Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an ISS Analytics publication by Kosmas Papadopoulos, Managing Editor at ISS Analytics.

Related research from the Program on Corporate Governance includes The Elusive Quest for Global Governance Standards by Lucian Bebchuk and Assaf Hamdani.

Global board practices have changed significantly in recent years. Regulatory developments, the introductions and revisions of corporate governance codes, and company-shareholder engagement have all contributed towards the improvement of standards in both developed and developing economies.

In an effort to assess the landscape of global governance, we look at the current state of board governance standards and practices at 50 of the largest global equity markets under ISS coverage. We base our analysis on the market intelligence and expertise of ISS’s global research teams as well as ISS Analytics board and director data for more than 17,000 companies in these 50 countries.

We primarily focus on market standards and best practices in relation to board independence, which constitutes one of the most fundamental principles of corporate governance.

Board Independence Standards Continue to Evolve

The rate of change in corporate governance standards remains robust, as markets periodically reassess their corporate governance codes and guidelines and make revisions to their standards. Among the 50 markets under review, at least 33 countries have revised their corporate governance codes and standards in the past three years or are currently conducting consultations for upcoming revisions. Countries that are currently undergoing consultations include Australia, Belgium, France, India, Japan, Singapore, and the United Kingdom.

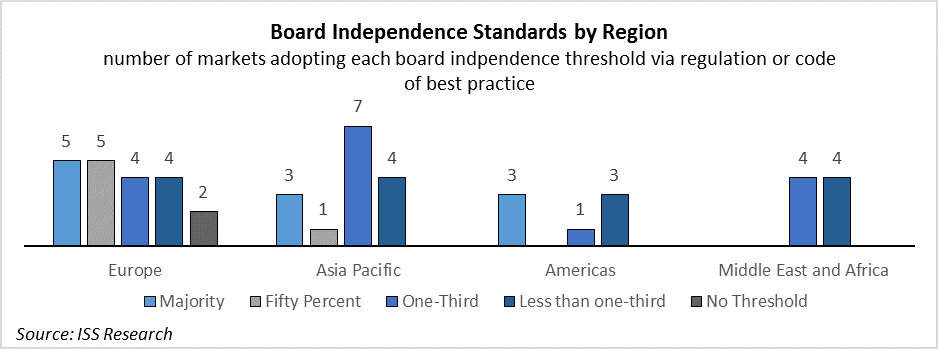

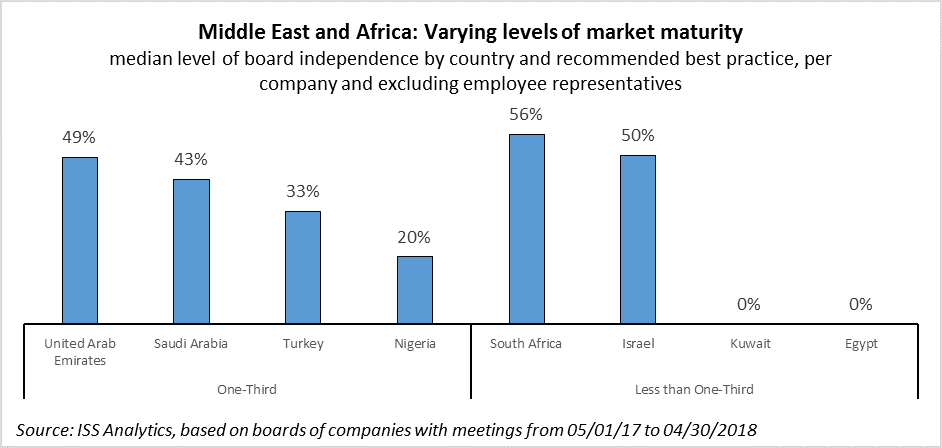

Board independence requirements tend to vary by level of market maturity and ownership structures, as developed markets with companies that have more dispersed ownership are more likely to adopt higher thresholds of independence compared to emerging markets. Half of the European markets under review have adopted board independence standards requiring that either half or a majority of board members are independent directors. By contrast, in the Asia Pacific, Latin America and Middle East and Africa regions, the majority of countries have adopted board independence thresholds at one-third of the board or a lower percentage.

This snapshot of market best practices in time should be viewed in the context of constant movement in standards. Many European markets, for example, had lower independence requirements until recently, while many emerging markets had weaker or no requirements at all. As countries update their corporate governance standards, they make incremental changes to board independence requirements. For example, in its proposed revisions to its code, the United Kingdom is moving from a fifty-percent independence requirement (excluding the chair) to a majority requirement (including the chair), while Portugal recently changed its code provisions to require at least one-third of the board to comprise independent directors (from no specific threshold provided in the previous version).

Best Practice vs. Actual Practice

Most markets have established their corporate governance standards via codes of best practices following the comply-or-explain principle. The United States, Canada, and Israel are the only three markets under review that do not have a code of best governance practices. In countries that base their board independence criteria on codes of best practices, standards are not mandatory, and compliance levels can sometimes be low.

Europe

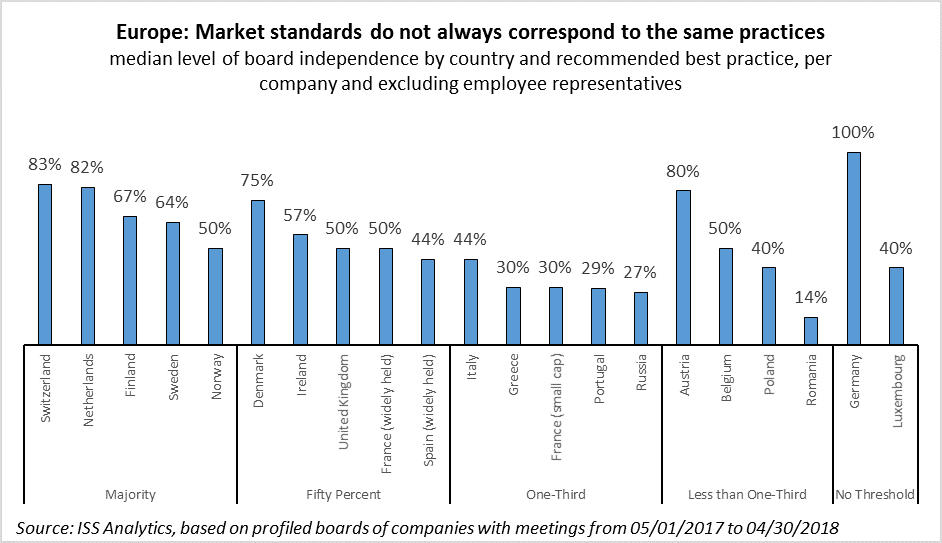

One can notice the potential disconnect between established standards and actual practices when comparing practices in Europe. The graph below examines median board independence in European markets, categorized by the board independence standard each country has adopted. In general, higher board independence standards tend to correspond with higher levels of board independence. However, certain markets fall outside this theorem. For example, Austria and Germany exhibit high levels of board independence (after excluding employee representatives from the calculation), even though they have not established strict criteria in their governance codes. At the same time, some of the Southern European markets struggle to achieve the levels of board independence their codes of best practices aspire to.

Asia Pacific

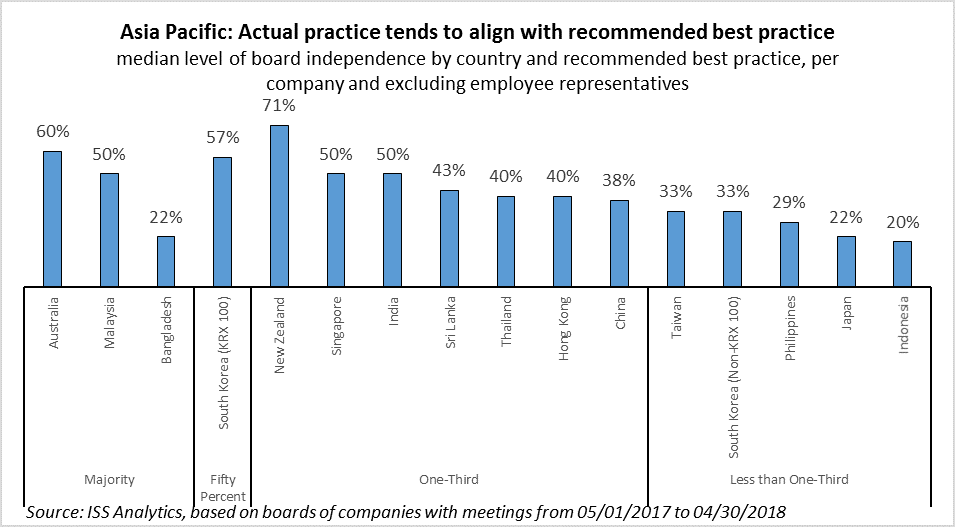

In the Asia Pacific region, the correlation between actual practice and recommended best practice appears to be stronger, as markets tend to perform in line with their codes and regulatory standards. Bangladesh may be one of the few exceptions, as the code’s recommendation for a majority-independent board may have been premature in relation to the market’s level of development. Malaysia, Singapore, and India have some of the most progressive codes in Asia, which reflects their higher actual levels of board independence. The Malaysian code requires a majority independent board at large firms and fifty-percent independence at smaller firms. Singapore and India set their independence thresholds at fifty percent of the board if the chair is not independent, or at one-third of the board if the chair is independent or non-executive. Korea maintains two separate standards for large and small firms, and it appears that compliance levels in the market are in line with expectations. Finally, despite being one of the most advanced economies in the region, Japan ranks considerably low in terms of board independence levels compared to its peers. The market has only recently adopted a corporate governance code (2015), and is already planning revisions in the coming months.

Americas

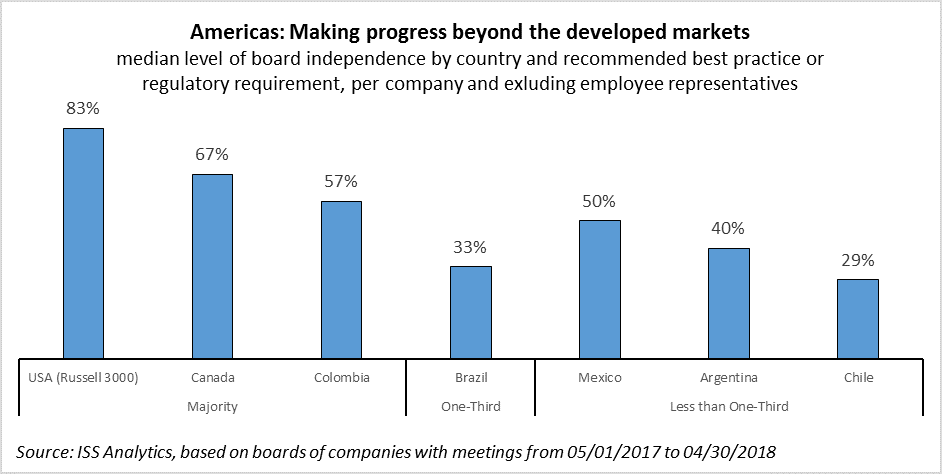

In the Americas, as expected, the United States and Canada lead the way in board independence levels, in light of higher standards established by listing requirements and recommended practices. However, several Latin American markets show signs of improvements thanks to recently updated codes and regulations. Colombia has one of the most progressive codes in the region, aspiring to majority-independent boards, while Mexico’s code recommends that sixty percent of board members are non-executive directors, which helps increase board independence levels overall. Brazil, with its multi-tier system of listing rules, appears to perform in line with the recommendations of the governance code.

Middle East and Africa

In Middle East and Africa, company practice in terms of board independence may be determined by reasons outside corporate governance codes and recommended best practices. Israel does not have a code of best practice, and the law requires a minimum of two independent directors. However, many companies adopt higher levels of board independence, with the median board comprising fifty percent independent directors. Many Israeli firms have diluted ownership structures and have listing outside the country in exchanges like the NASDAQ, which may explain the higher levels of board independence adopted in the market. South Africa is another mature market with higher levels of dispersed ownership and a long-established corporate governance code. The code requires that the board comprises a majority of non-executive directors, a majority of whom should be independent directors. Officially, this standard sets a minimum of independence for about one-quarter of the board. However, the requirement of a majority of non-executive directors appears to drive overall independence higher.

Print

Print