Nick Dawson is Co-Founder and Managing Director of Proxy Insight. This post is based on a Proxy Insight publication by Mr. Dawson.

Dual stock structures have been cropping up quite a lot in the news recently. The resurgence of this long-standing debate can be traced back to Snap Inc’s listing earlier this year. The tech company’s IPO took the unprecedented step of offering no voting rights for its common stock.

This led the Council of Institutional Investors (CII) and some asset managers to reiterate the call for indices to ban non-voting shares. Picking up the debate, this post will look at the arguments surrounding this controversial issue alongside Proxy Insight data.

Although most investors agree with CII that dual stock structures represent poor corporate governance, rivalry between exchanges means that the council is likely fighting a losing battle.

A number of countries around the world already permit non-voting shares such as the US, Canada, France, Italy and Switzerland. With competition for tech company listings heating up, the likes of London, Hong Kong and Singapore have considered allowing them as well.

It used to be mostly family-owned companies like Ford Motor Co. and News Corp. that had these structures. However, since Google dual listed in 2004, it has been common for tech companies such as Facebook to adopt dual stock structures in order to allow their founders to retain control.

Earlier this year, Facebook announced it would be creating a new class of non-voting shares. At the time, CEO and Founder Mark Zuckerberg cited a number of reasons why this was a good thing, including Facebook’s controversial $1 billion purchase of Instagram, which has since proved fruitful.

Zuckerberg argued that, had he been answerable to the board and shareholders this, and a number of other key decisions, may not have been made. Critics counter this by arguing that a dual stock structure undermines the fundamental principle that those who provide the capital should get a say in how the company is run.

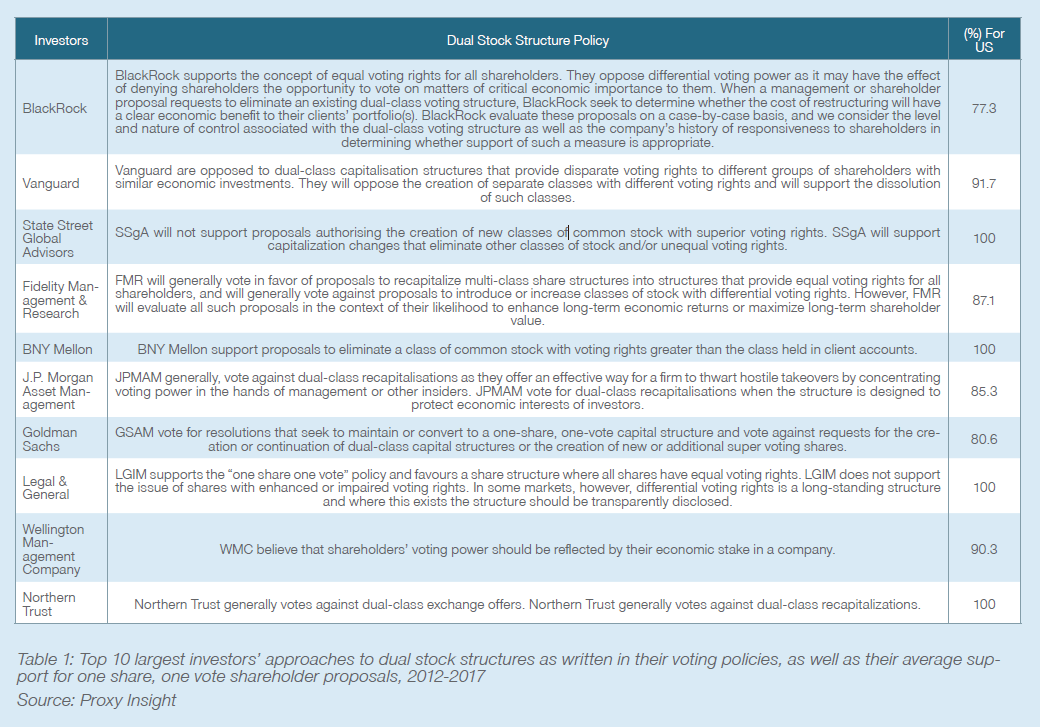

Large institutional investors have more cause than most to object because a lot of them manage index funds. This means they have no choice but to buy shares in these dual stock companies and then have no way to effect change. Table 1 shows the policies of the top 10 investors on dual stock structures, all of which say they are opposed to the concept.

It seems that the investors are choosing to back up their words with actions. Table 1 also illustrates the percentage of times the top 10 investors decided to support these proposals. Average support among them was 91%, which is incredibly high for a shareholder proposal.

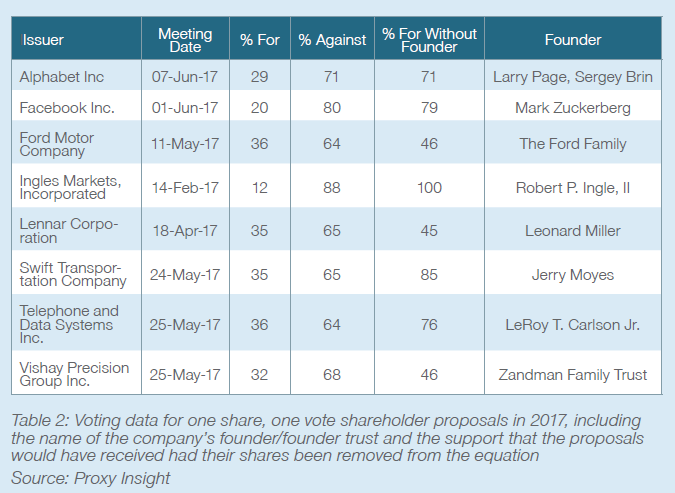

The data in Table 2 certainly seems to show a consensus among the investor community that dual stock structures are bad practice. Taking all shareholder resolutions asking to abolish dual stock structures in 2017 and excluding the founders’ voting rights reveals that, without their influence, the majority of these resolutions would have passed. Average support without founder influence was 69%, compared to just 29% when the founder votes were included.

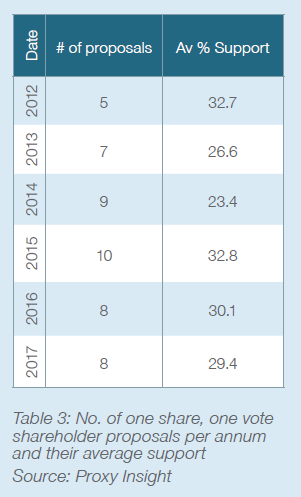

Despite a consensus among investors over the harmful nature of dual stock structures, and growing concerns over their increased adoption by companies, Table 3 shows that the number of shareholder proposals seeking to adopt a one share, one vote policy has not increased.

Neither has the level of support for those resolutions. The quantity of shareholder proposals and levels of support peaked in 2015, but there have already been 8 this year so there may be more proposals to come.

It may be that ordinary investors have conceded that there is little they can do on this issue. While they put up a united front when a shareholder proposal is put forward, as Table 2 shows, there is little they can do without the support of those who hold founder shares. Indeed, it seems that such investors are stuck in a catch-22, as their efforts to overthrow their companies’ dual class structures are undermined by those very structures.

Print

Print