Marc S. Gerber is a partner at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on a Skadden publication by Mr. Gerber.

As we approach the end of the 2017 proxy season, the third since the New York City comptroller launched the Boardroom Accountability Project to enact proxy access across the U.S. market, proxy access has begun to transition from its “teenage growth spurt” to its “young adulthood” phase. Its adoption by companies is still on the rise, but not at the same rate; it is still developing its more nuanced features, but with fundamental elements fully formed; and it has short-term predictability, but longer-term questions remain.

Growth

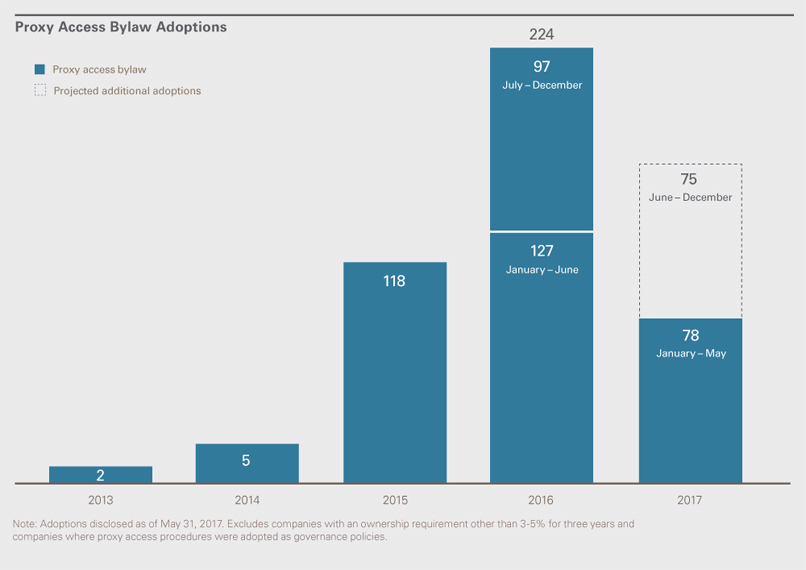

From roughly the end of the 2016 proxy season through the bulk of the 2017 proxy season, an additional 175 public companies have adopted proxy access bylaws (or charter provisions), bringing the total number to more than 425, including more than 60 percent of companies in Standard & Poor’s 500 index (see chart below).

Investor interest in proxy access remains strong—as evidenced by shareholder proposal voting results (described below). In all likelihood, most of the companies adopting proxy access in the second half of 2017 and into 2018 will be large-cap companies, and the percentage of S&P 500 companies with proxy access will likely exceed 75 or 80 percent by early 2018. As has been the case with other corporate governance changes institutional investors have sought (e.g., board declassification and majority voting in director elections), the rate of adoption often slows with respect to the last 10-20 percent of S&P 500 companies, and with mid- and small-cap companies.

Fundamental Elements

The main parameters of proxy access bylaws are now well-established: an ownership requirement of at least 3 percent of a company’s shares for at least three years; an ability to nominate candidates for up to 20 percent of board seats, with a minimum of two nominees; a 20 shareholder limit on the ability of shareholders to aggregate to meet the 3 percent ownership requirement (with related funds counting as one shareholder for aggregation limit purposes); and loaned shares counting toward the ownership requirement so long as the shares are recallable upon reasonable notice. Although proxy access provisions may vary somewhat with respect to secondary elements of proxy access bylaws, most bylaws require some minimum level of support for a nominee to be eligible to be renominated in subsequent years (typically 10-25 percent); most address “proxy access creep” either by counting recently elected access nominees whom the board renominates toward the maximum number of access nominees allowed in a particular year, placing a “cooling off” period on the nominating shareholders whose access nominee is elected, or both; and most address concerns regarding concurrent proxy contests, either by “cutting off” access in the event of such a contest or by reducing the number of access nominees for that annual meeting by the number of advance notice nominees submitted for the same meeting (sometimes providing for a minimum of one access nominee).

Predictability

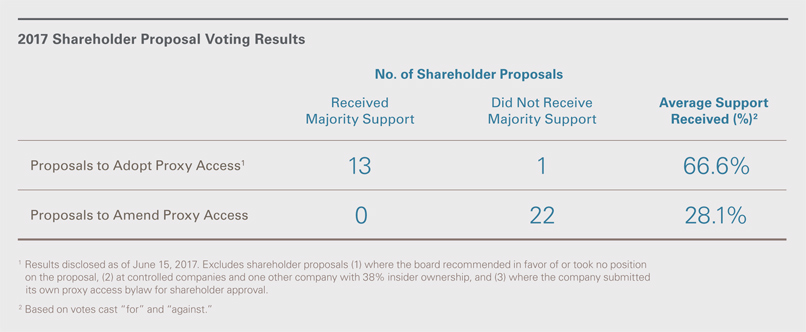

As shown in the table below, for the 2017 proxy season to date, shareholder proposals seeking the adoption of a proxy access bylaw almost universally achieve majority support (excluding controlled or quasi-controlled companies). At the one company where the proposal fell short of majority support, it nevertheless received 49.6 percent of votes cast.

On the other hand, 2017 shareholder proposals seeking amendments to proxy access bylaws containing standard provisions have universally failed to achieve majority support, indicating a level of investor satisfaction with “middle of the fairway” bylaws. Half of these shareholder proposals sought a single amendment—to change the aggregation limit from 20 shareholders to 40 or 50 shareholders. The other half sought multiple amendments—typically elimination of any aggregation limit, increasing the number of access nominees from 20 percent of board seats to 25 percent and removing any limitations on the renomination of proxy access candidates. Voting results were substantially similar for both types of amendment proposals.

In addition, the Securities and Exchange Commission no-action process regarding proxy access proposals may have attained some degree of predictability, with the important caveat that every proposal and response needs to be analyzed on its own merits. Companies have continued to be able to exclude as “substantially implemented” proposals to adopt proxy access (typically 3 percent, three years, 25 percent of the board and no aggregation limit) by adopting a proxy access bylaw with 3 percent/three-year ownership requirements, a 20-shareholder aggregation limit and providing access for 20 percent of board seats. This proxy season companies also were able to exclude as “substantially implemented” proposals to amend aggregation limits from 20 shareholders to 40 or 50 shareholders by providing company-specific data to support the view that the company already provided a meaningful proxy access right to its shareholders. On the other hand, to date, proposals seeking multiple amendments to proxy access bylaws were not excludable as substantially implemented unless a company could show that it had adopted at least some of the proposed changes.

Uncertainty

It remains the case that there has been only one attempt to use proxy access in the U.S. In November 2016, GAMCO and Gabelli Funds nominated one person under the proxy access bylaw at National Fuel Gas Company. That nomination was withdrawn when National Fuel Gas asserted that GAMCO and Gabelli Funds were not eligible to use proxy access because they were unable to represent that they lacked intent to “change or influence control” of the company. This episode has had no apparent impact on companies’ willingness to adopt proxy access bylaws or on shareholder support for proxy access shareholder proposals. Many advocates of proxy access maintain that it is a shareholder tool of last resort that will be used sparingly. Nevertheless, it is just a matter of time until a company faces a proxy access election contest. The circumstances that will trigger investors to utilize proxy access, and the potential for success of such a contest, remain questions for future proxy seasons.

Print

Print