Anne Sheehan and Darla C. Stuckey are Co-Chairs of The Best Practices Committee for Shareowner Participation in Virtual Annual Meetings. This post is based on a report by The Best Practices Committee for Shareowner Participation in Virtual Annual Meetings. The Committee consists of interested constituents, comprised of retail and institutional investors, public company representatives, and proxy and legal service providers.

State laws require companies to hold annual meetings of their shareowners to elect directors and to allow their shareowners to vote on matters in which a vote by shareowners is required for approval. In that context shareowners may be permitted to ask questions about items on the ballot prior to voting. The annual meeting often also serves as an opportunity for management to update the company’s shareowners on company developments and to review the company’s performance. It also can be an opportunity for shareowners to ask questions of management and directors about the business of the company if they wish to do so. It is generally accepted that shareowner participation should be welcomed and encouraged at a company’s annual meeting of shareowners.

Shareowners who attend a company’s annual meeting generally view it as an opportunity to see and hear the company’s directors and management and judge their quality. For some shareowners it is an opportunity to express concerns or advocate action on important issues.

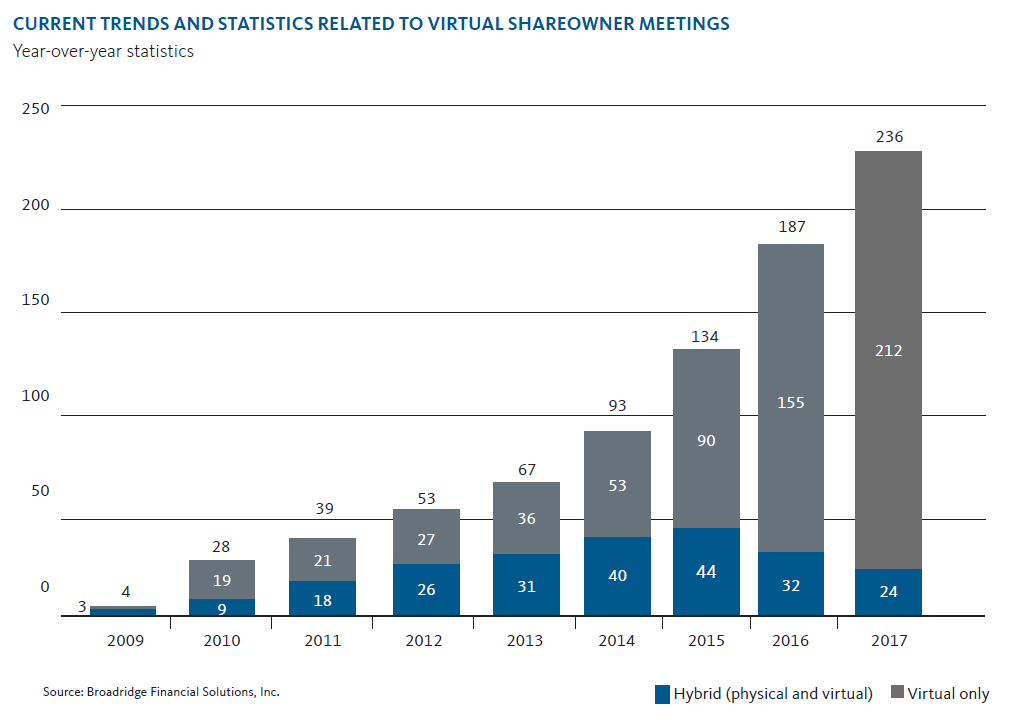

In recent years, some publicly traded companies have adopted virtual meetings of shareowners. Sometimes these are hybrids where in-person meetings include a virtual aspect to allow shareowners who could not travel to the meeting to participate remotely. Sometimes these meetings are virtual-only with no in-person participation.

We are a committee of interested constituents, comprised of retail and institutional investors, public company representatives, and proxy and legal service providers, who have been discussing best practices for virtual shareowner participation in annual meetings—with a view toward ensuring that the needs of all constituents are met in a fair and well-balanced manner.

There is debate over virtual shareowner meetings. Virtual participation in shareowner meetings presents an opportunity for shareowners that cannot travel to more easily attend and participate. Some endorse virtual-only shareholder meetings, noting that few shareholders physically attend smaller companies’ shareholder meetings. Others, including some committee members, are concerned that virtual-only participation could diminish the ability of shareowners to fully participate and have their questions and concerns heard without the risk of management exerting excessive control. In particular, if virtual technology is used to replace in-person meetings, in this view, the only opportunity for shareholder engagement with independent board members may be lost.

Every issuer will decide for itself the best way to conduct its annual meeting. Our purpose here is to ensure that when companies do opt for virtual participation in shareowner meetings, they are accessible, transparent and efficiently and cost-effectively managed, while meeting the important business and corporate governance needs of shareowners, boards and management.

For purposes of the following discussions, the phrase “virtual meeting” refers to a meeting in which shareowners are able to attend the meeting online via the internet, be certified electronically as a company shareholder, ask questions of the board of directors and management, and if desired cast their votes online in a secure manner while the meeting is in progress. It may or may not include an in-person meeting.

The phrase “virtual-only shareowner meeting” refers to a meeting of shareowners that is held exclusively through the use of technology (either online audio or video)—without a corresponding in-person meeting. The term “hybrid shareowner meeting” as used in this post refers to an in-person, or physical, meeting which shareowners are also able to attend virtually either through an online audio or video format, and if they wish to do so, cast votes online via the internet while the polls are officially open.

Corporate Governance Practices

The committee noted that although there is great latitude regarding the conduct of an annual meeting, shareowner meetings should permit the exercise of all of the rights granted to shareowners under state law, as well as comply with stock exchange listing standards and a company’s governing instruments. Shareowners are also entitled to be treated respectfully by their companies in the way shareowner meetings are conducted. Further, the committee agreed that companies should acknowledge their shareowners’ concerns about how shareowner meetings are conducted and ensure that they adopt procedures that are fair to, and respect, their shareowners regardless of the medium by which the meetings take place.

**The majority of current Committee participants worked together previously on consensus principles and best practices for online shareholder participation in virtual meetings, which were reflected in these June 2012 Guidelines for Protecting & Enhancing Online Shareholder Participation in Annual Meetings (“2012 Guidelines”). These Principles and Best Practices for Virtual Annual Shareowner Meetings are intended to supersede the 2012 Guidelines.

Members Take Different Positions On Hybrid Vs. Virtual-Only Meetings

Each company must consider its own objectives, preferences and costs as well as its shareowners’ concerns in deciding what kind of annual meeting to conduct. In some cases, companies have been holding in-person meetings for years and now want to move to a virtual meeting. Some Committee members state that virtual-only meetings are an acceptable practice under certain circumstances. Other Committee members believe that a hybrid meeting is always preferable to a virtual-only meeting. The goal of these guidelines is to present best practices to be considered by a company when evaluating the use of virtual shareowner meetings.

Considerations For Virtual Shareowner Participation In Shareowner Meetings

When deciding whether to implement any aspect of a virtual shareowner meeting, companies should take the interests of all shareowners into account. A virtual component of a shareowner meeting can enhance participation, but it is important that the meeting be handled in a way that affords remote shareowners the same amount of access to participate in meetings as they would have in person. some questions companies should consider:

- Do we have adequate technology to reach all shareowners, as well as management, who wish to participate?

- Do we have a plan in place to give equal opportunities to both in-person and online participants (in the case of a hybrid meeting)?

- Are we enabling meaningful engagement with shareowners?

- Does our investing base broadly understand why we are holding the meeting virtually?

- Is this virtual meeting in the best interests of the majority of our shareowners?

- Do we have a plan in place to ensure that shareowners have opportunities to ask questions outside of the parameters of the virtual meeting?

Principles

Once a company has decided to hold a hybrid or virtual-only annual meeting, it should follow these important guiding principles that the Committee has generally agreed upon, following a review of applicable state laws that are discussed and summarized in Appendix A.

These principles are not intended to create a higher standard than currently accepted best practices for in-person shareowner meetings.

Broad investor participation in annual meetings should be valued and encouraged. The Committee endorses the view that companies incorporating virtual technology into their shareowner meeting should use it as a tool for broadening, not limiting, shareowner meeting participation. (That is the reason some members of the Committee only support virtual technology as an addition to in-person meetings, not a replacement.) With this objective, a virtual option, if used, should facilitate the opportunity for remote attendees to participate in the meeting to the same degree as in-person attendees.

Shareowner meetings should promote equitable and equal treatment of investor participants. Glass Lewis’ 2018 guidelines for virtual meetings state the following: “When analyzing the governance profile of companies that choose to hold virtual-only meetings, we look for robust disclosure in a company’s proxy statement which assures shareowners that they will be afforded the same rights and opportunities to participate as they would at an in-person meeting.”

Opportunities for meaningful engagement between investors and directors should be provided. Companies, and their boards, should strongly favor the value of, and ways to facilitate, meaningful engagement of shareowners with board members, as they consider time and cost factors.

Issuers should communicate the benefits of a virtual meeting to shareowners. Companies should communicate clearly with their shareowners before moving to virtual meetings in order to ensure that shareowners understand what a virtual meeting is and how they can meaningfully participate.

Virtual meetings should be used as a way to provide meaningful open dialogue between shareowners and companies. Virtual shareowner meetings should provide the same opportunities for questions and dialogue as an in-person meeting.

Best Practices

To ensure that virtual participation in shareowner meetings provides the same opportunity for dialogue among the company’s shareowners, management and directors that is often possible at an in-person shareowner meeting, the Committee recommends that companies adopt the following best practices. These may be amended, as needed, to accommodate companies and their shareowners as they seek to enhance the annual meeting experience and increase shareowner participation at meetings as corporate governance practices evolve and technological advances are made.

Recognize that the meeting format is determined before the proxy is published. This means that the board needs to be fully aware of prospective investor reactions before deciding among a virtual-only, hybrid and in-person-only meeting. Companies should evaluate shareholder responses to previous meetings held virtually and consider requests to attend subsequent meetings in person. The format of the meeting and participation instructions should be clearly disclosed in the proxy statement.

When making a decision on annual meeting format, companies and their boards should consider the items to be voted on at the meeting as well as other issues that may be of current concern to their shareowners such as:

- Whether the meeting may be limited to the consideration of routine or noncontroversial proposals, such as the uncontested election of directors and the ratification of auditors.

- Whether a controversial management or shareowner proposal may be considered at the meeting.

- Whether a significant business transaction, such as a merger, may be considered at the meeting.

- Whether a matter to be considered at the meeting may be subject to counter-solicitation or a “vote no” campaign.

- Whether the company may be subject to significant shareowner dissent or activism concerns involving significant governance, operational or performance issues.

Evaluate constantly changing technology and process. Companies considering enabling a virtual component of the annual meeting—and particularly those contemplating, a virtual-only meeting—should fully and annually evaluate their technology and process for the meeting to ensure maximum shareowner participation. These evaluations should involve boards in decisions about future virtual meetings. After conducting an annual shareowner meeting that enables virtual participation, companies should evaluate whether goals were met and where they need to make changes.

Ensure equal access. Allow shareowner proponents to present their proposals on a “virtual basis”—whether via a phone line or a prerecorded or online video presentation. Open video, web lines and telephone lines should be implemented before the meeting to allow shareowners to test their access and be sure they will be able to participate in the meeting. When a company typically conducts a shareowner question and answer period after the official business of the meeting, it needs to ensure the ability of virtual participants to participate in that portion of the meeting.

Create formal rules of conduct. Companies should adopt formal, universal rules of conduct for participation in shareowner meetings. The rules should allow sufficient opportunities for shareowners to ask questions or make brief comments about each proposal that is up for a vote, while being respectful of the time of all meeting participants. The rules of conduct should be available before the meeting begins, and should be available to in-person and virtual attendees before and during the meeting. There should be rules that promote both the reality and the perception of scrupulous fairness during the voting and question and answer period when there is a virtual component to the meeting.

- As to the voting period, it is wise to always appoint an Independent Inspector of Elections to observe the virtual aspects of the meeting and review the final vote reconciliation prior to certifying the final results.

- As to the question and answer period, companies should allow shareowners to present questions in advance of the meeting, e.g. via their investor relations website or a shareowner discussion group or bulletin board. When there is a virtual component, companies should allow their shareowners to submit questions over the internet during the live meeting. When there is an in-person component to the meeting, companies should allow in-person shareowners to ask questions.

- The Committee recommends that the Chair take the first question received, after which the Chair should alternate among in-person attendees, those who submitted questions in advance and those shareowners online who may be submitting questions in real time.

- The Committee also believes that when there is a virtual component to the meeting, companies should consider including a toll-free number for their shareowners to call in during the meeting. Their call would be placed in a queue and taken in turn to ensure, to the fullest extent possible, that all shareowner questions will be taken on a first-come-first-served basis during the time that has been allotted for questions and general discussion. If there are still shareowners waiting to ask questions at the end of the allotted meeting time, the Chair of the meeting should consider extending the time, if possible.

Establish reasonable time guidelines. Companies should set reasonable time guidelines for shareowner questions, whether related to proposals during the formal part of the meeting or the company’s overall business after the formal business of the meeting has been concluded. Time limits such as three- to five-minute limits for shareowners to present their proposals and two-minute limits for general questions or comments are widely perceived as being appropriate and helpful.

Establish rules for when questions are out of order. Companies should publish rules clearly explaining when questions, taken either in-person or online, will be ruled out of order. For example, questions or comments that are not related to the proposal under discussion, are about personal concerns not shared by shareholders generally, or use blatantly offensive language may be ruled out of order. In addition, companies should require that shareowners who have already spoken, either in-person or online, wait until all other questioners have had a turn to speak on a given matter before asking a second question or making a comment.

Establish rules to promote transparency. Companies should pay special attention to establishing rules of procedure that will promote transparency about how questions will be recognized. Where there is a virtual component to the meeting, companies should seek to avoid the appearance of, or potential for, manipulation with respect to the way they might screen, organize, combine, prioritize and answer, or fail to answer, their shareowners’ questions received in advance or via the web. Such rules for recognizing questions and comments by shareholders should be disclosed to meeting participants.

Post questions received online during the meeting. Companies that have a virtual component to their meeting, or that solicit questions in advance of the meeting, should strongly consider posting all appropriate questions that have been received during the course of the meeting—and the company’s answers—on the investor page of their website as soon as is practical after the meeting.

Ensure shareowners have access to board members. It is important for virtual participants to have the opportunity to see, hear and ask questions of board members and particularly independent board leadership. Where an independent director does not chair a board, an independent lead director should participate on at least an informal basis in chairing the meeting.

Have a technical support line available. Companies should provide a technical support line for shareowners that may have questions about accessing the webcast.

Archive virtual shareowner meetings for future viewing. Companies should archive the meeting on a publicly available website for a specific and reasonable period of time (ideally at least one year).

Appendix A

Background Information and Information About Current State Rules Regarding Virtual and Hybrid Meetings

The following is a brief background on Delaware’s and other states’ statutory provisions for virtual participation in shareowner meetings, as well as the proposed best practices—and shareowner safeguards—for such meetings.

Delaware Law

Delaware General Corporation Law (DGCL) governs corporations incorporated in the state of Delaware, representing over 55 percent of U.S. publicly traded corporations and 65 percent of the Fortune 500. From a legal perspective, the primary purpose of the annual meeting is to elect directors and take action on management proposals or shareowner proposals.

In 2000, in an effort to keep Delaware law current with emerging technological advances, and realizing the importance of annual meetings in the corporate governance process, the Delaware legislature adopted amendments to Section 211 of the DGCL to allow companies to hold virtual-only and hybrid shareowner meetings.

Specifically, under Section 211 of the DGCL, a board, if authorized by its charter or bylaws, may determine the place of a meeting of shareowners, or, in its sole discretion, determine that the meeting should be held solely by means of remote communication. In addition, Section 211 provides that shareowners can use the internet or another form of “remote communication” to (1) participate, (2) be deemed present and (3) vote at an annual shareowner meeting if the following three conditions are met:

- The company takes reasonable measures to verify that each person deemed present and permitted to vote at the meeting is a shareowner or the holder of a valid proxy from a company shareowner;

- The company takes reasonable measures to provide such shareowners and proxy holders a reasonable opportunity to participate in the meeting—including an opportunity to read or hear the proceedings as they happen substantially and concurrently with such proceedings—and to vote on matters submitted to the shareowners; and

- The company maintains a record of votes and other actions taken at the meeting.

Other States

As noted above, many states, such as Delaware, permit virtual-only and hybrid shareowner meetings. Additionally, other states allow the practice in theory, but include restrictions that make it difficult, if not unrealistic, to conduct a virtual-only shareowner meeting. Some states do not permit companies incorporated in those states to hold virtual-only shareowner meetings, but do permit hybrid shareowner meetings. Lastly, some states require in-person meetings and do not permit virtual-only or hybrid shareowner meetings. Specifically, the laws of:

- 30 states, including Delaware, Minnesota, Ohio, Pennsylvania and Texas, allow virtual-only shareowner meetings. Most recently, Virginia, Washington and Wisconsin have allowed virtual-only shareowner meetings. However, some states, such as California and Maryland, while allowing virtual-only shareowner meetings, impose conditions that make them impractical or unrealistic (e.g., California requires unrevoked shareowner consent to hold a virtual-only meeting). Please see the attached list regarding states’ restrictions on virtual-only shareowner meetings.

- 42 states in total, including New Jersey and Connecticut, as well as the District of Columbia, permit remote participation in such meetings via the internet (i.e., a hybrid meeting).

- 9 states, including Georgia, Idaho and New York, preclude corporations incorporated in those states from hosting virtual-only or hybrid shareowner meetings and require a physical meeting location.

Most states that allow virtual participation in shareowner meetings impose conditions on such participation. Generally, those states require that the company (1) verify that each person deemed present and permitted to vote at the virtual shareowner meeting is a shareowner or proxy holder, (2) maintain a record of the vote or other action taken at the shareowner meeting and (3) implement reasonable measures to provide a shareowner participating in a shareowner meeting virtually with the ability to:

- Participate in the meeting and vote on matters submitted in the meeting;

- See and hear the proceedings contemporaneously; and

- Communicate with the other participants of the meeting contemporaneously. In addition to these conditions, a company that intends to host a virtual-only shareowner meeting generally must make its shareowner list available for the examination by any shareowner during the meeting on a reasonably accessible virtual network.

Federal Law and Listing Standards

Federal securities laws are largely silent on the conduct of the annual meeting, other than through the proxy solicitation rules. The NYSE and NASDAQ require listed companies to hold annual meetings, with NASDAQ requiring companies to afford shareowners an opportunity to discuss company affairs with management. The corporate codes of each state and the governing instruments of each company also provide guidelines for the conduct of annual meetings of shareowners.

| State | Abbrev. | Virtual Only Allowed? | Hybrid Allowed? | In-Person Meeting Only? |

|---|---|---|---|---|

| Alabama | AL | N | N | Y |

| Alaska | AK | N | N | Y |

| Arizona | AZ | Y | Y | N |

| Arkansas | AR | N | N | Y |

| California | CA | Y | Y | N |

| Colorado | CO | Y | Y | N |

| Connecticut | CT | N | Y | N |

| Delaware | DE | Y | Y | N |

| District of Columbia* | DC | N | Y | N |

| Florida | FL | Y | Y | N |

| Georgia | GA | N | N | Y |

| Hawaii | HI | Y | Y | N |

| Idaho | ID | N | N | Y |

| Illinois | IL | N | Y | N |

| Indiana | IN | Y | Y | N |

| Iowa | IA | N | Y | N |

| Kansas | KS | Y | Y | N |

| Kentucky | KY | Y | Y | N |

| Louisiana | LA | N | Y | N |

| Maine | ME | N | Y | N |

| Maryland | MD | Y | Y | N |

| Massachusetts | MA | Y | Y | N |

| Michigan | MI | Y | Y | N |

| Minnesota | MN | Y | Y | N |

| Mississippi | MS | N | Y | N |

| Missouri | MO | Y | Y | N |

| Montana | MT | N | Y | N |

| Nebraska | NE | N | Y | N |

| Nevada | NV | Y | Y | N |

| New Hampshire | NH | N | Y | N |

| New Jersey | NJ | N | Y | N |

| New Mexico | NM | N | N | Y |

| New York | NY | N | N | Y |

| North Carolina | NC | N | Y | N |

| North Dakota | ND | Y | Y | N |

| Ohio | OH | Y | Y | N |

| Oklahoma | OK | Y | Y | N |

| Oregon | OR | Y | Y | N |

| Pennsylvania | PA | Y | Y | N |

| Rhode Island | RI | Y | Y | N |

| South Carolina | SC | N | N | Y |

| South Dakota | SD | N | N | Y |

| Tennessee | TN | Y | Y | N |

| Texas | TX | Y | Y | N |

| Utah | UT | Y | Y | N |

| Vermont | VT | Y | Y | N |

| Virginia | VA | Y | Y | N |

| Washington | WA | Y | Y | N |

| West Virginia | WV | Y | Y | N |

| Wisconsin | WI | Y | Y | N |

| Wyoming | WY | Y | Y | N |

| TOTALS | 30 | 42 | 9 |

* Nonstate Matrix as of March 2018

Appendix B

Select Policies or Statements on Virtual Shareowner Meetings

Council of Institutional Investors, Corporate Governance Policies—September 15, 2017

4.7—ELECTRONIC MEETINGS: Companies should hold shareowner meetings by remote communication (so-called “virtual” meetings) only as a supplement to traditional in-person shareowner meetings, not as a substitute. Companies incorporating virtual technology into their shareowner meeting should use it as a tool for broadening, not limiting, shareowner meeting participation. With this objective in mind, a virtual option, if used, should facilitate the opportunity for remote attendees to participate in the meeting to the same degree as in-person attendees.

A Virtual Reality: New Opportunities for Shareholder Meetings in Virginia and Beyond, McGuireWoods, June 2017

Making the Switch: A Company’s Guide to Virtual-Only Shareholder Meetings, Hunton & Williams, November 2017

2018 Proxy Paper—Guidelines, an Overview of the Glass Lewis Approach to Proxy Advice, United States—January 2018

Virtual Shareholder Meetings: Glass Lewis is aware that a relatively small but growing contingent of companies have elected to hold shareholder meetings by virtual means only. We believe that virtual meeting technology can be a useful complement to a traditional, in-person shareholder meeting by expanding participation of shareholders who are unable to attend a shareholder meeting in person (i.e., a “hybrid meeting”). However, we also believe that virtual-only meetings have the potential to curb the ability of a company’s shareholders to meaningfully communicate with the company’s management. In 2018, we will not make voting recommendations solely on the basis that a company is holding a virtual-only meeting. When analyzing the governance profile of companies that choose to hold virtual-only meetings, we look for robust disclosure in a company’s proxy statement which assures shareholders that they will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Beginning in 2019, however, Glass Lewis will generally recommend voting against members of the governance committee of a board where the board is planning to hold a virtual-only shareholder meeting and the company does not provide such disclosure.

Virtual-Only Shareholder Meetings: The Good, Bad & Ugly, Boardroom Resources/The Conference Board, February 2018

New York City Pension Funds, 2017 Shareowner Initiatives— PostSeason Report—November 2017

Holding Boards Accountable for “Virtual-Only” Shareowner Meetings: In response to the surge in public companies holding “virtual-only” annual meetings, the NYC Funds amended their voting guidelines in spring 2017 to affirm their expectation that companies hold “in-person” annual meetings and only hold “virtual” meetings to supplement, not replace, in-person meetings. In-person meetings enable shareowners, regardless of their size, to have a face-to-face opportunity to engage and ask questions of senior management and directors in the presence of other investors at least once per year. Under the new guideline, the NYC Funds will vote against incumbent members of the governance/nominating committee at any company that holds a “virtual-only” annual meeting. This new guideline was implemented immediately for S&P 500 companies holding virtual-only annual meetings in 2017, with an exception for those companies that agreed in advance of their 2017 meeting dates to revert to in-person annual meetings in 2018; the voting guideline will extend to all U.S. portfolio companies in 2018.

Build a Better Meeting—Five tips for U.S. companies looking to convene a shareholder-oriented shareholder meeting, Council of Institutional Investors—October 2017

Virtual Annual Shareholder Meetings—A Great Idea, Andrew Wilcox, February 13, 2018

Hertz official sees easy path with virtual AGMs, Corporate Secretary, July 2017

Appendix C

Current Trends and Statistics Related To Virtual Shareowner Meetings

The Best Practices Committee for Shareowner Participation in Virtual Annual Meetings

This Committee consists of interested constituents, comprised of retail and institutional investors, public company representatives, and proxy and legal service providers

Anne Sheehan

Formerly of California State Teachers’ Retirement System

Co-chair

Darla C. Stuckey

Society for Corporate Governance

Co-chair

Keir D. Gumbs

Covington & Burling LLP Legal Advisor

Maryellen Andersen

Broadridge Financial Solutions, Inc.

Ken Bertsch

Council of Institutional Investors

Anne T. Chapman

Joele Frank, Wilkinson Brimmer Katcher

(Formerly of Capital Group)

Christopher Clark

National Association of Corporate Directors

Cathy H. Conlon

Broadridge Financial Solutions, Inc.

Fay Feeney

Risk for Good

Carl T. Hagberg

Carl T. Hagberg and Associates

Suzanne Hopgood

The Hopgood Group, LLC; Board of Directors, Mace Security International

Stephen P. Norman

S.P. Norman & Co. LLC

Brandon Rees

Office of Investment, AFL-CIO

TerriJo Saarela

State of Wisconsin Investment Board

John Seethoff

Formerly of Microsoft

Timothy Smith

Walden Asset Management, a division of Boston Trust & Investment Management

Kristina Veaco

Veaco Group

Print

Print