Elizabeth Carroll is a Research Analyst at Equilar, Inc. This post is based on an Equilar publication by Ms. Carroll.

Concurrent with discussions around board refreshment and diversity, age has also become a hot topic in board composition. Though older directors generally have more executive and board experience, there is concern that a lack of board refreshment and age diversity can stultify companies and result in subpar performance, and on the flipside, that younger executives may be able to bring unique skills to the boardroom to help navigate a fast-changing corporate environment.

In addition to actively seeking younger directors, some companies have instituted mandatory retirement ages or term limits as a way to promote regular board refreshment and avoid any of the negative connotations surrounding stale, aging boards. For example, a majority of companies with retirement mandates say that no director can be reelected to the board after reaching either the age of 72 or 75.

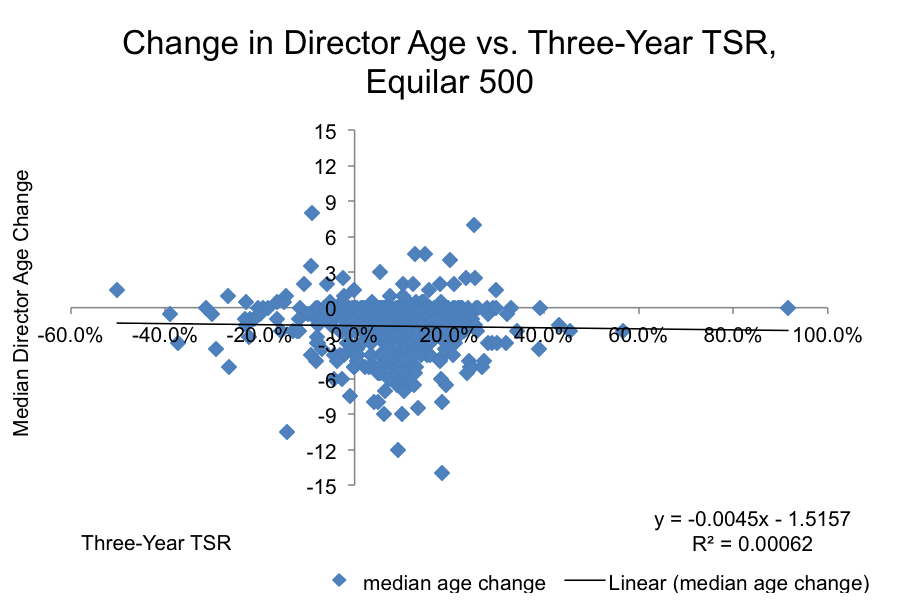

According to Equilar research, having younger directors on boards may not necessarily result in better company performance. A new study looked at companies within the Equilar 500—a sample of the 500 largest U.S. companies by revenue—and compared each company’s change in median director age over the past three fiscal years against three-year total shareholder return (TSR). TSR is not the only way to measure a company’s performance, but it is of critical importance to the stakeholders for whom a board primarily exists to protect—investors.

After running a linear regression on the connection of median age and TSR, the r-squared value—the total effect of the variable on the outcome when all else is held constant—was a mere 0.006, as depicted in the figure below. This indicates that, in general, the age of directors at a company does not have any significant effect on its performance. The changes in median director age among companies in the study ranged from -14 (indicating the median director was 14 years younger at the end of the three-year period) to +8.

The majority of boards (66.2%) saw their median director age decrease in the three-year study period, and 98.5% of companies saw a median director age change below +3. This indicates that refreshment, in particular refreshing with younger directors, is a real phenomenon, regardless of its correlation with performance. (Note: If a company did not replace any of its directors during the three-year study period, then the board’s median age would increase by exactly three years.)

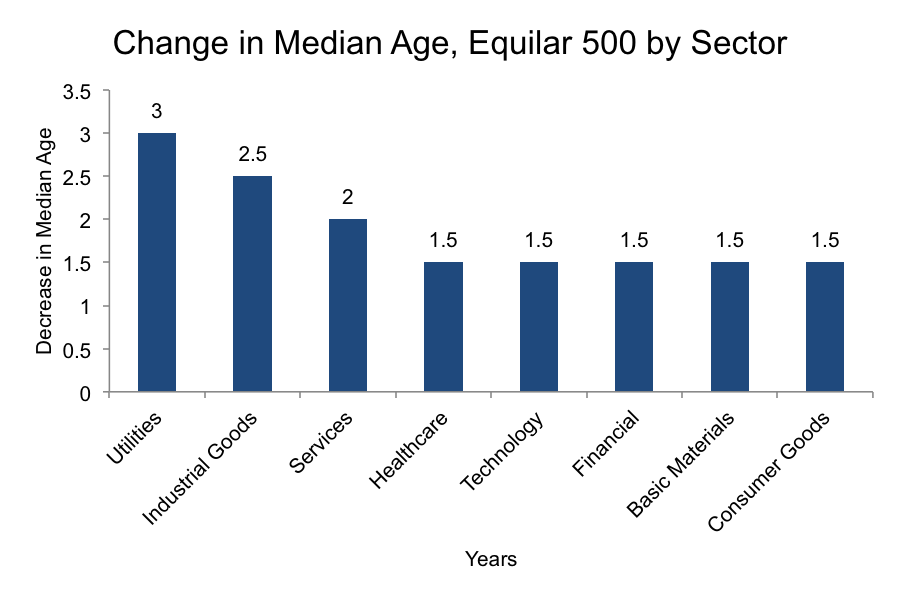

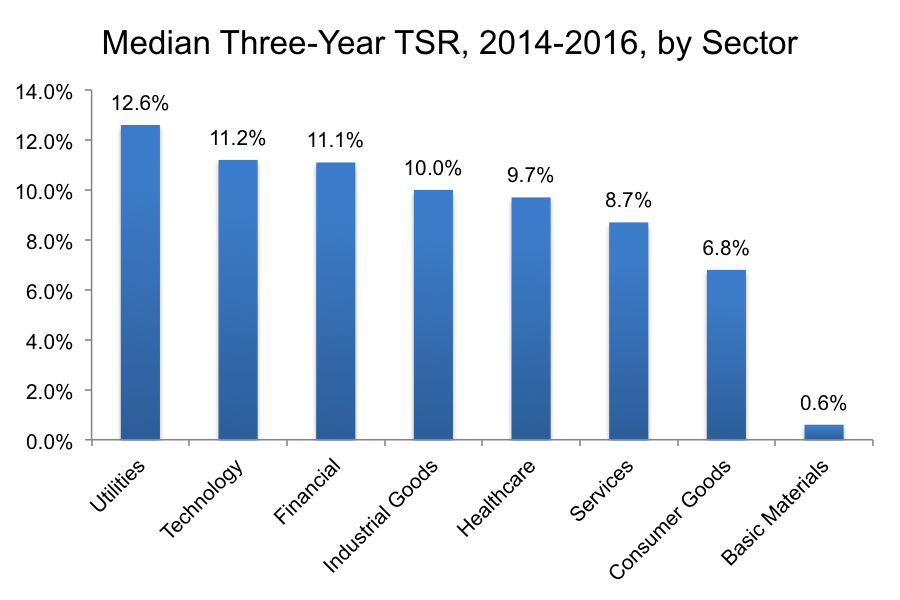

A shift to younger directors has also played out differently among sectors. The utilities sector had the largest change with a three-year decrease in median director age during the study period, while also having the highest TSR over those same three years. Five sectors saw a median age decrease of 1.5 years, yet the corresponding TSR varied from 0.6% to 11.2%, similarly representing a disparate correlation between director age and performance as the overall sample.

Median director age does not tell the whole story by itself. Age does not necessarily correlate with board tenure at a specific company and in some cases may be misleading. An older director may be newly elected to a company’s board, and can provide a different perspective in a way that a younger director with longer tenure might not be able to. Additionally, changes in median director age do not necessarily indicate the range of ages present on the board. Two boards may have experienced a similar shift in median age, but one may be significantly more diverse in age and other backgrounds than the other board. Finally, a company’s performance is dependent on many variables, and though it may be appropriate to draw some conclusions with one or two, the bigger and more complete picture is not painted without accounting for multiple variables.

In other words, it may be too early to see how the trend toward younger directors is truly affecting company performance. One thing that is known, however: younger directors provide different outlooks and experiences to provide boards with new perspectives on competing in the changing business climate. Companies will continue to adapt to the business climate by hiring fresh, new directors and trying to increase value for shareholders.

Print

Print