John Roe is Head of ISS Analytics and Managing Director at Institutional Shareholder Services, Inc. This post is based on an ISS publication by Mr. Roe.

Sometimes, watching corporate governance standards evolve seems like watching a glacier flow—and at other times it’s like witnessing a flash fire develop. Now that the 2017 proxy season in many global markets has come and gone, and many companies have made their updated governance disclosures for the year, we thought it is the ideal time to reflect and see where the glacier continues to flow—and where flash fires are burning with intensity.

The “Delightful Dozen” are the twelve governance areas, by region, where companies have made (or disclosed) the most shareholder-friendly advances so far in 2017. To identify these areas, we are using ISS Governance QualityScore data, and calculating the net number of companies making improvements in each area—that means tallying the number of companies making an improvement, and subtracting the number companies that have taken a step backwards in each category.

Globally, a few themes emerge describing the most rapid advances in corporate governance practices:

- The proportion of board seats occupied by women is increasing (but the number of women serving on each board is not growing as quickly)

- Boards are improving the ways in which they evaluate their own performance

- Compensation disclosures are steadily improving, though in different ways in different regions

- Companies are bringing more financial experts onto their audit committees

This analysis is limited to the governance areas that ISS QualityScore measures and monitors in each region. For more information on the factors measured under QualityScore in each region, please refer to the ISS QualityScore Technical Document.

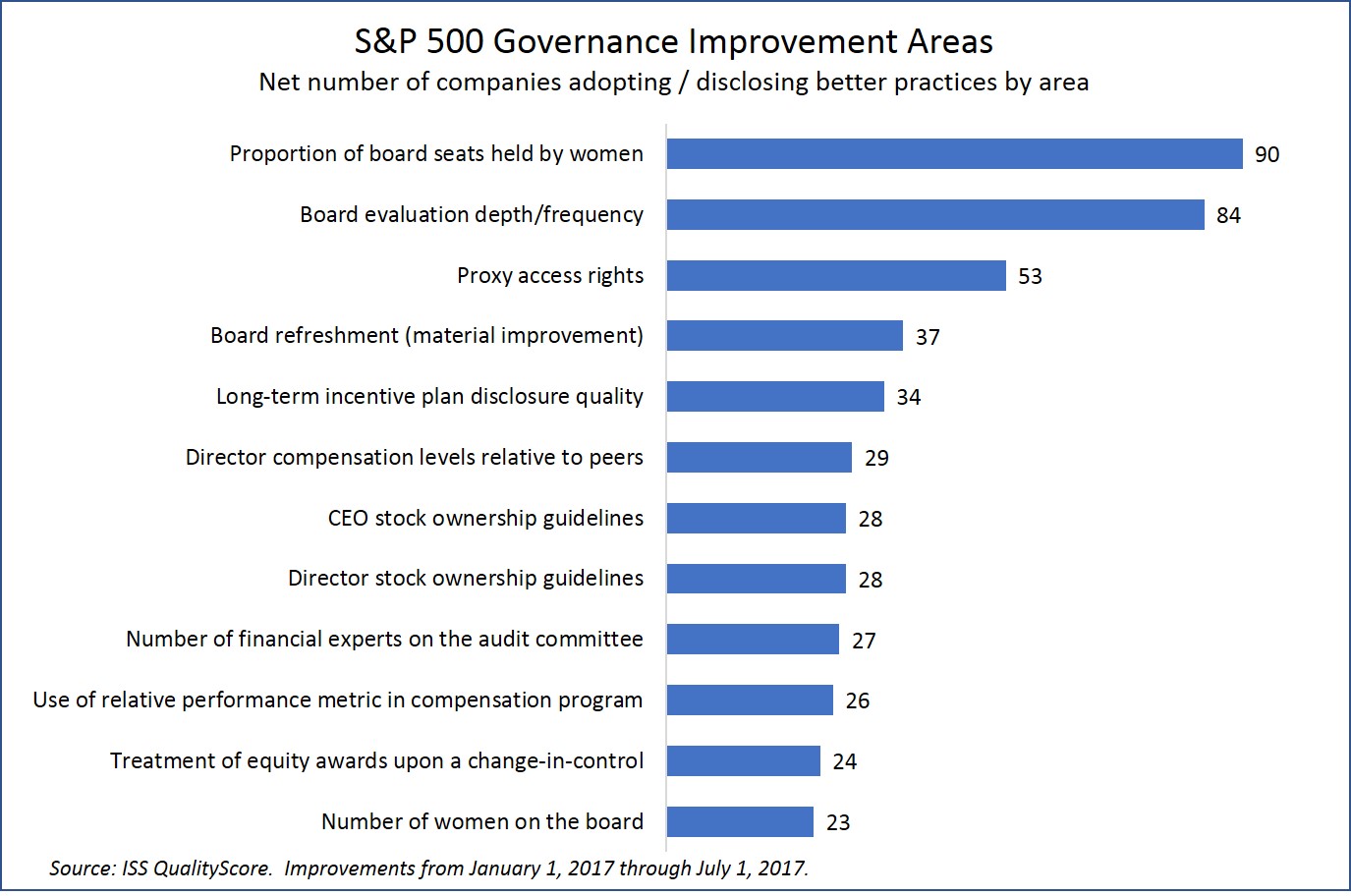

U.S. Large Cap (S&P 500) Delightful Dozen

Among large-cap U.S. firms, there are three measured governance areas that are seeing rapid advances—and for the purposes of this analysis, that means that more than 10% (net) of S&P 500 members have adopted or disclosed more shareholder-friendly policies. These “flash fire” issues in the U.S. are boardroom gender diversity, director evaluation, and proxy access.

Gender diversity led the “Delightful Dozen” leaderboard—but looking more deeply, it’s a mixed message. The percentage of board seats occupied by women increased at a net 90 members of the S&P 500. (All factors presented in each of these analyses are net, and contain the impacts of companies making improvements and those taking a step backwards. For instance, underneath these net 90 companies improving are the raw numbers: 171 S&P 500 members increased their proportion of women, while 81 firms decreased the proportion.)

The large increase could be because of the numerator (an increase in the number of women serving on the board) or the denominator (a decrease in the overall size of the board). Looking at the last of the twelve factors, we find the number of women on the board went up at a net of 23 companies—so the top factor is due to a combination of shrinking boards as well as more directorships being filled by women.

Board evaluations are also sharply increasing, with more and more boards opting for individual (rather than committee or group) evaluations, and a few boards beginning to rely on external expertise to assist with director evaluations.

Finally, proxy access continues to appear on the leaderboard. After three proxy seasons, more than sixty percent of all S&P 500 companies have granted shareholders the right to nominate directors and have them placed on the company’s ballot.

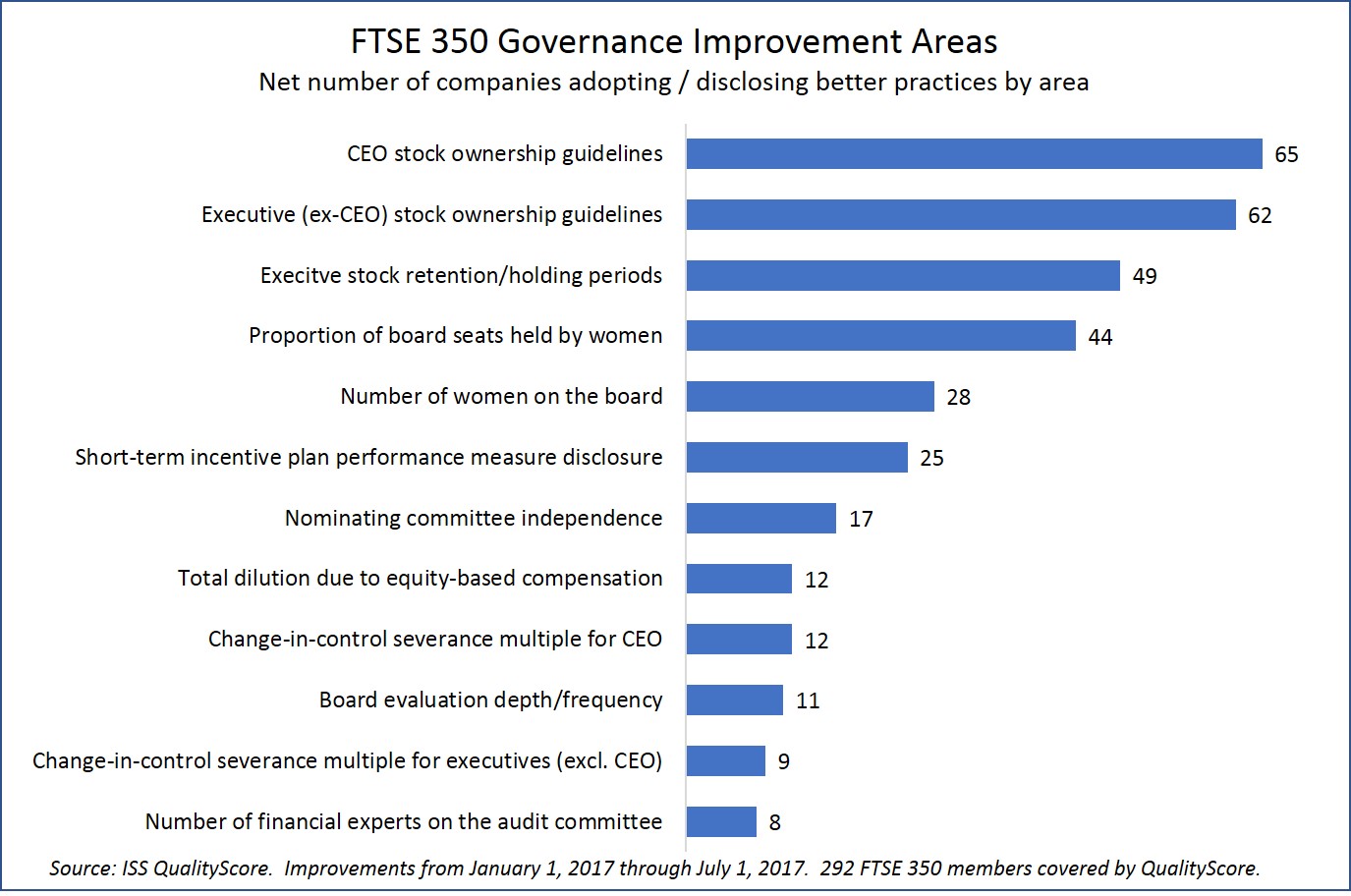

The U.K.’s “Delightful Dozen”

Among larger U.K. listed companies, there were three “flash fire” issues this year where more than ten percent (net) of covered companies made an improvement: Stock ownership guidelines (for both the CEO and the remainder of the executive team), stock retention period requirements, and the proportion of board seats held by women.

Stock ownership guidelines for both CEOs and non-CEOs are among the leaders in this category, with many companies making significant improvements. Firms such as Acacia Mining and Aggreko doubled their ownership requirements, while other firms, such as GlaxoSmithKine, went even further.

Board gender diversity at FTSE 350 companies exhibited a similar trend to S&P 500 companies, with women gaining a higher proportion of board seats faster than the number of women-held seats. But in the U.K., the trend was much closer, with 28 boards increasing the number of women on the board, and 44 having a higher proportion of women serving.

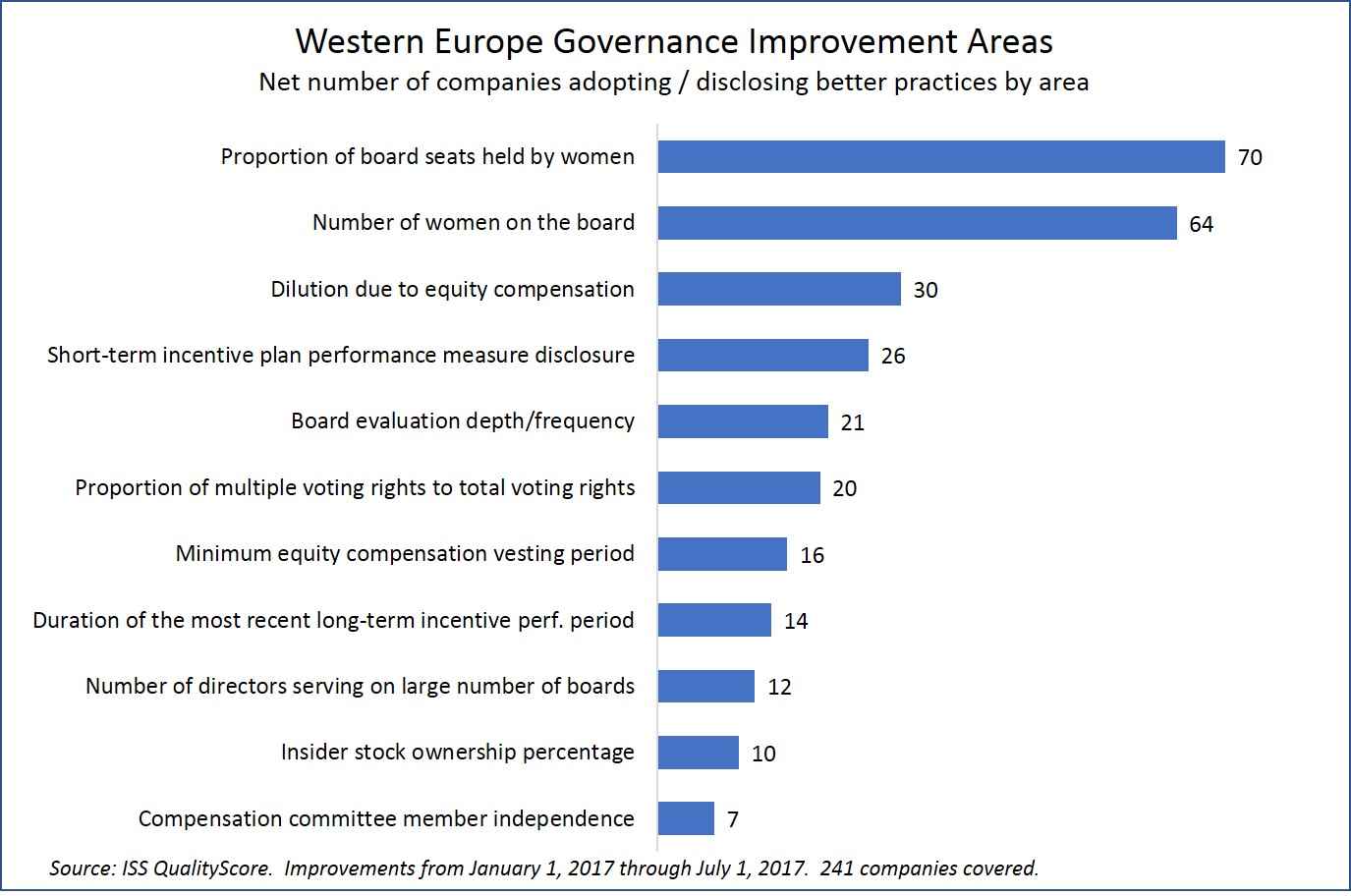

Western Europe (France, Netherlands, Belgium, Luxembourg) “Delightful Dozen”

Western Europe, which under the QualityScore methodology includes France, Netherlands, Belgium, and Luxembourg, mirrors many of the trends seen among U.K. companies, with rapid improvements witnessed on boardroom gender diversity, reductions in equity compensation-driven shareholder dilution, and improved short-term incentive plan performance metrics disclosure.

Compensation disclosure made some good advances here, with companies such as Renault, Sanofi, Valeo, Capgemini, L’Oreal, and Danone making significant improvements in their short-term compensation program disclosures.

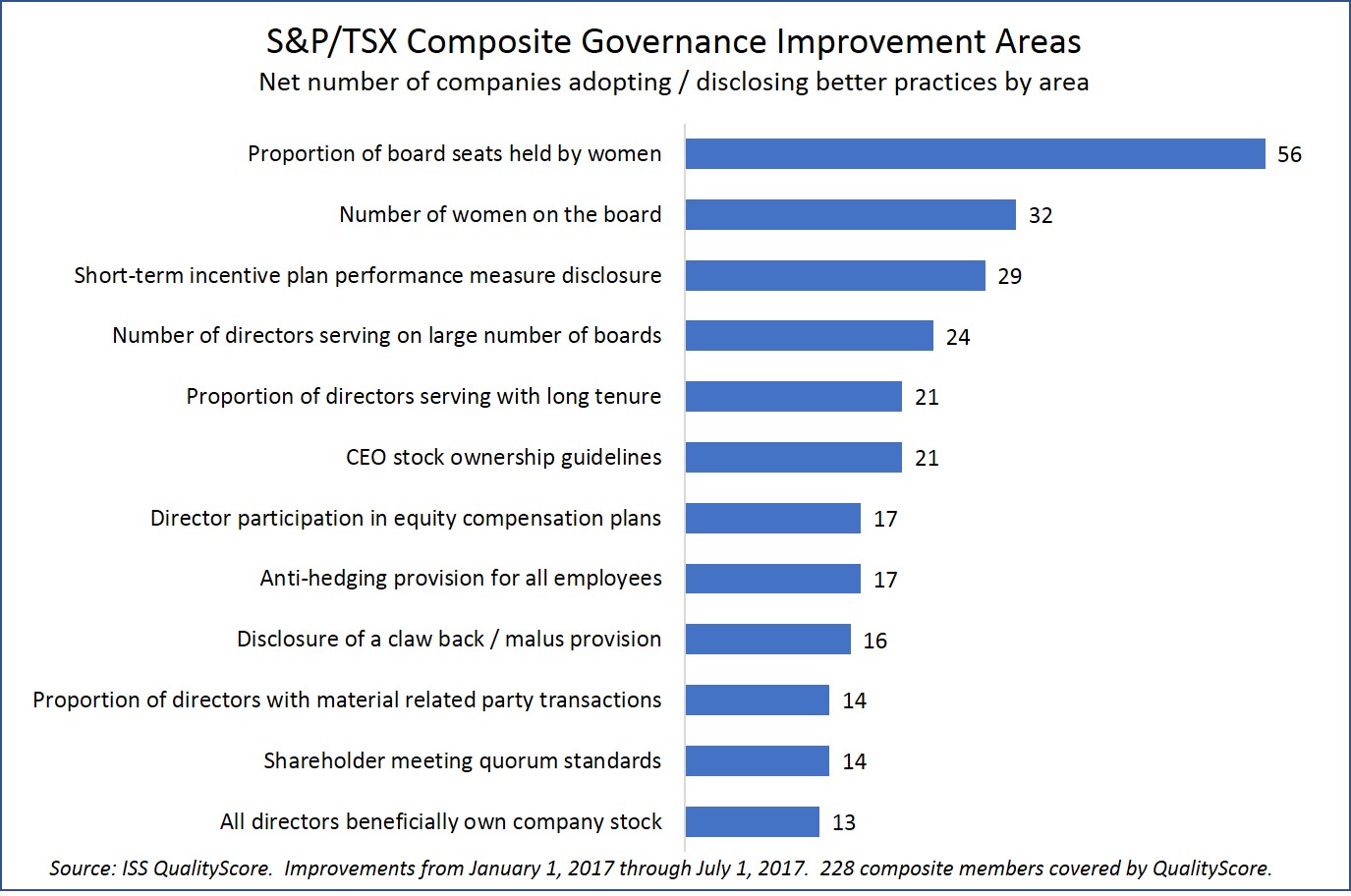

S&P/TSX Composite “Delightful Dozen”

Governance advances in gender diversity, compensation program disclosure, and reductions in overboarded directors lead the way among S&P/TSX Composite members. Also significant are the reduction of the number of overboarded directors and long-tenured directors; on net, Canada is clearly focused on making substantial improvements to the boardroom.

As in Western Europe, compensation program details were among the biggest advances, with companies such as Pason Systems, Bombardier, CIBC, Celestica, NuVista, and Husky Energy all making advances in their short-term compensation program disclosures.

Lower-ranked improvements also important

While much of the focus is on governance “flash fires,” some of the continuing trends are just as important. Reductions in related-party transactions, continued improvements to change-in-control provisions, and equity compensation terms (holding periods, vesting periods, and ownership requirements) all continue to encourage better stewardship for the benefit of all shareholders.

Governance changes not all roses in 2017

Although we’ve focused on the “Delightful Dozen,” not all governance areas have taken a step forward in 2017. Among the U.S. S&P 500, for instance, fourteen more companies have disclosed a material weakness in their internal controls within the last two years compared to at the beginning of the year. Fourteen more S&P 500 companies were also identified as having a pay and performance misalignment.

In Canada, among the S&P/TSX Composite, four more companies (compared to in January) were identified with pay and performance misalignments, as well as four more companies identified with directors that failed to attend at least three-quarters of their meetings without a valid excuse. And among U.K. FTSE 350 members, three more companies were identified as having overboarded directors.

Print

Print