Marc Treviño is a partner at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Mr. Treviño, Melissa Sawyer, H. Rodgin Cohen, and June Hu.

A. Overview of Shareholder Proposals

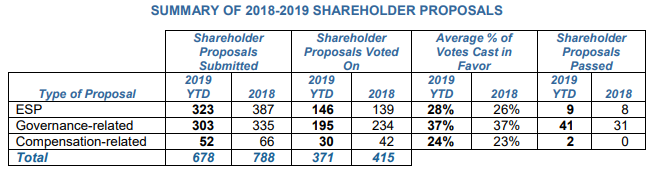

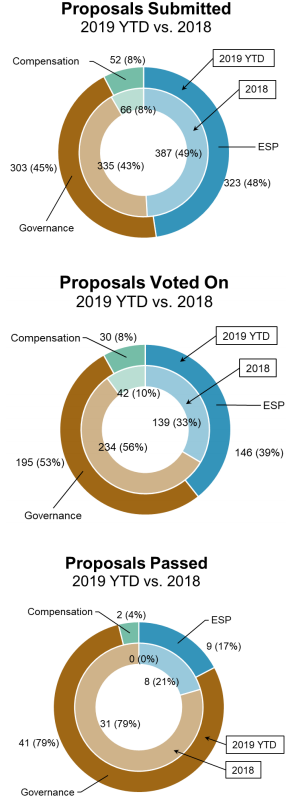

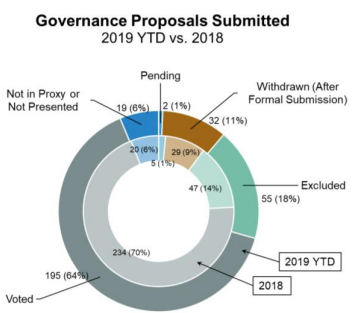

The following table and pie charts summarize, by general category, the Rule 14a-8 shareholder proposals submitted in 2018 full-year and 2019 year-to-date, the number voted on and the rate at which they passed. Overall, the total number of shareholder proposals significantly declined, continuing a downward trend from 2015. A total of 678 shareholder proposals have been submitted to-date in 2019, relative to 751 at this time last year, 788 for 2018 as a whole and 836 for 2017. The decline relative to this time last year is led by a 12.5% drop in environmental, social, and political (“ESP”) proposals, closely followed by compensation-related proposals (11.9% drop), with governance-related proposals declining by a smaller proportion (6.2% drop). The overall decline would have been steeper but for the increase in proposals against investing or managing on the basis of ESP factors (so-called anti-ESP proposals).

Summary of 2018-2019 Shareholder Proposals

Despite the drop year-over-year, more ESP proposals were submitted than any other type of shareholder proposal for the third year in a row. This year nearly half of submitted ESP proposals went to a vote, while in 2018 only about a third reached the shareholder vote stage.

Very few ESP proposals actually passed, as was the case in 2017 and 2018, although shareholder support for ESP proposals has increased steadily over both the long- and short-term. Average shareholder support for ESP proposals reached 28% this year, continuing the upward trend from less than 10% ten years ago to 26% in 2018. The gap in the average support rate between ESP and governance-related proposals also continued to narrow, down to nine percentage points from 11 percentage points in 2018 and 17 percentage points in 2017. ESP proposals are discussed in more detail in Section D.

The number of governance-related proposals fell 6.2% compared to the same time last year, as companies continued proactive adoption of practices that have become market standard (e.g., proxy access), and proponents continued to explore those areas where market practice has not settled (e.g., independent board chair).

As was the case in 2018, governance-related proposals were the most likely to reach a vote (64.4% in 2019; 69.9% in 2018) and continued to represent the vast majority of proposals that actually passed. The percentage of proposals that passed in 2019 (21% of voted proposals) increased from 2018 (13% of voted), primarily due to an increase in the number of elimination of supermajority thresholds proposals that came to a vote and that passed (19 and 16 in 2019, respectively, compared to 11 and 9 in 2018). Governance-related proposals are discussed in more detail in Section E.

The number of compensation-related proposals remained at a negligible level, continuing a trend that began when mandatory say-on-pay votes came into effect. As was the case in 2018, the most common proposal topic is tying ESP performance to compensation targets (34.6% of all compensation-related proposals submitted, compared to 36.4% in 2018). Whereas no compensation-related proposals passed in 2018, two proposals (both related to clawbacks) passed in 2019. Compensation-related proposals are discussed in more detail in Section F.

B. Who Makes Shareholder Proposals

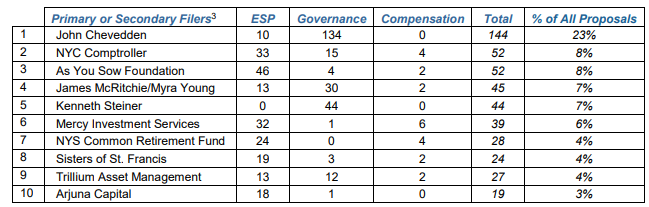

The focus of a relatively concentrated group of individuals and entities continues to drive the voting agenda at U.S. public companies. The top ten proponents account for more than half of shareholder proposals submitted to U.S. S&P Composite 1500 companies. This year, with the exception of John Chevedden, Kenneth Steiner, and James McRitchie/Myra Young, all of the top proponents submitted a greater number of ESP proposals than governance-related proposals, including the public pension funds. It is worth noting that reporting on the filer of a shareholder proposal camouflages the even more robust activity this year from investor coalitions (such as the National Center for Public Policy Research and the Interfaith Center on Corporate Responsibility), which submit proposals through individual members. It appears that the concentration of proposals would be even higher if aggregated at the coalition level.

The following table shows a breakdown of the types of proposals submitted by the top shareholder proponents in 2019:

- Individuals. Three of the five most prolific proponents were the individual investors who have been prominent for a number of years: John Chevedden, Kenneth Steiner, and James McRitchie/Myra Young. Collectively, these individuals and their family members were responsible for the submission of 233 proposals. These individuals often submit proposals jointly as co-filers. Without counting overlaps, these individuals submitted 210 unique proposals in 2019 so far. Overall, they represented 31% of all proposals submitted (up from about 27% in 2018) and the clear majority of governance-related proposals (62%, up from about 58% in 2018). For the first time since we began tracking total submissions, this group submitted a meaningful number of ESP proposals, with 20 unique ESP proposals submitted in 2019 to date (compared to six in all of 2018), most of which related to political contributions (all of the ESP proposals submitted by John Chevedden related to disclosure on political contributions, most of which reached a shareholder vote). In December, James McRitchie announced that he and his wife, Myra Young, would turn their attention to collaborations with As You Sow Foundation and the Center for Political Accountability as proponents for proposals in the ESP area.

- Social Investment Entities. The majority of ESP proposals continued to come from asset management or advisory institutions that seek to make “socially responsible” investments and advance social causes. The entities that were most active in 2019 included As You Sow Foundation (46 ESP proposals submitted), Mercy Investment Services (32), Arjuna Capital (18), and Trillium Asset Management (13). This year, a meaningful number of proposals came from “anti-ESP” entities such as Burn More Coal, a special interest group supportive of the coal industry, and the Free Enterprise Project, the conservative shareholder activist arm of the National Center for Public Policy Research (NCPPR), as further discussed in Sections D and E.

- Religious Organizations. This year, religious organizations also submitted a meaningful number of ESP proposals (focusing on environmental, human capital and human rights) and proposals targeting companies in the pharmaceutical, healthcare and financial services sectors. Many of the active religious organizations were affiliated with the faith-based investor coalition, the Interfaith Center on Corporate Responsibility (ICCR). Among other initiatives, ICCR has teamed up with the Investors for Opioid Accountability (IOA), a 54-member coalition of global institutional investors with $3.5 trillion in assets under management established to engage opioid manufacturers. This year, IOA focused on independent chair, board level responsibility for opioid business risk oversight, misconduct clawback policies, exclusion of legal/compliance costs from compensation metrics, and expanded disclosure in connection with the opioid crisis. In significant part due to the engagement of IOA, ICCR and their affiliates, this year, at least ten pharmaceutical companies have included proposals in their proxy statements related to the opioid epidemic, and a number of other proposals reference opioid-related issues at the company to support governance and/or compensation reforms. Several healthcare and pharmaceutical companies, including Healthstream, Siga Technologies and Eagle Pharmaceuticals, have also began to include in their proxy statements director qualifications relating to the management of the opioid crisis.

- Public Pension Funds and Entities. Public sector pension funds and entities proposed 79 unique proposals to public companies for 2019 meetings. The most frequent proponent in this category was the New York City Comptroller (with 52 proposals submitted). Topics commonly addressed by proposals from pension funds and other public sector entities include political contributions and lobbying, management of human capital, and environmental matters.

- Labor Unions. Labor unions, such as the AFL-CIO and the Teamsters, were the proponents of 32 unique proposals, with ESP as the most popular issue, and then evenly spread between governance- and compensation-related issues.

The ability of shareholders with a relatively small investment in the company ($2,000 of stock held for one year) to submit Rule 14a-8 proposals has been a subject of controversy and calls for change in recent years. Although congressional attempts to increase the investment threshold for submission or to curtail resubmission of proposals have fallen short, such amendments are currently one of the SEC’s stated near-term priorities. At a roundtable on proxy process that the SEC hosted in November 2018, the current thresholds for filing shareholder proposals was a main topic under consideration, with participants discussing whether the current thresholds, or more rigorous thresholds, are appropriate in light of the interests of all shareholders. On May 22, 2019, the SEC released its Regulatory Flexibility Agenda, which includes plans to consider amendments to the Rule 14a-8 thresholds. Although the agenda does not address the specific changes the SEC expects to make, it does indicate that the SEC intends to release advanced notice of proposed rule-making by April 2020.

C. Targets of Shareholder Proposals

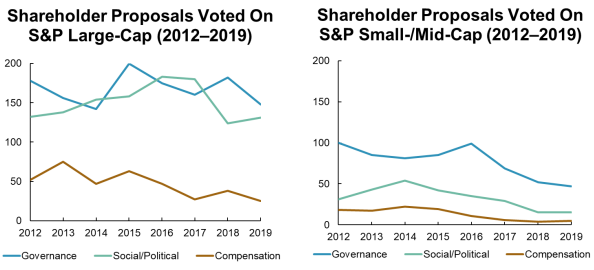

Traditionally, large-cap companies have received the vast majority of shareholder proposals. In 2019 so far, S&P 500 companies received nearly 82% of proposals voted on, consistent with levels in 2018 (83%).

The following graphs show the frequency of proposals, by category, voted on at large-cap companies compared to small- and mid-cap companies. The higher numbers at large-cap companies are particularly notable given that the small-/mid-cap graph includes twice as many companies.

D. Shareholder Proposals on Environmental / Social / Political Matters

ESP proposals continued to gain momentum, with the ESP proposals that went to a vote receiving record average support of 28% and a record nine proposals passing. Unlike governance proposals, which have high support concentrated in a limited number of topics, support across a variety of ESP topics was relatively consistent. The proposals that did register substantially lower voter support related to requests that were in direct contradiction with the company’s business (e.g., proposing The Coca-Cola Company report on the deleterious health impact of processed sugar, or requesting Altria Group, Inc. reduce nicotine levels in tobacco products) or were so-called anti-ESP proposals (e.g., proposing that Duke Energy report on the costs of voluntary environment-related activities).

The percent of ESP proposals voted rose sharply to 45.2% from 35.9% in full-year 2018. As a result, the number of ESP proposals voted on is higher than the same period last year, notwithstanding the 12.5% drop in the number of ESP proposals submitted in the first half of 2019 compared to the same period in 2018 (16.5% drop compared to full-year 2018).

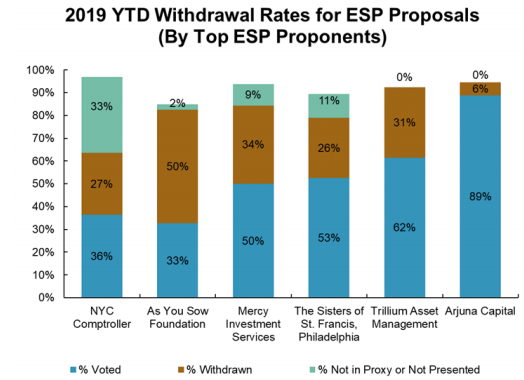

The ten shareholder proponents referenced in Section B submitted about two-thirds of all ESP proposals received by U.S. S&P Composite 1500 companies. Among these proponents, As You Sow Foundation submitted the greatest number of ESP proposals (46), most of which related to climate change and reducing the company’s carbon footprint, the majority of which was withdrawn. Arjuna Capital (18), Mercy Investment Services (32), Sisters of St. Francis (19) and Trillium Asset Management (13) also submitted a meaningful number of ESP proposals, particularly focusing on environmental issues and political contributions. Companies resolved about half of the proposals brought by these proponents outside of a shareholder vote, but almost all of the proposals brought by Arjuna went to a vote (most of these were proposals to disclose an unadjusted gender pay gap and are further discussed in Section D.3.a). Although social investment entities and religious groups submitted the bulk of ESP proposals, as was the case in 2018, ESP proposals also represented a larger portion of the submissions this year from other types of proponents, such as public pension funds. For example, over half of all proposals submitted by the NYC Comptroller this year have been ESP proposals.

1. Political

Political contributions and lobbying became the most common ESP topic in 2019, representing 28.8% of ESP proposals in 2019, increasing from 24.0% in 2018. The majority of proposals were requests for companies to disclose their political spending (expenses and/or policies), including contributions to candidates, lobbying expenditures and related policies. One notable proposal was a shareholder request at Intel to allow annual advisory votes on political contributions, which received only 6% of votes cast. Last year, some companies (including Duke Energy and General Electric) received proposals to disclose a report on the benefits and costs of lobbying and/or political spending, which was not the main topic of any proposal this year, perhaps due to the generally low support for these proposals in 2018. Many of the companies that received a political proposal this year were high-profile American brands (such as Macy’s, Disney, Ford, and UPS) or companies in sectors that attract public attention every election year or due to recent sociopolitical events (such as the banking, healthcare, pharmaceutical, insurance, energy, and steel sectors).

Political contributions and lobbying proposals were the most likely to reach a vote among ESP proposals (63.4% in 2019, slightly up from 59.1% in 2018). For the political proposals that reached a vote, the average shareholder support increased to 34% from 29% in 2018 (ISS supported 95%, consistent with 2018).

Before this year, no political proposal had passed since 2016. This year, four political proposals passed, the highest number of passed proposals on any ESP topic. Of these proposals, the proposal to drug maker Mallinckrodt from a coalition of investors led by United Church Funds received the highest shareholder support at approximately 80% of votes cast. In their supporting statements for the proposal (which demanded that the company make annual reports on its lobbying policies, activities and expenditures, and membership in any organization that writes and endorses legislation), the proponents emphasized their concern over the reputational implications of Mallinckrodt’s lack of lobbying disclosure, citing “the heightened media scrutiny” on pharmaceutical companies’ political donations and membership in certain political nonprofits in light of the opioid epidemic. Mallinckrodt supported the shareholder proposal, stating in its proxy that it was already planning to disclose a “Political Engagement Report” covering similar topics, which it intends to update annually. Similar to the proposal at Mallinckrodt and many political proposals submitted by shareholders in recent years, the proposals that passed at Alliant, Cognizant and Macy’s emphasized the importance of transparent disclosure to shareholders on a company’s direct and indirect political expenditures, non-monetary contributions, and affiliation with political nonprofits, citing the Supreme Court’s Citizens United decision for the proposition that “disclosure permits citizens and shareholders to react to the speech of corporate entities in a proper way.” At Alliant, a utilities company, the proponent, the NYC Comptroller, also highlighted that many of the company’s industry peers publicly disclose political spending. The proposals that passed at Alliant, Cognizant and Macy’s were opposed by the respective company’s board, and received just over 50% of votes cast (54%, 54% and 53%, respectively). In their response statements, each board expressed the concern that expanded disclosures could place the company at a competitive disadvantage and that the disclosure of indirect political activities, including membership in various trade organizations, may misrepresent their respective companies’ actual political activities, since these organizations take independent action with which the board may disagree. This year, political proposals at 17 other companies received over 40% of votes cast, including at three other consumer/retail companies (49.8% at Kohl’s, 42.4% at Honeywell, and 41.7% at Netflix) and two other utilities companies (48.7% at NextEra Energy and 45.4% at NRG Energy).

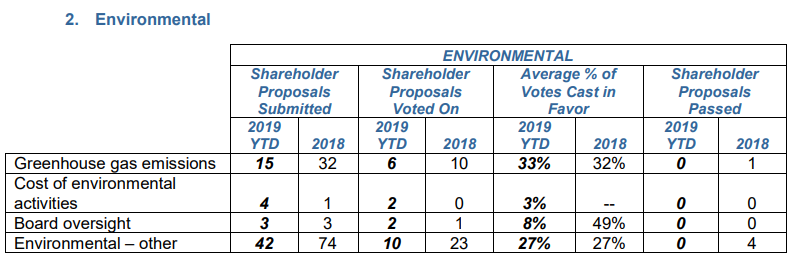

2. Environmental

This year, there was a significant drop in the number of environmental proposals (64 in 2019, compared to 110 in 2018), but the percentage of proposals that went to a vote this year was level with 2018 (31.3% in 2019, compared to 30.9% in 2018). For the first time since 2015, no environmental proposal passed (compared to five in 2018).

Environmental proposals had been the most common ESP topic in both 2017 and 2018 but were in second place this year. In 2018, following President Trump’s June 2017 announcement that the United States was withdrawing from the Paris Agreement, shareholders submitted a number of proposals requesting that companies (particularly in the energy and manufacturing sectors) report on the alignment between their environmental goals and the goals set out in the Paris Agreement, in particular with respect to greenhouse gas emissions targets. Accordingly, last year, there were close to 70 proposals submitted that related to the goals of the Paris Agreement, including 32 greenhouse gas emissions-related proposals. This year, fewer than 30 submitted proposals related to the goals of the Paris Agreement, with only 15 proposals on greenhouse gas emissions targets.

On aggregate, average shareholder support for environmental proposals decreased, dropping from 31% in 2018 to 24%, with ISS support for environmental proposals dropping from 85% in 2018 to 60%. Adjusting for the two anti-ESP environmental proposals that reached a vote, however, the 2019 average shareholder and ISS support rates were aligned with the 2018 levels, at around 31% and 90%, respectively. ISS recommended against both voted anti-ESP proposals to report on the cost of taking voluntary environmental actions (one from Burn More Coal at Exelon and one citing Burn More Coal at Duke Energy, receiving 1.6% and 4.4% of votes cast, respectively). Two anti-ESP proposals at Exxon (one to disclose the costs of environmental activities and one to adopt a policy not to undertake projects based on climate change concerns) were excluded through the SEC no-action process on the basis of substantial implementation.

In addition to recommending against the anti-ESP proposals, ISS recommended against six other environmental proposals this year, including two voted proposals that called for greater board oversight of environmental issues (the two voted proposals called for the establishment of a new environmental committee on the boards of Exxon and Chevron; another proposal, which requested that PNM Resources nominate a director with climate change experience, was excluded through the SEC no-action process on the basis of substantial implementation). ISS recommended against environmental proposals at Mondelez, PepsiCo, Exxon and DuPont to report on certain specific issues, such as deforestation, pesticide management, petrochemical operations in flood-prone areas, and efforts to reduce plastic pellet pollution, noting that these companies already provide industry-standard environmental disclosures.

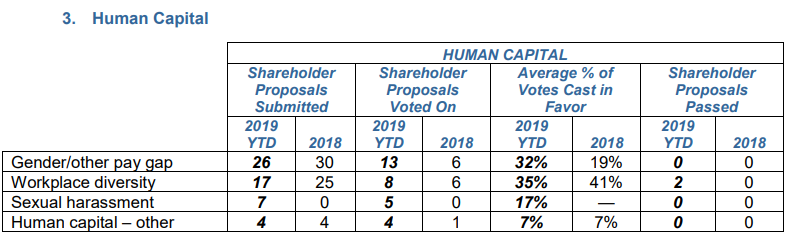

3. Human Capital

Shareholders began to submit a meaningful number of proposals related to management of human capital for the first time in 2018, driven in part by the momentum of the #MeToo, #TimesUp and similar movements. This year, proposals related to management of human capital remained the third largest category of ESP proposals submitted (16.7% of all ESP proposals submitted, compared to 15.2% in 2018), as shareholders, proxy advisors and the public continued to focus on topics such as gender pay equity, workplace diversity, and sexual harassment. However, compared to 2018, when companies that received such proposals generally reached a compromise with the proponent in advance of the shareholder voting stage, over half of these proposals went to a vote this year (55.6% in 2019, compared to 22.0% in 2018). The increase in the percentage of voted-on proposals is due in part to proposals requesting additional disclosure from companies already providing some disclosures on the relevant topic (particularly with respect to gender pay gap), either proactively or in response to a prior shareholder proposal.

More companies are likely to adopt or expand public disclosure on human capital management in response to growing pressure from investors and regulators. For example, the SEC’s Investment Advisory Committee voted 14 to 6 in March 2019 to recommend that the SEC consider as a part of the SEC’s Disclosure Effectiveness Review imposing a requirement on public companies to make disclosures relating to human capital management disclosure. In his opening remarks, Chairman Jay Clayton emphasized that human capital “is a mission-critical asset” but that making appropriate rules and guidance around human capital management disclosure is not a simple task due to sector- and company-specific factors.

a. Gender Pay Gap

This year, proposals on pay-gap disclosures once again comprised around half of submitted proposals related to management of human capital, as lawmakers, courts, shareholders, the media and the general public continue to focus on pay equity, particularly the gender pay gap. Although the global World Economic Forum has reported in its Global Gender Gap Report 2018 that the economic gender gap narrowed slightly in 2018, it also suggested that it would take 108 years to close the global gender gap at the current rate of change. In the United States, the public spotlight on the gender pay gap has intensified as the 2020 presidential election approaches. Multiple candidates from the Democratic Party have endorsed legislation and policies intended to close the national wage gap, which was at a median of 18.9% in 2018 according to data from the Institute for Women’s Policy Research. Earlier this year, House Speaker Nancy Pelosi and other Democratic Congressional leaders reintroduced the Paycheck Fairness Act, a bill first proposed in 1997 with the goal of increasing pay-equity protections for women and strengthening the Equal Pay Act of 1963 by, among other things, requiring employers that compensate employees differently for performing the same job to justify the discrepancy, and eliminating pay secrecy. The bill passed the House in March and now sits in the Senate. New York, Delaware, Oregon, California and Massachusetts have also adopted laws that increase pay-equity protections, including prohibiting employers from asking about a candidate’s wage history, while other states are considering similar legislative steps. Studies show popular support, particularly among women, for legislation that would mandate that companies disclose gender pay-gap data, a policy position that has become a priority for a number of federal lawmakers and presidential candidates; similar legislation has been adopted in the U.K. and Germany in recent years.

In parallel with these legislative efforts, shareholders continued to apply pressure on companies to disclose voluntarily pay-gap information, primarily focusing on the gender pay gap. This year, shareholder proposals relating to pay-gap reporting represented half of all human capital proposals, similar to 2018. The New York City Comptroller and Arjuna Capital, a social investment entity, submitted the majority of these proposals. The recipients of these proposals were predominately in the financial services and technology sectors.

This year, the majority of proposals on the gender and/or racial pay gap failed to reach a vote, as was the case in 2018, in many cases following private engagement between the company and the proponent. However, a far higher percentage of these proposals went to a vote (50% in 2019 compared to 20% in 2018). Proposals from Arjuna Capital represented all but two of the voted proposals. In each case, Arjuna Capital requested that the company, which already reports its pay gap on a statistically adjusted equal pay basis, disclose the unadjusted global median pay-gap figures as well. (Between 2016 and 2018, Arjuna Capital had successfully engaged with 22 companies to publish their gender pay-gap figures on an adjusted basis, including some of the companies that received a proposal this year to publish unadjusted figures.) In the supporting statements for their proposals this year, Arjuna Capital argued that statistically adjusted numbers, which reflect pay disparity between employees at similar roles, levels and/or geographies, fail to consider how discrimination affects differences in job and advancement opportunity, and that disclosure of the global median pay gap would better highlight the structural biases that affect the jobs women hold, particularly at higher-paying ranks. In response, boards generally expressed the view that median figures are misleading, because they involve too much abstraction, and emphasized other corporate initiatives to examine and/or report on the fairness of advancement opportunities across demographic groups. In addition, Bank of America and Wells Fargo tried to exclude the Arjuna Capital proposals they received, but the SEC rejected each company’s argument that the proposal amounted to “micromanagement” to justify an exclusion under Rule 14a-8(i)(7).

Arjuna Capital only withdrew one pay-gap proposal this year, at Citigroup (in contrast, the pay-gap proposals submitted by the New York City Comptroller, which seemed to focus on companies that did not report on gender pay gap, were all withdrawn before a vote). Earlier this year, Citigroup became the first U.S. company to disclose a global median pay gap that was not adjusted for job function, level, or geography. Notably, Citigroup’s unadjusted data reflected a 29% gap between male and female employees, whereas it had disclosed a 1% gender pay gap on an adjusted basis in 2018. Arjuna Capital withdrew its shareholder proposal after Citigroup’s disclosure and commended Citigroup for “this new level of transparency that provides investors with baseline metrics to understand broad pay equity at the company.” In April, Arjuna Capital and Proxy Impact issued a report card ranking 46 prominent companies on gender and racial pay equity, and the only company that received an “A” was Citigroup.

Although none of the eleven voted proposals from Arjuna Capital passed, three received support above 30% of votes cast, and one of the other two voted pay-gap proposals, a proposal at Cigna from Proxy Impact, which addressed an identical issue and provided similar reasoning, also received over 30% of votes cast (the other voted pay-gap proposal was a request at The TJX Companies from Zevin Asset Management to generally report on the company’s policies and goals for reducing pay inequities, which received 18.4% of votes cast). Shareholder support may further increase in the future. Given the significant shareholder support for many of its proposals and its stated goal of increasing transparency with respect to pay disparity, Arjuna Capital is likely to continue requesting companies to disclose unadjusted figures and is unlikely to accept a compromise short of the requested disclosure.

b. Workplace Diversity

The number of workplace diversity proposals fell by more than half relative to 2018. The proposals submitted, which requested companies to report on workplace diversity metrics and policies, were predominantly sponsored by Trillium Asset Management. This year, 47.1% of these proposals reached a vote, representing a significant increase from 2018, when 24% reached a vote. Shareholder support for these proposals remained high (at 35% in 2019, relative to 41% in 2018). The eight voted workplace diversity proposals included repeat proposals at Charles Schwab, Home Depot and Travelers to report on diversity along EEOC identified categories, which received a substantial amount of shareholder support in both 2019 and 2018 (39.8%, 33.1% and 50.9%, respectively, in 2019, compared to 35.8%, 48.3% and 36.4%, respectively, in 2018).

In addition to the repeat proposal at Travelers, which passed at 50.9% of votes cast this year, a proposal at Newell Brands to report on the diversity of the company’s executive leadership team passed this year with 56.6% of votes cast (in 2018, no workplace diversity proposal passed). In the supporting statement for its proposal at Newell Brands, Trillium Asset Management highlighted the limited racial/ethnic diversity on the company’s highest management committees and that only 11% of the committee members were women. In a 2019 blog post, Trillium Asset Management stated that its goal for submitting similar proposals to Newell Brands and other companies was for the companies to assess “diversity in senior leadership ranks and clear plans to expand diversity, inclusive of gender, race and ethnicity” and “set goals, measure and report progress, and hold executives accountable to improving diversity and inclusion in senior roles.” In addition to requesting companies to report on current diversity, Trillium Asset Management also hinted that it might submit further proposals linking diversity performance metrics to senior executive compensation, expressing in its supporting statements for the workplace diversity proposals that diversity-linked compensation packages can “sharpen management’s ability to manage human capital management risks, increase accountability and successfully reach inclusion and diversity goals.”

c. Sexual Harassment

This year, in parallel with legislative efforts to strengthen sexual harassment prevention (including the recent adoption by New York State and New York City of laws that require employers to conduct annual, interactive sexual harassment training for all employees by October 2019), there were seven shareholder proposals (at Alphabet, Amazon, CBS, Xenia Hotels, Pebblebrook Hotel Trust, Walmart and XPO Logistics) specifically addressing voluntary reporting on sexual harassment and/or policies to strengthen sexual harassment prevention in the workplace. Five reached a vote and averaged 17% shareholder support.

E. Shareholder Proposals on Governance Matters

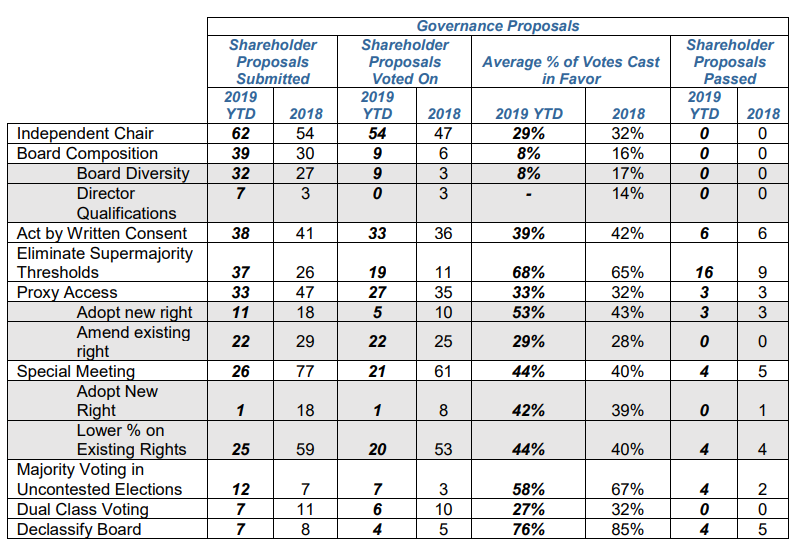

The number of proposals on governance matters (board-related and anti-takeover concerns) that came to a vote in 2019 was down significantly from 2018, continuing a trajectory from 2015. Proposals on independent chair, board composition, supermajority vote requirements, and majority voting in uncontested elections increased year-over-year. These increases did not offset the significant drop in special meeting-related proposals, the most common governance-related topic in 2018. Average support for governance-related proposals in 2019 was 37% overall, level with 2018 but representing a decrease from prior years.

Unlike ESP proposals, when governance proposals failed to reach the shareholder vote stage, it was most often due to exclusion through the SEC no-action process, as the following chart illustrates:

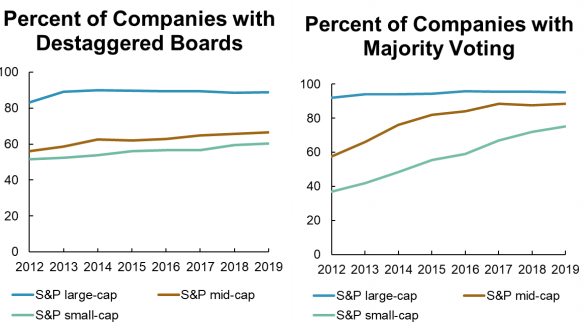

As so-called shareholder-friendly governance features have become standard at S&P 500 companies, a number of governance proposals that previously have dominated proxy seasons and garnered high support from investors (e.g., destaggered boards, majority election of directors, special meeting rights, simple majority vote thresholds and, more recently, proxy access) have become much less prevalent. There are simply fewer large-cap companies that have not already adopted these features, and those companies are often unappealing targets for governance proponents because many have structural hurdles, such as dual class voting, that limit the efficacy of shareholder proposals.

Notwithstanding the continuing decline of governance proposals voted on since 2016 at small- and mid-cap companies, these companies may be experiencing heightened pressure as a consequence of developments in governance proposals and practices. Therefore, over time, the most popular governance practices have become somewhat more common (e.g., destaggered boards) or much more common (e.g., majority voting) at smaller companies, as demonstrated in the following charts:

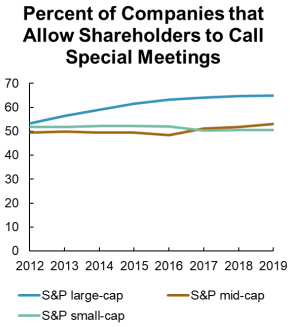

In recent years, special meeting rights and proxy access also have become more widely adopted, especially among the S&P 500, although they are still comparatively less common. As the following chart illustrates, the number of S&P 500 companies that have adopted special meeting rights has plateaued at around 65%, without much change over the past four years. There is also a significant level of adoption of special meeting rights among large-cap and small-cap companies (around 50% among each of the S&P 400 and S&P 600). This is partially attributable to the fact that many of the smaller companies are incorporated in states that have adopted the Model Business Corporation Act, which mandates the shareholder right to call special meetings (about 30% of S&P 400 companies and 25% of S&P 600 companies are incorporated in states that mandate the right, as compared to about 15% of S&P 500 companies).

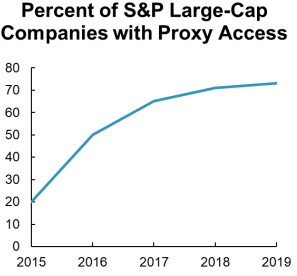

Approximately 600 U.S. companies have adopted proxy access provisions at this point, including roughly 73% of the S&P 500. Proxy access was a rarity among public U.S. companies before 2015 but became a favorite topic among shareholder proponents between 2015 and 2017 (the New York City Comptroller was the primary sponsor of these proposals from 2015 to 2017, primarily at large-cap companies). As further discussed in Section E.5 and illustrated in the following chart, in recent years, many large-cap companies have elected to adopt proactively a market standard proxy access provision rather than face a shareholder vote.

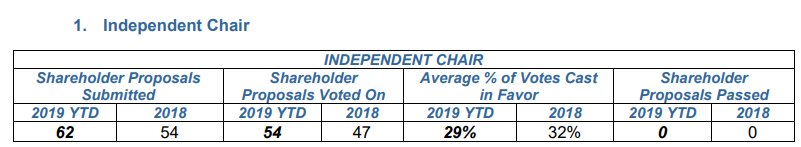

1. Independent Chair

Proposals requesting that the board chair be an independent director were the most common type of governance proposal submitted this year. Large companies have regularly received these proposals since the mid-2000s, and the slight year-over-year increase in the number of proposals on this topic reflects that certain shareholders continue to believe that having the CEO or another executive serve as chair may negatively influence the independence of the board as a whole. Half of the independent chair proposals this year were submitted by John Chevedden, who often referenced recent public controversies to support his call for more robust independent board oversight (for example, at Abbott Laboratories, Anthem and UnitedHealth, Chevedden and his affiliates submitted proposals that cited concerns relating to the opioid crisis in their supporting statements). In connection with the opioid crisis, religious organizations, faith-based coalitions, and their affiliates, including members of ICCR and IOA, also submitted a meaningful number of independent chair proposals at healthcare and pharmaceutical companies, as discussed in Section B. In addition to healthcare and pharmaceutical companies, proponents of independent chairs also focused on tech companies, in part due to the sustained public scrutiny on tech industry corporate culture and human capital management issues, with 12 high profile tech companies (including Amazon, AT&T, Facebook, IBM and Verizon) receiving a proposal on this topic in 2019.

These proposals tend to receive meaningful shareholder support (generally 25% to 40%), but rarely pass. Only a handful each year managed to win majority support between 2012 and 2015, and none passed since.

ISS only recommended in favor of about 39% of proposals (down from about three-quarters in 2018 and more consistent with actual voting results).

2. Board Composition

a. Board Diversity

Board diversity, in particular, female representation on boards, has been a topic of continuing and well-publicized focus for lawmakers and regulators:

- Recently, California became the first U.S. state to pass a law setting mandatory thresholds for female directors. On September 30, 2018, California passed Senate Bill 826,7 which requires publicly held corporations with their principal place of business in California to have at least one woman on their boards by December 31, 2019, with the minimum raised to at least two female directors for companies with five directors and at least three female directors for companies with six or more directors by December 31, 2021.

- Subsequently, lawmakers in other states have taken similar legislative steps. In November 2018, a board gender diversity bill mimicking California Senate Bill 826 was introduced to the New Jersey Assembly, and on February 14, 2019, the bill moved to the Senate as New Jersey Senate Bill No. 3469.On January 11, 2019, a dozen Washington senators introduced Senate Bill 5142, which would apply similar requirements to companies subject to the Washington Business Corporation Act. On January 23, 2019, Illinois Senator Cristina Castro introduced Senate Bill 0076, which would apply to publicly held corporations with their principal place of business in Illinois.

- On February 6, 2019, the Securities and Exchange Commission’s Division of Corporation Finance released Compliance and Disclosure Interpretations (C&DIs) 116.11 and 133.13, which provide that, to the extent a company’s nominating committee considers diversity characteristics such as race, gender, and other self-identified characteristics, the company’s disclosure should include those characteristics and how they were considered.

- On the same day the SEC released its C&DIs on director diversity disclosures, the “Improving Corporate Governance Through Diversity Act of 2019” was introduced in both houses. The bill seeks to require public companies to disclose the gender, race, ethnicity, and veteran status of their directors and nominees, as well as senior executive officers, and to disclose whether the board has a policy or strategy to promote racial, ethnic, and gender diversity among directors, nominees, and executive officers. The bill has been referred to subcommittees in the House and the Senate for review.

In addition to lawmakers and regulators, companies are also facing pressure from institutional shareholders and proxy advisory firms to increase female representation on their boards:

- State Street Global Advisors (SSGA) stated in its 2019 proxy voting and engagement guidelines that it views board quality as a measure of a variety of factors, including board diversity, and that it expects boards of Russell 3000 and TSX listed companies to include at least one female director.Since the launch of its “Fearless Girl” campaign in 2017, SSGA has been voting against nominating chairs if there are no female directors on the board, and beginning in 2020, SSGA will vote against the entire nominating committee if there are no female directors on the board.

- On January 17, 2019, BlackRock released its updated 2019 proxy voting guidelines for U.S. securities. Notable updates include expanding its policy on board diversity to take into account both personal and professional factors and encouraging companies to have at least two women directors on every board. In February 2018, BlackRock sent letters to all Russell 1000 companies with fewer than two female directors asking the companies to justify how their board diversity aligns with their long-term strategies.

- ISS’s 2019 proxy voting guidelines indicated that for meetings held after February 1, 2020, adverse voting recommendations may be issued against nominating committee chairs of boards of Russell 3000 or S&P 1500 companies with no female directors.

- Glass Lewis’s Proxy Paper states in its Summary of Changes for the 2019 U.S. Policy Guidelines that per its policy regarding board gender diversity announced in November 2017, for meetings held after January 1, 2019, Glass Lewis will generally recommend against the nominating committee chair of boards with no female members.

- A number of social investment entities, governance activists, and other interested parties have formed advocacy groups, most notably the Thirty Percent Coalition, to engage with corporations and the public to advance the cause of board diversity.

In response to investors’ scrutiny on board diversity, it has become increasingly common for both large- and small-cap companies to address the topic of board gender diversity in their proxy statements. The following chart, which presents the number of proxy statements that include the phrases “women on the board,” “gender diversity” or “female directors,” presents a partial picture of trends in proxy disclosures with respect to board gender diversity.

Female representation on boards has been increasing in recent years, particularly at larger companies. In 2018, approximately 87% of S&P 500 companies had two or more female directors, an increase of 7% from 2017.18 Conversely, in 2018, 47% of Russell 3000 companies had boards comprised of less than 15% female members, a decrease of 11% from 2017.

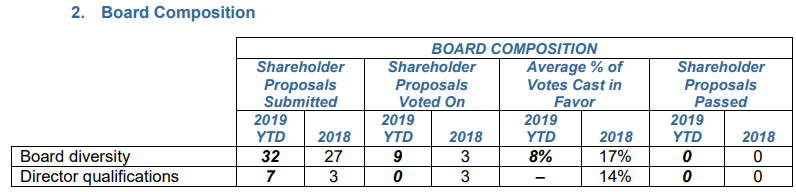

So far in 2019, shareholders have submitted more board diversity proposals (32) than they did in all of 2018 (27). As was the case in 2018, companies resolved the vast majority of these proposals before they reached a vote, suggesting that companies are continuing to make board gender diversity a priority in response to many of the above developments, eliminating the perceived need by shareholders to push for a vote on a specific proposal.

Of the nine board diversity proposals that reached a vote in 2019, seven were anti-ESP proposals submitted by the Free Enterprise Project, the conservative shareholder activist arm of the National Center for Public Policy Research (NCPPR). NCPPR seeks to shift companies’ board diversity efforts away from diversity based on race, gender, and other self-identified demographic characteristics, and towards “true board diversity,” defined as a nominee’s skills, experience, and ideological perspectives.

”True board diversity” proposals tend to go to a vote and receive low support. As a result, a larger percentage of board diversity proposals as a whole went to a vote (28% in 2019 compared to 11% in 2018) and voted proposals received lower average shareholder support (8% in 2019 compared to 17% in 2018).

Last year, the NCPPR submitted only one proposal to disclose a “true board diversity” matrix (to Alphabet); ISS recommended against it and the proposal received only 2% of votes cast. ISS recommended against all seven of these proposals this year (to Amazon, Apple, Discovery, Facebook, salesforce.com, Starbucks, and Twitter), and shareholder support remained low at between 1-3% of votes cast.

The other two voted board diversity proposals, which were proposals aimed at increasing board diversity (at Exxon and Skechers), garnered higher shareholder support (at 26.6% and 29.8% of votes cast) and positive ISS recommendations. Adjusting for the true board diversity proposals, both the percentage of voted proposals (8% in 2019 compared to 7.7% in 2018) and the average shareholder support (28% compared to 25% in 2018) were level with 2018.

In light of the current interest in this topic, companies should be prepared to engage with investors on diversity issues and, in particular, to articulate the principles by which the board considers gender, race and other types of diversity in choosing a slate, the steps taken to ensure a diverse pool of potential nominees is considered, and how the board is considering this issue for the upcoming meeting.

b. Director Qualifications and Director Tenure

In 2014, the New York City Comptroller launched the Boardroom Accountability Project, a nationwide campaign to implement proxy access. Once that initiative had achieved critical mass, the Boardroom Accountability Project transitioned to its second phase in September 2017, focusing on increasing diversity, independence, and competence on climate-related issues at the board level, especially among larger companies. On September 8, 2017, the Comptroller sent letters to 151 portfolio companies (80% of which are in the S&P 500) asking them to publish standardized annual disclosures on their board qualifications and diversity (including in terms of skills, race, and gender) and board refreshment processes.

The impact of the second phase of the Comptroller’s campaign has been widely felt, as many companies have started to include annual disclosure on board qualifications and diversity in a matrix form. In addition to the board diversity related proposals discussed above, there were seven director qualifications proposals this year, all from the Comptroller requesting more disclosure of director qualifications (many of the board diversity related proposals submitted this year requested disclosure of director qualifications in addition to board diversity; we have not categorized those proposals as director qualification proposals).

Between 2012 and 2018, there have been a few director qualification proposals coming to a vote each year (with eight in 2012 and three in 2018), but none came to a vote in 2019 thus far. No director qualification proposals have passed since 2012. The decline in director qualifications proposals that have been voted on and the large number that have been withdrawn suggest that companies are voluntarily agreeing to make disclosures of director qualifications when these proposals are received.

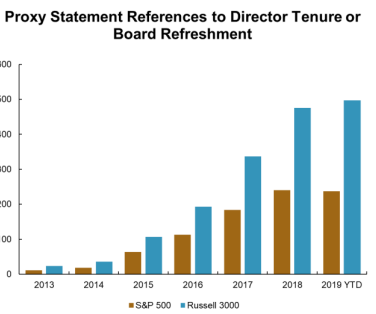

Another aspect of board composition that is notable for its absence as a proposal topic is director tenure. The topic of director tenure has generated a significant amount of conversation in recent years. A number of investors, investor groups and governance commentators have queried whether there comes a point where a long-tenured director should not be seen as independent and whether mandatory term limits or retirement ages are advisable. For example, in 2014, SSGA announced that it may vote against directors (including the governance committee chair and/or long-tenured members of key committees) when the average board tenure or tenure of individual directors is excessive, which remains part of its voting policy. ISS also added factors on director tenure to its QualityScore ranking in recent years, noting that “excessive tenure is considered to potentially compromise a director’s independence and as such ISS Governance QualityScore will consider the non-executive directors where tenure is higher than the recommended local best practice.”

However, ISS has not included questions on director tenure in its annual investor survey since 2016, and most institutional investors that set out policies on the topic assess the experience and attributes of the board as a whole and oppose bright-line rules such as age and term limits. BlackRock’s 2019 proxy voting guidelines for U.S. securities state that they are not opposed in principle to long-tenured directors. And, where boards find age or term limits are the most efficient mechanism for ensuring periodic board refreshment, BlackRock defers to the board’s determination in setting those limits.

As one component of shareholder engagement, an increasing number of companies now include more meaningful explanations of the manner in which the board considers tenure in assessing board composition and choosing the management slate. The mounting attentiveness of large- and small-cap companies to disclosures on this topic is reflected in the steep rise over the past few years in the number of proxy statements referencing “director tenure” and/or “board refreshment”, as shown in the following chart:

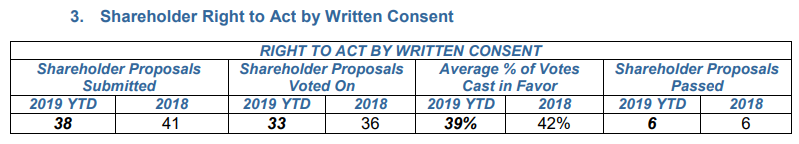

3. Shareholder Right to Act by Written Consent

There was a significant increase in the number of proposals requesting that the company grant shareholders the right to act by written consent in 2018, reversing a downward trend from 2015 through 2017. In 2019 so far, the number of proposals in this category submitted by shareholders is lower than 2018 but still higher than 2017. The vast majority of these proposals (87%) went to a vote. ISS recommended in favor of about 88% of the written consent proposals voted on in 2019, and the proposals, as usual, received relatively strong support levels. In 2019, six proposals (18% of the total voted on) have passed so far, the same as in all of 2018, although there was a slight decline in the level of overall support for these proposals.

The corporate laws of most states provide that shareholders may act by written consent in lieu of a meeting unless the company’s certificate of incorporation provides otherwise. Commonly, public companies provide in their charters that shareholders may not act by written consent, or that they may act by written consent only if the consent is unanimous. The main concern that companies have about giving shareholders the right to act by written consent is that the written consent process can frustrate the orderly and transparent debate on the merits that would occur if the proposed action were raised at a shareholder meeting.

In 2019, all but one company that had written consent proposals up for a vote already provided shareholders with the right to call a special meeting. All of these companies stressed in their opposition statements that adopting a written consent provision would be unnecessary, and potentially detrimental to shareholder interests, in light of existing corporate governance structures and practices. The relatively low success rate of written consent proposals in both 2019 and 2018 seems to reflect continuing agreement by a majority of shareholders that special meeting rights adequately address this concern and render written consent rights unnecessary. When companies do implement a written consent right today, the right is often subject to a number of the same terms contained in market standard special meeting provisions, such as defined waiting periods, disclosure requirements (including disclosures to shareholders who are not solicited), holding requirements, and black-outs, as further discussed in Section E.6.

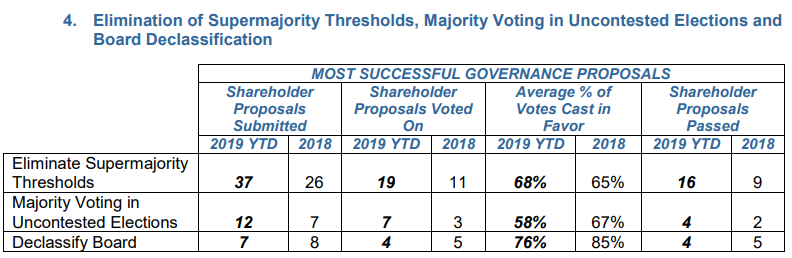

4. Elimination of Supermajority Thresholds, Majority Voting in Uncontested Elections and Board Declassification

In previous years, the only shareholder proposals that passed on a consistent basis have been the three governance proposals that have been widely adopted at large companies—elimination of supermajority voting thresholds to effect certain corporate actions (such as charter or bylaw changes or the removal of directors), majority voting in uncontested director elections (rather than plurality voting), and declassification of boards. Although these three types of governance proposals still managed to pass this year at almost every company where they reached a vote, only proposals relating to elimination of supermajority voting thresholds reached a vote a meaningful number of times (19, compared to seven majority voting proposals and four declassification of board proposals).

Around 36% of the proposals on these topics have been at non-S&P 500 companies this year. As shown in the charts at the beginning of this Section, these governance reforms are common among large-cap companies, and have been steadily advancing at smaller companies as well (particularly majority voting). The widespread adoption of these practices has led to a sharp decrease in these proposals in recent years at both large- and small-cap companies. Approximately 90% of S&P 500 companies and 47% of Russell 3000 companies have adopted some form of majority voting in uncontested director elections. Additionally, the practice of requiring supermajority votes has also declined, with only 38.8% of the S&P 500 requiring a supermajority vote for changing the charter and 24.1% requiring a supermajority vote for changing bylaws in 2019.

5. Proxy Access Proposals

This year saw a further decrease in the number of proxy access proposals voted on, continuing the trend in 2018. As discussed in the beginning of this Section, almost 600 companies have adopted proxy access rights, including roughly 73% of S&P 500 companies and 19% of Russell 3000 companies. Given the widespread and continued adoption of proxy access bylaws at larger companies, it is unsurprising that shareholders submitted fewer proposals for the adoption of a new proxy access right this year.

Over the past four years, there has been significant convergence in the terms of proxy access provisions adopted by companies, with the market standard now being a so-called 3/3/20/20 bylaw—that is, a threshold of 3% ownership for three years, a director cap of 20% of the board but no less than two, and a group limit of 20 shareholders. Continuing a trend that began in 2017, most companies receiving a proposal to adopt proxy access opted to adopt the market-standard bylaw before a vote, resulting in a near elimination of such proposals that reached a shareholder meeting in 2019 (five total, compared to ten in 2018 and 28 in 2017). The pass rate of these proposals was higher in 2019 (60%) compared to 2018 (30%). Of the two proposals that did not receive majority support, one appears to have failed due to idiosyncratic reasons.

As more companies implement proxy access, some have expected to see a rise in shareholder proposals to amend existing proxy access rights. However, the number submitted this year so far decreased by 24% (22 in 2019, compared to 29 in all of 2018). All of the submitted proposals reached a vote in 2019, compared to 86% in 2018. As was the case in the past two years, none of these proposals passed. These proposals did receive meaningful average support from shareholders (29% in 2019, 28% in 2018 and 2017), and ISS supported all of them. They generally sought to remove limits on the size of shareholder groups, and/or to remove various other limitations on the use of proxy access, like the percentage vote required to qualify a shareholder proxy access director candidate.

In appropriate cases, Rule 14a-8(i)(10) is available to exclude shareholder proposals to adopt or amend a proxy access bylaw as “substantially implemented.” Throughout 2016, 2017, and 2018, the SEC generally allowed the exclusion of shareholder proposals for a new proxy access right if a company adopts a 3/3/20/20 provision, even if the company’s bylaw contains terms that are different from the shareholder’s proposal (for example, imposing a lower group size limit, so long as the ownership percentage and duration thresholds matched those proposed by the shareholder) or imposes additional requirements on proxy access (such as a “net long” definition of ownership or qualification requirements for nominees). With respect to proposals to amend a proxy access bylaw, the SEC denied no-action relief to each of the two requests for relief in 2019.

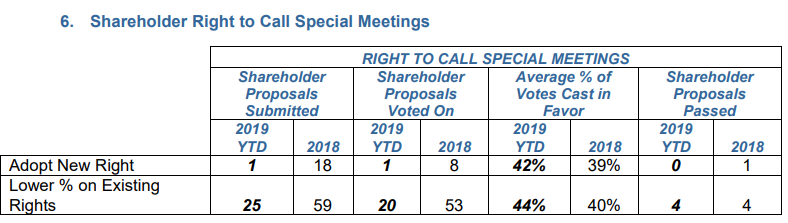

6. Shareholder Right to Call Special Meetings

Proxy advisory firms and many shareholders support the right of shareholders to call a special meeting, because it enables shareholders to act on matters that arise between annual meetings (such as the replacement of one or more directors, including in circumstances intended to permit an acquisition offer to proceed, or the amendment of bylaws). The right to call special meetings should be viewed in conjunction with the strong movement away from classified boards—in Delaware, directors of a non-classified board can generally be removed by shareholders without cause. Thus, given the trend of declassifying boards, the ability to act outside the annual meeting to remove directors without cause and elect their replacements can be viewed as the dismantling of an effective mechanism to provide directors with additional time to respond to shareholder activism or consider hostile takeover proposals. Nearly two-thirds of S&P 500 companies (about the same level as last year) now provide shareholders with some right to call a special meeting, a development driven largely by shareholder proposals and shareholder support for the concept over the past decade. Consequently, this type of proposal is no longer the most frequently proposed.

a. Types of Proposals

Only one company received a shareholder proposal to add a special meeting right so far this year. Although the proposal received ISS support, it ultimately did not pass, receiving only 42% shareholder support.

Last year, proposals seeking to reduce the ownership threshold to call a special meeting were the most common type of governance-related proposal, and there have been 25 proposals to reduce special meeting thresholds in 2019 so far, compared to 59 submitted in all of 2018. The vast majority of these proposals (80%) went to a vote. Most of these proposals were submitted by John Chevedden or Kenneth Steiner.

Of the 20 reduce special meeting threshold proposals that came to a vote in 2019, 16 sought to reduce a 20% or 25% threshold to either 10% or 15%. These proposals continued to receive high shareholder support this year (averaging 44% in 2019 compared to 40% in 2018), with four managing to gain majority support, the same as in 2018. The significant level of support these proposals continue to receive suggests that some governance-focused shareholders are not satisfied with the 25% ownership threshold that has become the market standard at large companies.

b. Terms to Consider When Adopting or Amending a Special Meeting Provision

Companies putting forth a new special meeting right or evaluating an existing right, either preemptively or in response to a proposal, may wish to consider the following terms:

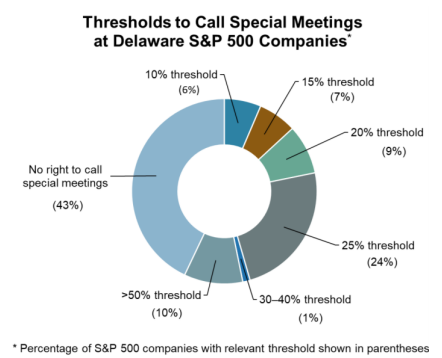

- Threshold. Though practice varies, for a number of years 25% has been the most common threshold for special meeting rights at public companies, as reflected in the following chart showing the threshold for special meeting rights at Delaware companies among the S&P 500.26 BlackRock’s current policies indicate that it generally believes a threshold between 15–25% is reasonable “in order to avoid the waste of corporate resources in addressing narrowly supported interests.” They also believe that a right to act by written consent is “not a sufficient alternative to the right to call a special meeting.”However, companies with a 25% threshold should monitor and consider developments at peer companies on special meeting proposals and practices. Although some large institutional investors may continue to support a 25% threshold, the meaningful shareholder support for proposals to move from a 25% to a 10–15% threshold indicates that a substantial portion of a company’s other shareholders may support making special meeting rights more accessible.

- Definition of ownership. Many companies require “record” ownership of shares (as opposed to “beneficial” ownership), essentially requiring street name holders to work through their securities intermediaries to become a record holder. This eliminates uncertainty as to proof of ownership, but introduces an additional administrative step for shareholders seeking to use the right. In addition, a number of companies have introduced a “net long ownership” concept into their special meeting provision—essentially reducing the shareholders’ actual ownership level by any short positions or other hedging of economic exposure to the shares. Companies that do not include a “net long” concept should nevertheless provide that the information required from the requesting shareholders must include details of any hedging transactions, so that the company and other shareholders can have a full picture of the requesting shareholders’ economic stake in the company.

- Pre- and post-meeting blackout periods. In order to avoid duplicative or unnecessary meetings, many companies provide that no meeting request will be valid if it is received during a specified period (usually 90 days) before the annual meeting, or during a specified period (usually 90 or 120 days) after a meeting at which a similar matter was on the agenda.

- Limitations of matters covered. Special meeting provisions typically provide that the special meeting request must specify the matter to be voted on, and that no meeting will be called if, among other things, the matter is not a proper subject for shareholder action. Generally, the only items that may be raised at the special meeting will be the items specified in the meeting request and any other matters that the board determines to include.

- Timing of meeting. Companies typically provide that the board must set the meeting for a date within 90 days from the receipt of a valid request by the requisite percentage of shareholders. Often, the special meeting provisions provide that, in lieu of calling a special meeting, the company may include the specified item in a meeting called by the company within that same time period.

- Holding period. A few companies require the requesting shareholders to have held the requisite number of shares for a specified period of time prior to the request.

- Inclusion in charter versus bylaws. Companies should consider whether to include the special meeting provisions in the charter, the bylaws or a combination. In some cases, companies include the critical provisions (such as ownership threshold) in the charter so that shareholders cannot unilaterally amend them, but provide the details and mechanics in the bylaws, so that they can be adjusted by the board without a shareholder vote.

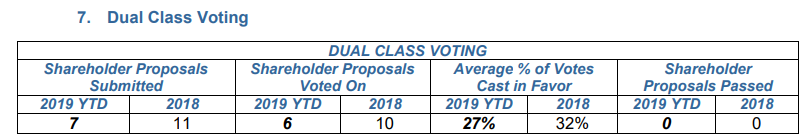

7. Dual Class Voting

Over the years, dual class voting has ranked among the most controversial topics in corporate governance, and the debate continued to be animated during the last 12 months. On March 14, 2019, a group of institutional investors with $3.2 trillion assets under management issued a letter urging Lyft’s board of directors to adopt the one share, one vote structure or to adopt a near-term sunset provision for its dual class structure.29 In October 2018, the Council of Institutional Investors, backed by BlackRock and Rowe Price Group, filed petitions with the New York Stock Exchange and the NASDAQ, calling on them to limit listings of companies with dual class share structures.The prevalence of the dual class structure is in part due to its widespread use by technology companies, with nearly 50% of recent technology listings having a dual class status.

However, proposals to eliminate supervoting stock (either by adopting a recapitalization plan for all equity securities to have one vote per share or by converting the supervoting shares into low-vote shares) are typically among the least common types of governance-related proposals each year. Six such proposals came to a vote in 2019 so far, compared to 10 in all of 2018. These proposals received about the same level of shareholder support in 2019 (average support of 27%) as in 2018 (average support of 32%). Despite ISS’s support for all of these proposals, none of them passed, which is not surprising when the holders of supervoting stock vote against them.

Proposals to reclassify supervoting shares do not reflect the full extent of the impact of the debate on dual class voting. For example, the increased scrutiny on dual class companies may translate into negative votes for directors. ISS’s 2018 policy updates specifically provide for a negative director vote recommendation at newly public companies where the classes have unequal voting rights, as we will discuss in Part 2 of our 2019 proxy season review. Glass Lewis indicated in its 2019 Proxy Paper that in evaluating dual class companies’ board responsiveness in 2019, it will consider the level of approval or disapproval attributed to unaffiliated shareholders. It expects that where vote results indicate a majority of unaffiliated shareholders voted in support of or against a proposal, the board should demonstrate an appropriate level of responsiveness.

In addition, some stakeholders have resorted to means outside of shareholder proposals to generate momentum for change at dual class companies. For instance, the NYC Comptroller recently released a letter announcing it will no longer vote in favor of Facebook, to draw attention to a perceived lack of accountability contributing to mismanagement of public incidents. Employees of Alphabet staged a global walk-out to protest the company’s handling of sexual harassment, which shareholders cited as support for a proposal requesting the company to reform its policies on sexual harassment and executive exit packages.

8. Other Governance Proposals

Some less frequent and less successful governance-related proposals are addressed below:

- No Abstentions in Vote Counting. The past few years have seen a number of proposals asking that the general standard for shareholder action be “majority of votes cast” rather than the common standard, and Delaware default, of “majority of votes present at the meeting in person or by proxy and entitled to vote.” The only difference is that, in the latter case, the denominator includes abstentions, as well as “for” and “against” votes. Such a change would have little practical impact, as most shareholder proposals are precatory anyway, so the legal standard for passing is irrelevant. In addition, the number of abstentions (not to be confused with broker non-votes, which is where a broker is not entitled to vote, and so excluded from both standards) is generally small. Only one of these proposals came to a vote in 2019 and in 2018, compared to 10 in 2017. The lack of practical impact likely explains both the low frequency and low vote results for these proposals, which received an average of less than 10% support in 2017 through 2019. No proposal in either year came close to passing.

- Mandatory Arbitration Bylaw Provisions. The issue of mandatory arbitration provisions in the bylaws of U.S. publicly listed companies has recently become a highly controversial issue. Chairman Clayton of the SEC issued a public statement on February 11, 2019 backing a no-action letter sent to Johnson & Johnson Co. that allowed it to omit a shareholder proposal on mandatory arbitration from its proxy but emphasizing that views expressed in no-action letters are not binding, and “[a] court is a more appropriate venue to seek a binding determination of whether a shareholder proposal can be excluded.”The proposal sought to have the board adopt mandatory arbitration of shareholder claims, but was excluded on the basis that such action violated both state and federal law, making it invalid for a shareholder vote. Notably, the shareholder that submitted this proposal acted on Chairman Clayton’s recommendation and commenced a lawsuit in the District of New Jersey alleging, among other things, that Johnson & Johnson Co. violated federal securities law by improperly excluding the shareholder proposal from its proxy. While this lawsuit is still in its infancy, CalPERS and Colorado PERS have both intervened in the lawsuit, potentially teeing up a decision with large corporate governance ramifications. If the court were to find that mandatory board arbitration did not violate federal and state law (and thus the proposal was improperly excluded), companies will begin to see a proliferation of proposals for and against mandatory board arbitration.

- Virtual-Only Meetings. Over the last three years, an increasing number of companies have moved from in-person meetings to virtual-only meetings. However, based on a 2018 ISS survey, 8% of institutional investors did not support either virtual-only or “hybrid” (both physical and electronic/online) meetings, and 36% considered hybrid shareholder meetings to be acceptable but not virtual-only meetings. In addition, effective in 2019, Glass Lewis’s policy is to vote against governance committee members at companies without in-person meetings unless their proxy materials contain disclosures that are sufficiently robust to assure shareholders that they would not lose any participation rights by moving to virtual-only meetings. Earlier this year, Frontier Communications received a shareholder proposal to hold a face-to-face annual meeting with shareholders starting in 2020 (Frontier Communications held a virtual meeting in 2019). The SEC staff granted no-action relief to Frontier Communications, agreeing with the company that this proposal related to ordinary business operations. This was the only shareholder proposal related to virtual meetings this season, and therefore it is too early to predict whether the Staff will continue to permit such proposals to be excluded.

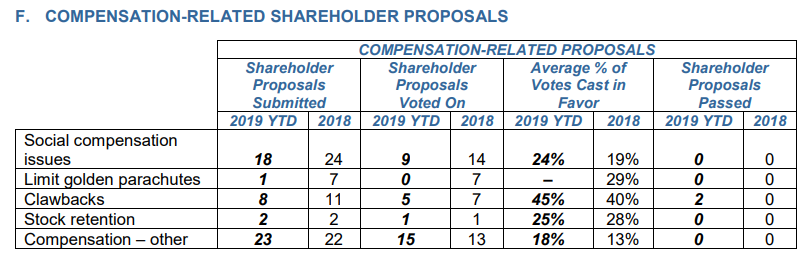

F. Compensation-Related Shareholder Proposals

From 2012 to 2017, there was a steep decline in the number of compensation-related proposals, in large part a result of mandatory say-on-pay votes becoming the primary mechanism by which shareholders express concerns over executive compensation. In 2018, the number of compensation-related proposals leveled out, and this trend has continued in 2019. Compensation-related proposals still tended to receive relatively low support, although two passed this year.

The most common type of compensation-related proposal in 2019 sought to link executive compensation to social issues, such as sustainability or social or environmental impact. Though there have been fewer ESP compensation-related proposals so far in 2019, the number was still higher than 2017 (12 submitted). Shareholder proposals linking compensation to ESP issues may increase going forward; for example, Trillium Asset Management has hinted that it is contemplating submitting proposals linking diversity performance metrics to senior executive compensation, as discussed in Section D.3.b. Similar to 2018, half of these proposals reached a vote in 2019 (nine total, including five proposals relating to the integration of drug pricing risks into compensation plans at pharmaceutical companies). Five of the compensation proposals relating to social issues that did not go to a vote were withdrawn (covering drug pricing risks, greenhouse gas reduction and human rights risks), while the other three (two covering sustainability as a performance measure) were excluded.

ISS supported 70% of the compensation-related proposals voted on so far in 2019, and shareholder support averaged 31% for proposals where ISS recommended in favor, as compared to 9% for proposals where ISS recommended against. ISS recommended in favor of all clawback-related proposals, continuing the trend from 2018, which likely is also responsible for the continued increase in average support for this proposal in 2019. One of the two clawback-related proposals that passed this year was at drug maker Mallinckrodt, who also had a lobbying proposal pass this year, as discussed in Section D. The other was at FleetCor Technologies.

Proposals to limit golden parachutes (i.e., acceleration of performance awards upon a change in control) and to enhance executive stock retention requirements saw temporary increases in frequency and support levels in 2014 and 2015, but have since slowed to a trickle.

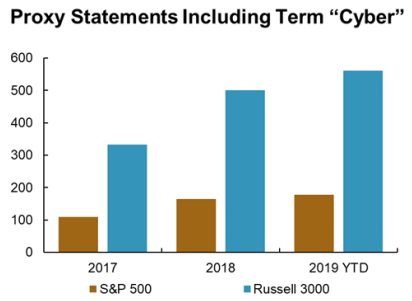

This year, two proposals on data privacy and cybersecurity as performance metrics for senior executive compensation went to a vote. ISS supported the proposal submitted to Walt Disney, although it received only 26.8% shareholder support. Recent regulatory changes, such as recent SEC cybersecurity guidance and new data privacy laws (e.g., the General Data Protection Regulation in the E.U.), may spur shareholders to submit more proposals of this type going forward, in particular if they consider a company’s disclosures on issues relating to cybersecurity and/or data privacy to be outdated, overly generalized or otherwise lacking. The SEC issued guidance on cybersecurity disclosures in February 201835 and issued an Investigative Report in October 2018 urging public companies to consider cyber threats when implementing internal accounting controls, based on its investigations of nine public companies that were victim to cyber fraud.36 In connection with these regulatory developments, it has become increasingly common for both large- and small-cap companies to address the topic of cybersecurity in their proxy statements. The number of proxy statements that included the term “cyber,” which presents a partial picture of trends in proxy disclosures with respect to cybersecurity risk oversight, has risen steadily:

Notwithstanding the trend of proactive disclosure on cybersecurity, given the recent attention on this subject, shareholder proposals on cybersecurity issues may increase going forward. One future source of shareholder movement may relate to companies and their handling of facial recognition technology. This year, Amazon received two proposals related to facial recognition—one to prohibit the sale of facial recognition technology to government agencies unless it is found to not harm civil and human rights, the other to report on the impact of government use of its facial recognition technology. As facial recognition becomes more prevalent in fraud prevention and security, companies may expect increased disclosure regarding their use of this technology and data.

G. No-Action Relief

Through June 30, 84 S&P Composite 1500 companies challenged a total of 156 proposals through the SEC no-action process, amounting to almost 25% of all proposals submitted. Around 46% of these challenged proposals were governance-related, 41% were ESP-related and 13% were compensation-related. Out of these no-action requests, the SEC staff granted full relief to 108 (or 69%), partial relief to three (or 2%), and denied the remaining 45 (or 29%). The vast majority of the 45 proposals where relief was denied went to a vote, with only three withdrawn.

Of the proposals subject to no-action requests, the most popular ones were environmental (15% of all no-action requests), eliminating supermajority voting (9%), and requiring independent board chairman (6%). Proposals that companies are most likely to challenge through the no-action process include declassify-the-board proposals (83% of all declassify-the-board proposals were challenged) and animal rights proposals (71%). Of the 111 no-action requests that received full or partial relief from the SEC, over 50% were governance-related proposals, closely followed by ESP proposals (40%). The most successfully excluded proposals were reduce special meeting threshold proposals (100% success rate), animal rights (100%), human rights (83%), and eliminate supermajority voting (79%).

The landscape for no-action relief is constantly changing as the SEC staff refines its criteria for granting relief. Although the changes have not been as dramatic as some predicted at the beginning of this season, companies should take these changes into account as they evaluate potential avenues for exclusion with respect to the shareholder proposals they receive for the 2020 season.

1. Ordinary Business

Companies seeking to exclude ESP proposals rely heavily on 14a-8(i)(7), the “ordinary business” exception. Last year, the SEC staff set a precedent for providing no-action relief under the micromanagement prong of 14a-8(i)(7) when it agreed with EOG Resources that a shareholder proposal asking the company to adopt “quantitative, time-bound targets for reducing greenhouse gas (GHG) emissions,” and to issue a report “discussing its plans and progress towards achieving these targets,” sought to micromanage the company. Notably, this year the SEC staff provided no-action relief to Devon Energy and Exxon, allowing the companies to exclude proposals from the George Gund Foundation and the New York State Common Retirement Fund, each seeking annual reporting that would include disclosure of greenhouse gas reduction targets aligned with the Paris Climate Agreement. In each case, the SEC staff determined the proposal would “micromanage the company by seeking to impose specific methods for implementing complex policies in place of the ongoing judgments of management as overseen by its board of directors.”

The SEC staff, however, did not agree with Anadarko Petroleum that a shareholder proposal from Jeanne Miller requesting that the company issue a report “describing if, and how, it plans to reduce its total contribution to climate change,” and align its investments and operations with the goals of the Paris Climate Agreement, sought to micromanage the company, and instead found that the proposal transcends ordinary business matters. This is consistent with the SEC’s responses to other no-action requests on other types of ESP proposals, including proposals related to the allocation of tax savings, immigration detention and mandatory employee arbitration. Nearly two-thirds of climate-related proposals filed with publicly held energy and utility companies have been challenged. The SEC has provided no-action relief to 45% of these proposals, the highest percentage in the last five years. Notably, the proponent behind the climate-related shareholder proposal challenged by Anadarko “took the opportunity to raise a big red flag about recent trends with regard to expanded interpretations of Rule14a-(i)(7),”37 highlighting the numerous no-action requests in the 2019 season aimed at excluding shareholder proposals dealing with “long-standing and established areas of shareholder concern,” such as “management of greenhouse gases, the use of antibiotics in the supply chain, promotion of gender equity management of the firm’s pollution impacts, [and] impacts on civil rights.”