David F. Marcus is Senior Vice President and Frank Schneider is Vice President at Cornerstone Research. This post is based on their Cornerstone memorandum and is part of the Delaware law series; links to other posts in the series are available here. Related research from the Program on Corporate Governance includes Appraisal After Dell by Guhan Subramanian and Using the Deal Price for Determining “Fair Value” in Appraisal Proceedings by Guhan Subramanian (discussed on the Forum here).

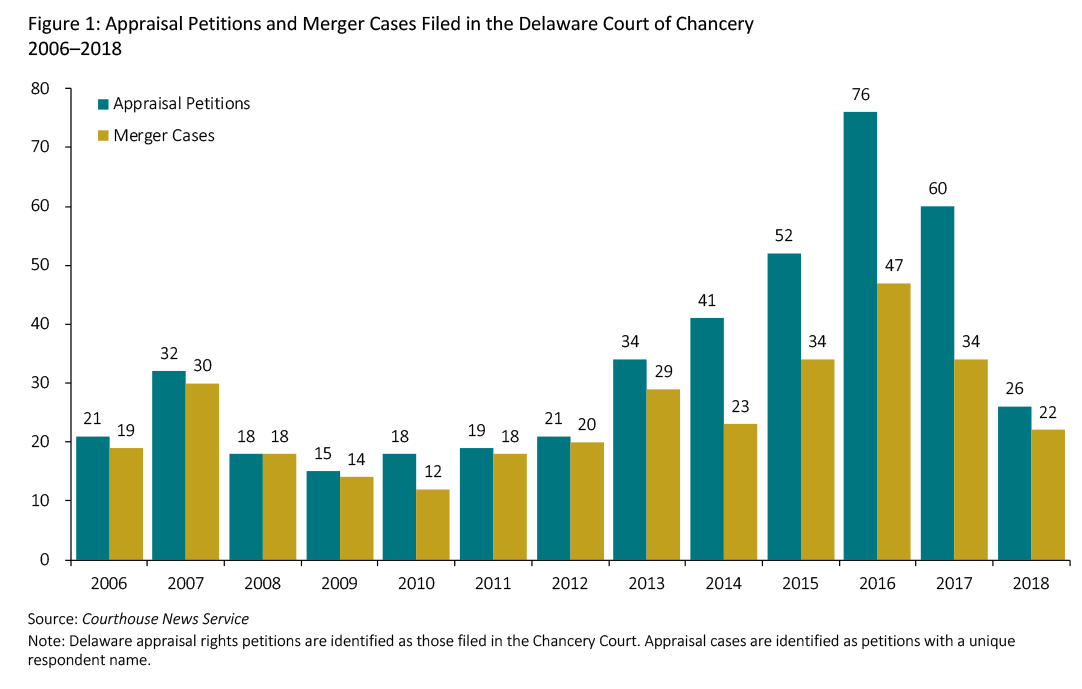

Last year saw a drop in the number of appraisal petitions filed in the Delaware Court of Chancery. After steadily rising since 2009 and peaking at 76 in 2016, the number of appraisal petitions filed by shareholders declined to only 26 in 2018.

For the 34 appraisal cases that ultimately went to trial between 2006 and 2018, the data show substantial variation in the awards granted by the Delaware Courts. Several recent decisions, including Dell and Aruba, have highlighted judicial concerns about the quality of the sales process and the appropriate methodologies used to determine fair value.

Number of Appraisal Petitions

- In 2018, shareholders filed 26 appraisal petitions in the Delaware Court of Chancery (Chancery Court)—a 57 percent decrease from 2017.

- Between 2006 and 2018, 433 appraisal petitions were filed in total, comprising 320 unique cases.

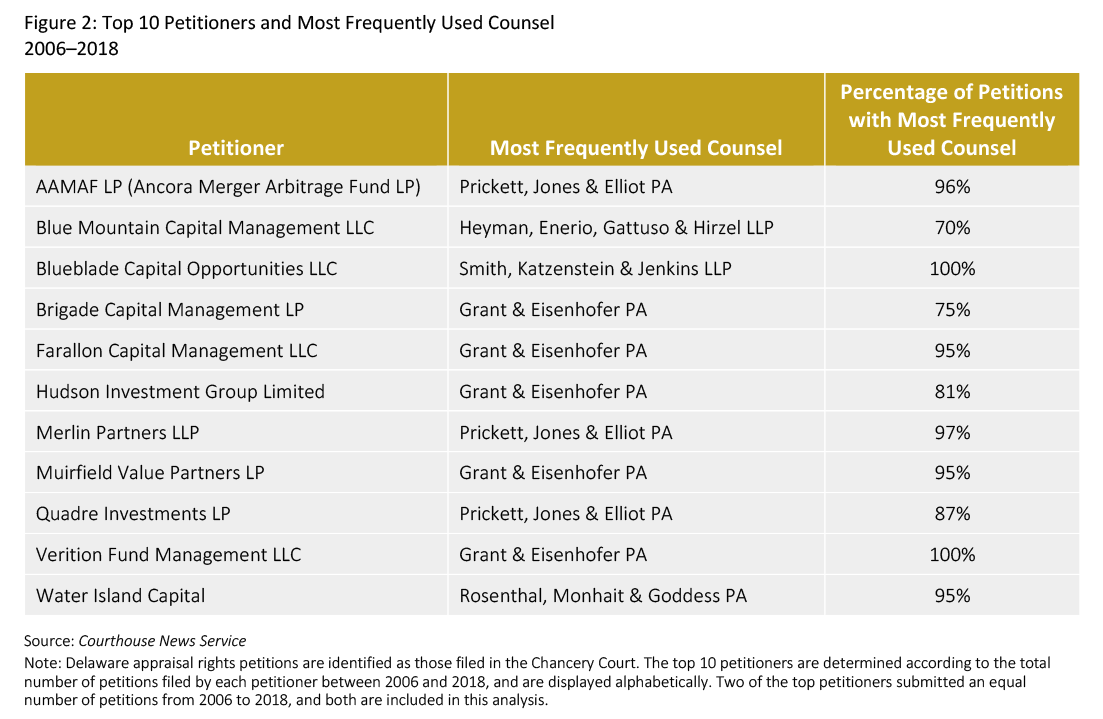

Top Petitioners and Frequently Used Counsel

- The top 10 petitioners accounted for more than half of all filings between 2006 and 2018.

- Among these top petitioners, many were represented by the same law firm repeatedly—most filed over 90 percent of their petitions with the same legal counsel.

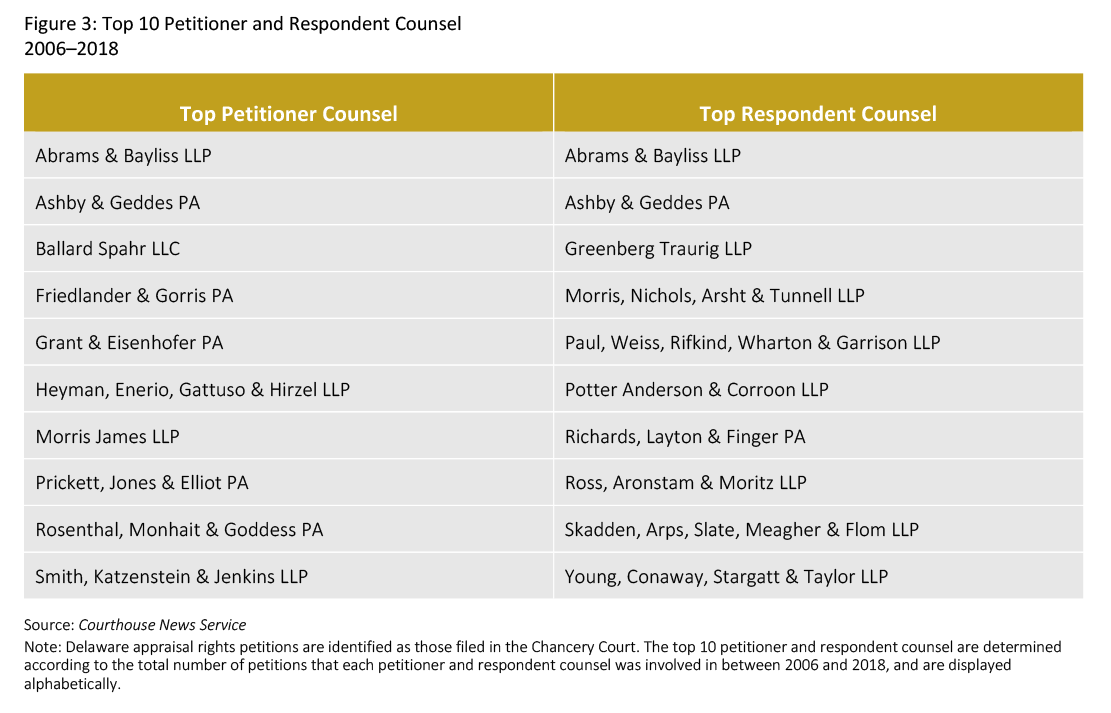

Top Petitioner and Respondent Counsel

- The top 10 petitioner law firms were involved in 98 percent of all petitions between 2006 and 2018.

- The top 10 respondent firms were involved in 77 percent of all petitions over the same 13-year period.

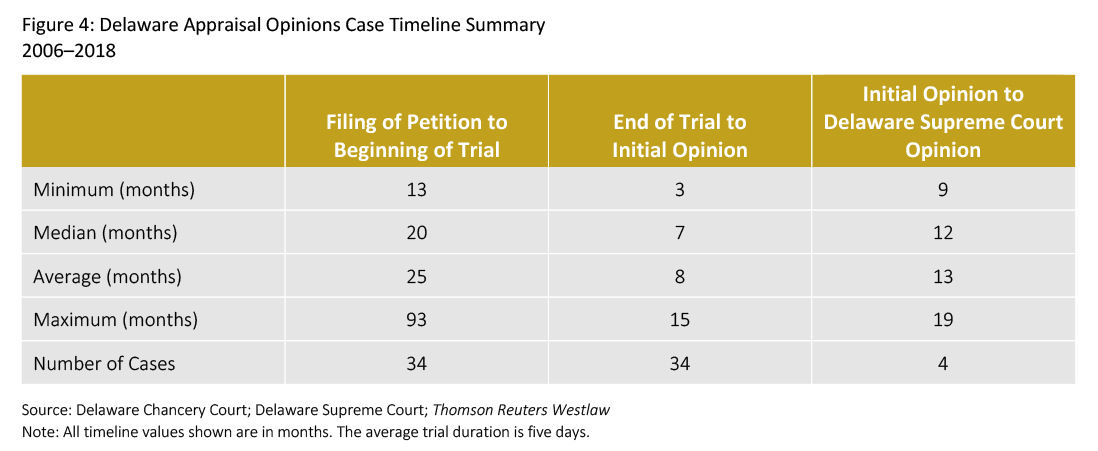

Trial Opinions and Case Timing

- Of the 34 cases decided by the Chancery Court and the Delaware Supreme Court (together the “Delaware Courts”) between 2006 and 2018, the average case took over two years from the filing of the petition to the beginning of trial, and the average time from trial to the issuance of the initial opinion was approximately eight months.

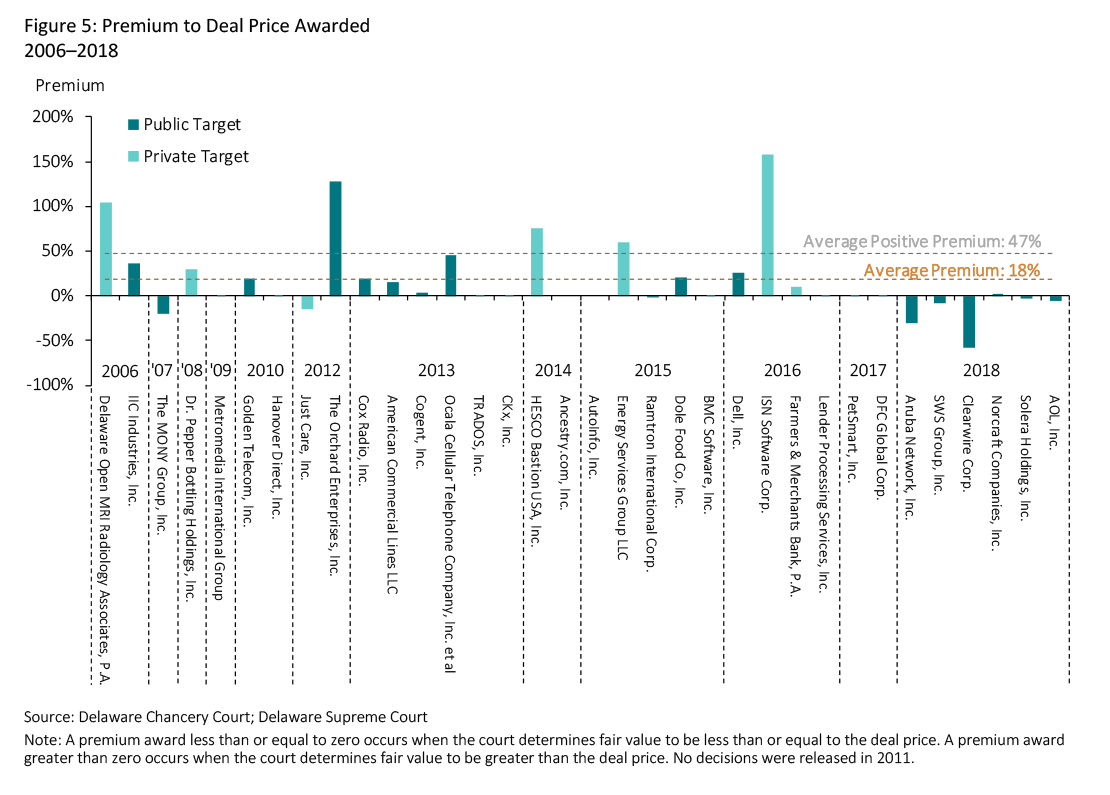

Premium to Deal Price Awarded

- There was an almost even split between rulings in which fair value was determined to be above the deal price and rulings in which fair value was determined to be at or below the deal price.

- While there is substantial variation in the premium awarded, the average premium across all 34 opinions was 18 percent above the deal price. For the 16 cases in which a positive premium was awarded, the average premium was 47 percent.

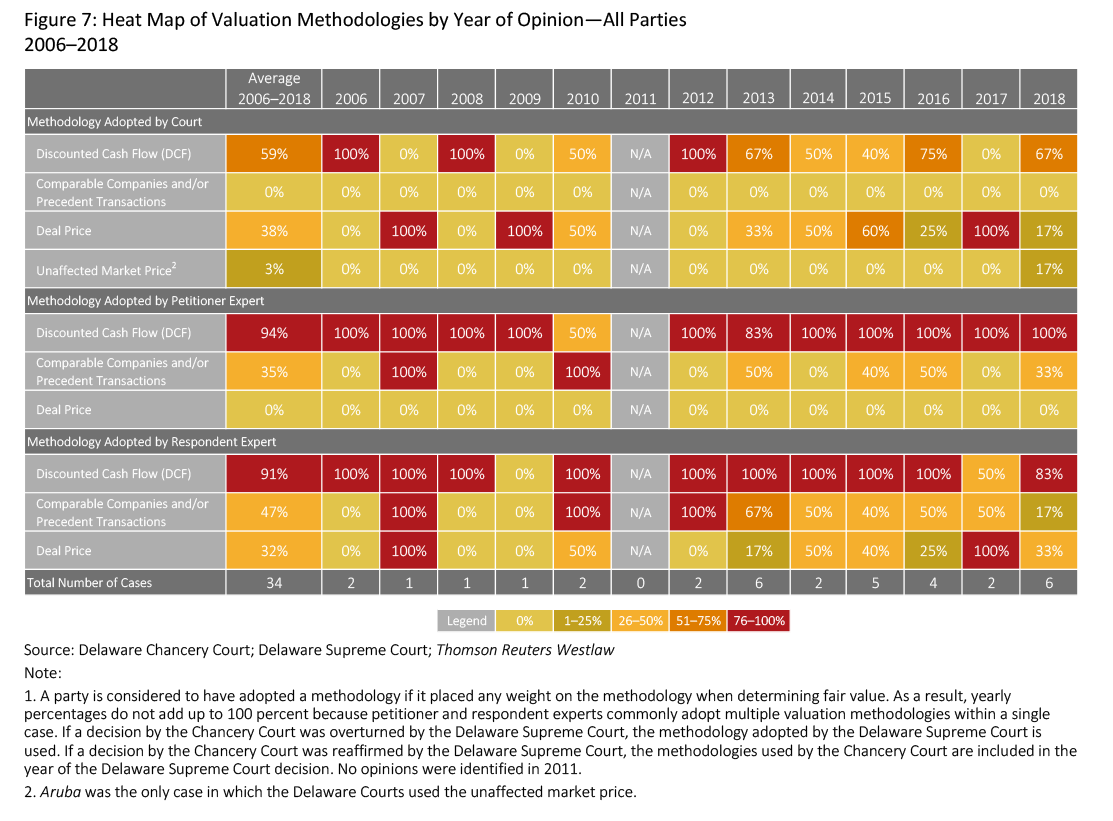

Valuation Methodologies

- Over the 13-year sample period, the Delaware Courts have relied heavily on discounted cash flow (DCF) analyses, despite large differences in the specific implementation employed by petitioner and respondent experts.

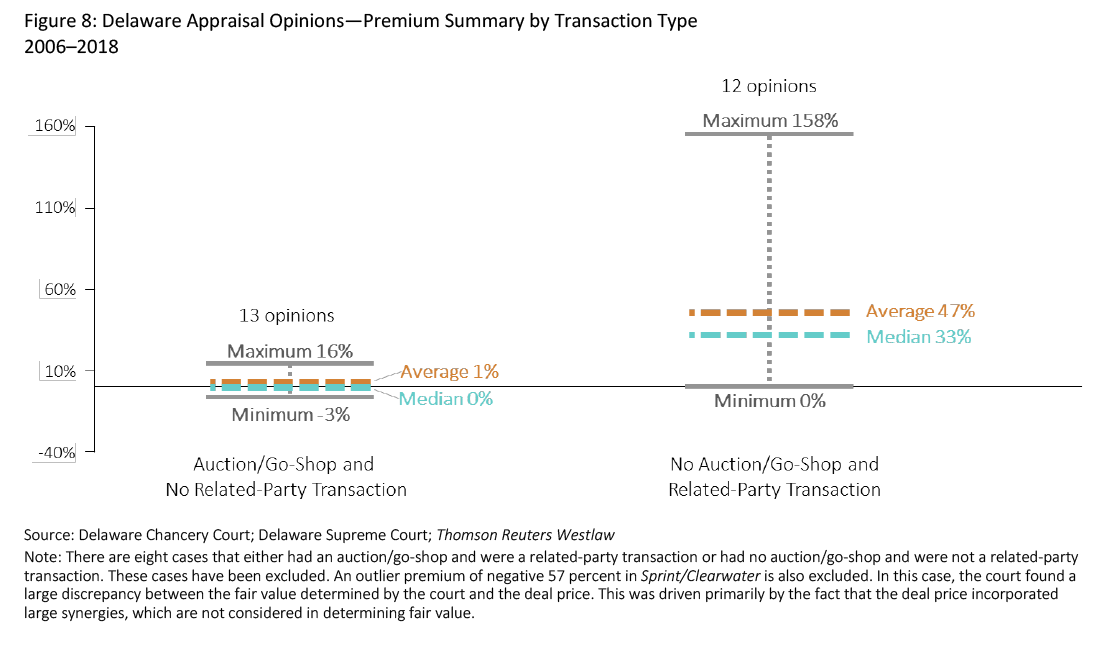

Sales Process

- The robustness of the sales process is an important factor in explaining the premiums to deal price awarded.

- The data show that a robust sales process, in which an auction or go-shop process is used and the acquiring party is not related to the target, results in lower premiums to deal price awarded on average.

Author Commentary

From 2006 to 2018, we observe substantial variation in the premiums to deal price awarded in appraisal actions decided by the Delaware Courts. Recent rulings have highlighted concerns about the quality of the sales process and the methodology used to determine fair value. We expect that more clarity on these issues will be provided in 2019 and beyond.

In Delaware appraisal cases, we observe considerable variation in court decisions over the last 13 years. Premiums to deal price awarded ranged from negative 57 percent for ACP Master Ltd. et al. v. Sprint Corporation et al. & ACP Master Ltd. et al. v. Clearwire Corporation (Sprint/Clearwire) to positive 158 percent for In Re: ISN Software Corp. Appraisal Litigation (ISN Software).

Valuation Methodologies

Experts use three main methodologies to determine fair value—DCF analyses, valuation based on comparables (including comparable companies and precedent transactions), and deference to the deal price. The data show that from 2006 to 2017, the Delaware Courts either deferred to the deal price or relied on DCF analyses to determine fair value.

Even so, the Delaware Courts frequently cite concerns about the subjectivity of DCF models, such as:

- The use of many inputs and the fact that even slight differences in these inputs can produce large valuation gaps.

- The reliability of management projections, such as the neutrality of projections made in expectation of impending litigation or a management buyout.

- Concerns about the selection of the discount rate, including which risk factors are included and the appropriate usage of a historical equity risk premium.

- The trustworthiness of the company’s expected long-term growth rate and its impact on the terminal value of the firm.

- Whether growth rates surpass “sanity checks,” such as forward-looking projections of GDP growth.

Recent Rulings

Two decisions by the Delaware Supreme Court reversed rulings by the Chancery Court that determined that fair value exceeded the deal price. These decisions signaled that the deal price should receive substantial weight as long as the sales process was “robust,” leading to the question of what constitutes a sufficiently robust process.

In In Re Appraisal of DFC Global Corp. (DFC Global, July 2016), the Chancery Court awarded a premium to deal price of 8 percent, despite the court’s finding that the deal price was the result of a robust sale process. The Delaware Supreme Court reversed and remanded the appraisal decision of the Chancery Court in August 2017, and indicated that an increased reliance upon the deal price was appropriate.

In In Re: Appraisal of Dell Inc. (Dell, May 2016), the Chancery Court held that the deal process was sufficiently robust to satisfy fiduciary duties, but not to warrant deference to the deal price. Instead, the Chancery Court relied on a DCF analysis to determine fair value and awarded $17.62, an award 26 percent higher than the deal price of $13.96.7 This award was also higher than the 30-day average unaffected stock price of $12.53.

The Delaware Supreme Court, however, later concluded that the sales process was sufficiently robust for the purpose of price discovery. Officially, the Delaware Supreme Court remanded the case to the Chancery Court, stating: “[O]n this particular record, the trial court erred in not assigning any mathematical weight to the deal price. In fact, the record as distilled by the trial court suggests that the deal price deserved heavy, if not dispositive, weight.”

In light of Dell and DFC Global, in In Re: Verition Partners Master Fund Ltd. et al. v. Aruba Networks Inc. (Aruba, February 2018), the Chancery Court found that the most reliable indicator of fair value was in fact the 30-day average unaffected trading price of Aruba’s stock on the Nasdaq exchange. This method, which the court applied in this matter for the first time, resulted in a fair value estimate of $17.13, below the deal price of $24.67. The Chancery Court accorded full weight to this indicator and no weight to any other indicator, including its own “deal-price-less-synergies” estimate of $18.20.

In another ruling, In re Appraisal of AOL Inc. (AOL, August 2018), the Chancery Court used the deal price as a robustness check on its DCF analysis, which came in below the deal price. Coining the term “Dell-compliant,” the court determined that the sales process in AOL did not meet the standard set in Dell and that fair value could thus not be determined solely based on deal price. The court instead relied on a DCF analysis, which resulted in a 6 percent discount to the deal price.

Looking Ahead

Decisions such as DFC Global, Dell, Aruba, and AOL highlight the importance of the robustness of the sales process and the use of an appropriate methodology to determine fair value. Reliance on market prices in recent decisions appears to have affected the methodologies used for determining fair value. We expect that more clarity on these issues will be provided by the Delaware Courts in 2019 and beyond.

Chancery Court Petitions

Appraisal petitions filed in Delaware nearly quadrupled from 2012 to 2016 but have been declining thereafter.

Number of Appraisal Petitions and Merger Cases

- From 2006 to 2018, a total of 433 appraisal petitions were filed in Delaware. These petitions corresponded to 320 unique merger cases, as the Delaware Courts frequently consolidate multiple filings against the same respondent.

- The number of unique merger cases for which shareholders filed appraisal actions increased from a low of 12 in 2010 to a peak of 47 in 2016.

- In 2017 and 2018, the number of cases fell to 34 and 22, respectively, declining by 28 percent from 2016 to 2017 and a further 35 percent from 2017 to 2018.

- The recent decrease in appraisal petitions followed a similar pattern, declining 21 percent from 2016 to 2017 and 57 percent from 2017 to 2018.

Top Petitioners and Most Frequently Used Counsel

- The top 10 petitioners accounted for more than half (254) of the 433 appraisal petitions filed between 2006 and 2018.

- The concentration in petitioners was largely driven by hedge funds and private equity firms that actively pursue a strategy of appraisal arbitrage. This strategy involves purchasing shares after the record date and filing appraisal petitions with the goal of receiving an award greater than the deal price as well as statutory interest.

- Since the 2007 Transkaryotic decision (see page 12), which first permitted appraisal of shares purchased after the record date, appraisal arbitrage has become an increasingly viable strategy for asset management firms.

- The data also indicate substantial concentration in the counsel used by repeat filers. The top 10 petitioners were represented by the same legal counsel in 230 of the 254 petitions they filed.

Top Petitioner and Respondent Counsel

- Between 2006 and 2018, the top 10 petitioner law firms were involved in 423, or 98 percent, of the 433 appraisal petitions filed.

- The top three petitioner law firms accounted for over half of all filings.

- Similarly, the top 10 respondent law firms were involved in 332, or 77 percent, of total petitions filed.

- The top three respondent law firms represented over half of all respondents.

Delaware Courts’ Trial Opinions

There were 34 cases that went to trial and were decided by the Delaware Courts between 2006 and 2018. These cases varied with respect to their life cycle and timing, the specific awards granted by the courts, and the methodologies applied to determine fair value.

Life Cycle and Timing

- The data show considerable variation in the timing of Delaware appraisal cases that went to trial. These cases took on average about 25 months from the filing of the petition to trial, with the longest case taking over seven and a half years to reach the trial stage, and the shortest case taking just over one year.

- In addition, the average trial lasted five days and the average time from trial to the issuance of the initial opinion was approximately eight months.

- Finally, for the four cases in which the Delaware Supreme Court issued an opinion on appeal, there were, on average, just over 13 months between the date of the initial Chancery Court opinion and the most recent Delaware Supreme Court opinion.

Premium to Deal Price Awarded

- Of the 34 cases that went to trial between 2006 and 2018, 16 resulted in awards above the deal price and 18 resulted in awards at or below the deal price.

- In the Sprint/Clearwire merger, which resulted in a bidding war that drove up the deal price, the Chancery Court awarded the largest negative premium to deal price of negative 57 percent.

- At the opposite end of the spectrum, the award in ISN Software was a positive 158 percent premium to deal price.

- On average, the premium to deal price across all 34 opinions was 18 percent, with eight cases with awards below deal price, 10 cases in which the deal price was accepted as fair value, and 16 cases with awards above deal price. Among these 16 cases, the average premium was 47 percent.

Premiums Proposed by Experts and Awarded by Judges

- Among private target firms, the average premium to deal price proposed by petitioner experts was 380 percent, with the petitioner’s expert in one case suggesting an award 1,800 percent above deal price.

- Among publicly traded target firms, the average award

proposed by petitioner experts was 74 percent above deal price. - In contrast, respondent experts overwhelmingly proposed awards below the deal price. Their average proposed awards for both public and private target firms were negative 17 percent.

- The awards determined by the Delaware Courts reflected the public or private status of the target, with public targets receiving on average only an 8 percent award to deal price, as opposed to 47 percent for private firms.

Valuation Methodologies Used by Experts and the Delaware Courts

- The three main methodologies used to determine fair value were DCF analyses, valuation based on comparables (including comparable companies and/or precedent transactions), and reliance on the deal price (“deference to the deal price”).

- Petitioner experts overwhelmingly relied on DCF analyses, preparing a DCF model in 94 percent of the cases. In 35 percent of the cases, they used a form of comparables analysis, in which they asserted that the fair value of the firm at issue could be determined through comparison to other companies and/or precedent transactions.

- Respondent experts also employed DCF analyses in the vast majority of the cases, considered comparable companies and/or precedent transactions in approximately half of the cases, and relied in part or fully on the deal price about a third of the time.

- Over the 13 years from 2006 to 2018, 59 percent of opinions issued by the Delaware Courts utilized a DCF analysis, 38 percent relied on the deal price in determining fair value, and no opinion relied on comparable companies and/or precedent transactions.

- In February 2018, in Aruba, the Chancery Court ruled that in an efficient market, the market price was the most reliable measure of fair value. The court adopted a new methodology for determining fair value: Aruba’s 30-day average unadjusted market price.

Sales Process

- Some transactions included either an auction or a “go-shop” process, in which the target company was allowed to solicit competing bids for a period of time after the merger agreement was signed. If executed properly, the use of such processes can indicate a robust sales process.

- This practice has become increasingly common— between 2012 and 2018, 17 out of the 27 mergers subject to appraisal actions (63 percent) included an auction or go-shop process, compared to none of the seven mergers between 2006 and 2011.

- In addition, the absence of related-party involvement in mergers can also be viewed as a proxy for a robust sales process. This analysis examines two types of transactions: the first set of 13 opinions concerns mergers that were not related-party transactions and which included an auction or go-shop process. The second set of 12 opinions concerns mergers that involved a related party and which did not include an auction or go-shop process. Given these characteristics, the first set of transactions potentially has a more robust sales process than the second.

- In transactions that included an auction or go-shop process and the acquiring firm was not a related party, the average premium to the deal price awarded was 1 percent and the median premium was 0 percent. Among these 13 cases, the premium ranged between negative 3 percent and positive 16 percent.

- In transactions without an auction or go-shop process and where the acquirer was a related party, the average premium to the deal price awarded was 47 percent, with a median of 33 percent. These transactions had substantially wider variations in premium, with minimum and maximum premiums of 0 percent and positive 158 percent, respectively.

Section 262: Appraisal in Delaware

Minority shareholders of Delaware corporations who disagree with the deal price in a proposed merger or consolidation are allowed to seek appraisal of their shares under certain conditions in accordance with Section 262 of Delaware General Corporate Law.

If they opt to do so, these shareholders forgo their right to exchange shares at the agreed-upon deal price and instead accept the fair value for their shares as determined by the Delaware Courts.

While there are various caveats to the requirements determining the right to petition for appraisal, the majority of cash-out mergers are eligible. Notably, shareholders may also obtain statutory appraisal remedies even if they acquire shares after the record date for determining entitlement to vote on the merger.

A 2007 opinion in In re: Appraisal of Transkaryotic Therapies Inc. (Transkaryotic) opened the door for appraisal arbitrage, and the data show that this strategy has become more prevalent over time. In Transkaryotic, the Delaware Courts determined that an investor who purchases publicly traded shares in the open market may have no way of ascertaining who owned the shares on an earlier date or compelling the unknown prior owner to grant a proxy that would enable the current owner to vote the shares. In essence, the Transkaryotic decision allowed appraisal arbitrageurs to purchase shares after the record date for the stockholder vote for the merger in question and submit these shares for appraisal.

In determining fair value, Delaware Courts are instructed to “take into account all relevant factors.” As explained in detail by the Delaware Supreme Court in Tri-Continental Corp. v. Battye et al., “market value, asset value, dividends, earning prospects, the nature of the enterprise and any other facts which were known or which could be ascertained as of the date of merger and which throw any light on future prospects of the merged corporation are not only pertinent to an inquiry as to the value of the dissenting stockholders’ interest, but must be considered by the agency fixing the value.”

However, it is important to note that Section 262(h) requires Delaware Courts to determine fair value “exclusive of any element of value arising from the accomplishment or expectation of the merger or consolidation, together with interest, if any, to be paid upon the amount determined to be the fair value.” This means any synergies expected from the merger should be excluded in determining the fair value of the target company, as the appraisal’s “purpose is to compensate dissenting stockholders for what was taken from them.”

Research Sample

Appraisal petitions filed in the Chancery Court are identified through Courthouse News Service, a third-party data provider that publishes original news content on civil litigation from the date of filing through the appellate level.

A keyword search is used to identify appraisal cases, followed by a manual review to remove cases that are not appraisal actions. Subsequently, the case docket associated with each appraisal petition is collected. The Data Analytics Project Group at Cornerstone Research then performs advanced text analytics to identify relevant information from each appraisal petition.

This search results in a sample of 433 petitions filed between January 1, 2006, and December 31, 2018.

Appraisal petitions that result in trial decisions are identified through a manual review of all opinions and orders from the Chancery Court and the Delaware Supreme Court. The sample of Delaware Court opinions includes opinions issued between January 1, 2006, and December 31, 2018. Opinions dated in 2006 and one opinion dated in 2007 stem from petitions filed before the start of the appraisal petition data. The manual review identified 34 appraisal petitions that resulted in trial decisions.

Each published opinion is reviewed and relevant information is categorized for further analysis. Expert reports in these matters are typically confidential and unavailable for data collection. All information collected on expert valuation methodologies is collected from opinions filed by the Delaware Courts in these matters and is subject to the limitation of the information the judge deemed relevant to discuss in the opinion.

The complete publication, including footnotes, is available here.

Print

Print