Oliver E. Browne is a partner at Latham & Watkins LLP. This post is based on a Latham publication by Mr. Browne, Catherine Campbell, and Ashleigh Gray.

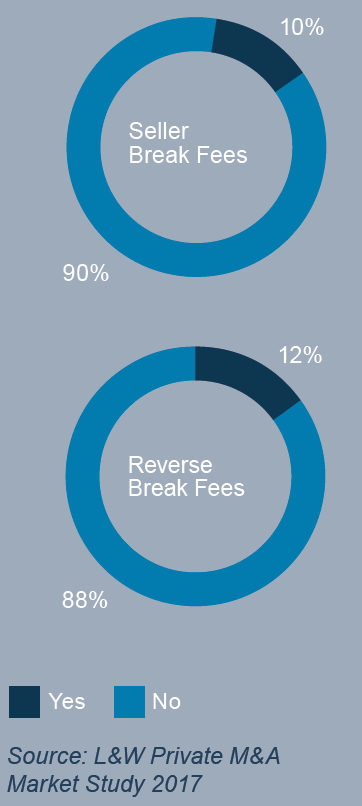

Given ongoing competition between buyers in a strong sellers’ market, the resilience of seller break fees as a feature of the European M&A market is surprising. According to the Latham & Watkins 2017 European Private M&A Market Study (which examined over 190 deals signed between July 2015 and June 2017), 10% of European private M&A transactions featured a seller break fee, slightly up from 8% in 2016.

“Break fee and reverse break fee quantum ranges greatly based on transaction factors. Examples of reverse break fees in UK public M&A in the first half of 2017 ranged from 1% to 2.5% of the deal value.”

American Influence On the Prevalence of European Break Fees

In our view, the prevalence of cash-rich US buyers in the European M&A market is playing a role — seller break fees are commonly requested by buyers and given by sellers in US transactions and that practice appears to have influenced a number of deals in Europe. Further, cautious buyers, mindful of collapsed deal risk, may also be seeking comfort from sellers in the form of break fees.

What to Look Out For When Considering Break Fees and Reverse Break Fees

While seller break fees can provide protection for buyers, parties must consider jurisdictional issues and entity permissibility. Break fees are generally prohibited under the UK takeover code, because of concerns that deal protection mechanisms (including break fees) deter potential bidders from submitting competing bids. Parties must also be alert to the risk of a break fee constituting unlawful financial assistance. However, the takeover code does not prohibit reverse break fees or regulate private M&A, therefore reverse break fees and private deal break fees may be negotiated. For reverse break fees, shareholder approval requirements (especially if a bidder is subject to UK listing rules) and related-party transaction issues (where the bidder already has an equity interest in the target company and the UK listing rules apply) must be navigated.

Break Fee or Reverse Break Fee

Break fees (also referred to as inducement fees or failure costs) are deal protection measures where a party to a transaction agrees to pay a fee to another party if the transaction fails due to the occurrence of a specified event.

A break fee may be payable by the target or a seller (a “break fee” or “seller break fee”) or a buyer (a “reverse break fee”).

Enforceability Challenges Remain

As all break fees are, by their nature, paid when a transaction fails, liable parties may attempt to dispute enforceability. To mitigate this risk, English law governed documents require careful drafting—any break fee may be unenforceable if found to be a penalty payable on breach of contract (rather than arising following a defined event as part of a contractual payment mechanism) and the fee is out of proportion to the legitimate interest of the receiving party.

Can Creative Use of Governing Law and Jurisdiction Clauses Aid Enforcement?

While the English law approach to break fees which are deemed penalties can be discouraging, the substantive law of other jurisdictions, such as New York, offers a less restrictive approach and may allow the enforcement of break fees. Including break fee arrangements for UK transactions in separate New York law governed documentation, in parallel to English law-governed sale and purchase agreements, may offer opportunities for jurisdictional arbitrage. However, this approach is untested. While English courts are usually happy to enforce New York law governed documents, English public policy and other rules may override the New York law document, rendering it unenforceable. An alternative may be to document the entire transaction in accordance with New York law, subject to New York courts’ jurisdiction. However, any New York court proceedings may be complicated if parallel proceedings arising out of the failed transaction are ongoing elsewhere and judgments may still face enforcement issues in the UK based on public policy and other rules applied by the English courts. Accordingly, there are no easy solutions.

Finally

Break fees and reverse break fees remain a point of negotiation in European private M&A, particularly in transactions with high completion risk. Parties considering cross border deals must be mindful of cultural differences in the approach to and enforceability of break fees and, in a competitive auction process, consider the risk of assertive US buyers, familiar with break fees, conceding a reverse break fee to gain strategic advantage.

Print

Print