David T. Robinson is the J. Rex Distinguished Professor at Duke University Fuqua School of Business. This post is based on a recent paper by Professor Robinson; Niklas Hüther, Assistant Professor at Indiana University Kelley School of Business; Thomas Hartmann-Wendels, Professor at the University of Cologne; and Soenke Sievers, Professor at Paderborn University. Related research from the Program on Corporate Governance about CEO pay includes Paying for Long-Term Performance (discussed on the Forum here).

Limited partner agreements in private equity typically focus on three elements of compensation: Management fees, carried interest, and the timing provisions that govern when general partners receive carried interest. By now, the standard conventions in most Limited Partnership Agreements (LPAs) are well understood by most observers and students of the industry—most investment managers (general partners, or GPs) charge 1.5% to 2.5% management fees to their investors (the limited partners, or LPs), and take a 20% carried interest in the net return in the exited investments, resulting in the “2 and 20” compensation structure that is commonplace in private equity.

However, the conventions governing when GPs receive their carried interest are less well-understood. Historically, LPAs have followed one of two approaches for paying carried interest to GPs: deal-by-deal or whole-fund. Deal-by-deal, or “American” carry provisions are considered more GP-friendly because they allow GPs to earn carried interest on each deal as each portfolio company is exited. In contrast, whole-fund, also known as “European” carry provisions are generally considered more friendly to Limited Partners (LPs), giving LPs return on their commitment before GPs receive any carried interest.

Clearly whole-fund carry provisions are more advantageous to the LP, all other things being equal. But are all other things equal? Or could the terms of the carry reflect differences in investment performance? Could contracts change investment incentives? This paper explores whether LPs are better off with whole-fund or deal-by-deal carry timing provisions, at least in the case of venture capital investing.

Our findings suggest that—at least in venture capital during a period when both types of contracts were common—deal-by-deal carry terms generated far higher returns for LPs than whole-fund terms. In other words, LP-friendly contracts are associated with underperformance. Part of the explanation for this finding is the obvious fact that better-performing GPs command better terms. Historically LPs have been better off paying higher prices in order to be affiliated with higher quality GPs, at least on average. However, a second key factor lies in the incentives each set of terms creates. The exit patterns from portfolio investments suggest that deal-by-deal contracts, despite being thought of as GP-friendly, actually provide better-aligned exit incentives than whole-fund contracts. This has important implications for LPs investing in private equity.

Why the Timing of Carried Interest Matters

Litvak (2009) shows that the timing of carried interest is a major determinant of the present value of GP compensation. To see why, consider a fund that has exited two investments, the first at a gain and the second at a loss, so the overall return on the two exits is zero. Under deal-by-deal, the GP would earn carried interest on the strong exit even though the combined return on the two investments was zero. Clawback provisions typically do not require the return of interest, and often do not cover the entire return of principle, so the GP essentially receives an interest-free loan during that time period, even if he has to return part or all of the capital he has received. In contrast, a GP facing “fund-as-a-whole” carried interest provisions would not yet be eligible to receive carried interest, because the whole fund had not yet earned a positive return. If the fund’s returns exceed a contractually specified benchmark return later in the fund’s life, the GP on a fund-as-a-whole carry scheme would begin earning carried interest at that point.

Although variation in the timing of carry is of little concern to the worst funds (they never earn carry!) or the best funds (they earn carry quickly) Litvak’s work shows that timing differences can be large for mediocre-performing funds. Her calculations, based on simulated compensation from hypothetical investment behavior that matches industry statistics, indicate that standard shifts in timing induce changes in the net present value of compensation that are at least as large as observed shifts in management fees and carried interest percentages.

Understanding Performance Differences

How do these incentives show up in performance? To answer this, we examined 3,552 portfolio company investments by 85 venture capital funds raised between 1992 and 2005, as well as due diligence documents from an additional 102 venture capital Private Placement Memoranda.

We use the public market equivalent (PME) to measure performance. This compares a private equity investment to what would have been earned in the public markets instead: a PME of 1 means that private equity was on par with public equity performance; a PME greater or less than one means private equity outperformed or underperformed the public markets.

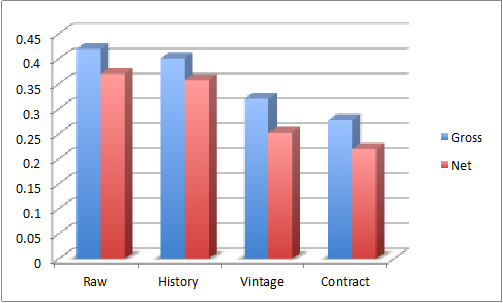

Our results are shown below. Blue bars indicate the gross-of-fee performance, which is the PME associated with each portfolio company investment, averaged over the entire set of deal-by-deal contracts, minus that of whole-fund contracts. Red bars report differences in net-of-fee PMEs that LPs earn.

Figure 1. Summary of Performance Differences

The raw, or unadjusted, PMEs were around 0.82 for whole-fund contracts, but averaged 1.24 for deal-by-deal contracts. This means that whole-fund contracts destroy about 18 cents per dollar of NPV of invested capital, while deal-by-deal funds exceeded what one could have earned in public markets by about 24% over the life of the fund.

Conditioning on the historical performance of the partners in the fund is one way to try to account for differences in underlying GP quality that might drive this difference. Because our results are based on due diligence materials not typically available to researchers, we have unprecedented access to past performance information. Thus, we can distinguish between true first-time funds and first-time funds started by GPs with track records at previous organizations. Controlling for historical performance does little to erase the performance differential between GP-friendly and LP-friendly contracts.

Controlling for the vintage year of the fund does cut down the performance differential—GP-friendly contracts were more common in stronger vintages—but this does not erase the result. Nor are the differences in gross performance absorbed by variation in other contract terms like fees and carry. While fees and carried interest percentages are typically higher for deal-by-deal funds, LPs earn higher net returns in deal-by-deal funds than in funds with whole-fund carry provisions. Thus, LPs are not, on average, better off with LP-friendly contracts.

Why the Difference in Performance?

Why are GP-friendly contracts better for LPs? Because our data all came from the same limited partner, differences in investor type cannot be the answer. There are instead two possible explanations. The first is a selection argument: Better-quality GPs, all else equal, are able to command better deal terms, and thus would be more likely to have GP-friendly contract terms in place. (Industry conventions may limit their ability to capture fully the rents associated with their better performance, leaving LPs still better off.) The second explanation centers around differences in behavior: the terms of the GP-friendly contract itself may induce the GP to expend greater effort or take greater risk in choosing the investments, effectively causing the GP to behave differently than they otherwise would.

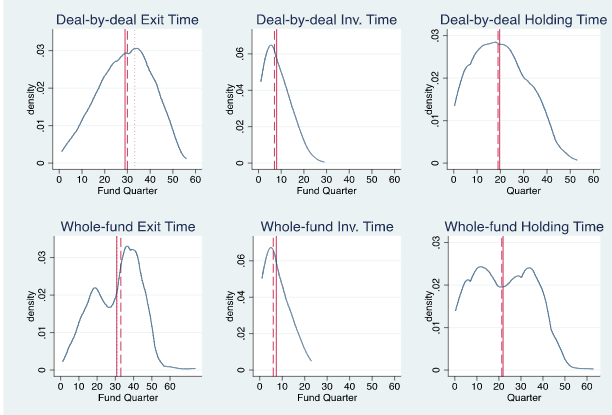

Figure 2. Portfolio Companies Investment and Exit Times by Fund Quarter

One place to look for differences in incentives is exit behavior. Figure 2 illustrates the timing of investment and exit decisions according to whether the fund follows a whole-fund or deal-by-deal carry scheme. The left column of graphs depicts the distribution of investment times for the two types of contracts as a function of fund age. This is computed by pooling all of the initial investments by fund age for each contract type and plotting the distribution of investments. There is little difference in the distribution of investment times: for both contract types the median investment occurs in about the seventh or eighth quarter of the fund’s existence, meaning that funds have made about half of their initial investments by the beginning of their third year.

There are, however, substantial differences in the distribution of exit times by contract type, as seen in the two graphs in the right column of Figure 2. Deal-by-deal distribution times follow the evolution of net asset values that one would obtain by following the procedures outlined in Metrick and Yasuda (2010) and forecasting the evolution of NAVs. This is consistent with the idea that managers under deal-by-deal are acting under an incentive to maximize the value of each exit irrespective of how it is connected to the broader portfolio they manage.

In contrast, whole-fund contracts are associated with a first spike in distributions between the 16th and 18th quarters of the fund’s life, and a later spike around the 40th quarter of age. The first spike coincides roughly with the end of the fund’s investment period and hence the need to raise a follow-on fund. This is related to findings in a series of papers connecting the timing of fund-raising decisions to revisions in the stated NAVs of the underlying assets under management of the GP: It suggests that whole-fund contracts operate under an increased incentive to grandstand, posting early returns to investors in order to send a signal of the fund’s underlying quality.

Conclusions

These findings indicate that policy makers and other industry observers should tread carefully when making blanket prescriptions aimed at improving LP returns by changing the structure of LPAs. LP-friendly contracts, historically, offered lower returns than GP-friendly contracts.

There are two reasons for this. One is that better-quality GPs command better terms. Thus, on average, GP-friendly LPAs are good for LPs because better quality GPs can produce better returns, and some of this added surplus flows back to LPs.

The terms of the contract also appear to be associated with differences in GP behavior. GPs operating funds under LP-friendly contracts appear to begin by generating early exits in relatively less risky deals. This suggests they have a motive to “put points on the board,” consistent with the classic “grandstanding” results of Gompers (1996).

We can only speculate about the underlying economic mechanisms responsible for these findings, but that speculation is important for the “what if” question of how the private equity investing world would look if things changed. One mechanism is that the whole-fund provisions induce GPs to exit investments early so they can begin earning carried interest. A second is more subtle and is based on a signaling argument. The idea here is that if market participants know that the pool of whole-fund contracts contains a mix of low-quality as well as high-quality, but unproven GPs, then GPs may use early exits as an attempt to persuade LPs that they are better type—closely in line with the classic grandstanding result of Gompers (1996). If this is the primary mechanism behind the early exit, then abolishing deal-by-deal carried interest, as suggested by ILPA (ILPA Private Equity Principles, 2011) and other industry observers, would result in pooling. The lack of an alternative available contract could presumably undermine the incentive to exit early.

The complete paper is available here.

References

K. Litvak, “Venture Capital Limited Partnership Agreements: Understanding Compensation Arrangements”, University of Chicago Law Review, 76, 161-218, 2009

P. Gompers, “Grandstanding In The Venture Capital Industry”, Journal of Financial Economics, 42, 133-156, 1996

Institutional Limited Partner Association, “Private Equity Principles, Version 2.0” January, 2011.

Andrew Metrick, and Ayako Yasuda, “The Economics of Private Equity Funds,” Review of Financial Studies, 2011, 23, 2304-2341.

Print

Print