Kosmas Papadopoulos is Managing Editor at ISS Analytics. This post is based on an ISS Analytics memorandum by Mr. Papadopoulos. Related research from the Program on Corporate Governance includes The Case for Increasing Shareholder Power by Lucian Bebchuk and Private Ordering and the Proxy Access Debate by Lucian Bebchuk and Scott Hirst (discussed on the Forum here).

Over the past three decades, shareholder proposals have transformed the corporate landscape in the U.S. by spurring the adoption of governance best practices. Annual director elections, majority vote rules for director elections, shareholder approval for poison pills, and proxy access bylaws are some of the critical governance practices that have become common practice thanks to investor support for shareholder proposal campaigns led by a wide variety of investors—some large; others small. Despite the advisory (non-binding) nature of most shareholder proposals in the U.S., successive waves of campaigns eroded boardroom entrenchment by convincing directors to respond to shareholders’ calls for accountability, transparency and stewardship.

In this second installment of our examination of long-term trends in proxy voting, we examine the impact of shareholder proposals on corporate governance practices since the turn of the century, and we forecast the potential paths forward for corporate governance changes in the future. As many of the key corporate governance practices listed above have been adopted by close to 90 percent (or more) of large market capitalization firms, proponents are turning their attention to governance topics, such as independent board chairs and written consent rights, that boards have been slower to address. Notably, voting results demonstrate that members of the investment community often have varying views on these topics, as evidenced by the declining number and percentage of governance shareholder proposals receiving majority support in recent proxy seasons.

Antitakeover Measures and Corporate Scandals Prompt Calls for Governance Reform

The high rates of support for governance proposals predate the financial crisis and the recent focus on stewardship, sustainability, and ESG investing. The roots of modern day governance activism trace back to the 1960s and 1970s, when so-called “gadfly” investors, such as the Gilbert brothers and Evelyn Y. Davis, filed numerous shareholder proposals on issues like the repeal of classified boards and the adoption of cumulative voting.

Some institutional investors joined the shareholder proposal fray in the late 1980s in response to the widespread adoption of poison pills, payments of “greenmail” and other effort by boards to entrench themselves in the wake of a wave of “hostile” takeovers.

In the 1990s, concerns about governance practices among some investors and shareholder advocates continued to spread, as we saw a substantial number of proposals seeking governance changes, including requests to curb executive pay, remove poison pills, and declassify boards.

Activism at annual general meetings picked up speed in the new millennium, as investors suffered serial knockout blows from the dot-com bubble’s burst, the Enron/Worldcom era accounting scandals, and the financial crisis. The dot-com bubble and the major accounting scandals of the early 2000s prompted calls for board accountability and governance reform by the public at large. The bipartisan Sarbanes-Oxley Act of 2002 was an effort to address public and investor concerns and reinforce the responsibilities of directors and management as fiduciaries. Soon thereafter, the exchanges changed their listing rules to require majority independence on boards and independent key committees.

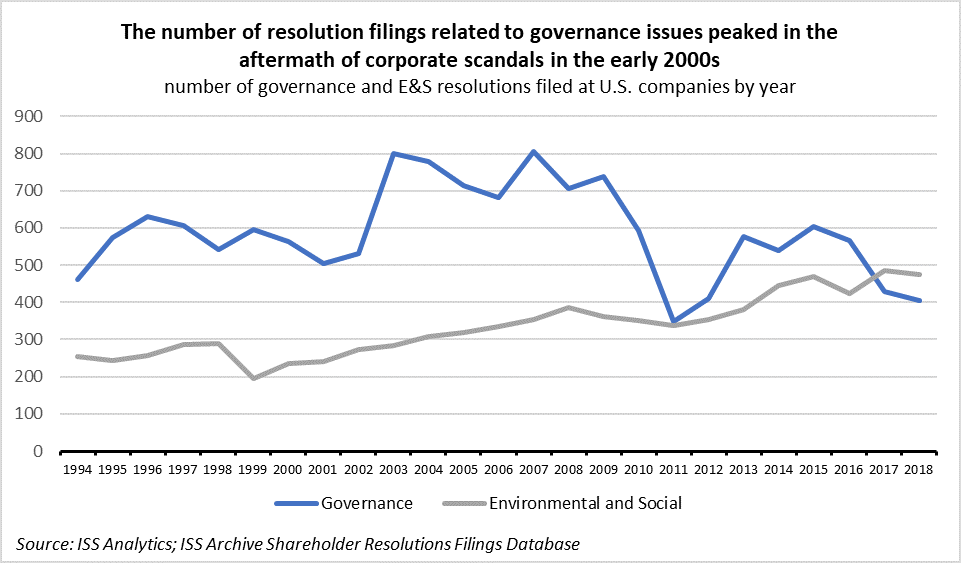

While applauding these reforms, shareholders turned to private ordering to build the tools that would allow them to hold boards more accountable. As a result, the number of shareholder proposal filings dealing with governance issues rose by 50 percent in 2003. The remainder of the decade saw a succession of highly-successful shareholder proposal campaigns, including efforts to require majority vote standards for uncontested director elections, and to hold advisory votes on compensation (“say on pay”).

Following Dodd-Frank’s say on pay mandate, the number of governance proposals dropped in 2011. From 2011 to 2014, however, Professor Lucian Bebchuk’s Shareholder Rights Project initiative led to the declassification of at least 100 board of large-capitalization companies, as the project helped institutional investors coordinate and structure their efforts towards advancing annual board elections at S&P 500 and Fortune 500 companies. Further, from 2014 to 2016, a new wave of governance proposals swept through proxy ballots, with the campaigns led by the New York City Comptroller and several individual proponents requesting companies to adopt proxy access gaining significant support.

In the past two years, the filings of proposals dealing with environmental and social issues surpassed governance proposals, as E&S issues continue to gain momentum, spurred by increased support by shareholders, willingness by companies to engage and reach a common solution, and a focus on monitoring and oversight of material risks by proponents.

Support Levels for Governance Proposals Peak during the 2000s and early 2010s

Investors gave strong backing to many of these governance reform initiatives, with some proposal categories (e.g. declassify board, remove supermajority vote requirements, and redeem or vote on poison pills) consistently obtaining support levels above 60 percent of votes cast.

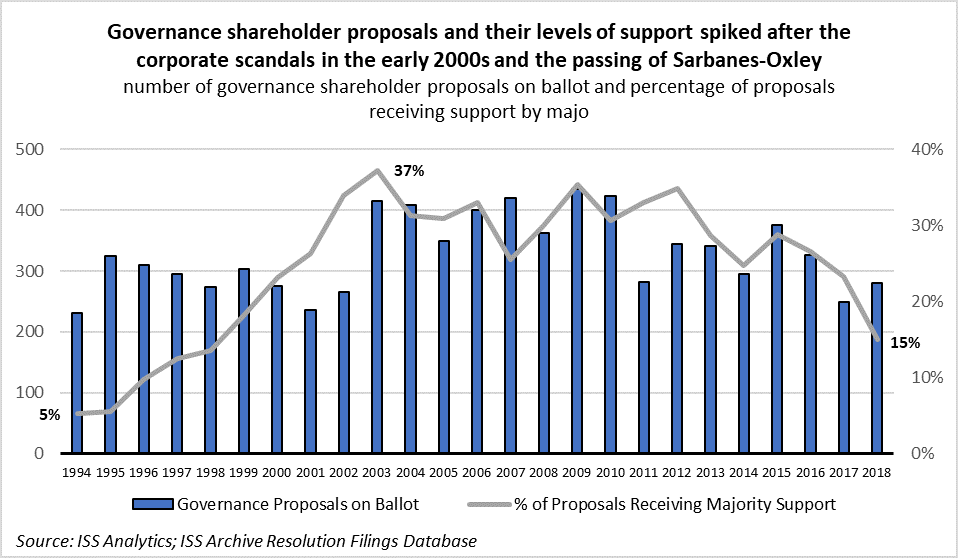

The percentage of governance shareholder proposals receiving support by majority of votes cast rose steadily from 5 percent of proposals in 1994 to 37 percent of voted proposals in 2003.

Support levels have remained high since then. However, as many key governance practices become widely adopted by most large-capitalization companies, proposal campaigns recently shifted to governance topics where shareholders do not appear to have reached consensus, such as shareholders’ ability to call a special meeting and the establishment of an independent board chair. As a result, in 2018, the percentage of majority-supported governance shareholder proposals dropped to its lowest level since 1999.

Four Types of Governance Shareholder Proposals

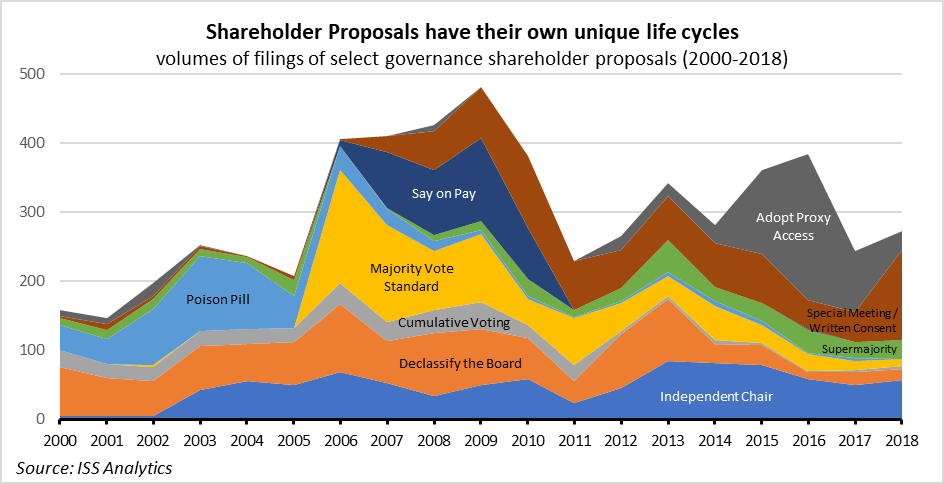

The longevity of each shareholder proposal campaign depends on the level of support the issue receives from shareholders and the rate and ease of voluntary adoption of the practice in question by companies. Looking at some of the most prevalent corporate governance topics on ballots over the past two decades, we can discern some general patterns among various shareholder proposal types. Based on our analysis, we group shareholder proposals in four main categories with respect to their support levels and the relative length of their campaigns:

- High Support and Easily Adopted: These proposals attract average support levels higher than a majority of votes cast and diminish in numbers once the requested practices are widely embraced by boards via changes in bylaws or governance guidelines. Examples include proposals to adopt a majority vote standard for director elections and requests to adopt proxy access. As support for each of these issues reached critical mass (above majority support), boards become more willing to engage with investors and proponents about adopting the proposed practice. Typically, the number of proposals on ballot begins to dwindle after more than three-quarters of the S&P 500 index firms adopt the governance practice in question.

- Medium Support and/or Difficult to Enact: These proposals tend to receive significant levels of support, but the rate of adoption by boards is low, because the proposals either fail to receive majority support, or they are difficult to implement. These campaigns tend to continue for longer periods, often spanning for more than a decade. Examples include requests to establish an independent chair to the board and proposals seeking the right of shareholders to call a special meeting. Calls to declassify boards or reduce supermajority vote requirements also belong in this category. For example, despite their median support levels of 68 percent of votes cast since 2000, proposals to reduce supermajority vote requirements are difficult to implement, since the thresholds for adoption are very high and are often based on shares outstanding (instead of votes cast), which raises the hurdle rate even further.

- High Support Followed By Market-wide Mandate: Some proposals end their cycle when laws, listing rules, accounting standards, or other regulatory mandates establish the requested practice as the market standard. For example, shareholder proposals requesting the expensing of stock options in the income statement were one of the most common proposals from 2003 until 2005, when new U.S. GAAP rules changed to require the expensing options effective June 2005. Similarly, requests to adopt say-on-pay votes appeared in the highest volumes compared to any other shareholder proposal from 2007 to 2010, leading to a significant number of voluntary adoptions before the Dodd-Frank legislation made say on pay the law of the land in 2011. Proposals regarding requests to have majority-independent boards also fall in this category.

- Lack of Traction: Some proposal campaigns have relatively short life spans, as they are unable to garner significant support from investors to push companies towards changes in governance practices. While some of these proposals did not have success in the past, it is quite possible that they may be revived in the future. For, example, before the recent successful campaigns on proxy access bylaws, several proxy access proposals were filed in the early 2000s, but none of them made it to ballots, as they were challenged at the SEC.

Top 10 Filed Governance Shareholder Proposals by Volume (2000-2018)

| Proposal Type | Proposal Filed |

Proposals Voted |

% Proposals with Majority Support F/(F+A) |

Median Support F/(F+A) |

|---|---|---|---|---|

| Declassify the Board | 1053 | 699 | 82% | 68% |

| Establish Independent Chair | 902 | 701 | 4% | 30% |

| Adopt Majority Vote Standard | 792 | 490 | 51% | 50% |

| Adopt Proxy Access | 562 | 273 | 49% | 49% |

| Right to Call Special Meeting | 528 | 351 | 30% | 44% |

| Poison Pill (Remove/Submit for a Vote) | 515 | 299 | 71% | 61% |

| Adopt Say on Pay | 382 | 264 | 20% | 43% |

| Reduce Supermajority Vote Requirement | 334 | 242 | 79% | 68% |

| Adopt Cumulative Voting | 325 | 289 | 3% | 33% |

| Right to Act by Written Consent | 296 | 234 | 20% | 43% |

Source: ISS Analytics

Higher Rates of Governance Proposals Make it to the Ballot in Recent Years

Once filed, shareholder proposals may lead to three main outcomes: they may appear on the ballot and be voted upon, they may be withdrawn by the proponent following a successful negotiation with the company, or they may be omitted from the ballot due to the company being granted no-action relief by the SEC.

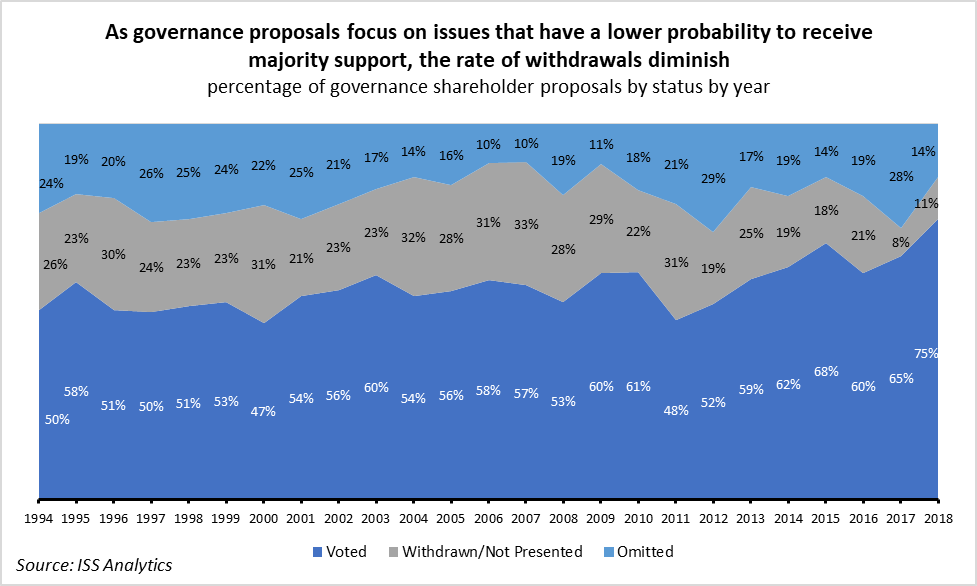

With respect to the status of filed proposals, in recent years, we observe the trend whereby higher rates of proposals tend to make it to the ballot for a vote.

In 2018, only 14 percent of filed proposals were omitted due to no-action relief by the SEC (compared to a ten-year average of 19 percent of proposals), which indicates that proponents improved their targeting compared to the previous years and were able to present convincing arguments as to why their requests should be on the ballot.

While proponents convinced SEC staff to allow their proposals to appear on ballots, they were less successful in convincing companies to change their practices prior to the vote, as the percentage of proposals that were withdrawn dropped to 8 percent in 2017 and 11 percent in 2018, compared to a historical average of 25 percent of filed proposals from 1994 to 2016. This trend represents the opposite of what we observe for environmental and social issues, where a record of 48 percent of proposals were withdrawn by proponents in 2018.

The most likely explanation for the decline in withdrawal rates is the prevalence of proposals that have generally failed to achieve above-majority support levels in prior years. As companies see a lower probability for these proposals to receive majority support, they are less likely to agree to change their governance practices in advance of the vote.

Proposals that Receive High Support Levels

To illustrate the phenomenon of the declining numbers of shareholder proposals based on the rate of adoption by large-capitalization firms, we highlight a few examples where one sees this inverse relationship take effect as soon as a practice is widely adopted by approximately two-thirds or three-quarters of the S&P 500.

The adoption of annual director elections is a case in point. Proposals to declassify the board were filed in large numbers since the mid-1980s, and they consistently received high levels of support. As adoption rates reached a critical point, we saw fewer filings and fewer shareholder proposals on ballot. These trends should not suggest that the issue itself has died away, since we continue to see companies declassify their boards, likely the result of heightened engagement. In fact, management proposals to declassify the board continue to appear in high numbers, especially at non-S&P 500 companies.

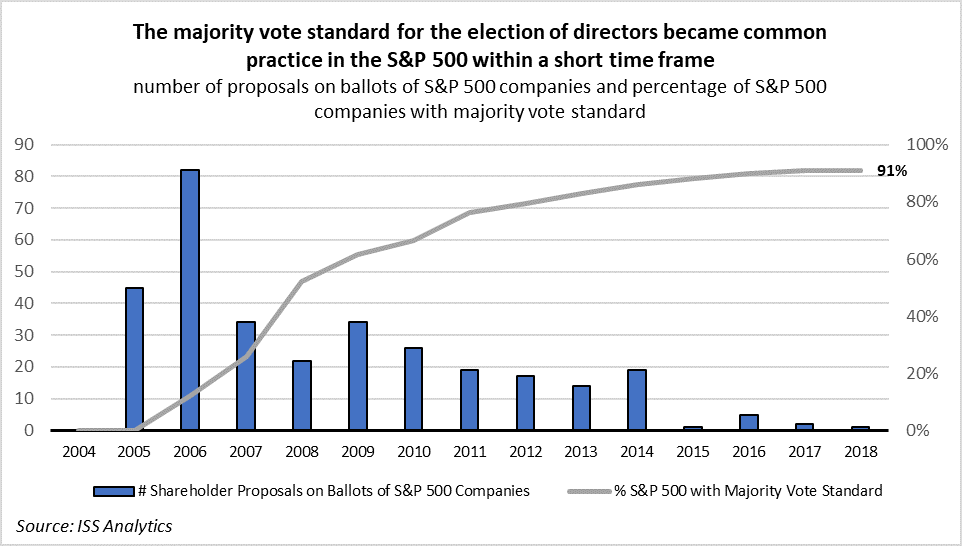

The figures regarding shareholder proposals to adopt the majority vote standard for director elections tell a similar story. Large-cap companies abandoned the plurality vote standard (an election method that allows a director to be elected with only one vote in favor) within a relatively short timeframe, as shareholder proposals on the issue received high support rates that continued to increase. By 2018, 91 percent of the S&P 500 had adopted the standard, and adoption rates among smaller companies are also growing.

One observes similar trends for proposals related to poison pills, as the percentage of S&P 500 companies with a poison pill dropped from 60 percent in 2002 to only 1.4 percent in 2018. Poison pills met significant opposition, as many investors adopted policies to vote against directors who approved poison pill adoptions without shareholder approval.

Proxy access is another notable example of an impactful shareholder campaign, as the percentage of companies adopting access provisions rose from 2 percent in 2013 to 70 percent in 2018.

Proposals that Lead to Gradual Change

As discussed above, some proposals tend to receive medium-to-high levels of support, and they rarely pass the threshold of majority of votes cast.

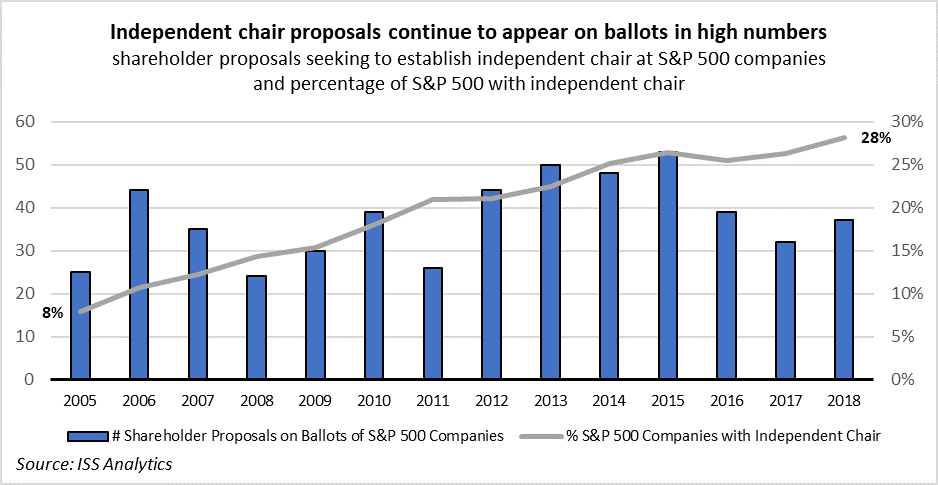

In the case of proposals to establish an independent chair, it appears that investors views on the issue vary. The median level of support for the proposal has remained relatively steady at approximately 30 percent of votes cast, and only 31 of the 701 voted proposals received majority support since 2000. However, company practice on independent board leadership is evolving, as investors, companies, and regulators continue the debate on this issue. The SEC’s 2009 enhanced disclosure rules on board leadership structure likely contributed to changes in practice. As of 2018, 91 percent of S&P 500 companies had independent board leadership through either an independent chair or an independent lead director (up from 68 percent in 2008). The percentage of S&P 500 companies with an independent chair has increased from 8 percent in 2005 to 28 percent in 2018. Board leadership remains a high-profile and highly-contested issue, especially in the wake of multiple cases of CEO misconduct in 2018. As such, we expect this proposal type to continue to appear on ballots in the years to come.

Supermajority vote requirements is another topic where a change in practice has been more gradual as opposed to proposals that led to almost universal adoption of a governance practice in a short timeframe. The percentage of S&P 500 companies with a simple majority vote requirement for changes to their bylaws or charter increased from 39 percent in 2002 to 54 percent in 2018, despite the proposal receiving median support levels of 68 percent of votes cast during that period. The main reason for the slow rate of change is the difficulty of overcoming supermajority lock-in vote requirements, especially since many of them are based on the percentage of shares outstanding.

Governance beyond Large-Capitalization Companies

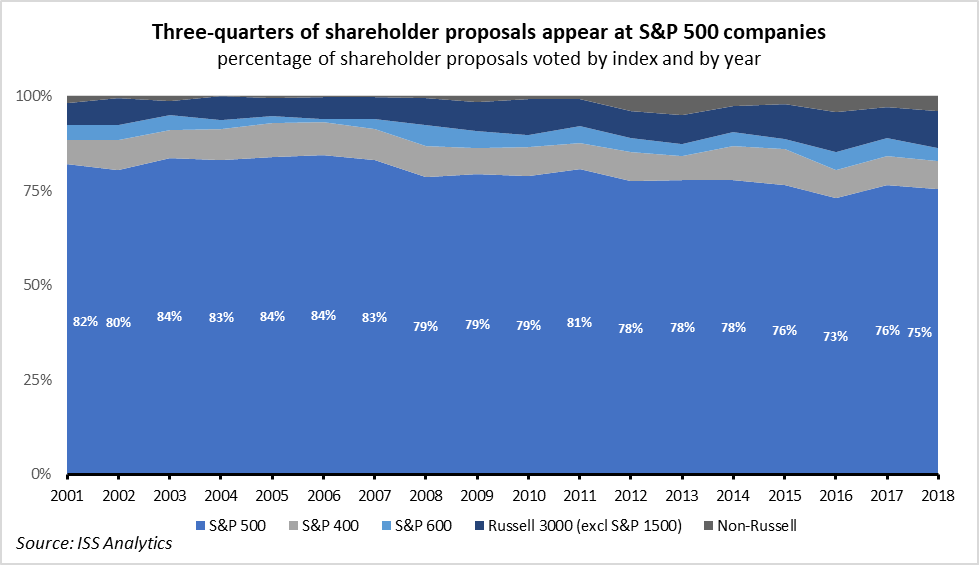

In 2018, 75 percent of all shareholder proposals were filed at S&P 500 companies, which is generally in line with average levels of 77 percent of proposals during this decade, but also represents a drop from the 82-percent average during the previous decade. From a shareholder proponent’s point of view, the additional level of effort required to reach a broader universe of companies (e.g. the Russell 3000) would likely be significantly disproportionate to the potential benefit.

The vast majority of governance shareholder proposals in recent years have been filed by individual investors (such as William and Kenneth Steiner, John Chevedden, James McRitchie, and Myra Young) who have been able to achieve a remarkable level of coordination with limited resources. By focusing on large companies, proponents can make a significant impact to the market nevertheless, as the S&P 500 represents approximately 70 percent of the market capitalization of all U.S. publicly-traded stocks. Furthermore, the size of large-cap companies along with their dispersed ownership and name recognition allows shareholder proposals to bring significant attention to the issue in question beyond the bylaws of individual companies.

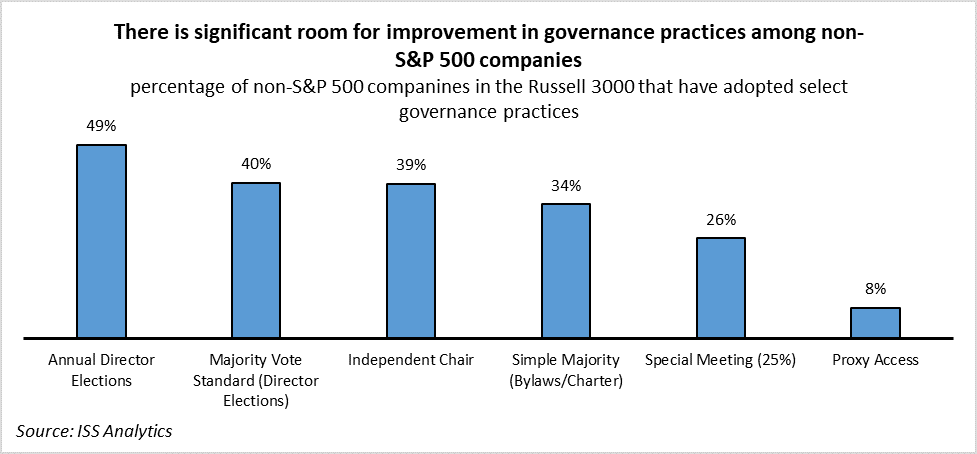

With proposal filings decreasing once a practice is widely adopted among large firms, one wonders whether the private ordering approach to corporate governance has inadvertently led to the creation of two different sets of governance standards: higher standards for larger companies, and lower standards for smaller companies.

With proposal filings decreasing once a practice is widely adopted among large firms, one wonders whether the private ordering approach to corporate governance has inadvertently led to the creation of two different sets of governance standards: higher standards for larger companies, and lower standards for smaller companies.

Such a development may raise concerns, as many of the small-cap companies of today may become the large companies of tomorrow. Furthermore, a new wave of takeover defenses has emerged at smaller firms, primarily among recent IPOs, in response to increased activist activity in the past decade, which further contributes to a widening governance gap between large and small firms.

With the rise of stewardship among large institutional investors, it appears possible that larger shareholders may pick up the baton from individual proponents and advance governance improvements through engagement at small-capitalization companies. As asset managers and asset owners build capacity to manage governance risk for larger parts of their portfolios, and as they prioritize stewardship as part of their investment process, they are likely to encourage best standards at the segments of the market that may have fallen behind.

Corporate governance at U.S. firms has come a long way compared to 30 years ago, largely thanks to shareholder proposals campaigns that pioneered reform efforts and helped establish best practices amongst large firms and a significant segment of smaller companies. Recent collective initiatives and efforts to set minimum governance standards—both by investors and companies—point to the direction of issuer-shareholder engagement playing a larger role in the continuous effort to improve governance practices in the U.S. market.

Print

Print