Elaine Harwood is vice president, Frank Mascari is principal, and Laura Simmons is senior advisor at Cornerstone Research. This post is based on their Cornerstone report.

Executive Summary

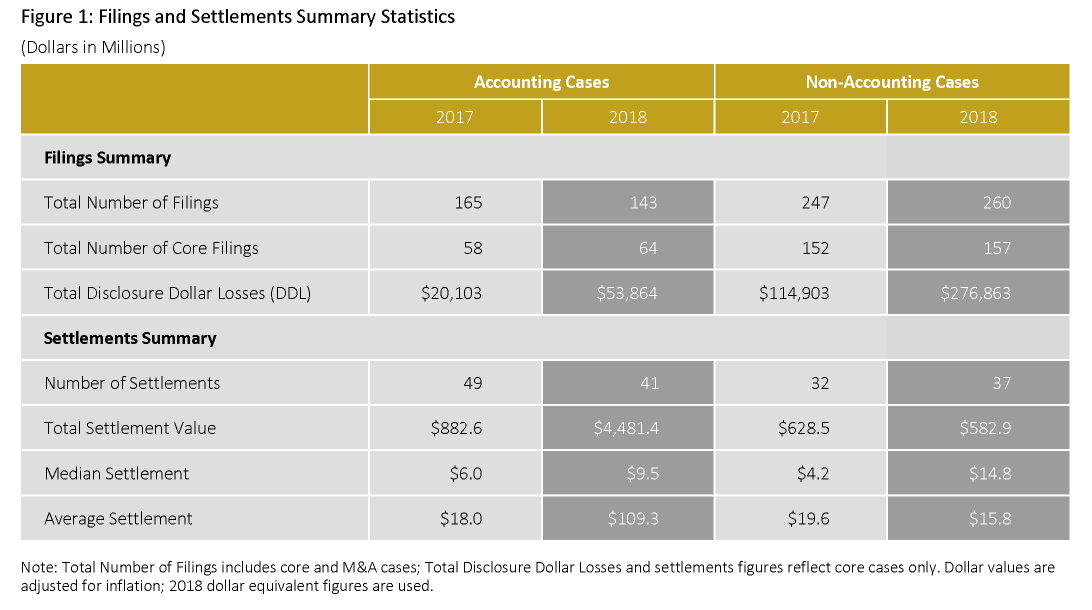

Securities class action filings involving accounting allegations remained at uncharacteristically high levels as the trend of core filings against larger defendant firms continued. The total value of accounting class action settlements rebounded to the second-highest level in the last 10 years, with all five mega settlements involving an accounting allegation.

There were 143 securities class actions involving accounting allegations (accounting case filings) during 2018, nearly 86 percent more than the historical average.

- Total accounting case filings far exceeded post-PSLRA (Private Securities Litigation Reform Act) levels for the second year in a row. The total was driven by the filing of 79 merger and acquisition (M&A) accounting case filings alleging failure to reconcile a non-GAAP measure to a GAAP measure.

- Market capitalization losses for core accounting case filings rose to its highest level in the last 10 years as the trend of filings against larger defendant firms continued.

- The number of accounting case settlements declined relative to 2017 and the prior five years but remained above the lows in 2011–2012.

- The value of accounting case settlements more than quintupled compared to the prior year, comprising almost 90 percent of total settlement value in 2018.

- The average settlement for accounting cases increased dramatically due to a handful of large settlements. In addition, the median settlement amount for accounting cases overall increased by almost 60 percent, indicating a broader shift in the typical case size.

Filings

Number of Accounting Case Filings

- Plaintiffs filed 143 accounting cases in 2018, the second highest on record after 2017.

- Accounting case filings declined by 13 percent in 2018, driven by fewer M&A-related accounting case filings.

- Despite the decline in accounting case filings in 2018, the proportion of accounting cases to total cases (35 percent), remained consistent with the historical average proportion (36 percent).

- The total number of accounting case filings in 2018 was 86 percent higher than the 2009–2017 average of 77.

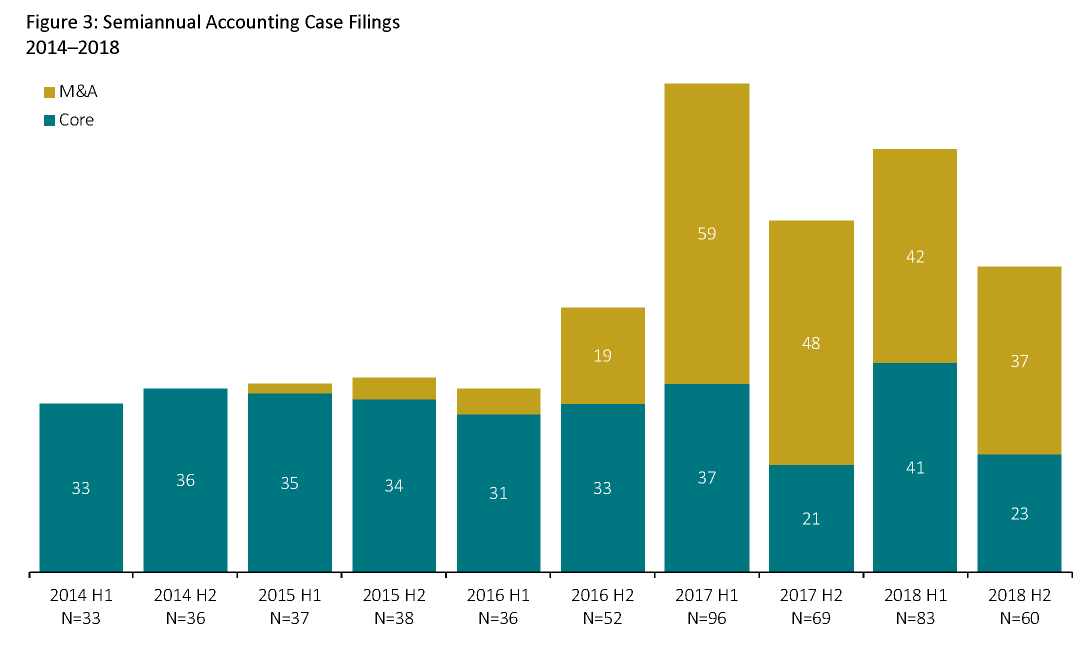

Semiannual Accounting Case Filings

- Total accounting case filing activity decreased by 28 percent in the second half of 2018 compared to the first half of the year.

- The second-half decline in 2018 accounting case filings (28 percent) is significantly greater than the second-half decline in total filings (2 percent).

- Although the pace of M&A accounting case filings slowed in the second half of 2018, the number of cases filed remained at relatively high levels.

- Two-thirds of core accounting cases were filed in the first half of 2018, mirroring the filing activity in 2017.

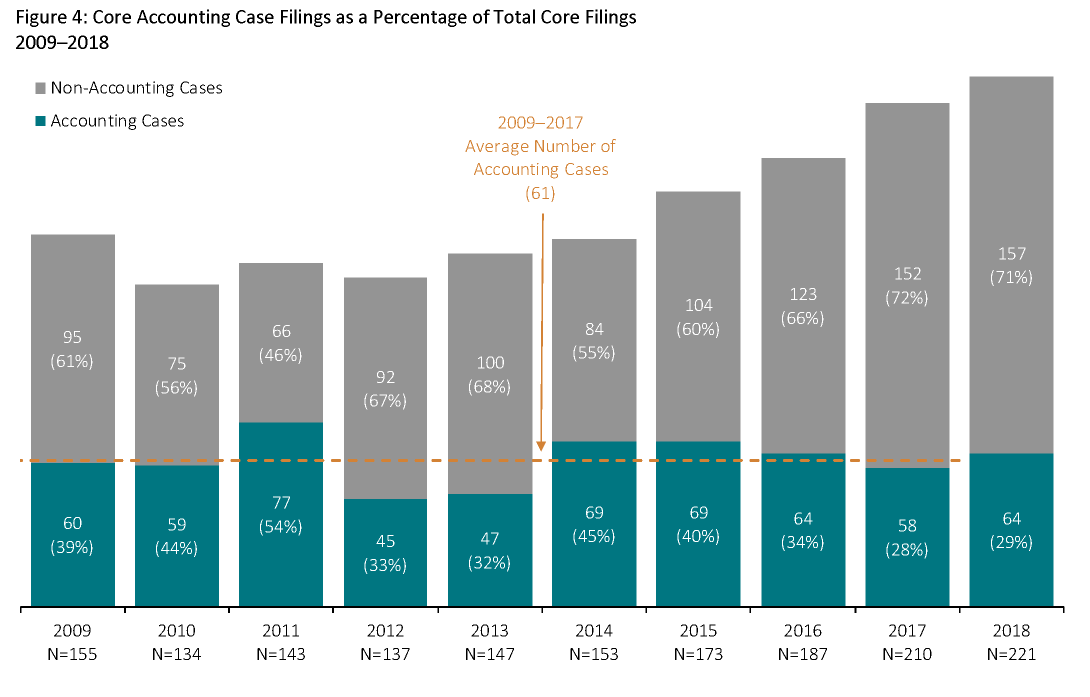

Core Accounting Case Filings

- There were 64 core accounting case filings in 2018, an increase of 10 percent from 2017.

- As a percentage of total core filings, core accounting cases were largely unchanged from 2017. The number of accounting case filings in 2018 was slightly higher than the 2009–2017 average.

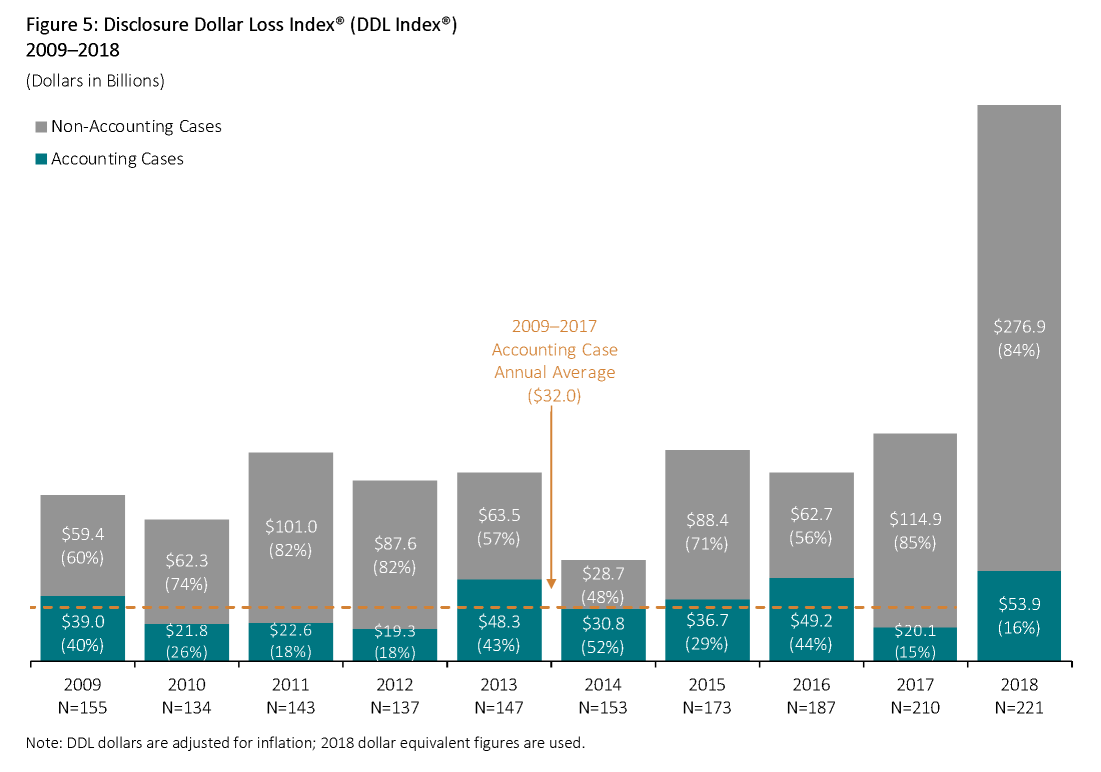

Core Accounting Case Filings and Market Capitalization Losses: Disclosure Dollar Loss Index® (DDL Index®)

This index measures the aggregate DDL for all filings over a period of time. DDL is the dollar value change in the defendant firm’s market capitalization between the trading day immediately preceding the end of the class period and the trading day immediately following the end of the class period. DDL should not be considered an indicator of liability or measure of potential damages.

- DDL for accounting cases in 2018 was 68 percent greater than the average annual DDL for all accounting cases over the last 10 years.

- In 2018, there were three accounting cases with a DDL of at least $5 billion (mega DDL cases). The three mega DDL cases accounted for approximately one-third of the total accounting case DDL in 2018.

- The increase in 2018 DDL was not solely the result of mega DDL cases—DDL for accounting case filings increased by approximately 80 percent excluding mega DDL cases. This trend is consistent with the increase in the size of issuer defendants as measured by market capitalization.

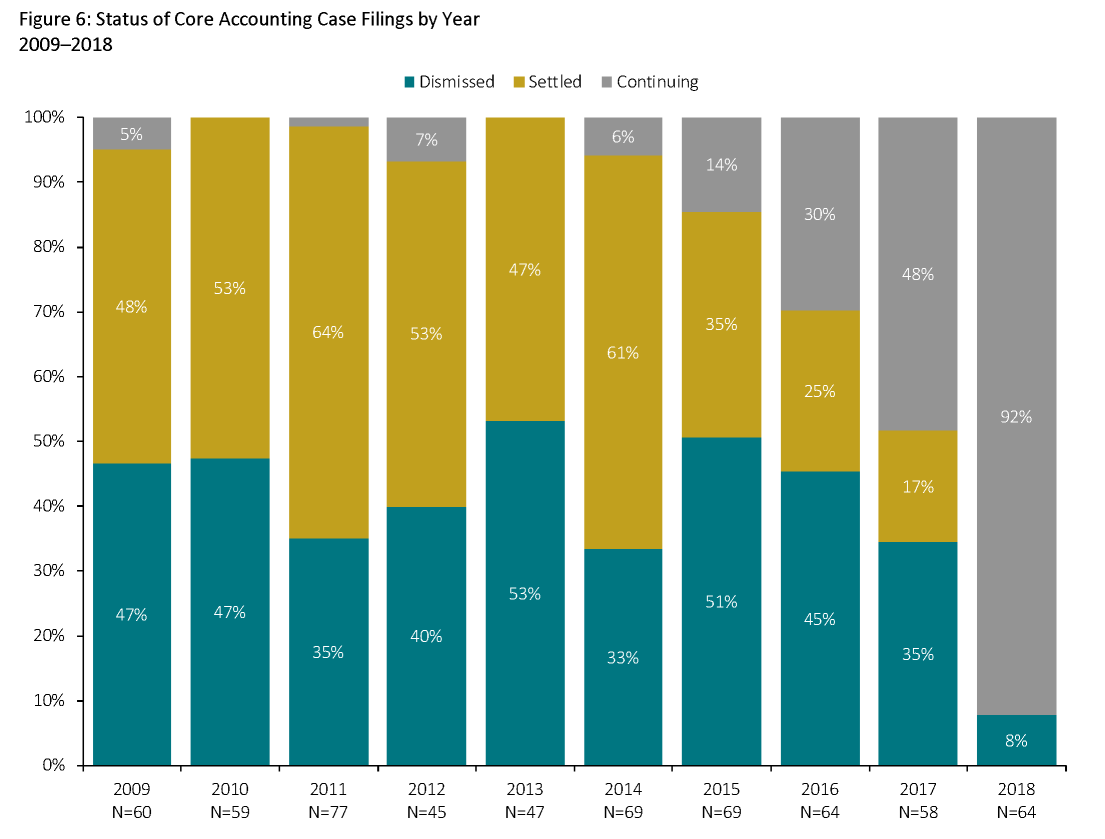

Status of Core Accounting Case Filings

This analysis examines whether filing outcomes have changed over time and compares the outcomes of filing cohort groups. As each cohort ages, a larger percentage of cases are resolved—whether through dismissal, settlement, or trial verdict outcome.

- From 2009 through 2017, 45 percent of core accounting cases settled, 43 percent were dismissed, and 12 percent are continuing.

- Dismissal rates for M&A accounting cases filed in the past two years have been significantly higher than the rates for core accounting cases. The majority of 2017 and 2018 M&A accounting cases have been dismissed—94 percent and 68 percent, respectively.

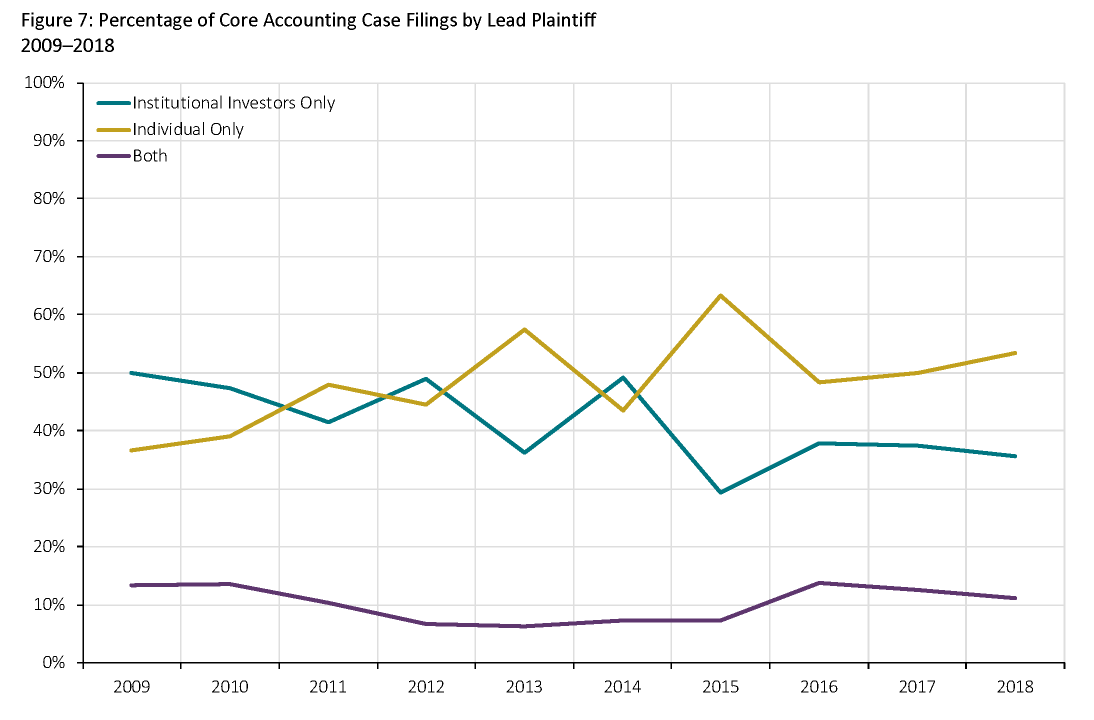

Core Accounting Case Filings by Lead Plaintiff

This analysis examines how frequently individual or institutional investors were appointed as lead plaintiffs in core accounting cases.

- On average, individual investors were appointed as lead plaintiffs in 48 percent of core accounting cases over the last 10 years.

- Institutional investors were appointed as lead plaintiffs more often than individual investors in only four of the last 10 years and not since 2014. A similar pattern exists for all core securities class action filings.

Settlements

Number of Accounting Case Settlements

- The proportion of accounting case settlements in relation to all settlements decreased in 2018 to the second-lowest level over the last 10 years.

- The number of accounting cases as a percentage of settlements remained higher than the percentage of filings. This is because accounting cases have historically been less likely to be dismissed (and thus more likely to settle), and accounting allegations are often added as cases progress beyond the initial complaint.

- Each of the three plaintiff law firms that have been associated with event-driven litigation was involved as lead or co-lead counsel in more accounting case settlements than any other plaintiff law firm. This may suggest that even cases initially brought as a result of an operating event often incorporate accounting allegations prior to reaching settlement.

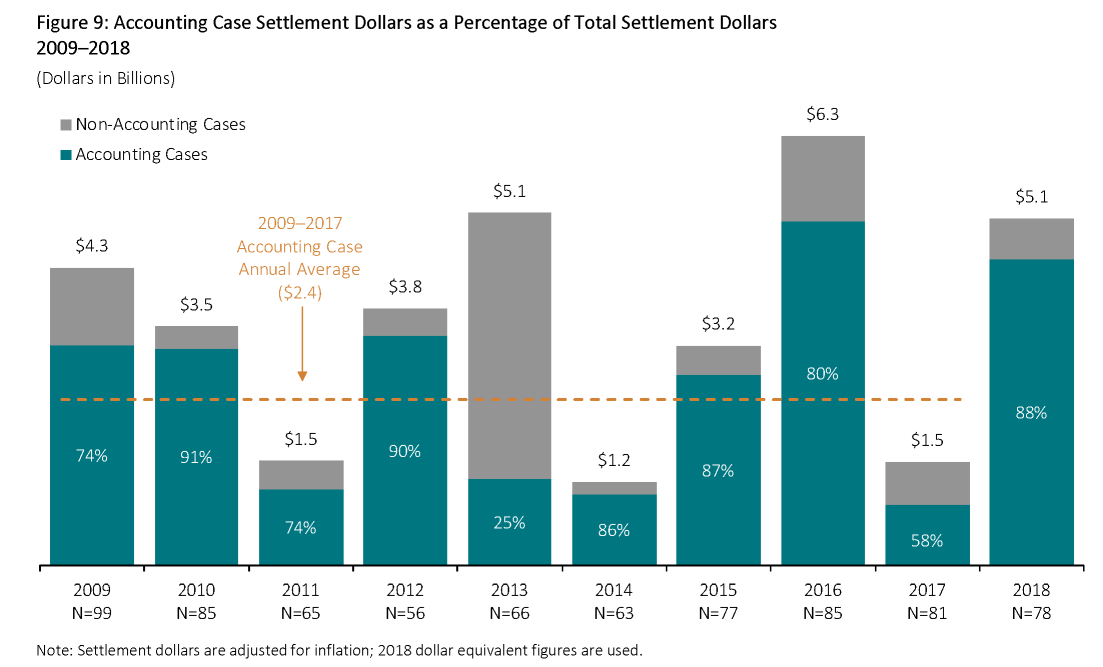

Accounting Case Settlement Size

- With the addition of settlements in 2018, total settlement dollars for all post-PSLRA cases reached more than $100 billion, of which approximately $86 billion comprised accounting case settlements.

- Total settlement dollars continues to vary substantially from year to year due to the presence or absence of very large settlements.

- At $4.48 billion, the total settlement value of accounting cases in 2018 was the second highest over the last 10 years.

- Overall, in 2018, five settlements were $100 million or more (mega settlements). All five of these settlements involved alleged weaknesses in internal controls, and four out of the five involved allegations of GAAP violations.

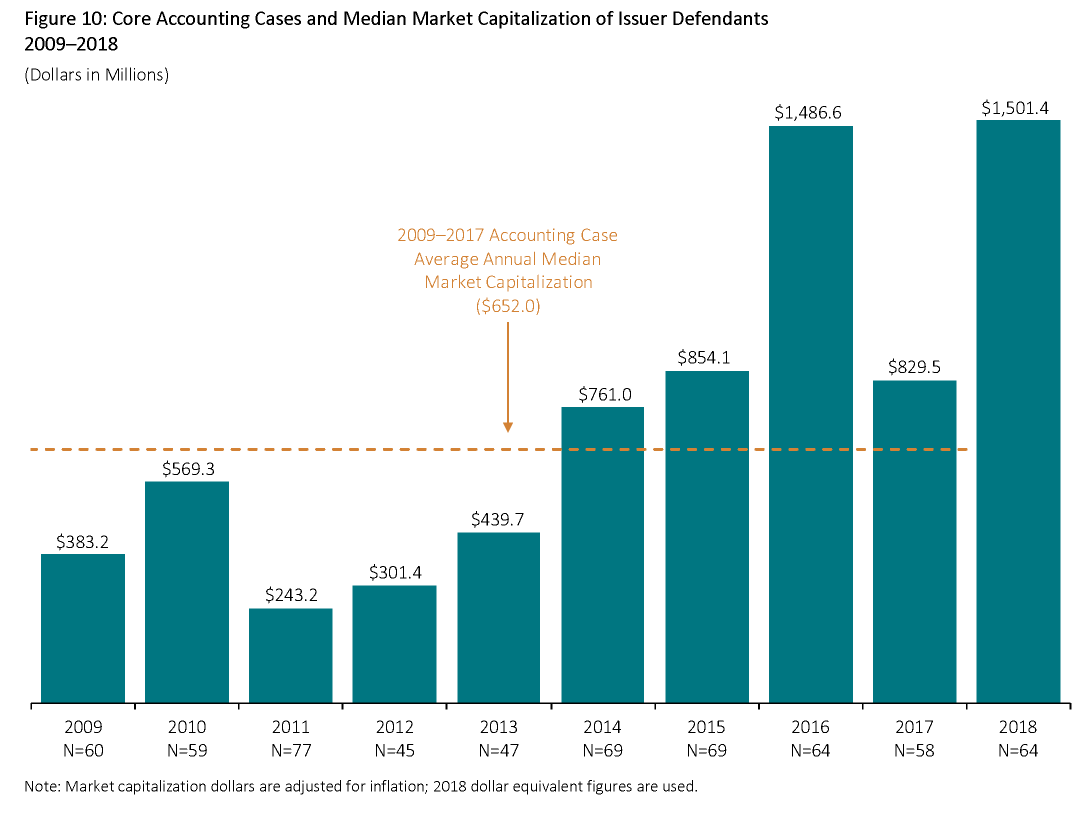

Firm Size

Core Accounting Cases by Firm Size

This analysis examines whether the size of defendant firms has changed over time based on their pre-disclosure market capitalization.

- Over the past five years, accounting cases have been filed against larger issuer defendants than in prior years.

- At $1.5 billion, median market capitalization of issuer defendants was more than double the 2009–2017 average.

- Median market capitalization in 2018 for issuer defendants in the Industrial sector was more than five times greater than the median market capitalization for all core accounting cases.

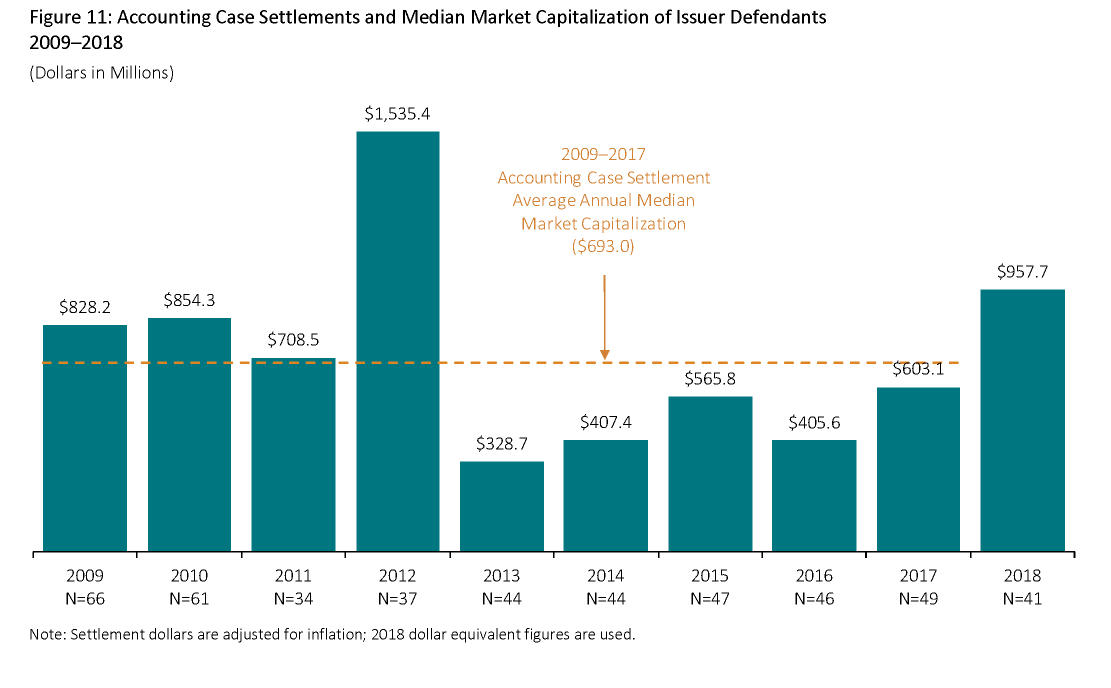

Accounting Case Settlements by Firm Size

- In 2018, the size of issuer defendants involved in accounting case settlements, as measured by median market capitalization, increased by almost 60 percent compared to 2017.

- Larger issuer defendant firms are generally associated with higher accounting case settlement amounts.

- Historically, accounting cases involving larger issuer defendants have also been associated with institutional lead plaintiffs and longer periods from filing to settlement; however, neither of these patterns was true in 2018.

Industry

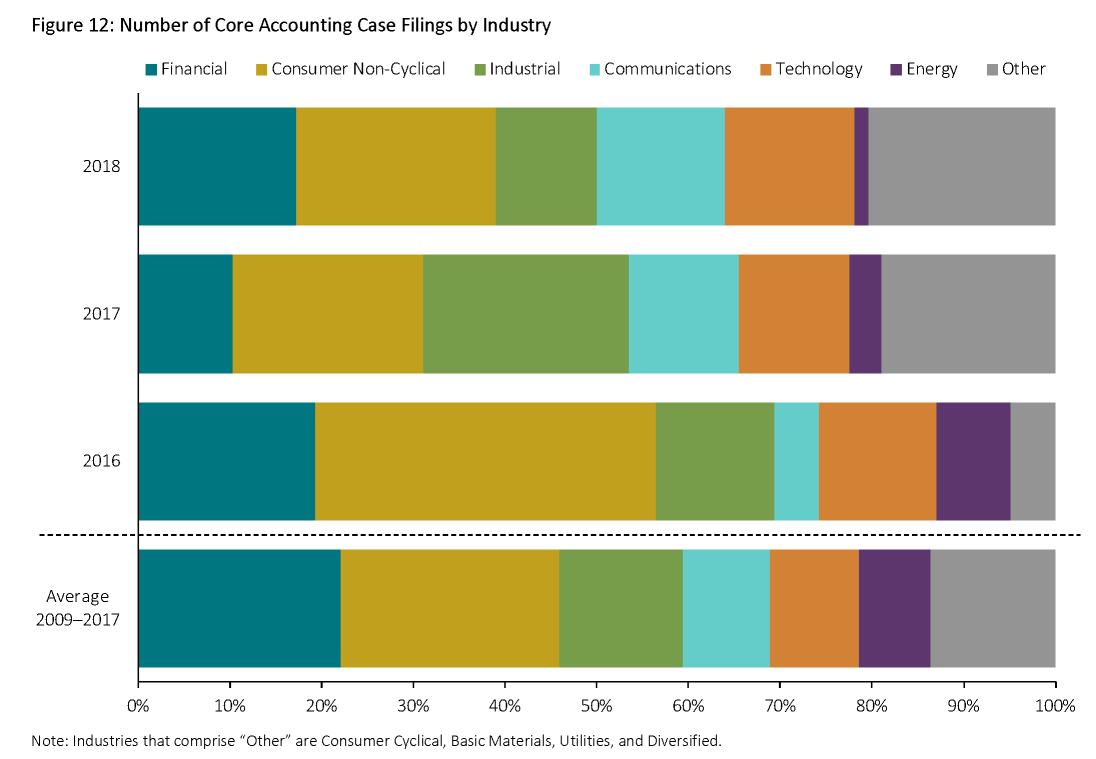

Core Accounting Case Filings by Industry

- Despite the large increase in DDL for Industrial sector accounting cases, the number of cases in this sector decreased by 46 percent from 2017, dropping below its historical average.

- There were more cases in the Consumer Non-Cyclical sector (which includes biotechnology, healthcare, and pharmaceutical companies) than any other sector. The DDL for these cases was over 20 percent greater than the historical average for this sector.

- The number of accounting cases filed in the Financial sector increased by 83 percent in 2018.

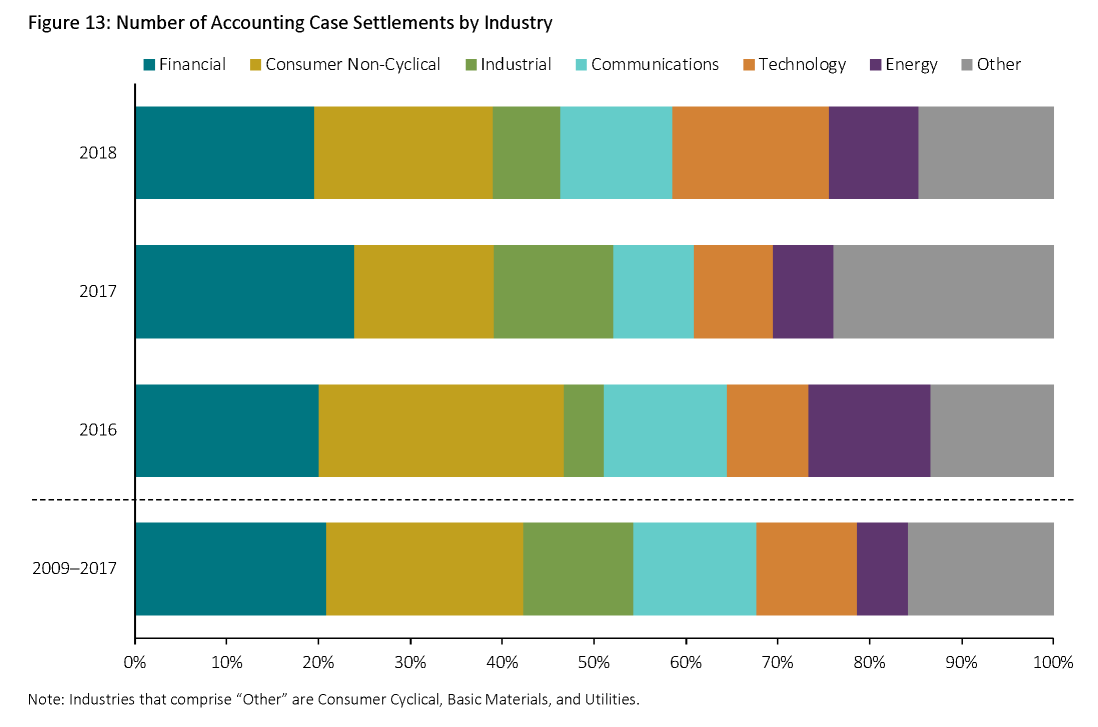

Accounting Case Settlements by Industry

- Energy sector accounting case settlements represented nearly 70 percent of the total dollar value for all accounting settlements even though they only comprised 10 percent of accounting settlements.

- In 2018, the dominance of Energy sector accounting case settlements is in sharp contrast to non-accounting cases, which had no Energy sector settlements.

- The number of accounting case settlements in the Financial sector was similar to 2016 and earlier years. However, the proportion of accounting case settlement dollars represented by financial firms was substantially lower, indicating that these cases settled for smaller amounts than in prior years.

- The number of accounting case settlements in the Consumer Non-Cyclical sector increased slightly, but the value of these settlements declined over 30 percent compared to 2017.

Restatements

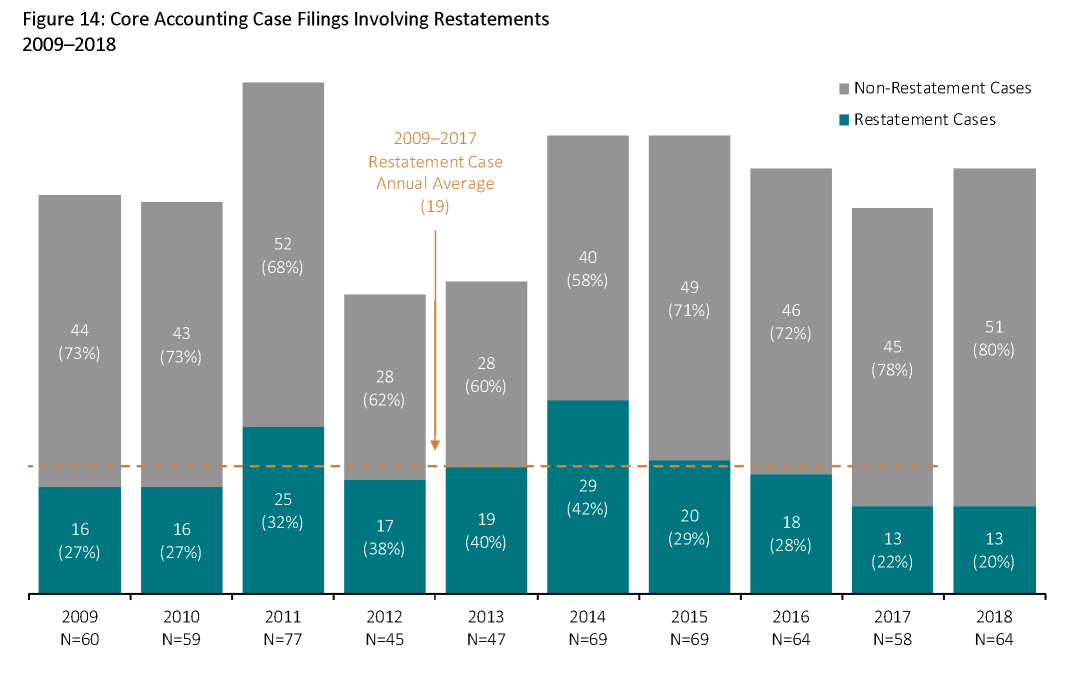

Core Accounting Case Filings Involving Restatements

- Cases involving financial statement restatements were 20 percent of the total number of core accounting cases.

- Companies in the Technology and Industrial sectors accounted for more than half of the restatement cases. Only one other sector, Basic Materials, had more than one case.

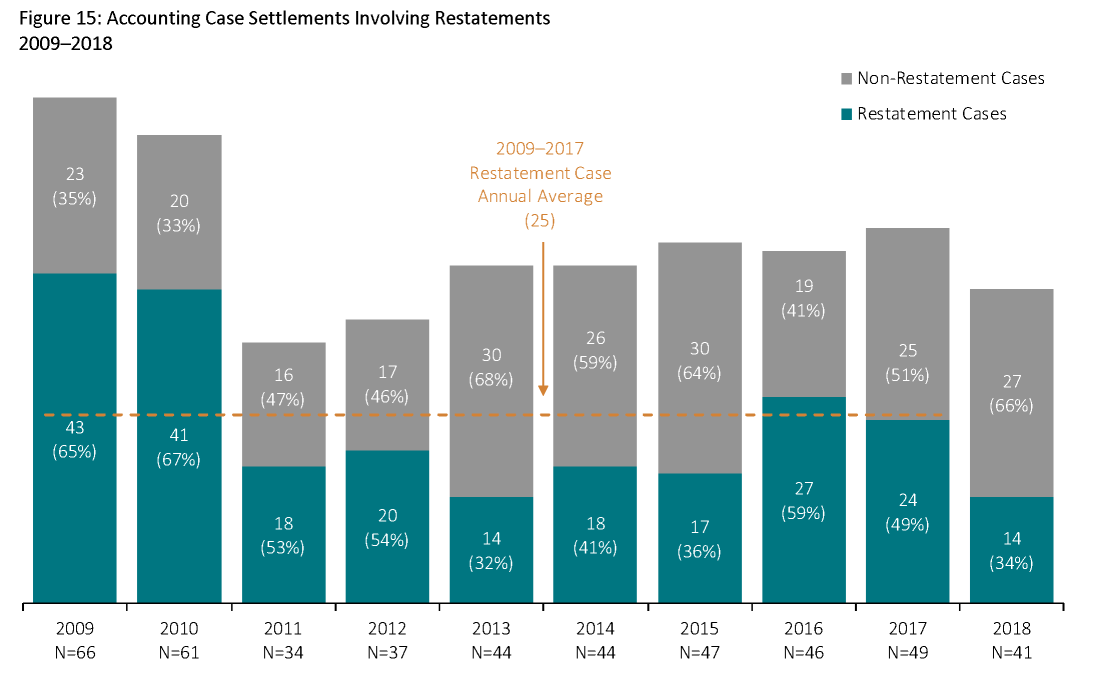

Accounting Case Settlements Involving Restatements

- Both the number and proportion of accounting case settlements involving financial statement restatements was the lowest since 2013.

- The decline in settlements involving restatements is consistent with observations made in other literature regarding an overall decline in the number of financial statement restatements by publicly traded firms in the United States.

- Settled cases involving restatements tend to involve allegations of internal control weaknesses and longer class periods.

- Similar to accounting cases overall, the three plaintiff law firms that have been associated with the rise in event-driven litigation were also frequently involved with settlements involving restatements. Specifically, these three firms served as lead plaintiff counsel in 10 out of 14 settlements involving restatements (sometimes with other co-lead counsel).

Internal Control Weaknesses

Core Accounting Case Filings Involving Allegations of Internal Control Weaknesses

- After a significant drop in 2017, cases with an allegation of an internal weakness but no announcement of an internal control weakness returned to historical levels.

- The number of accounting cases containing an allegation and announcement of internal control weaknesses exceeded the historical average for the sixth consecutive year.

- Allegations of internal control weaknesses arose in more than three out of four restatement cases.

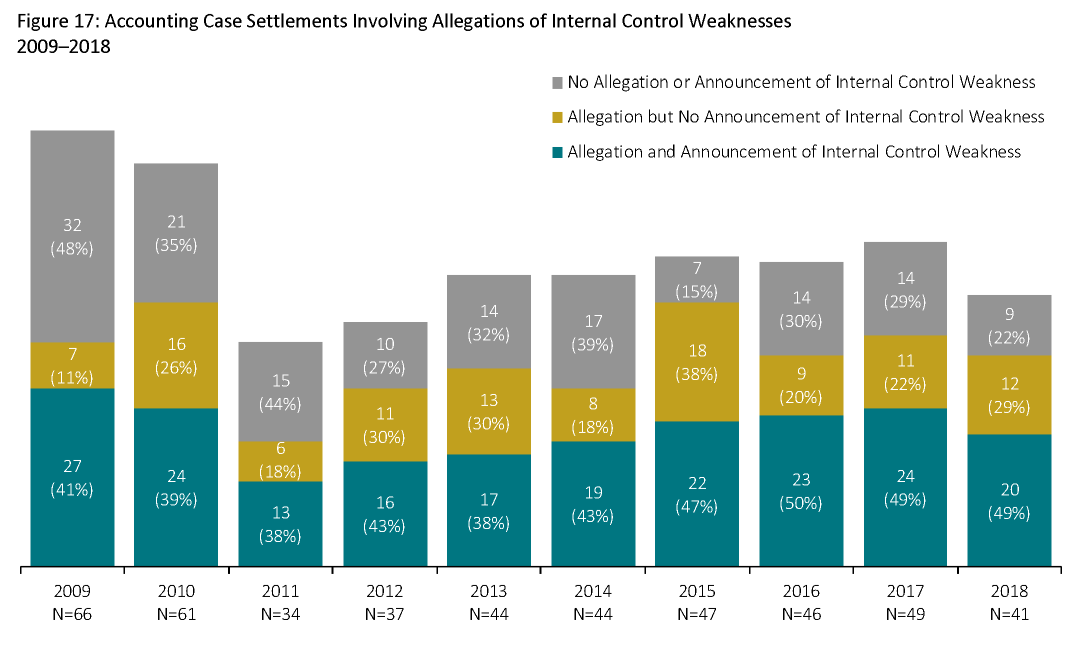

Accounting Case Settlements Involving Allegations of Internal Control Weaknesses

- The number of accounting case settlements involving an allegation and announcement of internal control weaknesses declined for the first time in seven years.

- The majority of accounting case settlements continue to involve allegations of internal control weaknesses (with and without accompanying announcements).

- Settlements of cases involving announcements of internal control weaknesses are more frequently associated with institutional investors as lead plaintiffs and accompanying derivative actions.

- While allegations of internal control weaknesses are common, they are not associated with higher settlement amounts, based on a regression analysis that accounts for several factors affecting settlements.

The complete publication, including footnotes, is available here.

Print

Print