Josh Black is Editor-in-chief of Activist Insight. This post is based on an excerpt from the Activist Insight Monthly Half-Year Review 2018, published in association with Olshan Frome Wolosky and authored by Mr. Black, Husein Bektic, Dan Davis, Iuri Struta, and Elana Duré.

Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Merger madness, flush balance sheets and the integration of environmental, social, and governance (ESG) issues into mainstream activism in the first half of the year mean 2018 should be set for record levels of activism.

Note: All data as of June 30.

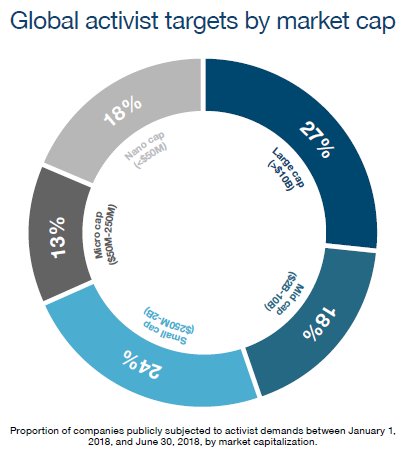

Activism looks poised for another record year in 2018. By the end of June, 610 companies worldwide had been publicly subjected to activist demands year-to-date, driven by record activity in North America. Indeed, the U.S. may be on course for over 500 companies to face financial or governance demands from shareholders by the end of 2018, while Canadian basic materials activism has returned with a vengeance.

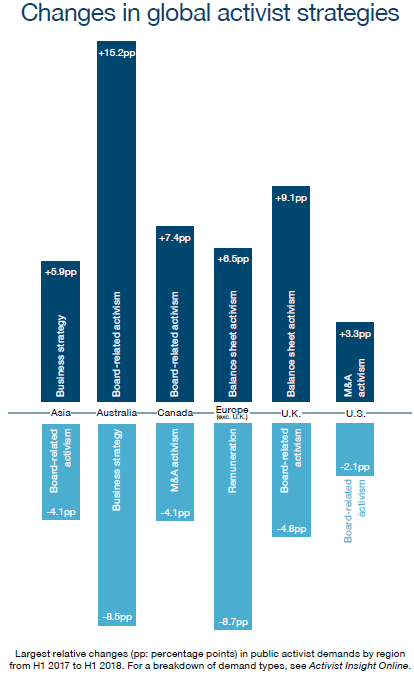

Asia has also experienced a bout of shareholder restlessness in the first six months of 2018, with a 25% increase in companies targeted compared to the first half of 2017. Three proxy contests in Japan for Oasis Management, ValueAct Capital Partners’ engagement with Olympus, and Elliott Management’s campaign against the restructuring plan put forward by South Korea’s Hyundai Motors signal that the region remains popular with hedge funds.

Outside of the U.K., Europe has seen a slight lull in the first half of 2018 despite a high-profile proxy contest at Telecom Italia, where Elliott emerged with a reputation-burnishing victory that saw it win over domestic investors and the Italian government, both of which had tired of French interloper Vivendi.

Yet with the first quarter of 2018 seeing the largest amount invested by U.S. activists in European companies since at least 2013, European corporations are starting to take notice. Now that global bank Barclays is in the spotlight and Whitbread has been prevailed on to spin off cafe chain Costa Coffee, both excitement and concern are growing.

A few firsts and a finale

In a sign that activists have developed a less syncopated rhythm, some funds have laid low during the past six months while others picked up the slack. After a quiet 2017, Carl Icahn has made new demands at four companies, while Starboard Value has matched its haul of eight companies publicly subjected to demands from H1 2014. The game-changer, however, has been Elliott Management. The New York-based fund has more than tripled its number of year-to-date targets over the past four years to 16 companies, extending beyond merger arbitrage and the technology sector to utilities and corporate restructurings, including three members of the Hyundai Group.

Moreover, with 524 activists making public demands worldwide so far this year, including first-timers Mudrick Capital Management, Nathan Miller and Peter O’Malley—who joined late-2017 newcomers Blackwells Capital and Roaring Blue Lion—there is no longer a guarantee that the next campaign will be from a dedicated activist hedge fund.

To prove the point, Appaloosa Management and Senator Investment Group dialed up the heat on Allergan between April and June, while T. Rowe Price said it would no longer issue a “request for activist” if frustrated with a company, preferring to make its views heard more plainly.

Quick and not dirty?

With traditional value-focused activists Jana Partners and ValueAct Capital Partners launching side funds emphasizing the contribution of environmental and social goals for companies, the tools utilized by activists continue to broaden. Jana has so far been the more vocal of the two, partnering with the California State Teachers’ Retirement System (CalSTRS) under retiring corporate governance chief Anne Sheehan to ask Apple to implement more stringent parental controls on its iPhones. ValueAct appears to be focused on investing in companies with an advantage over peers in their sustainability, likely a less confrontational approach.

Among more traditional activist approaches, balance sheet activism in the first half of 2018 remained lower than its historical average (2013-17) in the U.S. despite December’s tax reform, which should have made more cash available to return to shareholders, while surging in Asia and Europe. Perhaps accounting for the uncharacteristic subtlety, U.S. companies announced share repurchases worth a “truly unprecedented” $679 billion in the first half of 2018, according to data provider Trimtabs.

M&A activism, by contrast, is at elevated levels in both the U.S. and U.K., reflecting higher deal volumes and valuations. All but one of Carl Icahn’s new campaigns have involved disrupting previously-announced transactions. With Icahn at one point considering a bid for SandRidge and Broadcom waging a proxy fight almost to the death at Qualcomm—halted only by the Committee on Foreign Investment in the U.S. (CFIUS)—the lines between hostile M&A and activism look increasingly blurred. Even mulling an acquisition, as Allergan did with Shire, was enough to generate the ire of investors.

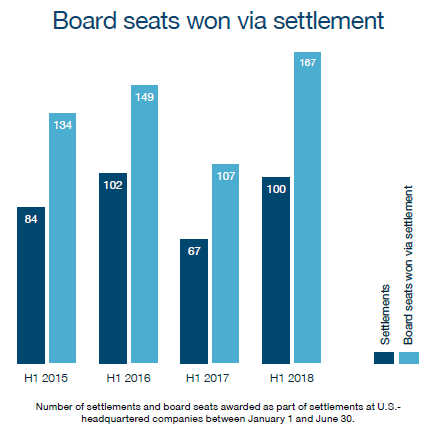

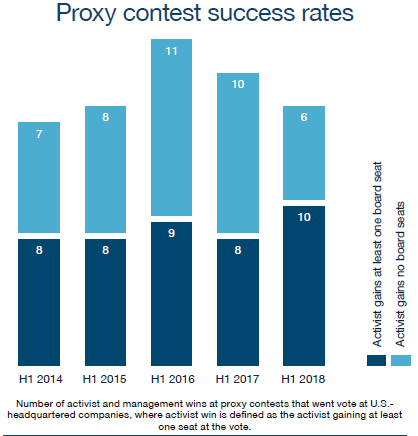

Notable amid the surge in campaigns is a series of quick-fire settlements. In the U.S., nearly 80% of resolved requests for board representation have settled so far this year, compared to almost 60% last year when activists waged proxy contests at a surfeit of large-cap companies. In 2018’s peak proxy season, almost two-thirds of activists were at least partially successful at the ballot box after two years in which companies dominated.

Holding Back

A surprise trend in the first half of 2018 has been the flurry of withhold campaigns by activists, either after being denied the option of embarking on a full proxy contest by deficient nominations (HomeStreet) or advance notice bylaws (Wynn Resorts, QTS Realty), or as part of a hostile takeover. At least six notable U.S. companies saw activists campaign for investors to vote against directors, including at least two with their own proxy card. At Wynn and USG, dissidents even won majorities.

The second half of 2018 could be equally dynamic, with media companies such as CBS and Twenty-First Century Fox in play and liable to create a chain reaction of takeover activity, and several activists watching United Technologies’ review of alternatives. Moreover, turnaround campaigns at Procter & Gamble and General Electric could yet see major reorganizations.

With a record number of activists making public demands and a record number of companies targeted in Asia, Australia, Canada, and the U.S. in the first half of 2018, part two can hardly disappoint.

* * *

The complete report is available here.

Print

Print