Armand W. Grumberg, Scott C. Hopkins, and Lorenzo Corte are partners at Skadden, Arps, Slate, Meagher and Flom LLP. This post is based on a Skadden publication by Mr. Grumberg, Mr. Hopkins, Mr. Corte, Matthias Horbach, Francois Barrière, and Holger Hofmeister. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); and Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here).

By the end of September, 2017 had seen more than 100 European-based companies publicly subjected to shareholder demands. Reached slightly later this year than last, and much earlier than in 2015, that milestone signals that if activism in Europe has lost its capacity to shock, its future also looks secure.

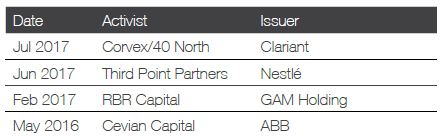

Activity is still a long way behind the U.S., where the annual number of companies publicly targeted has ranged from more than 300 to nearly 500 over the last four years. And at least part of the increase in European activism in recent years has been due to a higher incidence of foreign activists looking for opportunities as the U.S. market has become increasingly picked-over. Often the most high-profile of situations, campaigns by U.S. activists at European companies this year have included Third Point Partners at Nestlé, Elliott Management at AkzoNobel, and Corvex Management at Clariant.

At the end of September 2017, the absolute number of European companies publicly targeted by non-European activists was at a four-year high. Proportionately, foreign funds account for around 25% of campaigns, consistent with the years prior to 2016, which saw a lull in inbound activity. Year-to-date, almost three-quarters of foreign campaigns were led by U.S. activists.

Activist Insight data suggest U.S. interest in Europe has increased and the groundwork has been laid for a sustained level of activism. Yet if companies have thus far paid less attention to homegrown activists, that may soon change. Local players have shown they have the ambition to target some of Europe’s largest companies.

If the number of companies publicly targeted across Europe has fallen slightly compared to the same period last year, key markets have been steady. The U.K., which saw the most activity, is flat with 2016 at a historically high level. Germany has become more active and France may yet keep pace with, and potentially exceed 2015 and 2016 levels, while Switzerland and Italy have been less busy until now.

Moreover, Europe’s periphery, which has been economically troubled since the financial crisis, is taking up some of the slack. The five countries included in this report accounted for 66% of the total European companies targeted in 2017 thus far, compared to 70% for the period 2013-to-2016.

Large European companies have proven especially vulnerable to activism in recent years. The number of targets with a market cap of more than $10 billion peaked at 30 across Europe in 2016 and has stayed above the average from 2013 onward, with 23 large companies targeted by the end of the third quarter of 2017.

Whether that is because of the ongoing negotiations over Britain’s exit from the European Union, it may be too early to say. Larger businesses may be more exposed to disruption and trade barriers from Brexit but the outlines of a deal remain fuzzy and could yet be usurped by an activist from within the governing Conservative Party. Prime Minister Theresa May had hoped to make governance reforms a centerpiece of her administration but has become hostage to events. Europe’s CEOs may increasingly come to share that feeling.

United Kingdom

Compared to 2016, when activists won five proxy fights at U.K. companies and a board seat at FTSE 100 company Rolls-Royce Holdings, 2017 has seen a similar volume of activism (see chart below), but much quieter campaigns. Instead, the year has been notable for some activists delivering on their promises, with shares in Stock Spirits and Rolls-Royce Holdings up handsomely since activists joined their boards.

Different styles of activism have proven their effectiveness. ValueAct Capital Partners took a lower profile at Rolls-Royce after it won its board seat, but a campaign by Elliott Management at London-listed, Australia-based mining company BHP highlighted for directors the dangers of a “prosecutorial” approach. Even so, significant ownership, a good track record, and an understanding of the company and its problems remain a must for investors looking to gain traction. “Activists that have come from abroad have been more sensitive to the fact they might have to act differently,” says Liad Meidar, of London-based activist Gatemore Capital.

Politics has pushed the role of shareholders further into the limelight. A review of the U.K.’s governance structures initiated by Prime Minister Theresa May watered down proposals such as adopting Australia’s “two-strikes” response to failed remuneration proposals, and worker representatives on boards, but many onlookers have told Activist Insight that the debate had made boards more responsive to shareholders in general.

Andrew Honnor from financial PR firm Greenbrook Communications says interest in activism is high in the run-up to 2018’s proxy season, particularly among U.S. funds. Risk factors that may have deterred activists in the past, such as the state of the eurozone, are receding, he argues, while Brexit has apparently done little to stem the tide. “Activism has gone from a position where it was seen to be extraordinarily unusual, to being not quite the norm, to being a regular part of corporate life,” he says.

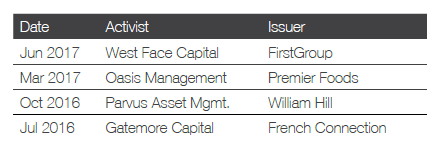

Noteworthy Activist Campaigns in the U.K.

Opposition to M&A has been a key theme in U.K. activism in the past 18 months, with SABMiller and William Hill among those targeted. For transport company FirstGroup, it is second time around with an activist; Canada’s West Face Capital has yet to comment on whether it believes a separation of the company’s U.S. businesses would be appropriate, following Sandell Asset Management’s 2014 campaign. Meanwhile, Oasis Management proved itself the exception to the general rule that activists struggle to win board representation in the U.K.—especially through negotiated agreements rather than proxy fights. Other busy activists in the country include Gatemore Capital and Chicago-based fund Livermore Partners. N.B. BHP is classed as an Australian company by Activist Insight.

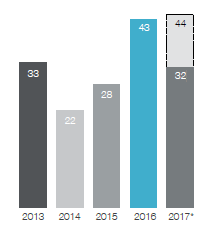

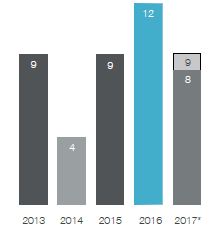

Companies publicly subjected to activist demands per year

Activism in the U.K. surged as Brexit impacted currency markets in 2016. This year will likely see fewer proxy fights, but overall activity may marginally exceed 2016’s numbers.

* As of September 30, 2017. Projected full-year figure shown in dotted box.

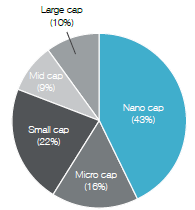

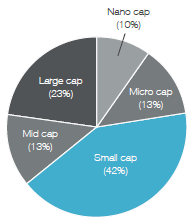

Size of companies publicly targeted by activists since 2010

Larger companies have drawn less attention in 2017, with a higher volume of sub-$250 million companies targeted in the first three quarters than in the whole of 2016. That may give a clue as to where activists think the U.K. leaving the EU is likely to hurt most.

Shareholder Activism—recent developments in the U.K., 2017.

“Criticisms of corporate governance have not always been successful in generating board representation.”

Despite the uncertainty created by its vote to leave the European Union, the U.K. continues to lead the way for shareholder activism in Europe, with 30% of European companies targeted in 2017 based in the U.K., according to Activist Insight data.

Consistent with last year’s campaigns at Stock Spirits and Rolls-Royce, attempting to obtain board representation by criticizing a target’s corporate governance has continued to be a point of entry for activist shareholders. In March, Crown Ocean Capital replaced Bowleven’s CEO and five other board members with two new non-executive directors (“NED”) after questioning the independence of four Bowleven directors that had previously worked at competitor Cairn Energy. In May, Renova, M&G, Sothic, and D.E. Shaw were also able to remove Petropavlovsk’s (“POG”) long-standing chairman, Peter Hambro, and three NEDs in favor of four new NEDs after attributing POG’s lack of revival following its 2015 restructuring to the board’s failure to engage with shareholders.

Despite this, criticisms of corporate governance have not always been successful in generating board representation. In August, Ecotricity attempted to place two NEDs on Good Energy’s board after criticizing “unjustifiable” contracts exchanged between Good Energy’s CEO and her husband. The resolutions were rejected at Good Energy’s annual meeting on the basis that Ecotricity was a direct competitor attempting to undermine, not strengthen, Good Energy.

At the same time, director and executive pay criticism has been less pronounced. This year only two FTSE 100 companies lost advisory votes on pay—Pearson and Crest Nicholson—as remuneration committees and directors seem to have become more attuned to potential complaints on pay as a possible platform for shareholder discontent. At Burberry, the company’s new finance director opted to hand back a £1.6m share award. BP, BT and WPP, which each suffered large shareholder defeats on executive pay resolutions at their 2016 annual meetings, saw a significant reduction in the number of investors voting against or failing to back scaled-down director and executive pay packages.

2017 also provides evidence to suggest that the manner of U.K. activism is changing with a significant upsurge in activists seeking to air grievances publicly, in a manner more akin to U.S.-style campaigns than those traditionally conducted in the U.K. Elliott’s criticisms of BHP in May 2017—including, amongst other things, its calls for BHP to spin off its oil business, appoint a new chairman and scrap its U.K.-Australian dual holding structure—were aired in the public arena through a series of open letters to shareholders and presentations following an extended period of private discussions.

The U.K. legal, regulatory, and political landscape remains supportive of shareholder engagement. That said, the government’s August 2017 corporate governance reform proposals scaled back previous suggestions that workers should be placed on company boards and annual votes on executive pay be made binding, which could have presented activists with further opportunities for shareholder engagement. Whilst this will do little to dampen the facilitative conditions for activist operations in the U.K., it remains to be seen whether the uncertainty and complexities brought on by Brexit will divert activist investment away from U.K. targets and toward EU member states, or whether Brexit merely represents a crisis they will not want to waste.

France

France has not been immune from large U.S. activists seeking opportunities in Europe as stock markets back home have soared. In August, it was reported that Corvex Management had taken a $400 million stake in French food company Danone, a former target of Trian Partners, although its plans are not yet clear. Elliott Management, a holdout against the delisting of logistics company XPO Europe, submitted resolutions again at this year’s annual meeting.

The most aggressive activist campaign of the year was waged by London-based The Children’s Investment Fund Management (“TCI”), to prevent Safran from acquiring Zodiac Aerospace. TCI’s campaign was criticized by Paris-based activist Charity Investment Asset Management (“Ciam”), a Zodiac shareholder that was ready to launch a proxy fight at the company before the agreement with Safran was announced. Eventually, the transaction went through at a lower price than first proposed, and both activists gave their support to the final deal.

That situation highlights a frequent outcome in France; while activists can draw concessions, management often gets its way. Two buyouts opposed by Ciam—at SFR and Euro Disney—have gone through this year following price adjustments.

Anne-Sophie d’Andlau, CEO of the Paris-based Ciam, told Activist Insight she is optimistic about French activism. “It is the second biggest market in Europe, and it’s behind the curve in terms of evaluation, M&A, and activism. It is a well-regulated market, with a stable takeover code and a stable legal system.”

Changes may be in the works. Loïc Dessaint, CEO of proxy advisory firm Proxinvest, told Activist Insight he believes French institutional investors are increasingly concluding that they could benefit from activists’ campaigns. Dissidents, he adds, often secretly obtain financial support from fellow shareholders for their lawsuits against issuers or controlling shareholders.

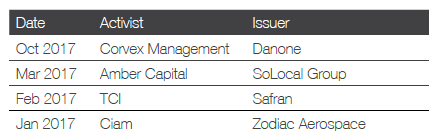

Noteworthy Activist Campaigns in France

France’s strong minority shareholder protections have allowed activists to carve out a niche protesting creeping takeovers. This year, The Children’s Investment Fund (TCI) objected to Safran’s takeover of Zodiac Aerospace—a deal supported by Ciam—which combined with industry headwinds forced the former to drop its offer price. Meanwhile, Amber Capital forced out the CEO of SoLocal Group and operational activism may be about to take root in the form of Corvex Management’s new stake in Danone, disclosed about two years after Trian Partners exited the yoghurt manufacturer.

Companies publicly subjected to activist demands per year

Activity in 2017 looks likely to end the year flat or marginally above the previous year’s tally, based on current trends.

* As of September 30, 2017. Projected full-year figure shown in dotted box.

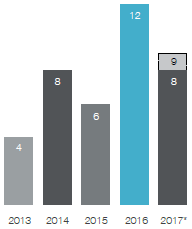

Size of companies publicly targeted by activists since 2013

While large-cap targets are a larger portion of the total in France than elsewhere, 2017 saw that taken to new levels; almost one-third of companies targeted in the first nine months had a market capitalization of more than $10 billion.

Governance issues: what French-listed companies should focus on during the coming year.

“The compensation of officers of listed companies remains a hot topic for activists.”

French-listed companies should consider further enhancing the role of their board of directors, in order to better anticipate requests of activists, and to determine whether it would be advisable, among other actions:

- To take into account, on a voluntary basis, the provisions relating to the duties of the board of directors provided for by Directive 2013/36/EC of June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms. The latter provides for detailed corporate governance obligations for financial institutions. The application of such rules, including on a voluntary basis, should increase the responsibility of the board to ensure that the basic corporate governance rules are properly applied within the company.

- To define and oversee the implementation of governance arrangements that ensure the effective and prudent management of a company, including the segregation of duties within the organization and the prevention of conflicts of interest.

- To determine to what extent, and under which conditions, the chairman of the board should be authorized to simultaneously carry out the duties of CEO within the same company, and whether it would be advisable to obtain the prior advice of the shareholders through a non-binding consultation process.

- To appoint an independent director as vice chairman of the board, and extend the powers of his/her role compared to the current—limited—role of a vice chairman.

- To grant additional responsibility to a nomination committee of the board, composed mainly of independent directors, which could be in charge not only of providing recommendations for the appointment of candidates for management and executive positions, but also of preparing a report, periodically and at least every year, to the board with regard to the structure, size, composition and performance of the board, and submitting recommendations to improve the corporate governance of the company.

Implementing the new “say-on-pay” rules

The compensation of officers of French-listed companies remains a hot topic for activists. In December 2016, the French legislature introduced a binding “say-on-pay” vote. As a consequence, shareholders of French listed companies are required to vote on all forms of compensation provided to a company’s corporate officers, including the compensation of the chairman: an ex-ante vote relates to the vote of shareholders on the principles and criteria of the executive officers and the chairman of the board’s compensation every year, and an ex-post vote relates to the vote of shareholders on the variable or exceptional elements of the compensation; in the event of a negative vote, the latter cannot be awarded.

In our view, given the continued relevance and expected increase in activism in France, it is critical that the board and the management of listed companies be well prepared and remain open to address requests from their shareholders and discuss their main concerns with them.

Germany

Germany has long been a laggard in the space of shareholder activism due to both legal and cultural challenges. Yet despite the headwinds, recent years have attested that activism can thrive there. If 2016 was a relatively blockbuster year for activism, with 16 companies publicly targeted across the entire year, 2017 looks set to at least match that tally.

While board refreshment remains a high priority, minority protections and the strength of German companies has M&A coming second. 2016 saw eight M&A campaigns, amounting to 26% of all publicly recorded demands, and a further eight demands related to board or management revamps. In 2013, the most fertile year before 2016, five M&A demands were recorded—representing almost one-third of the total—with Elliott Management alone launching two campaigns. Whereas most of the activity in the past was limited to merger arbitrage and opposition to takeovers, the past two years saw more complex campaigns, with a greater number of calls for board and business changes.

Activists interviewed for this special report radiate optimism, but acknowledge that the market is still embryonic and will probably never reach U.S. or U.K. levels. Petrus Advisers’ Till Hufnagel believes the nation needs time to embrace activism, much like private equity strategies required years to become popular two decades ago. Petrus sees many opportunities in Germany and Europe and is considering expanding into Italy.

The CEO of Active Ownership Capital (“AOC”), Klaus Roehrig, whose campaign at Stada put the drugmaker in play with private equity firms, says institutional investors are increasingly willing to support activists and become more active themselves because of a low yield environment and the European Union’s push for greater shareholder engagement, particularly on executive remuneration. Meanwhile, Guy Wyser-Pratte thinks the region is attractive for its “great” discounts, although he admits Germany’s corporate governance code of voluntary compliance “has no teeth.”

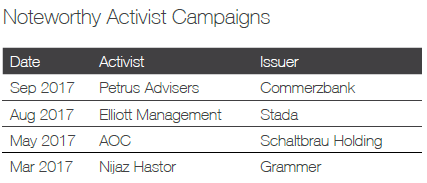

Noteworthy Activist Campaigns in Germany

After last year’s proxy contest at Stada Arzneimittel put the company in play, private equity firms had to work hard to get a deal past Elliott Management’s merger arbitrage strategy. For its second major campaign, AOC, the fund that started the Stada battle, teamed up with Satora Beteiligungs to try and elect a three-person slate at Schaltbrau Holding. Autoparts manufacturer Grammer only won a proxy contest with Bosnian activist Nijaz Hastor after courts lifted an injunction against a white knight investor brought in as a new 9% shareholder. More recently, Petrus Advisers challenged Commerzbank to outline credible plans for its subsidiary, Comdirect.

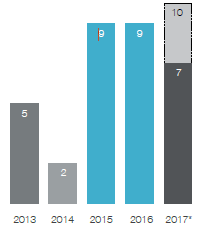

Companies publicly subjected to activist demands per year

The number of activist campaigns in Germany was already elevated in 2016 and is predicted to grow in 2017.

* As of September 30, 2017. Projected full-year figure shown in dotted box.

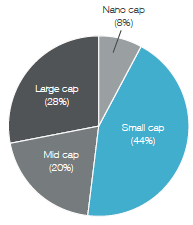

Size of companies publicly targeted by activists since 2013

At the end of the third quarter, the relative weighting of large-cap activist targets in 2017 was above the historical average, driven largely by a quiet year for mid-market firms.

Cultural and structural changes mean German activism is set to continue.

“Shareholder activism will likely develop and play an even more important role in Germany over the next few years.”

In 2017, shareholder activism continued to be a driver of change to the corporate landscape in Germany, launching or bringing to an end some noteworthy public campaigns. While overall activity, to the extent publicly visible, has been approximately at last year’s (high) level, there is still significantly less activity than, for example, in the U.K.

The relevant legal framework in Germany has not changed over the last year. However, changes are on the horizon due to an amendment to the EU Shareholder Rights Directive (Directive (EU) 2017/828 dated May 17, 2017) that has recently been enacted and must be implemented by the member states by mid-2019. Changes will relate to, among others, “say-on-pay” matters and related-party transactions, and have the potential to create uncertainties and, therefore, further disputes and exposure to shareholder activism.

The results are in

AOC’s campaign at German pharmaceutical company Stada, initiated in 2016, has been among the most prominent cases in Germany. This campaign resulted in a shake-up of the company’s management and supervisory board (in particular, the CEO and chief financial officer left the company), a successful takeover offer by Bain Capital and Cinven, and a recent Stada share purchase and public statement by Elliott aimed at increasing the compensation to be offered by the Bain Capital/Cinven bidding entity to all Stada minority shareholders in connection with a domination agreement it plans to enter into with Stada. While the offer price amounted to 66.25 euros per share,

Elliott requests compensation of at least 74.40 euros per share.

Elliott Management is also still busy with SLM Solutions, a provider of metal-based additive manufacturing technology solutions, after its opposition to the proposed takeover of SLM Solutions by General Electric led to GE dropping its takeover attempt and acquiring a competitor instead.

Activist demands are evolving

Over the last year, shareholder activism not only focused on “typical” goals such as obtaining board seats or pushing companies into M& A transactions. Board compensation matters and related shareholder resolutions also received a fair amount of media attention. For example, the supervisory board of SAP was only narrowly discharged from liability—a standard meeting item—due to shareholder resistance caused by the supervisory board’s approval of the management board’s compensation package. The annual general meeting of Munich Re had to resolve a “say-on-pay” vote (which is voluntary and non-binding in Germany) and rejected the company’s proposal.

Taking into account the growing number of educated investors that are willing to actively engage in discussions with boards, and ongoing, often technology-driven changes and challenges to various business sectors, shareholder activism will likely develop and play an even more important role in Germany over the next few years.

Italy

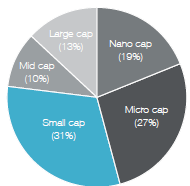

After reaching a record of 12 companies targeted in 2016, activism in Italy has slowed this year. Campaigns by investment firms have remained stable, however, with last year’s figures pushed up by campaigns launched by employee and ex-employee associations, individual shareholders, and long-term strategic partners that clashed with management.

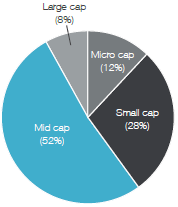

Amber Capital continues to be the busiest activist in the country. This year, it has blocked buyout offers at Caltagirone Editore and Parmalat—an effort U.S. activist Gamco Investors joined—amid several other engagements. It is also involved at Ansaldo STS, where Elliott Management is fighting a lengthy legal battle, and where new U.S. hedge fund, Litespeed Management, called for larger payouts in April.

Morrow Sodali’s Director Fabio Bianconi told Activist Insight that Amber’s campaign at Parmalat made clear that “patient activists can get results,” and said Italian issuers have started asking his firm to conduct vulnerability assessments to identify possible activist threats.

Giuseppe Bivona, the co-founder of investment adviser Bluebell Partners—and until recently a representative of Elliott on Ansaldo STS’ board—opposed the appointment of a new CEO at state-controlled Leonardo in March on behalf of a foreign institutional investor. He told Activist Insight that the advent of foreign activists in Italy is hampered by regulators, which are slow to intervene against misdeeds. However, traditional mutual funds are taking their fiduciary duties to investors more seriously, and are willing to vote against management, opening opportunities for activists. Amber recently told Activist Insight it believed foreign activists might increasingly be attracted by the ongoing stabilization of Italy’s economy, paired with the country’s advanced regulations for the protection of minority shareholders and the fading influence of controlling shareholders.

Noteworthy Activist Campaigns in Italy

U.S. funds played a significant role in Italy this year, with Elliott Management’s long-standing campaign at Ansaldo STS attracting Litespeed Asset Management, Amber Capital launching demands at five companies and Gamco Investors holding firm against a squeeze-out at dairy company Parmalat.

Companies publicly subjected to activist demands per year

The pace of activism in Italy slowed in 2017, but activity by funds has remained consistent with last year. Under Vincent Bolloré, Vivendi has also become a force to be reckoned with.

* As of September 30, 2017. Projected full-year figure shown in dotted box.

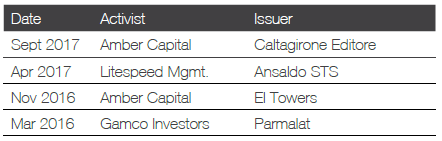

Size of companies publicly targeted by activists since 2013

Companies with a market capitalization of $2-10 billion have long made up the bulk of activist targets in Italy, but the growing prowess of investors has meant inroads have been made into large-cap companies.

Switzerland

After a banner 2016, activism largely eluded Switzerland for the first six months of 2017 until Dan Loeb’s Third Point Partners unveiled a $3 billion investment in consumer goods giant Nestlé. The campaign marked the return of U.S. activists after a four-year pause (in 2013, Knight Vinke Asset Management and Carl Icahn targeted UBS and Transocean, respectively) and saw Loeb argue that a business of Nestlé’s quality with so many avenues for improvement is a rare find. Third Point has advanced a series of demands, including share buybacks and portfolio streamlining, and the divestment of its stake in L’Oréal. Soon after, Keith Meister’s Corvex Management and 40 North Management publicly opposed the combination of Swiss chemical company Clariant and U.S.-based Huntsman, arguing for a spinoff of Clariant’s plastics and coatings business instead.

Despite low activity levels this year, RBR Capital’s Gregor Joos told Activist Insight he is confident Switzerland is a “good hunting ground” for activists and sees “a lot of opportunities.” Ali Saribas, a director at Morrow Sodali, says capital allocation will “be an area of focus,” as activists press conglomerates to divest underperforming assets and “focus on what delivers value.”

In addition to an unfavorable legal framework for more aggressive shareholders, one factor that drives down activity is the widespread presence of the so-called “anchor” shareholders—management-supporting investment firms that typically acquire stakes of 20% or more. According to Joos, Silchester Capital’s

15% stake in GAM and support for management prevented RBR from claiming victory in its proxy fight this year. As a result, approaching the anchor shareholder first is paramount for a successful activist action. Failing to get its support will make the campaign more difficult but not impossible, Joos says. RBR typically eliminates potential targets in the research phase if it finds the anchor shareholder is not open to suggestions.

Noteworthy Activist Campaigns in Switzerland

Switzerland’s large-cap companies, a significant portion of its activist targets, were on the receiving end of special attention in 2017. Third Point Partners provoked Nestlé into setting new margin targets but may not get the spinoff of the company’s stake in L’Oréal that it sought, while Corvex Management and 40 North Capital have attempted to sink the merger of Clariant and Huntsman. Elsewhere, hedge fund group GAM Holding fought off RBR Capital in a proxy fight and ABB rejected Cevian Capital’s request to separate its power grids business before offering the Swedish investor a board seat.

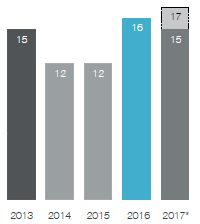

Companies publicly subjected to activist demands per year

Two high profile targets of activists belie the fact that 2017 has been a slight come down from the previous year. Nonetheless, current levels are still among the highest in recent years.

* As September 30, 2017. Projected full-year figure shown in dotted box.

Size of companies publicly targeted by activists since 2013

Activists continue to target large companies in Switzerland, although the level of activity is down from its peak in 2015. Less noted is the thriving market below $2 billion in market capitalization.

N.B. Percentages are rounded to the nearest whole and may cause summation errors.

Print

Print