Jennifer Burns is Audit & Assurance Partner at Deloitte & Touche LLP. This post is based on a Deloitte memorandum by Ms. Burns, Deborah DeHaas, Debbie McCormack, Maureen Bujno, Krista Parsons, and Bob Lamm.

The January 2019 edition of On the board’s agenda—The 2019 boardroom agenda: Something old, something new? suggested that the coming change in audit reports related to “critical audit matters” or “CAMs” would be one of the top issues of board and audit committee focus this year. Audit reports for large accelerated filers will include a new section addressing CAMs beginning for audits of fiscal years ending on or after June 30, 2019, and for other public companies in 2020. This will be a dramatic change in auditor reporting and is expected to generate significant media attention, particularly in the first year of adoption. What is the board’s role with respect to CAMs? How are CAMs identified? What is being done to prepare for CAMs and what might boards expect? This post discusses these questions and highlights considerations for boards in advance of the first auditor reporting of CAMs this summer.

What is the role of the board with respect to CAMs?

While oversight of financial reporting is delegated to the audit committee, boards should remain engaged and understand which areas may be identified as CAMs; this can be achieved through regular communications with the audit committee, auditor, and management. Audit committees, in exercising their oversight role, should engage with the auditor throughout the audit—during planning, interim periods, and at year-end—to understand the CAMs and any issues that may arise that may change the ultimate conclusion regarding CAMs. In addition, the board should understand how management and investor relations are preparing for implementation of CAMs.

What is a CAM and how will auditors identify CAMs?

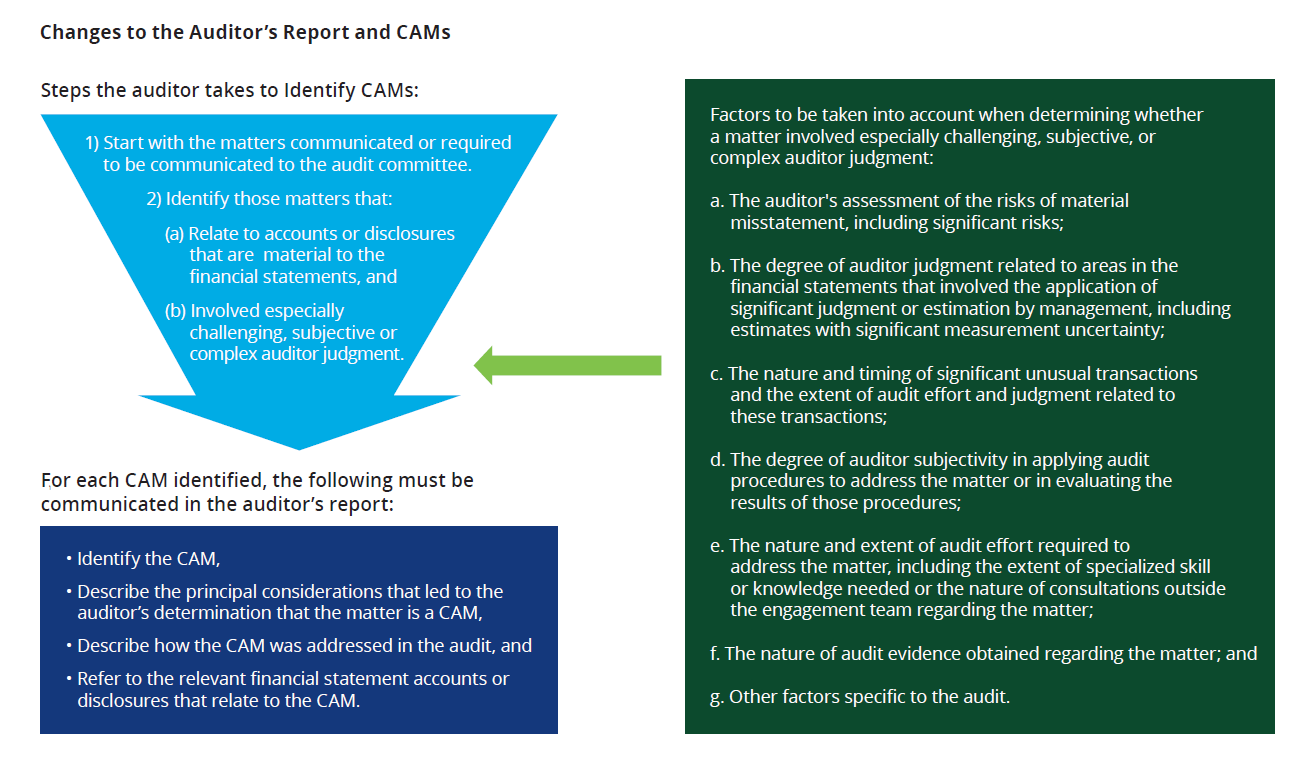

Under the standard adopted by the Public Company Accounting Oversight Board, a CAM is defined as any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee and that:

- Relates to accounts or disclosures that are material to the financial statements AND

- Involves especially challenging, subjective, or complex auditor judgment. [1]

In considering whether the matter relates to accounts or disclosures that are material to the financial statements, a CAM may relate to an entire material account or disclosure, a component of a material account or disclosure, or to several accounts or disclosures.

The PCAOB’s standard provides a non-exclusive list of factors to be considered in determining whether a matter involves especially challenging, subjective or complex auditor judgment. These factors include the risk of material misstatement, the nature and extent of audit effort required, including use of auditor specialists, and areas that involve significant estimation uncertainty. The auditor is required to also take into account other factors specific to the audit.

CAMs are only required to be identified in relation to the current period audit, although there is no prohibition on communicating CAMs for all periods presented.

What areas are likely to be CAMs?

The more common CAMs will likely relate to areas involving a high degree of estimation, such as goodwill impairment, intangible assets, acquisitions, taxes, and illiquid investments. However, a CAM could be identified in an area that does not require significant estimation but instead represents an area of the audit that is especially challenging or an area that is more complex to audit. One example is auditing revenue where contract terms are complex (e.g., situations involving long-term contracts, several modifications to contracts, or multiple performance obligations). In such cases, the significant judgments involved in recognizing revenue may lead to the auditing of revenue being a CAM.

Further, there may be industry-specific matters that involve a high degree of estimation and are typically very material that may be common CAMs (e.g., in the banking industry, the allowance for loan loss or in the insurance industry, the liability reserve).

For each annual audit, the area(s) identified as CAMs may be new or may be similar to those for the prior year, depending upon the facts and circumstances of that particular year’s audit. For example, if a CAM was identified in one year related to income taxes, it is possible that in the next year the area of income taxes no longer rises to the level of a CAM—even though income taxes remain as a line item in the financial statements. However, a matter wouldn’t cease to be a CAM in the following year just because another matter rose to the level of a CAM (i.e., if both matters meet the definition of a CAM in the current year, both would be identified as CAMs).

How will CAMs be described in the auditor’s report?

For each CAM communicated in the auditor’s report, the auditor is required to include introductory CAM language as prescribed by the PCAOB and to:

- Identify the CAM.

- Describe the principal considerations that led the auditor to determine that the matter is a CAM.

- Describe how the CAM was addressed in the audit.

- Refer to the relevant financial statement accounts or disclosures that relate to the CAM (or both accounts and disclosures).

In describing how the CAM was addressed in the audit, the auditor may describe, for example, (1) the auditor’s response or approach that was most relevant to the matter and (2) a brief overview of the audit procedures performed. The PCAOB stated [2] in its release adopting the standard that CAM descriptions are expected to be at a level that investors and other financial statement users would understand. In addition, the objective is to provide a useful summary, not to detail every aspect of how the matter was addressed in the audit. The description should be specific to the audit and clearly and concisely describe why the matter involved especially challenging, subjective or complex auditor judgment. The PCAOB expects that the auditor would identify at least one CAM in each audit, but it has acknowledged the possibility that no CAMs may be identified.

How are auditors preparing for the implementation of CAMs?

Significant efforts are underway at public accounting firms, including Deloitte, to prepare for implementation—including the development of tools and guidance as well as performing “dry-runs” of the CAM requirements. Through the dry-runs, auditors are evaluating what matters might be CAMs, considering how CAMs might be drafted, and discussing potential CAMs with management and the audit committee—in effort to help make sure all understand and are prepared for the CAM requirement when it becomes effective.

Reporting CAMs will be a significant change—and advanced preparation will be beneficial to all involved. We believe some of the benefits and lessons learned so far in doing the dry-runs include:

- Audit professionals are gaining experience about the process of identifying CAMs—which should help result in a smoother implementation process.

- Deciding whether something is a CAM requires significant judgment and is specific to the circumstances of each audit. Therefore, what might be a CAM on one audit may not be a CAM on another audit.

- Drafting CAMs is not easy. For example, it can be difficult to convey concisely the essence of why a matter is a CAM, and to summarize the audit procedures performed in a manner that is informative, but not overly technical. The dry-runs have pointed out the importance of starting the drafting of CAMs early, so the end result is as clear and concise as possible.

- Sharing draft CAMs with members of management and audit committees is providing an opportunity to make sure there is a common understanding about what the requirements are and how the process and timing may work, as well as helping to set expectations regarding CAMs.

- Communicating with management and the audit committee throughout the process of identifying and drafting CAMs will be important. At the same time—the auditor is responsible for the language in the auditor’s report.

In general, the dry-runs are also taking some of the angst out of the system—allowing auditors, management, and audit committees to be better prepared when the requirements become effective.

And speaking of effective dates, the phased in effective dates are very helpful in terms of preparing for implementation. With auditors of large accelerated filers adopting first for fiscal years ending on or after June 30, 2019, lessons learned can be shared with all stakeholders, which may help to ease implementation process for others. For example, December 31 year-end large accelerated filers will be able to benefit from the experiences gained through the first CAMs publicly reported in the summer and fall of 2019.

What may be some of the biggest challenges regarding communication of CAMs in the auditor’s report and how can these challenges be overcome?

One of the challenges that has been raised by some relates to whether CAMs will become boilerplate over time. While CAM topics are likely to be similar, CAMs are required to be specific to the audit and, therefore, are less likely to become boilerplate. For example:

- The reasons why something is a CAM will vary. A CAM may relate to a particular aspect of an account or may arise due to something unique happening at the company.

- The types of audit procedures performed may be different.

- The reasons why the matter involved especially challenging, subjective, or complex auditor judgment may be different.

An area companies have been focused on is aligning their own disclosures with the auditor’s potential CAM descriptions. The PCAOB has explained that auditors are not expected to provide information about the company that hasn’t already been disclosed by the company, unless such information is necessary to describe the principal considerations that led the auditor to determine that a matter is a CAM. [3] As a result, CAM language in the auditor’s report may need to be more descriptive than what the company has historically disclosed in order for the auditor to express why the matter resulted in it being a CAM. In such situations, companies may opt to include additional information in its disclosures. Having regular dialogue about the areas of potential CAMs and the potential CAM descriptions will help management as they consider their own disclosures.

Another challenge that is often raised is whether investors and analysts are prepared for the implementation of CAMs and whether they will understand what the CAMs mean. To help address this challenge, it is important for management, investor relations and communication teams, and those involved in the financial reporting process to understand the CAM requirements, so that they are prepared to address questions that may arise. For example, it is important to understand that the requirement to describe CAMs does not change the opinion in the auditor’s report—CAMs are not “piecemeal” opinions on the individual areas identified, and the auditor’s opinion will continue to be on the financial statements as a whole.

In addition, some have questioned whether CAMs will be consistent across industries and companies (and whether that should be an expectation). In certain industries, there may be certain areas that consistently rise to the level of a CAM (e.g., allowance for loan loss at a bank). However, the similarity may end with the topic of the CAM. As previously mentioned, the PCAOB standard requires CAMs to be particular to the individual audit. For example, what drives the auditor’s conclusion as to why a matter is a CAM, the procedures performed to address the CAM, and the reasons why a matter was especially challenging, subjective or complex is likely to be unique in each situation.

Conclusion

While the inclusion of CAMs is a significant development affecting auditor reports, adequate preparation and an active dialogue among auditors, audit committees, boards and management (including investor relations and communications teams) should help to facilitate a smooth transition to the new standard. We expect significant attention to be paid to the first reporting of CAMs, and as a result, boards should be prepared in advance so that they are less likely to be surprised by questions that arise. By understanding the CAM requirements and staying informed of the areas that may be identified as CAMs, directors will be prepared and will be providing value to their oversight of the company.

Questions for the board to consider asking:

- Have we discussed potential CAMs with the external auditors?

- Have we conducted any “dry-runs” of CAMs?

- If so, what was learned and what should we expect? What matters do we think are likely to be the subject of our CAMs?

- If not, why not?

- Is management considering whether company disclosures related to those areas that may be CAMs need to be enhanced?

- Do we have a communications and investor relations strategy to discuss CAMs with our investors?

- Is investor relations prepared for questions they may receive about CAMs?

- Is the company engaged in dialogue with investor analysts about the upcoming reporting of CAMs?

- Is it possible that we will have no CAMs to disclose?

Endnotes

1PCAOB AS 3101, The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion, paragraph 11.(go back)

2PCAOB Release No. 2017-001, The Auditor’s Report on an Audit of Financial Statements when the Auditor expresses an Unqualified Opinion and Related Amendments to PCAOB Standards, Page 32.(go back)

3PCAOB Release No. 2017-001, The Auditor’s Report on an Audit of Financial Statements when the Auditor expresses an Unqualified Opinion and Related Amendments to PCAOB Standards, Page 34.(go back)

Print

Print