Stephen T. Giove is partner and Arielle L. Katzman and Daniel Yao are associates at Shearman & Sterling LLP. This post is based on their Shearman memorandum. Related research from the Program on Corporate Governance includes Private Ordering and the Proxy Access Debate by Lucian Bebchuk and Scott Hirst (discussed on the Forum here).

In our fourth annual review of proxy access practices, we explore recent developments relating to adopt” and “fix-it” shareholder proposals, headline and key second-tier terms and amendments to adopted by-laws.

Proxy Access—The March Forward Continues but at a Slower Pace

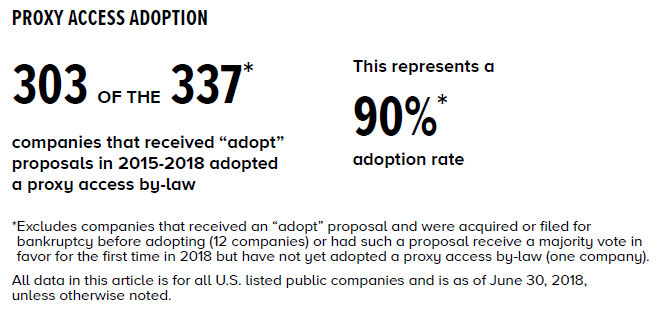

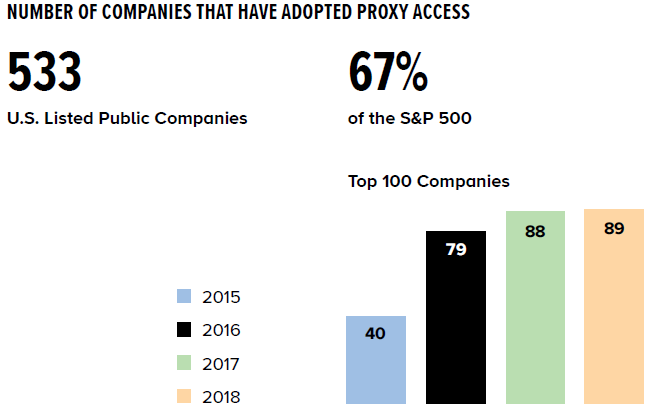

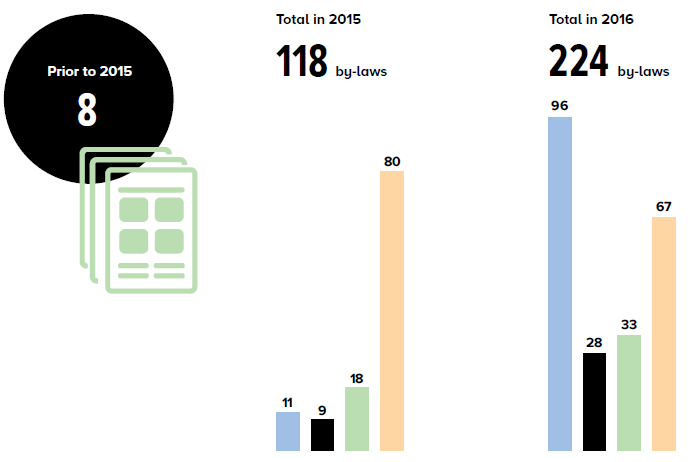

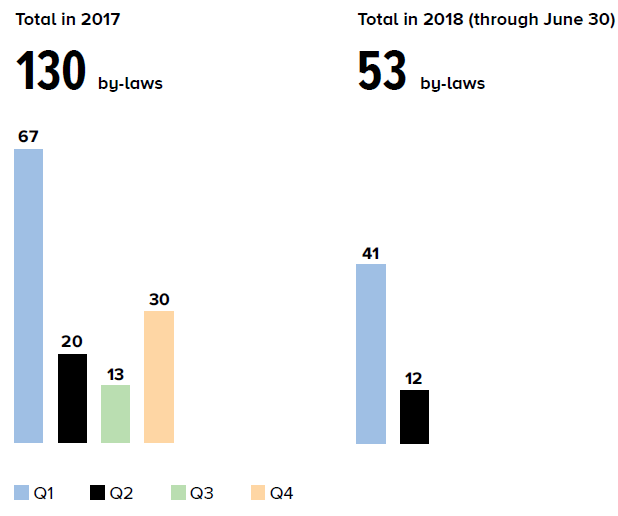

The proxy access adoption trend continued in 2018, although at a more modest pace. An additional 53 companies adopted proxy access by-laws in the first six months of 2018 compared to 87 in the first six months of 2017. In total, well over 500 companies, and over two-thirds of the S&P 500, have adopted proxy access by-laws. While the New York City Comptroller and other prolific shareholder proponents, including John Chevedden and James McRitchie, submitted fewer proxy access shareholder proposals in 2018 than in 2017, the volume of proxy access proposals was still substantial as compared to other corporate governance proposals. After three extremely active years, it appears that proxy access no longer leads the list of governance topics of shareholder

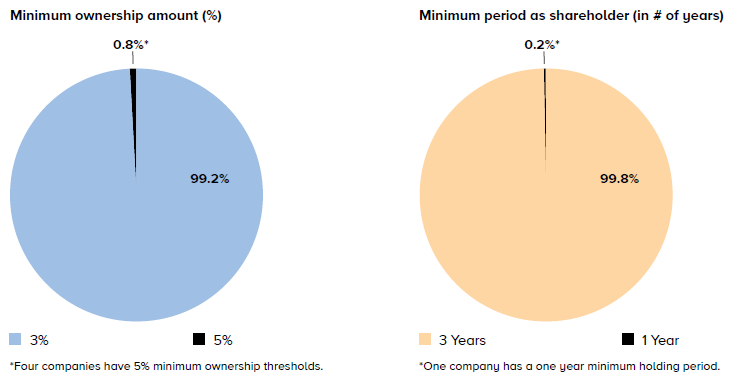

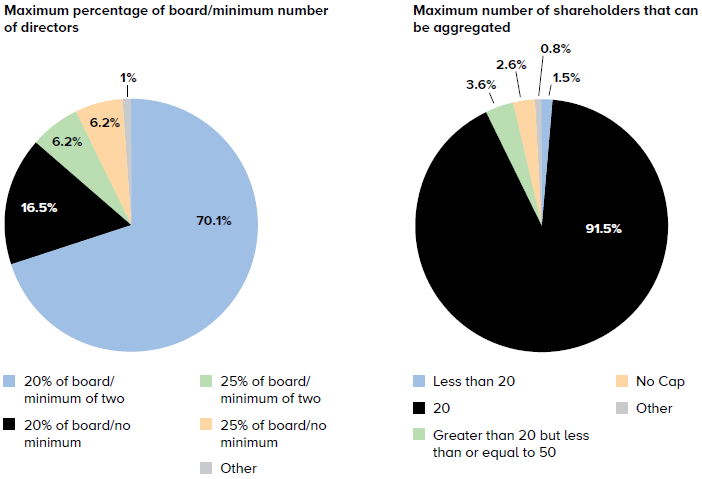

Headline Terms of Proxy Access By-Laws

The most common formulation of the headline terms permits shareholders owning at least 3% of company stock for at least three years to submit proxy access nominees up to a maximum of 20% of the board/minimum of two directors with up to 20 shareholders being able to aggregate their holdings to meet the minimum ownership requirements. The short hand for proxy access by-laws with this formulation is 3/3/20/20.

Proxy Access Adoption Over Time

Proxy Access Adoption Over Time

Shareholder Proposals—“Adopt” Proposals

Through June 30, 2018, this year had a much smaller number of shareholder proposals seeking adoption of proxy access as compared to 2017 (22 in 2018 through June 30, 2018 versus 100 through August 31, 2017). Of these “adopt” proposals, which are typically precatory, 13 proposals came to a vote in 2018, compared to 29 in the relevant period in 2017. John Chevedden and James McRitchie and their related proponents remained the most prolific proponents with 12 proposals submitted in the aggregate in 2018, which comprised over 50% of adopt proposals. As was the case last year, the number of shareholder proposals voted on compared to the number submitted remained low because many companies adopted proxy access and negotiated withdrawals of the proposal. Of the shareholder proposals that did come to a vote in 2018, four proposals passed with an average vote in favor of 73%, while nine proposals failed with an average vote in favor of 28%; in each case, the voting percentages in favor are essentially unchanged from last year. The low average vote in favor at several of these companies where proposals failed can be explained by the presence of large insider positions.

The decrease in the overall number of “adopt” shareholder proposals was due to a number of factors, including a greater number of companies choosing to adopt proxy access by-laws in the absence of a shareholder proposal and a switch in the focus of individual shareholder proponents from “adopt” proposals to “fix-it” proposals, which seek to amend the terms of a company’s existing proxy access by-law.

Second-Tier Terms—Overview

In this article, we refer to by-law terms beyond the headline terms as “second-tier terms.”

Institutional investors have become focused on second-tier terms. In July 2017, the Council for Institutional Investors updated its “Proxy Access: Best Practices” white paper and expanded the number of second-tier terms it considers when assessing a company’s proxy access by-law. Some common second-tier terms include:

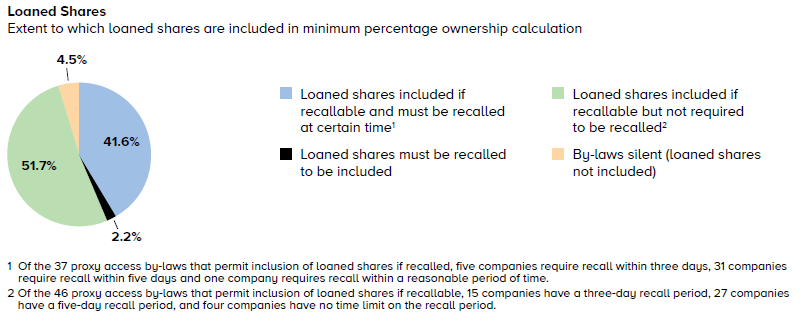

- Loaned shares. Whether shareholders are able to count loaned shares towards the minimum percentage ownership requirement

- Treatment of investment funds. Whether investment funds consisting of multiple entities are able to aggregate their shares and be treated as one shareholder for purposes of the shareholder cap found in most proxy access by-laws

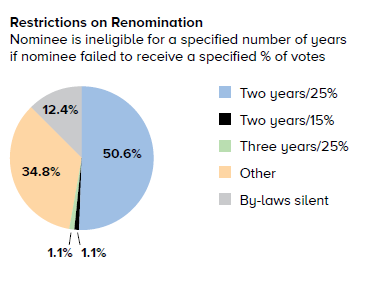

- Restrictions on renomination. Whether proxy access candidates who fail to achieve a specific percentage of votes (usually 25%) are prevented from being re-nominated for a number of years (usually two years) after their initial nomination

- Compensation arrangements. Whether proxy access candidates can receive candidacy fees (and director fees) paid by shareholders, and whether such fees need to be disclosed to the company

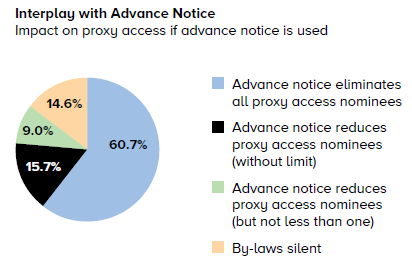

- Interplay of proxy access and advance notice. Whether there is a limitation on nominees pursuant to proxy access when nominations are made through advance notice

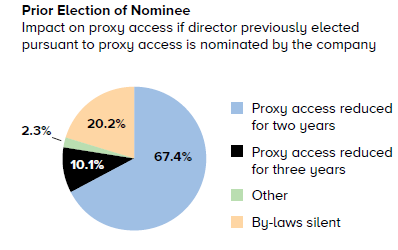

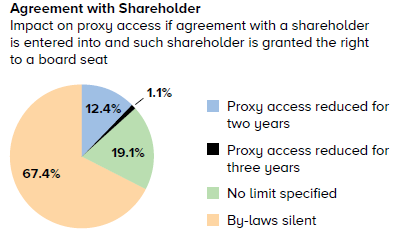

- Other proxy access interplays. Whether there is a limitation on proxy access nominees when a director previously elected pursuant to proxy access is nominated by the company or when an agreement with a shareholder is entered into pursuant to which such shareholder is granted the right to a board seat

Second-Tier Terms—Deeper Dive

Of the Top 100 Companies, 89 companies have adopted proxy access by-laws. Within those 89 proxy access by-laws, we examined the presence of the following second-tier terms.

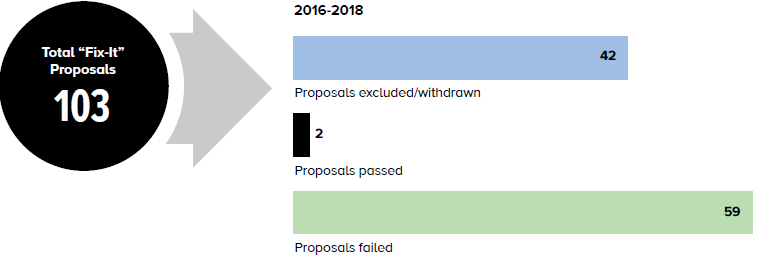

“Fix-It” Proposals

2018 saw a marked decrease in the number of “fix-it” proposals (proposals that seek to amend the terms of a company’s existing proxy access by-law) as compared to the number of such proposals in 2017, which follows a significant increase in such proposals in 2017 as compared to 2016. Only 28 “fix-it” proposals were received in 2018 compared to 64 proposals in 2017 and 11 proposals in 2016. Although only two “fix-it” proposals have passed (both in 2016), these proposals continue to merit attention as companies commence preparation for the 2019 proxy season and shareholder proponents continue to submit these proposals.

Companies have overwhelmingly adopted proxy access by-laws with 3/3/20/20 terms, in contrast to the “3/3/25/no cap” terms that many shareholders are seeking. Shareholder proponents have not acquiesced to the status quo; they continue to advocate for “fix-it” proposals that are designed to bring 3/3/20/20 by-laws closer to the 3/3/25/no cap by-laws they espouse, as well as requesting more shareholder-friendly second-tier terms. “Fix-it” proposals generally fall into three categories: “tailored,” “two-term”/“three-term” and “shareholder cap” proposals.

“Tailored” proposals request amendments to several (typically four or five) terms of a company’s by-laws. The terms include both headline and second-tier terms, such as the counting of loaned shares or treatment of investment funds. Only 16 tailored proposals have been submitted to date and none were submitted in 2018. Of those 16 proposals, seven were excluded or withdrawn, two passed with a 67% average vote in favor and seven failed with a 33% average vote in favor. The two “tailored” proposals that passed in 2016 were submitted at companies that had adopted by-laws with a 5% minimum percentage ownership threshold and to date, remain the only “fix-it” proposals that have passed. Not surprisingly, both companies subsequently amended their proxy access by-laws.

“Two-term” and “Three-term” proposals target companies on two or three issues, which typically include the percentage of the board electable pursuant to proxy access, the shareholder aggregation cap and the restrictions on renominations of failed proxy access candidates. While several companies attempted to exclude these proposals through the SEC’s no-action process, all such attempts have been unsuccessful.

There were 21 two-term proposals between 2016 and 2018. Of those 21 proposals, one was withdrawn while the remaining proposals all failed with a 27% average vote in favor.

There were 12 three-term proposals between 2016 and 2018. Of those 12 proposals, one was excluded, none passed and 11 proposals failed with a 29% average vote in favor.

“Shareholder cap” proposals only seek to amend the limitation on the number of shareholders that can aggregate their holdings to satisfy the minimum percentage ownership requirement. In 2018, shareholder cap proposals sought to remove an aggregation cap (as opposed to 2017 proposals which generally sought to increase the shareholder aggregation cap to 40 or 50 shareholders). All 10 proposals voted on in 2018 failed with a 26% average vote in favor.

There were 54 shareholder cap proposals between 2016 and 2018. Of those 54 proposals, 33 were excluded or withdrawn, none passed and 21 failed with a 27% average vote in favor.

Amendments

To date, 37 companies have amended their proxy access by-laws, although only one of these amendments occurred in 2018. While some amendments have been made prior to an upcoming vote on an “adopt” or “fix-it” proposal and some have been made in response to shareholder proposals that have passed, it is likely that at least a few amendments have been made in response to behind-the-scenes pressure from institutional investors seeking more favorable terms.

Fast Facts

Time from Adoption to Amendment

Among the 37 companies that have amended their proxy access by-laws, there was an average of 311 days between the initial adoption of the by-law and an amendment

More than 900 annual meetings have been held by companies with a proxy access by-law since 2011

Only 1 nomination has been attempted (and was disqualified by the company in question)

ZERO proxy access candidates have appeared in a company proxy statement

Exclusions and Withdrawals

The rate of exclusions/withdrawals of shareholder proposals declined precipitously in 2018 as compared to 2017 (from approximately 70% to approximately 20%). In 2018, among the 28 “fix-it” proposals, one was excluded and one was withdrawn. Among the 22 adopt proposals in 2018, six were excluded and three were withdrawn.

This decline in withdrawals/exclusions may be attributed to a refinement in shareholder proposals prior to submission, leaving a pool of proposals less vulnerable to exclusion and withdrawal. For example, the decline in “fix-it” proposals can be attributed to the SEC’s decision in 2017 to generally allow companies to exclude “shareholder cap” proposals requesting an increase to 40 or 50 shareholders under Rule 14a-8(i)(10), so long as the company’s proxy access by-law already had an aggregation cap of 20 shareholders and the company could represent as to certain facts about its shareholder base.

* * *

The complete Shearman and Sterling Corporate Governance and Executive Compensation Survey is available here.

Print

Print