Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an ISS Analytics publication by Kosmas Papadopoulos, Managing Editor at ISS Analytics.

The 2018 U.S. proxy season is around the corner, and an early overview of shareholder proposal filings may give us a first taste of what is in store for investors and companies in terms of hot-button issues and overall market dynamics. Based on our analysis of shareholder proposal filings available in ISS’ shareholder filings database, we identified 450 proposals filed at Russell 3000 companies, of which 334 are still pending, while the rest have already made on ballots or were omitted and withdrawn.

Environmental and social issues dominate the agenda

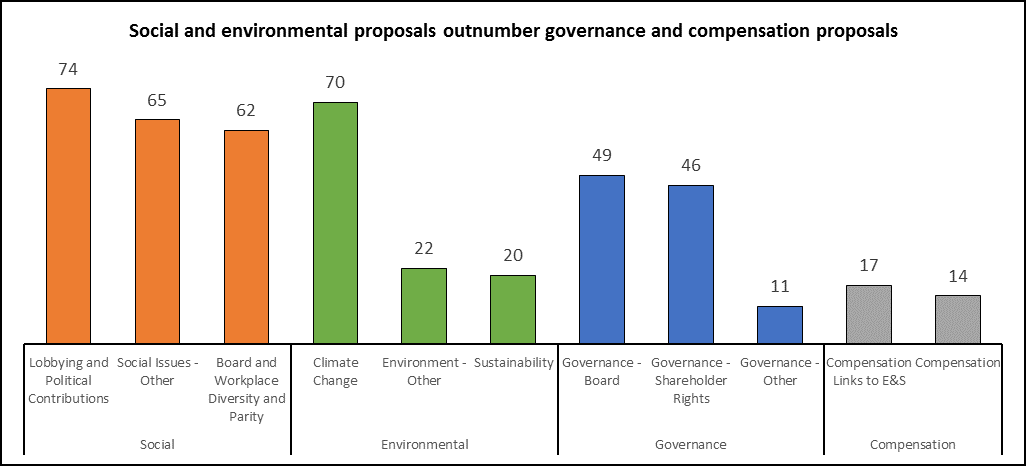

This year promises to continue the recent trend of social and environmental issues overshadowing governance- and compensation-related proposals. More than two-thirds of filed proposals are related to social or environmental issues, with political spending and actions, board and workplace diversity and parity and climate and sustainability being the key themes.

Source: ISS Analytics

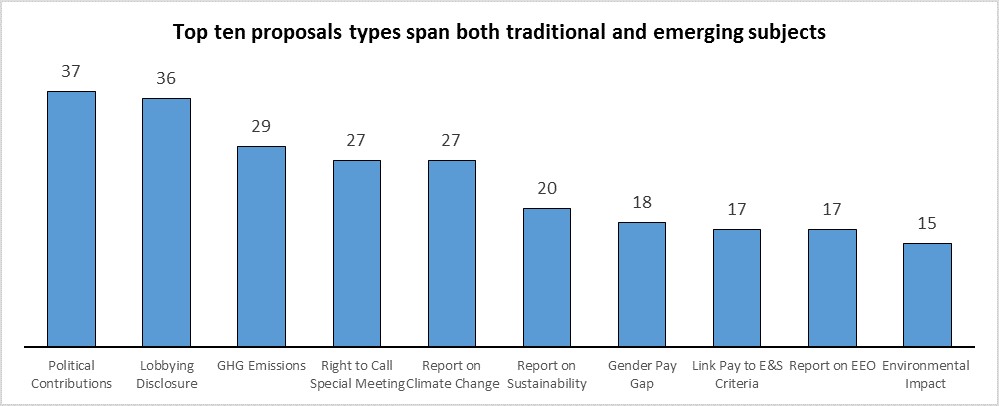

A closer look at proposal types and issue-specific campaigns makes the point clearer. Nine of the ten most commonly filed proposal types relate to environmental or social issues, while only one pertains to a governance concern.

Source: ISS Analytics

There may be a twofold explanation regarding this shift towards more environmental and social shareholder proposal filings and fewer governance proposals. First, social and environmental issues themselves are gaining significant traction with investors and the public. Important issues, such as concerns about the transparency of the political process, harassment and equity in the workplace, and climate change risks make headlines and dominate the public discussion daily. At the same time, investors and asset owners are bolstering their efforts towards greater ESG integration, which helps proponents gain further momentum. Second, governance topics may be lower on the agenda for the target universe. Shareholder proposals are typically filed at large-capitalization companies, where many formerly-contested governance issues have now become the standard. Annual director elections, majority vote standard, simple majority vote requirements and even proxy access—to a large extent—are now the norm for the vast majority of large companies. While, some proponents move on to the next tier of smaller-size companies to address governance concerns, those efforts are less likely to gain as much attention or make an impact to the broader market compared to proposals filed at large firms. Therefore, proponents may be forced to make a strategic decisions to continue to focus on large companies, which often serve as models for the rest of the market.

Among voted proposals, for which vote results are available, several have received significant support. The list below of proposal with highest support rates thus far in 2018 indicates that the types of proposals with high support levels may vary considerably, as not one issue seems to prevail.

| Company Name | Proposal | For/F+A (%) |

|---|---|---|

| Costco Wholesale Corp | Adopt Simple Majority Vote | 86.8 |

| ACUITY BRANDS, INC. | Report on Sustainability, Including GHG Emissions | 49.8 |

| Emerson Electric Co. | Require Independent Board Chairman | 46.2 |

| Sanderson Farms, Inc. | Require Independent Board Chairman | 44.9 |

| Sanderson Farms, Inc. | Phase Out Use of Antibiotics For Disease Prevention | 43.1 |

| Emerson Electric Co. | Report on Lobbying Payments and Policy | 39.6 |

| Emerson Electric Co. | Report on Political Contributions | 39.4 |

| Emerson Electric Co. | Adopt Company-Wide GHG Emissions Reduction Goals | 39 |

| Walgreens Boots Alliance | Reduce Ownership Threshold – Right to Call Special Meeting | 36.8 |

| Apple Inc. | Amend Proxy Access Right | 32.2 |

Source: ISS Voting Analytics

Opioid accountability campaign

A notable new proposal type concerns a campaign launched by Investors for Opioid Accountability (IOA), a coalition of 30 treasurers, asset managers, faith-based, public and labor funds with more than $1.3 trillion in assets. The proposals are directed at pharmaceutical and prescription drug distribution companies, and seek for reporting on the monitoring and management of financial and reputational risks related to the opioid crisis in the United States. The supporting statement for the proposal filed at AmerisourceBergen Corporation (meeting date 03/01/2018) cites a $16 million settlement with the state of West Virginia over claims of potentially negligent distribution of controlled substances to pharmacies that serve individuals who abuse opioids and failure to report suspicious orders according to state regulations. The proposal requests better transparency regarding governance measures to address such risks, including board and committee oversight as well as executive compensation incentives to promote ethical conduct in relation to opioid-related distributions. IOA has filed ten such proposals at U.S. companies so far in 2018.

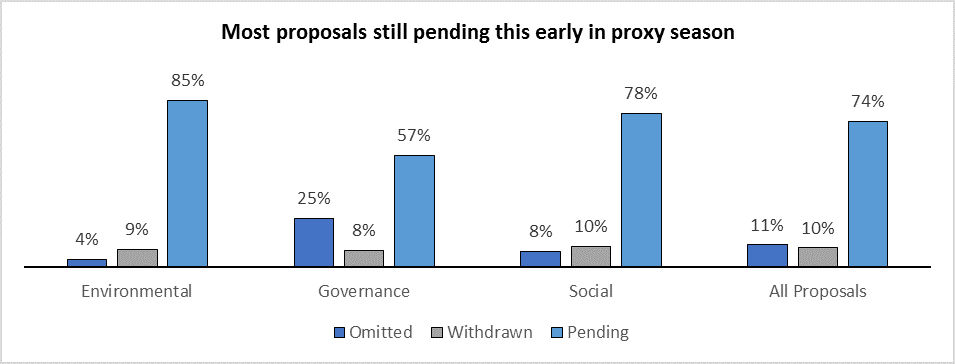

A significant portion of proposals challenged at the SEC

More than 40% of proposals filed in the ISS database were challenged at the SEC. For the full calendar year 2017, that figure stood at approximately 30% of filed proposals. While it may be too early to draw conclusions about trends, shareholders will follow resolution challenges closely. As the SEC has a full slate of commissioners after almost two years, and the administration has indicated its willingness to reform the shareholder proposal process, the SEC’s responses to shareholder proposal challenges gains further significance. As of today, 50 of the 450 proposals were omitted, while 43 were withdrawn.

Source: ISS Analytics

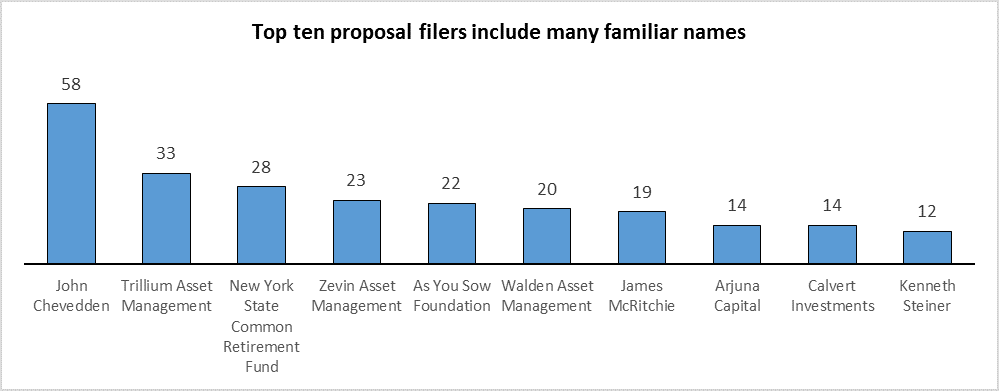

Proponents with variety of perspectives and some specialization

A look at the top proposal filers features many familiar names, including individuals, asset managers and asset owners. The top three filers demonstrate how there is some level of specialization among filers, while there are also very different perspectives among them. John Chevedden, who currently tops the list, has focused his efforts on governance-related items, and he may be responsible for the majority of governance proposals filed this year, including a large number dealing with the right to call a special meeting. Trillium Asset Management, on the other hand, primarily focused on board and workplace diversity and climate change. Meanwhile, the majority of proposals filed by the New York State Common Retirement Fund pertained to political contributions and lobbying disclosure.

Source: ISS Analytics

As the landscape of shareholder resolution filings continues to take shape, investors and companies will pay attention to developments in filing and voting trends. It seems certain that, even amidst an uncertain regulatory environment, shareholder resolution filings continue to play a major role in shaping the agenda for stewardship priorities in the market.

Print

Print