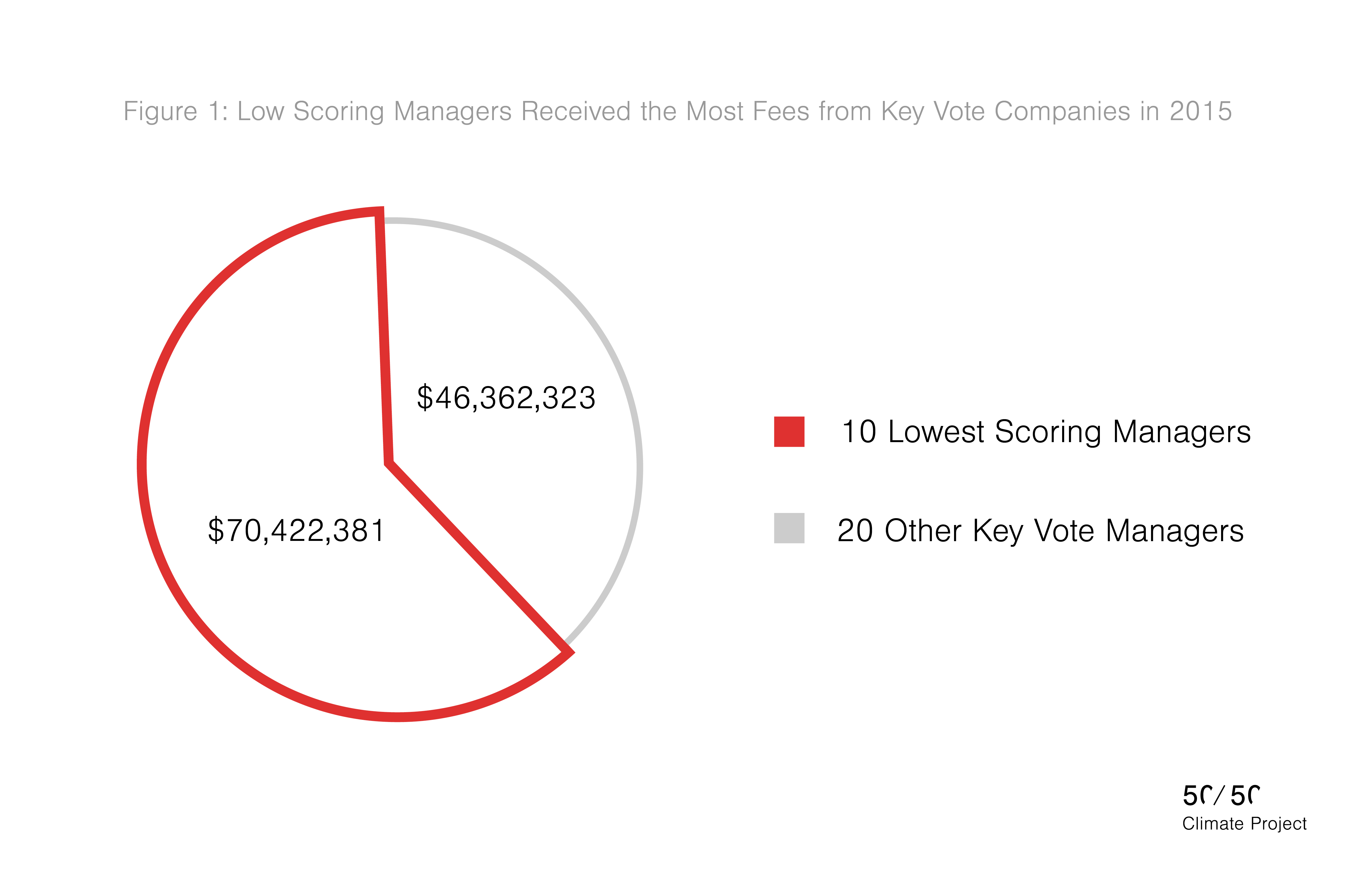

- Pension and welfare plans sponsored by the top energy and utility companies paid over $116 million in fees to the 30 largest asset managers in 2015. Asset managers who scored poorly on the 2016 survey of key climate shareholder votes captured the majority of these fees, receiving over $70 million. Low scoring managers also managed at least $17 billion in assets for these plans, more than all the other top asset managers in the study combined. Fidelity, BlackRock, and Vanguard alone managed over $13 billion in assets for these plans and earned over $18 million in fees in 2015.

- When these low scoring asset managers had business ties with energy and utility company pension and welfare plans, they voted against key climate shareholder proposals even more frequently.

- The voting actions of potentially conflicted asset managers affected the outcome of close shareholder votes:

- BNY Mellon was both a service provider and a fund manager for Occidental Petroleum’s retirement plans, and also held 2 percent of the company’s stock. In 2016, an unprecedented 49 percent of Occidental Petroleum shares were voted in favor of a resolution calling on the company to disclose the portfolio impact of global action to limit global warming to 2 degrees Celsius. BNY Mellon voted against the resolution, which would have received majority support if BNY Mellon had voted its stake in favor of it.

- BlackRock managed nearly $3 billion for BP’s retirement plans in 2015, and received over $2 million in fees. BP posted a $6.5 billion net loss for its FY 2015, including a $10 billion charge for its liabilities from the Deepwater Horizon disaster. However, BP’s proposed executive compensation plan for 2016 would have awarded the CEO a 20 percent pay increase, which one major shareholder called “unreasonable and insensitive.” While a majority of BP’s shares were voted against this plan, BlackRock voted in favor of it.

- Vanguard was paid $3.8 million in fees by Chevron in 2015, and managed at least $863 million for the oil giant as well. Vanguard was also Chevron’s largest shareholder during the 2016 proxy season, controlling 6.2 percent of shares outstanding. While 46 percent of Chevron shares were voted against the company’s compensation plan, Vanguard voted to approve it, ensuring it received majority support. Vanguard also voted against a resolution calling on Chevron to disclose the portfolio impact of scenarios in which global warming is restricted to a 2° C increase. 41 percent of shares cast voted to support the proposal.

- Wells Fargo funds showed a pattern of voting in favor of climate-change proposals in support of 2° C scenario planning in 2016, but this pattern reversed at Chevron, where former scandal-plagued Wells Fargo CEO John Stumpf sat on the board until he was ousted later in the year. Wells Fargo funds also voted in favor of approving Chevron’s “Say on Pay” program, even though 46 percent of Chevron’s voting shareholders opposed it. Mr. Stumpf sat on Chevron’s compensation committee.

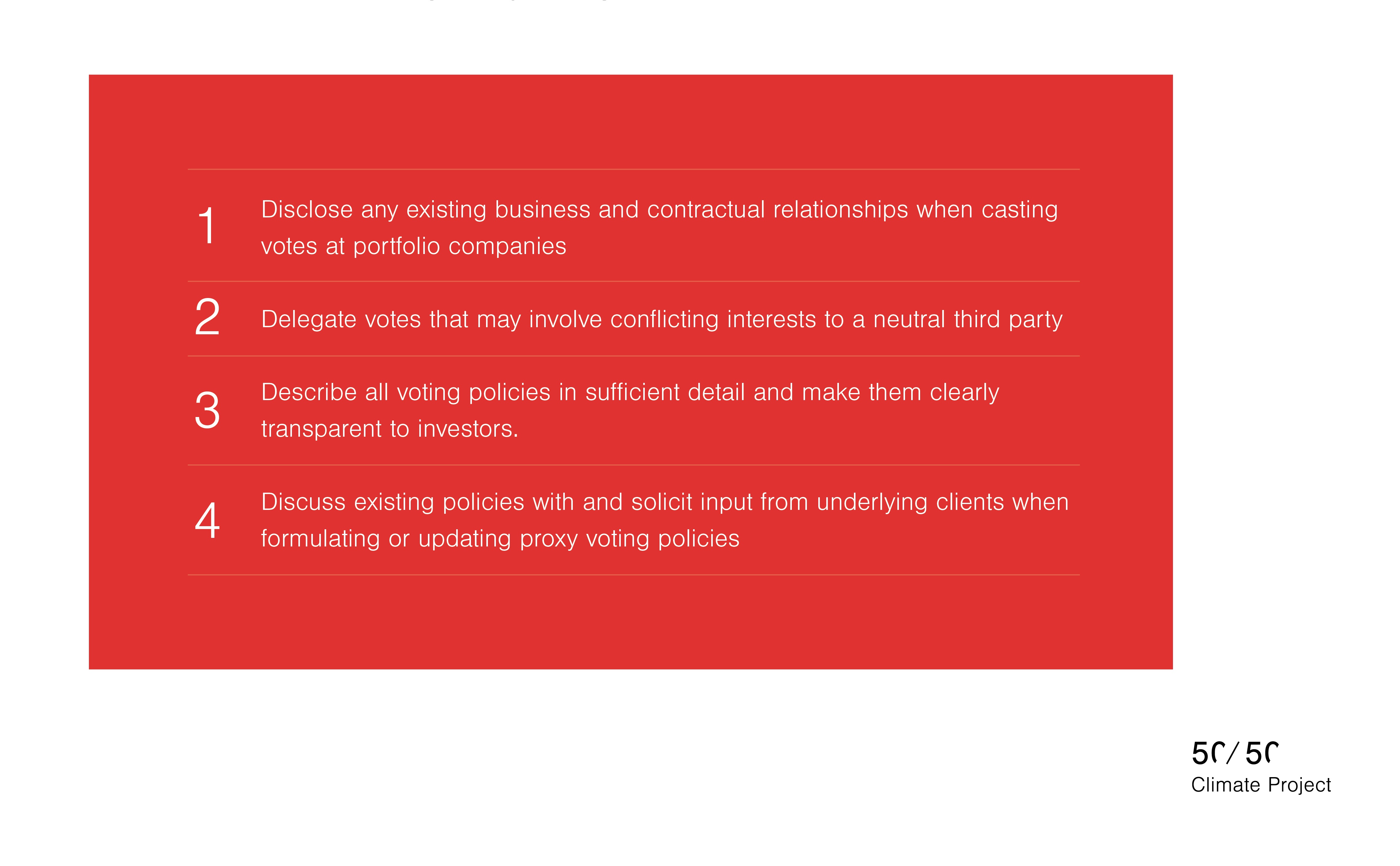

The report recommends that asset managers adopt the following best practices to effectively address potential conflicts of interest when making proxy voting decisions:

The complete publication is available here.

Print

Print