John Gould is Senior Vice President of Cornerstone Research. This post is based on a Cornerstone Research memorandum authored by Ravi Sinha.

This post examines litigation challenging M&A deals valued over $100 million announced from 2008 through 2017, filed on behalf of shareholders of publicly traded target companies.

These lawsuits usually take the form of class actions filed in either federal or state court. Plaintiffs typically allege that the target’s board of directors violated its fiduciary duties by conducting a flawed sales process that failed to maximize shareholder value.

Common allegations include:

- failure to conduct a sufficiently competitive sale

- existence of restrictive deal protections that discouraged additional bids

- conflicts of interest, such as executive retention post-merger or change-of-control payments to executives

- failure to disclose information about the sales process and the financial advisor’s valuation

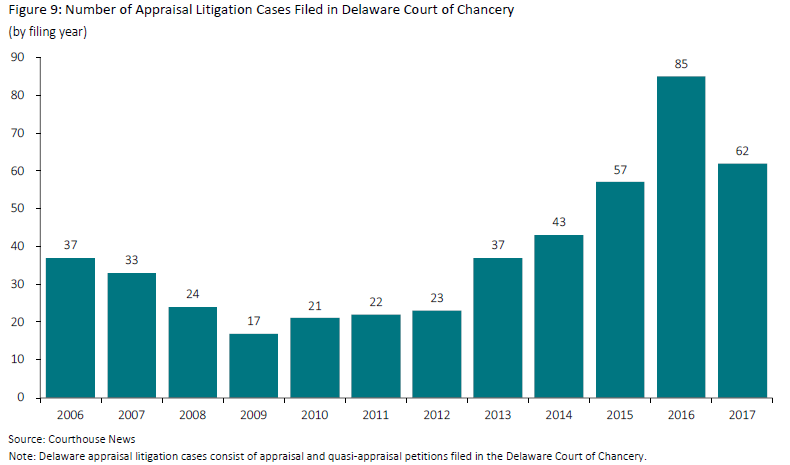

Distinct from these merger objection cases is appraisal litigation. In these suits, plaintiffs submit their shares to the court for appraisal instead of accepting the deal price. Appraisal litigation, and its recent unprecedented growth, is the subject of a forthcoming publication by Cornerstone Research.

In these lawsuits, plaintiffs typically allege that the target’s board of directors violated its fiduciary duties.

Executive Summary

For years courts raised concerns about merger objection class actions. In these cases, typical resolutions involved attorneys’ fees to plaintiffs’ counsel and a release for defendants. The only consideration to shareholders was “supplemental disclosures” of information not included in the merger’s original proxy statement.

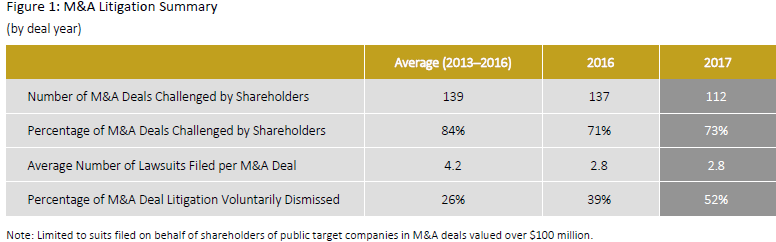

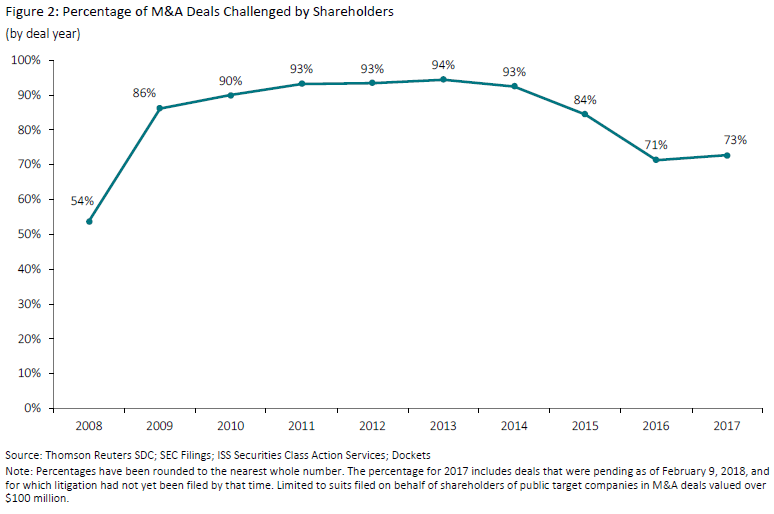

Since decisions made by the Delaware Court of Chancery against disclosure-only settlements—notably the 2016 Trulia decision—M&A litigation rates have decreased. In 2013, 94 percent of M&A deals valued over $100 million were litigated. While the majority of deals are still challenged by shareholders, in 2017 this percentage was 73 percent.

The 2017 data also show a shift from state to federal venues. The number of deals litigated in Delaware declined 81 percent from 2016 to 2017. At the same time, the number of M&A deals litigated in the Third Circuit more than doubled. It remains to be seen, however, if federal and other courts will continue to grant disclosure-only settlements.

Filings

- A total of 112 M&A deals valued over $100 million had associated lawsuits in 2017 compared to 137 in 2016 (an 18 percent decline).

- Shareholders filed lawsuits in 71 and 73 percent of all M&A deals valued over $100 million announced in 2016 and 2017, respectively.

- Lawsuits were filed more slowly in 2016 and 2017 compared to pre-Trulia In 2017, the first lawsuit was filed an average of 48 days after the deal announcement, compared to 40 days in 2016 and 21 days in 2015.

The rate of M&A litigation has declined following the 2016 Delaware decision in Trulia.

Lawsuits per Litigated Deal

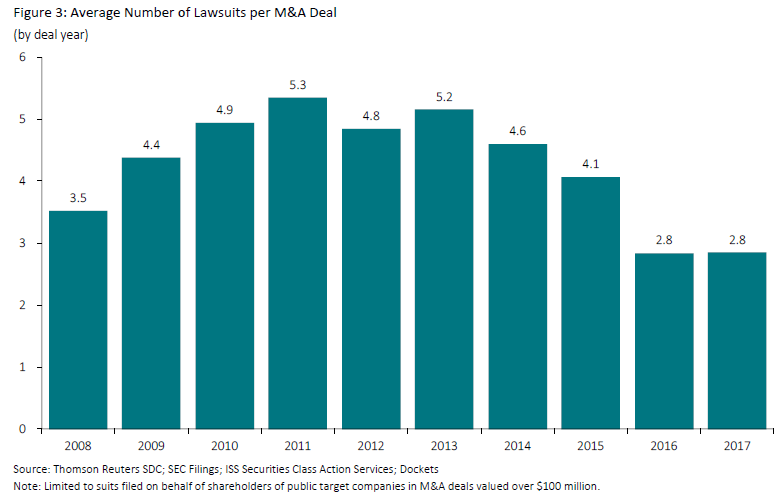

- In 2016, in the immediate aftermath of Trulia, the average number of lawsuits per M&A deal declined by 32 percent.

- The low levels continued in 2017, with an average of 2.8 lawsuits per deal.

The average number of lawsuits per M&A deal in 2017 and 2016 was at a 10-year low.

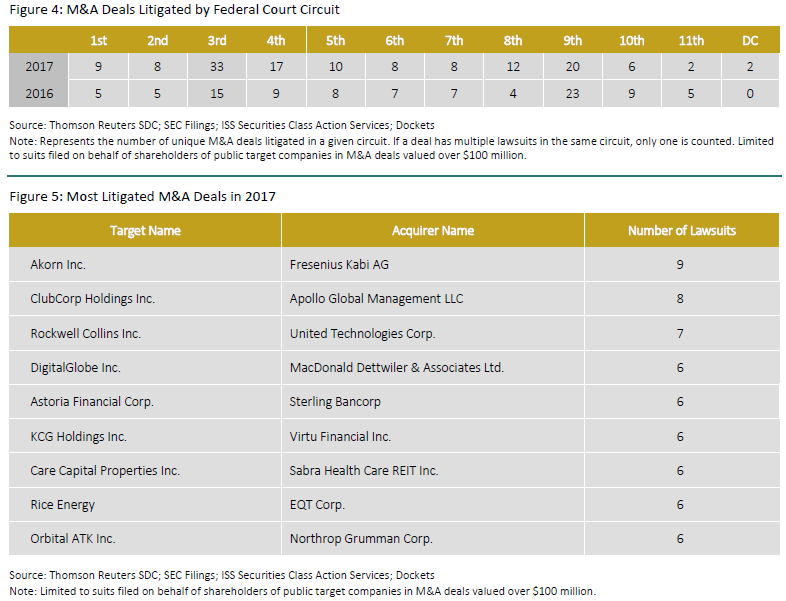

Most Active Courts

- In 2017, the number of M&A deals litigated in federal court increased 20 percent, while state court filings declined.

- The Third Circuit was the most active federal court in 2017.

- The number of M&A deals litigated in Delaware declined 81 percent from 37 in 2016 to seven in 2017.

- In 2017, there were only three deals litigated in California state courts, a decrease of 81 percent from 16 in 2016.

- In 2016 and 2017, there were no deals with more than nine lawsuits filed.

In 2016 and 2017, there was a shift in activity from state to federal courts.

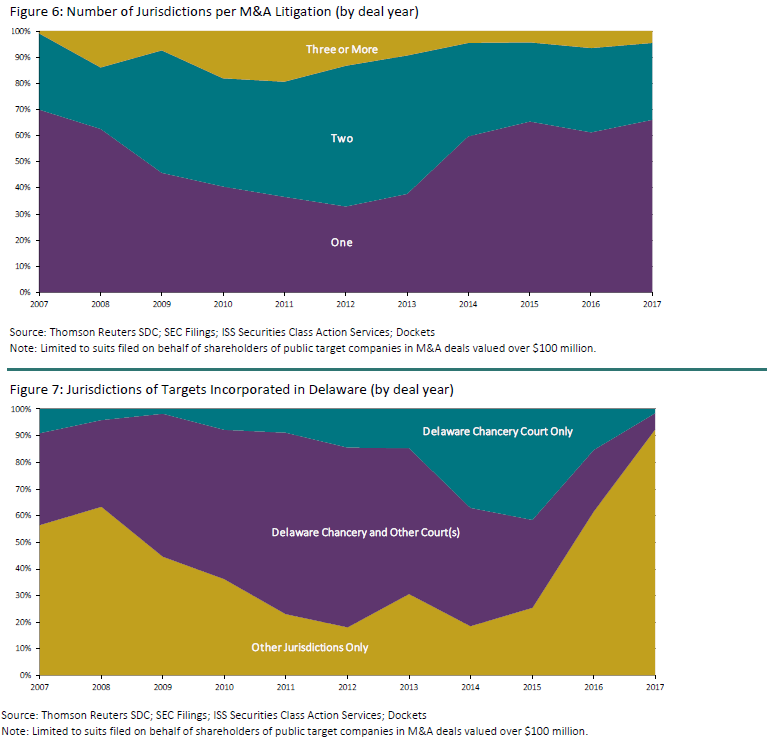

Litigation Jurisdictions

- In 2016 and 2017, the majority of M&A litigation (66 percent) was filed in a single jurisdiction, continuing a trend that began in 2014.

- For 2017 deals, only 4 percent were challenged in three or more jurisdictions, compared to 7 percent in 2016.

- For litigation in which the target was incorporated in Delaware, plaintiffs filed in Delaware for 6 percent of litigated deals in 2017 compared to 23 percent in 2016.

Plaintiffs filed in Delaware for only 6 percent of all litigated M&A deals in 2017, compared to 27 percent in 2016.

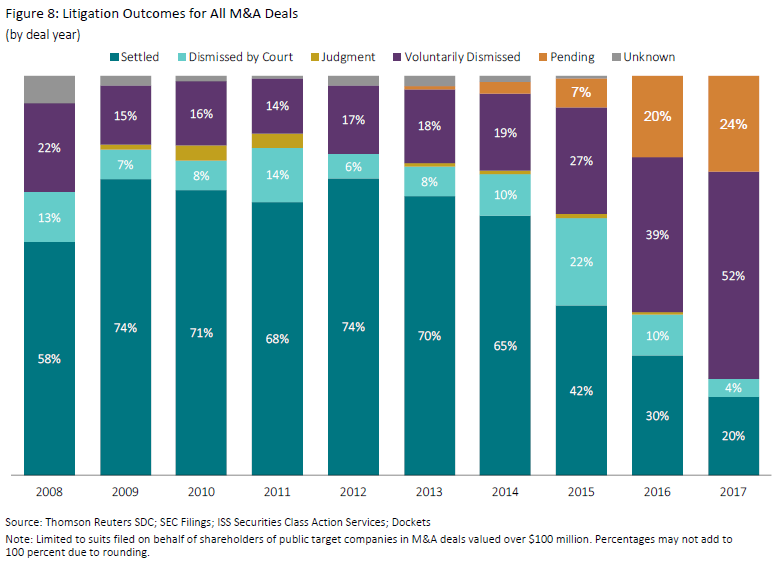

Litigation Resolution

- Between 2009 and 2014, more than 74 percent of M&A litigation was resolved before the deal closed.

- The rate of resolution prior to deal closing has steadily declined from 78 percent in 2012 to a 10-year low of 43 percent in 2017.

- Historically, of litigation that was resolved prior to closing, a large percentage of cases settled. The remainder was either voluntarily dismissed (withdrawn) or dismissed by courts.

- Settlement rates are considerably smaller for cases that were resolved post-closing.

- Voluntary dismissals in 2017 cases were 33 percent higher than in 2016. This is likely a reflection of the removal of the disclosure-only settlement option post-Trulia.

For the first time in a decade, more than 50 percent of cases were voluntarily dismissed.

Appraisal Litigation

M&A-related appraisal litigation in the Delaware Court of Chancery has surged in the past decade.

In appraisal litigation, shareholders submit their shares for valuation by the court instead of accepting the deal price.

The annual number of M&A transactions in which shareholders filed appraisal or quasi-appraisal actions in Delaware increased from a low of 17 in 2009 to a peak of 85 in 2016. This growth was concentrated between 2012 and 2016, with the number of petitions filed nearly quadrupling.

Following the Delaware Supreme Court’s decision in In re Appraisal of Dell Inc., the Chancery Court seems to have come to a crossroads. Its decisions in Verition Partners Master Fund Ltd. and Verition Multi-Strategy Master Fund Ltd. v. Aruba Networks Inc., and in In re Appraisal of AOL Inc., appear to question how to determine fair value in appraisals.

Research Sample

The research sample in this report uses Thomson Reuters SDC to identify mergers above $100 million and where the target company is publicly traded.

Institutional Shareholder Services through Securities Class Action Services (ISS SCAS) is used to identify the lead case in each jurisdiction against the target company involved in the merger. Data on other challenges to the target company within the same jurisdiction as the lead case are collected using SEC filings and PACER docket information.

The sample contains 1,372 deals announced from November 19, 2006 through December 18, 2017. The analyses in this report are as of February 9, 2018.

The views expressed in this report are solely those of the authors, who are responsible for the content, and do not necessarily represent the views of Cornerstone Research.

Print

Print