Dan Carroll is Director of Programs and Bruce Freed is President of the Center for Political Accountability. This post is based on their CPA memorandum. Related research from the Program on Corporate Governance includes Shining Light on Corporate Political Spending by Lucian Bebchuk and Robert J. Jackson Jr. (discussed on the Forum here) and The Untenable Case for Keeping Investors in the Dark by Lucian Bebchuk, Robert J. Jackson Jr., James David Nelson, and Roberto Tallarita (discussed on the Forum here).

Support among the largest mutual funds for the Center for Political Accountability’s political disclosure resolution reached 53 percent in the 2018 proxy season, the highest level ever. Despite the eight-percentage point jump over 2017, the Big 3 institutional investors—Vanguard, BlackRock and Fidelity—continued to oppose shareholder requests that companies adopt transparency and accountability for their political spending with corporate funds.

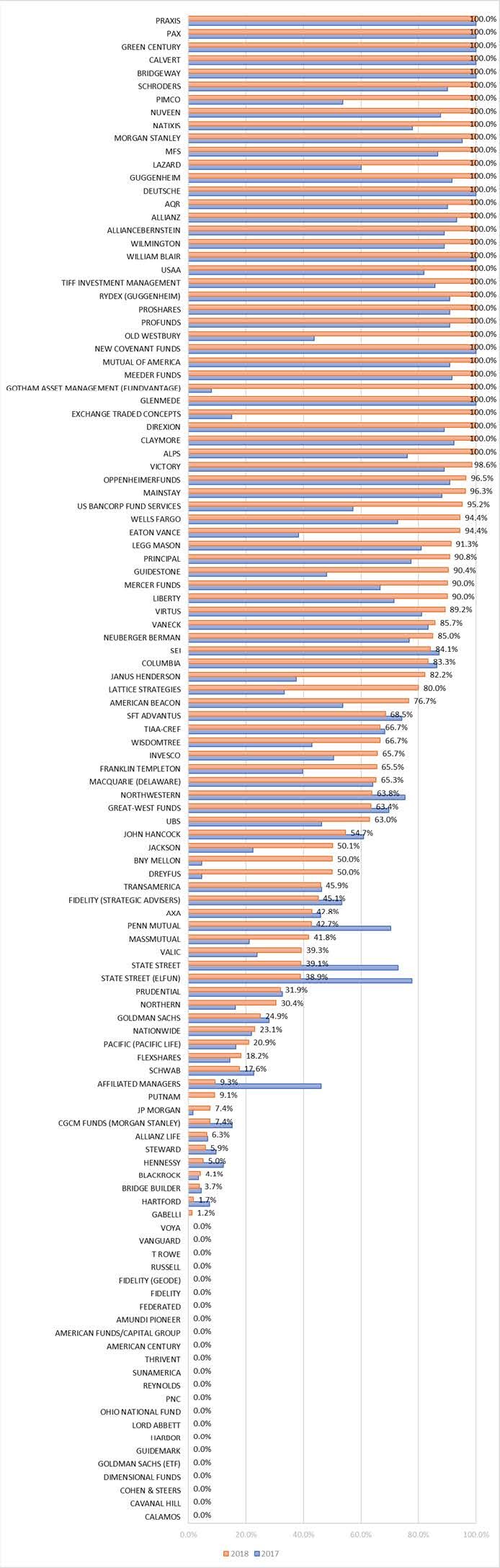

CPA’s analysis, based on the Morningstar® Fund Votes Database and released last month, found that of the 46 largest asset managers, 12 supported 100 percent of the political spending resolutions and 11 supported none. 25 of the 46 groups increased their support from 2017 to 2018, while nine decreased support.

A non-profit, non-partisan advocacy group, CPA has led the shareholder effort for the past 15 years to persuade companies to adopt disclosure, decision-making and board oversight policies for electoral-related spending.

Five groups—BNY Mellon, Janus Henderson, Eaton Vance, PIMCO and Lazard—increased their support by over 40 percentage points, with both PIMCO and Lazard supporting 100 percent of the resolutions. Other fund families that recorded 100 percent support included Morgan Stanley, Nuveen, AllianceBernstein and Guggenheim. Wells Fargo, Legg Mason and Oppenheimer Funds were just shy of 100 percent.

Average shareholder support reached a record level in 2018, at 34 percent, up from slightly under 30 percent last year.

The trend of increased support reflects mutual fund recognition of the importance of companies adopting political disclosure and accountability to manage heightened risk. Today, consumers, employees and stakeholders are even more sensitive to how companies spend their money politically, and they will act if they disagree with where a company contributes. This can harm a company’s reputation and ultimately its bottom line.

Contrary to the overall trend, Vanguard, Fidelity and BlackRock—the Big 3 institutional investors—have yet to recognize the importance of—and cast their proxies for—corporate political disclosure and accountability.

The analysis found several institutional investors, including AMG and State Street, that decreased their support for the resolution in 2018.

In a Philadelphia Inquirer article on the CPA analysis, Vanguard defended its record, saying that its “investment stewardship activities are not driven by any political, social, or environmental agendas.”

This is at odds with an Iowa Law Review article, “Campaign Finance Reform Without Law,” published in late 2017 that found corporate political disclosure had become the norm. This was buttressed by the results of the 2018 CPA-Zicklin Index, the annual benchmarking of the political disclosure and accountability policies of the S&P 500. In addition, corporate governance experts and companies see political disclosure is an integral part of enterprise risk management. The Conference Board issued a Handbook on Political Activity in late 2010 that set out best practices for how to manage and conduct board oversight of political spending with corporate funds.

The analysis examined 115 fund groups’ votes on corporate political spending resolutions based on the CPA model resolution in the 2018 and 2017 proxy seasons. The 115 fund groups included all funds in the Morningstar Fund Votes database that had cast votes on at least 5 resolutions in each of the two proxy seasons. Their total assets under management, according to Morningstar® fund data, amount to over $14 trillion, of which almost $5.5 trillion is invested in the U.S. securities market.

Other notable findings:

- Of the 115 fund groups studied, 60 increased their support for political spending disclosure resolutions between 2017 and 2018, compared to only 23 fund groups that decreased such support. Among the 46 largest asset managers, 25 groups increased support while nine decreased such support.

- In 2018, 53 fund groups supported at least three-quarters of the resolutions voted upon, compared with 40 fund groups in 2017. Only 23 groups failed to support a single political spending disclosure resolution in 2018, compared with 25 in 2017.

- Thirty-four fund groups, mostly comprised of socially responsible investment asset managers, supported all election spending disclosure resolutions in 2018.

Print

Print