Sean Barry is Senior Research Analyst at Equilar, Inc. This post is based on an Equilar memorandum by Mr. Barry.

Does the presence of multiple board memberships signal an experienced and dedicated board member or one who has overcommitted his or her time? For years, shareholders have questioned whether the experience and industry knowledge gained from sitting on multiple boards is overshadowed by excessive time commitments. Approximately 19% of Russell 3000 board members currently occupy more than one board seat, making it far from an oddity for a director to sit on multiple boards. The issue many shareholders and boards encounter is where to draw the line between a knowledgeable and practiced director and one who is possibly unable to fulfill their duties due to excessive commitments.

Proxy advisor Glass Lewis makes this distinction clear in its most recent proxy guidelines, recommending that “shareholders vote against a director who serves as an executive officer of any public company while serving on more than two public company boards and any other director who serves on more than five public company boards.” As of June 2018, the Russell 3000 contains only one over-boarded outside director based on Glass Lewis’ guidelines and 43 executive officers who serve on more than the recommended two public boards. Of the 44 over-boarded directors, 80% are male and 20% are female, which follows general board diversity trends as reported in the most recent Equilar Gender Diversity Index.

Russell 3000 Board Seat Count

| Number of Board Seats | Count of Board Members |

|---|---|

| More than five | 1 |

| Five | 3 |

| Four | 50 |

| Fhree | 335 |

As evidenced by the low number of board members holding more than four board seats, directors seem to have made concerted efforts to limit their board membership and maintain a responsible level of commitment in the past decade. This trend is likely a result of the 2008 financial crisis and the increasing scrutiny of board activities and director engagement that followed. The impact of this increased inspection has, in turn, led to amplified director responsibility. According to the National Association of Corporate Directors, the average board time commitment was 245 hours per year in 2016, which represents a large increase from the 191 hours per year reported in 2009. During the past year, 18 board members resigned positions that would have otherwise left them over-boarded. Not only are board members becoming conscious of their growing duty to shareholders, but many companies have also proactively issued governance clauses restricting outside board membership below what Glass Lewis recommends.

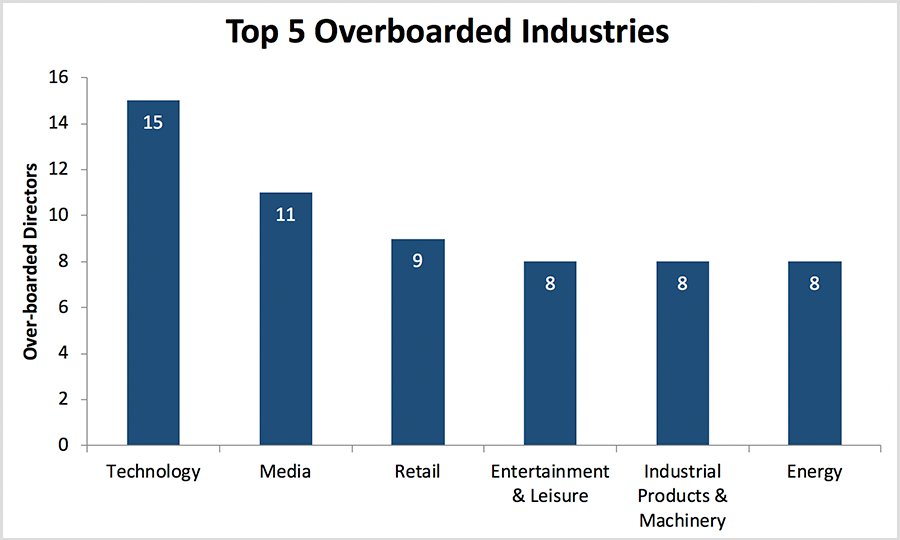

Although the number of over-boarded directors represents just 0.38% of the total number of Russell 3000 directors, the statistic sheds light on the advantages and disadvantages associated with serving on multiple boards. Particularly with regards to specific niche and technical sectors, multiple board seats can help facilitate accelerated education, strategic partnerships and knowledge in an environment plagued by steep learning curves. Both the technology and media industries currently boast the highest amount of over-boarded directors at 15 and 11, respectively.

Companies in the technology industry, especially earlier stage companies, face distinct problems with regards to scaling and succeeding in a disruptive sector filled with constant market entrance and competition. The guidance of an experienced director can produce tremendous benefits in these circumstances, particularly one who sits on multiple boards and is able to initiate diverse and meaningful conversation. Similar requirements exist in media as technological and economic factors force rapid shifts in the industry.

In order to combat this changing business environment, companies have turned to directors who bring the right mix of expertise and diversity of experience. Contrastingly, in industries such as financial services, the marginal benefit of serving on multiple boards may be diminished due to the excessive time commitments present in the industry. A notion supported by the fact that only two directors are currently over-boarded, financial institutions tend to be more leveraged and susceptible to liquidity and insolvency issues. As such, a director who holds multiple board seats may be incapable of providing necessary risk management and fiduciary duties, or may not necessarily offer as significant an increase in value over a new director as a more experienced director does in another industry.

Additionally, recent lessening of government regulatory requirements has shifted a heavier burden on board members to hold management accountable. Depending on the nature of the industry and current growth rate of a company, board requirements and commitments will vary. Just as the political climate has shifted financial services to require an increasing time commitment from directors, technological changes have demanded the media and technological companies seek out practiced and experienced directors. Thus, while holding multiple board seats certainly warrants significant benefits, shareholders must be cognizant of the strain of the industry and time commitment placed on their directors.

Print

Print