Doug Morrow is Director and Martin Vezér is Senior Associate of Thematic Research at Sustainalytics. This post is based on recently published reports by Mr Morrow, Dr Vezér and their colleagues Andrei Apostol, Kasey Vosburg, Rita Ferreira and Will Meister.

Corporate activities that generate undesirable social or environmental effects are a valuable source of information for investors. Environmental, social and governance (ESG) incidents can reflect gaps in a company’s management systems, vulnerabilities in corporate strategy and lapses in policy development, all of which are relevant to company analysis and evaluation. If policies and programmes are the talk of corporate ESG management, then incidents are the walk.

Incidents can also have direct financial effects. Many well-known examples of shareholder value destruction over the last few years, including product safety concerns at Samsung, the Dakota Access Pipeline controversy and the Volkswagen emissions scandal, constituent incidents.

Focusing on the essential trends and applications

In our recently published study, Understanding ESG incidents: key lessons for investors, we analyze 29,000 incidents that took place in 176 countries from 2014-2016. We identify the essential incident trends, including those related to company size, industry classifications, geographical considerations and financial effects.

Two incident types run against the grain

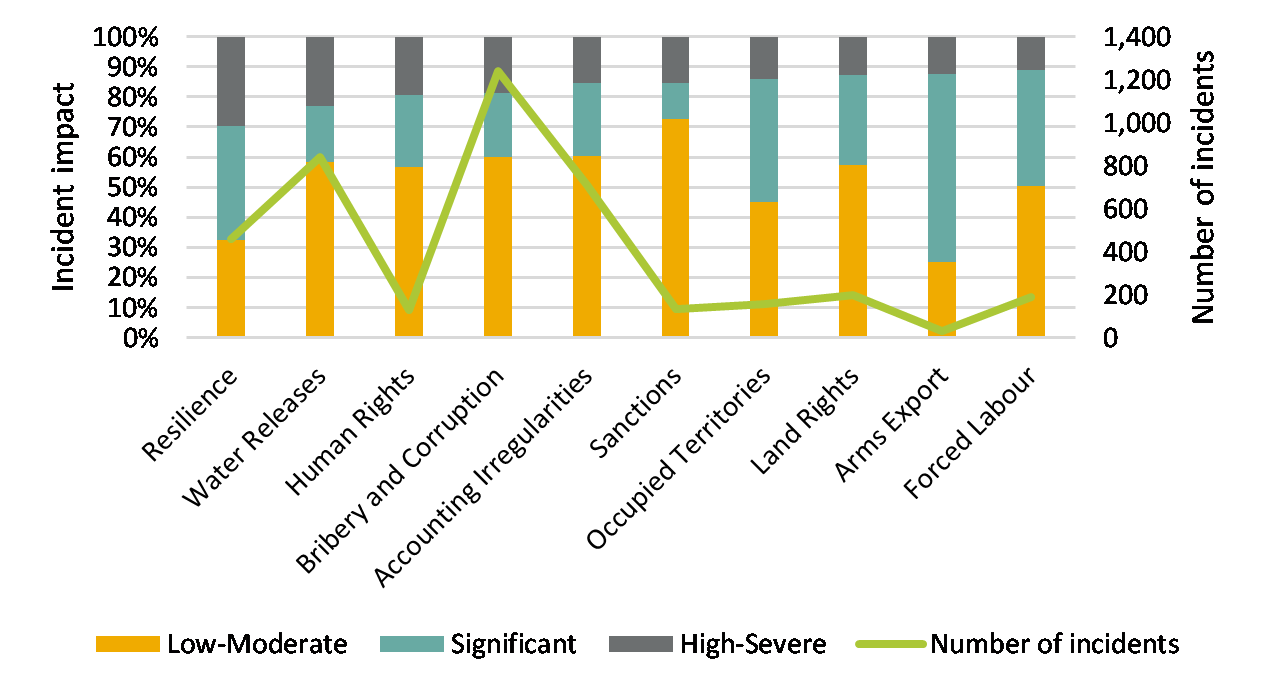

Our analysis reveals that low-impact incidents are common, and high-impact incidents are rare. Low- and moderate-impact incidents together account for more than three-quarters (78%) of all incidents. The remainder are categorized as significant (16% or 4,557 incidents), high (6% or 1,638 incidents) and severe (1% or 290 incidents).

As indicated by the figure below, however, two incident types—Bribery and Corruption and Water Releases—run against the grain: they are relatively common and often highly impactful.

Incident types with the largest proportion of cases ranked high-severe

Source: Sustainalytics

In our new report, 10 for 2018: ESG risks on the horizon, we take a closer look at these two incident types and focus on two of the most exposed industries: Diversified Chemicals and Aerospace & Defense.

Hazardous water releases in the diversified chemicals industry

The diversified chemicals industry is facing intensifying risks related to the ecological, social and human health effects of releasing hazardous chemicals into the environment. While hazardous chemical releases have been a long-standing problem in the industry, the associated financial consequences of such incidents are on course to catch up with involved firms. Exposed companies face increasing scrutiny from the public, the media, and regulators in key markets, including North America and Europe. A recent series of multimillion dollar lawsuits and government investigations could be a harbinger of shareholder value destruction on the horizon.

Companies responsible for hazardous chemical releases face direct legal and clean-up expenses and substantial reputational blowback. In February 2017, for example, DuPont (now DowDuPont) and Chemours agreed to a USD 671mn settlement involving more than 3,500 lawsuits brought by residents of Ohio and West Virginia after it was revealed that a chemical (PFOA/C8, used in Teflon production) that DuPont released into local water supplies was linked to several diseases, including cancer.

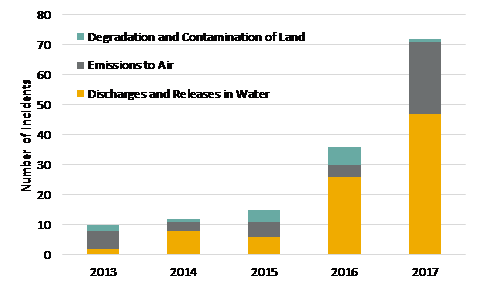

These are not isolated cases. Our analysis finds that between 2013 and 2017, 33 diversified chemicals firms were linked to 145 incidents involving emissions, effluents and waste in 15 countries around the world. As shown in the figure below, our research has been capturing a growing number of such incidents.

Diversified chemicals incidents involving emissions, effluents and waste

Source: Sustainalytics

Bribery and corruption

The aerospace & defense (A&D) industry continues to face elevated risks associated with anti-corruption initiatives launched by governments. Enforcement agencies are increasingly targeting firms under anti-corruption legislation, such as the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act.

To settle bribery and corruption allegations pursued by US enforcement agencies, a sample of just five global A&D companies have had to face penalties reaching USD 855mn in recent years.

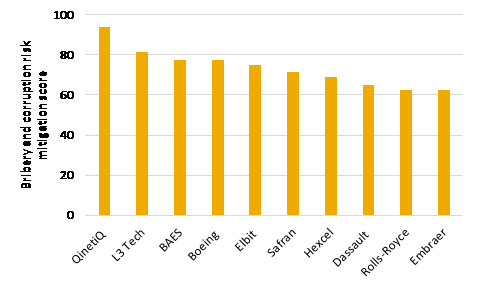

Zeroing in on 10 high-profile firms, the figure below shows the range of performance of companies we assess. Despite having relevant programmes, Embraer sits at the low end with a score of 63, reflecting its recent track record. Comparing the performance of Embraer, BAES and Boeing provides further context about the market. Although the USD 400mn fine that BAES incurred in 2010 was nearly twice as large as the figure cited in the cases against Embraer, Embraer’s 2016 settlement is more recent and, as we detail in the report, the controversy is persistent.

Embraer’s underperformance relative to Boeing is noteworthy because the two firms are currently working on a deal that could result in Boeing acquiring Embraer.

Bribery and corruption risk mitigation performance of 10 high-profile A&D firms

Source: Sustainalytics

Research on the horizon

Our case studies focusing on diversified chemical releases of hazardous materials in water supplies and bribery and corruption in the A&D industry are only two examples that illustrate how corporate law plays an important role in ESG incidents research. Other relevant examples that we examine include antitrust regulatory actions facing technology firms in Europe, litigation facing sugary drink producers in the US and public scrutiny of the supply chain management practices of apparel retailers with operations in Asia and Africa.

We will continue to analyze the growing Sustainalytics incidents universe, monitor the market and experiment with applications of our key findings. We anticipate that further developments in the legal and regulatory environment will continue to influence corporate activities and investment decisions moving forward.

The complete publication, including footnotes, is available here.

Print

Print