Bill Reilly is managing director at Pearl Meyer & Partners, LLC. This post is based on his Pearl Meyer memorandum.

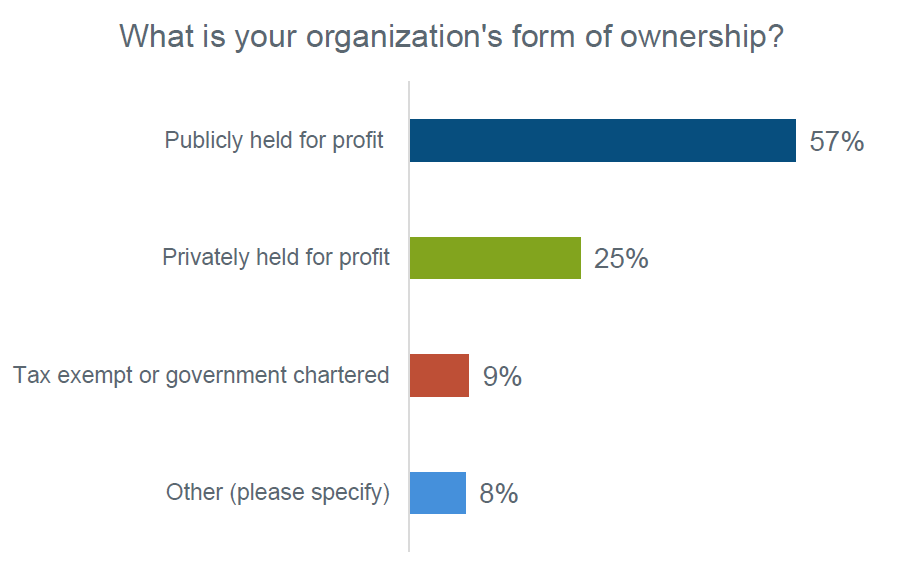

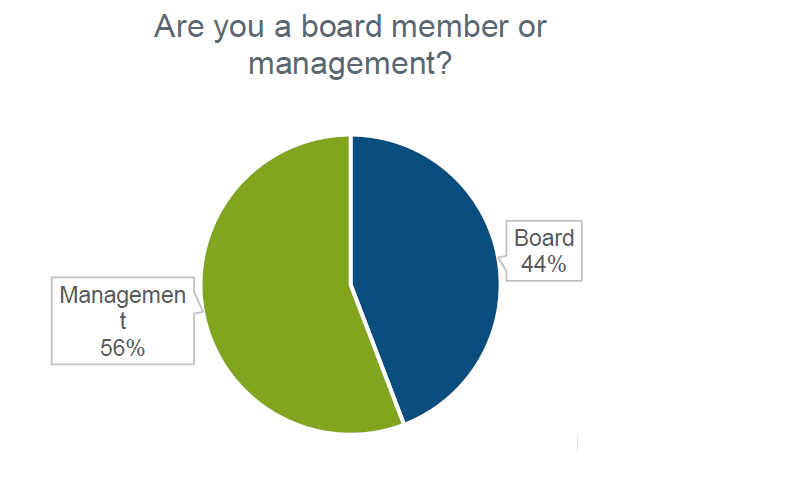

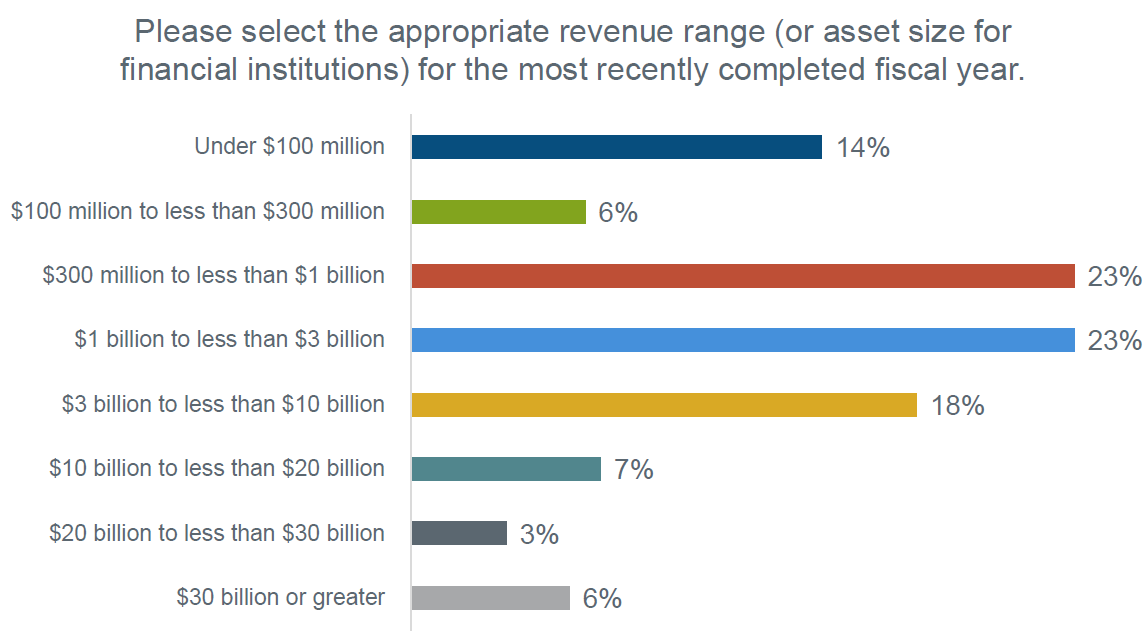

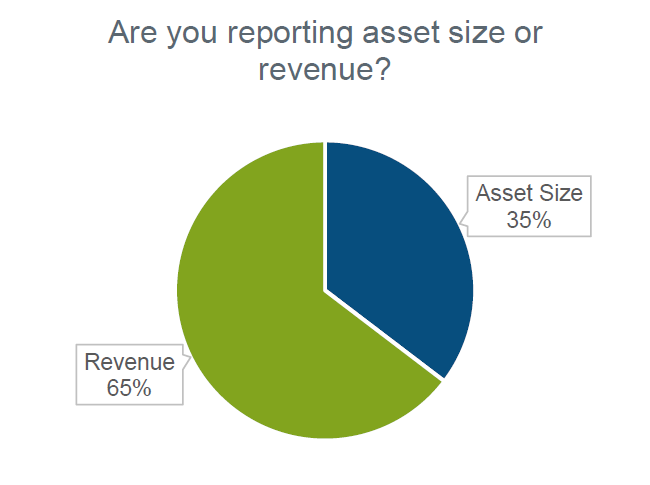

Pearl Meyer’s “On Point: Non-Employee Director Pay Practices” survey provides real-time insights on the latest trends in non-employee director (NED) compensation practices and potential responses to increased external scrutiny. This online survey was conducted in March and April of 2019, with participation from 204 companies, including 143 publicly traded, 52 private for-profit, and nine not-for-profit (NFP) organizations.

This survey addresses a variety of topics, such as time commitments and supplemental pay, NED pay-setting process and compensation philosophy, equity grant practices, and public company responses to enhanced external scrutiny on director compensation. These survey findings will provide valuable insights to companies as they evaluate potential NED program changes going forward.

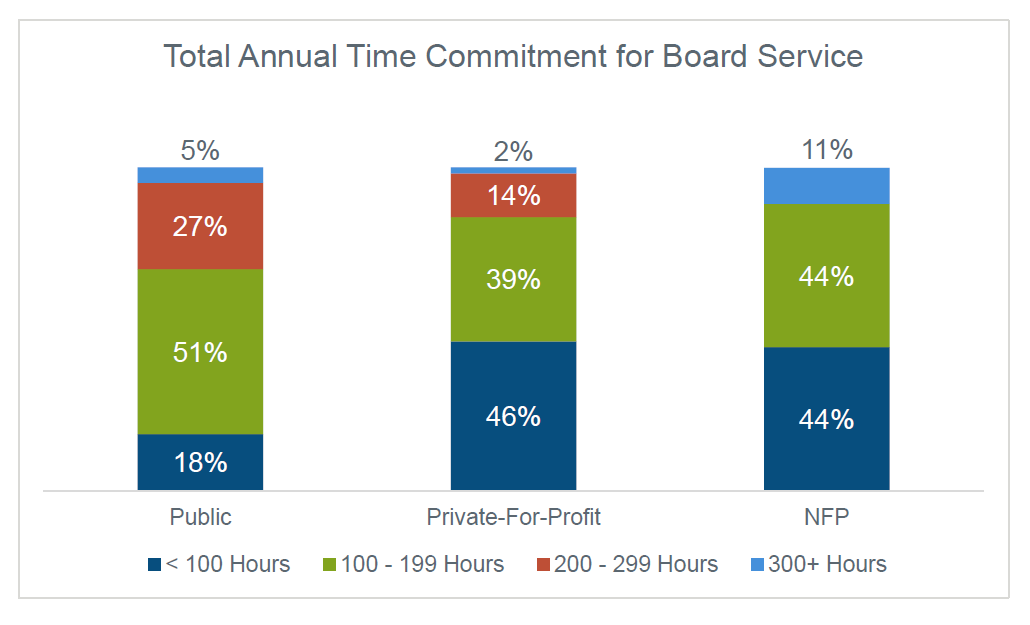

Hours Committed to Board Service

- Total annual time commitment for board service varies by ownership type.

- Time commitments strongly correlate with revenue size, with the longest time commitments cited by respondents in the $3 billion or more category and lowest for those under $500 million.

- Director respondents cited higher time commitments than management respondents.

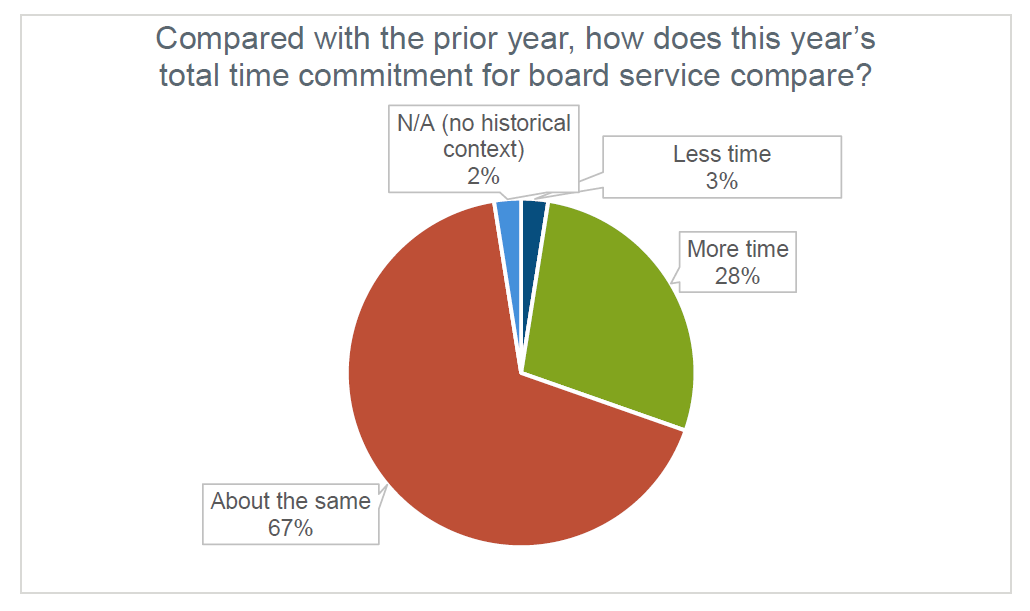

Time Commitment Comparison

- Most respondents (67% within the entire sample) expect similar time commitments as compared with the prior year.

- Higher time commitments are expected this year by approximately 32% of public company and 21% of private company respondents.

- Nearly 40% of director respondents anticipate higher time commitments this year as compared with 17% of management respondents.

Non-Standard Duties and Pay

- Most respondents (60%) do not provide additional compensation for higher-than-expected time commitments, consistent with the retainer-only pay model adopted by most public companies.

- Approximately one-third of respondents compensate for activities such as special committee service, unusual events, or meeting fees above a designated level.

- When applicable, additional pay is typically provided in cash (22% of respondents pay meeting fees, 17% provide retainers).

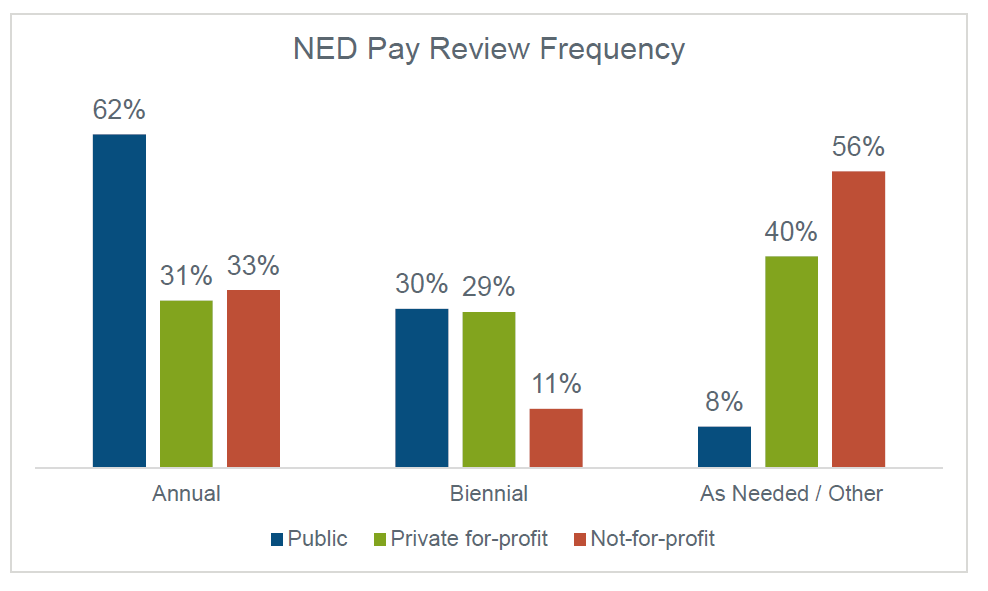

Frequency of Director Pay Review

- Public company respondents review NED pay more frequently than privately-held organizations, with twice as many conducting annual reviews.

- We do not find this surprising, given the much higher degree of external scrutiny on public companies and additional responsibilities.

Pay Review and Approval Responsibility

- For most respondents, the compensation committee is responsible for reviewing NED pay (67% of total sample), while the full board approves actual pay levels (65% of total sample).

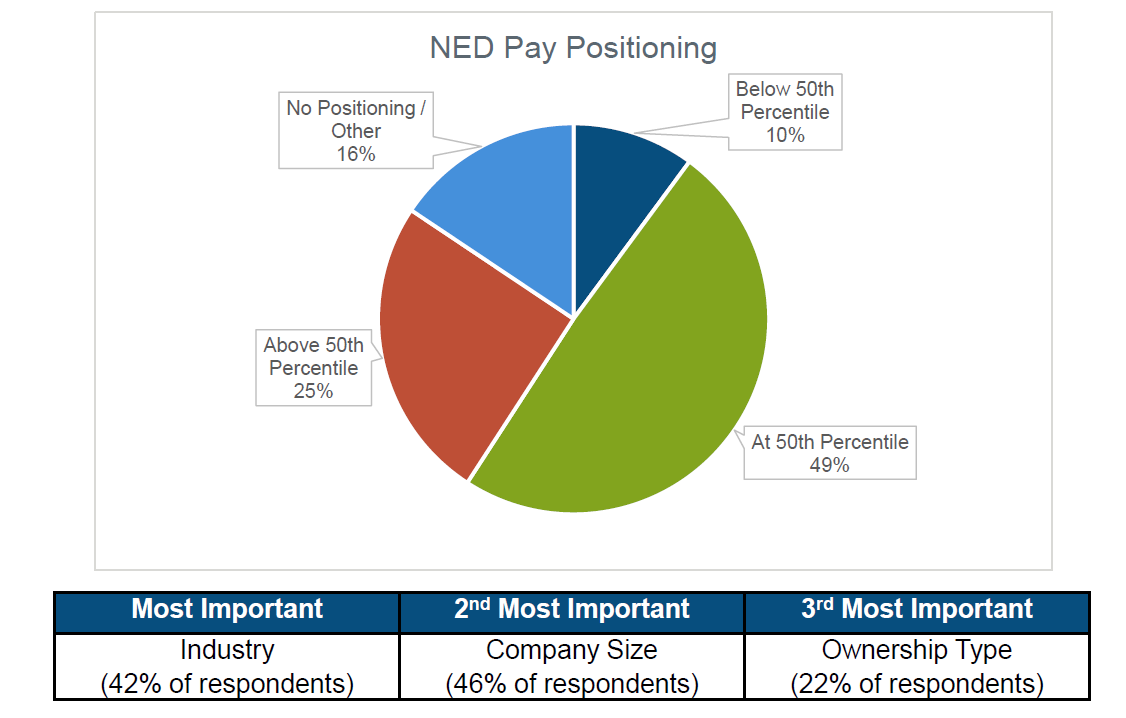

Pay Positioning and Benchmark Comparisons

- Approximately half of respondents within the total sample position NED pay at the market 50th percentile while 25% target above the 50th percentile.

- Consistent with findings from our executive pay practices survey, industry and company size are the most commonly cited criteria for NED compensation benchmarking.

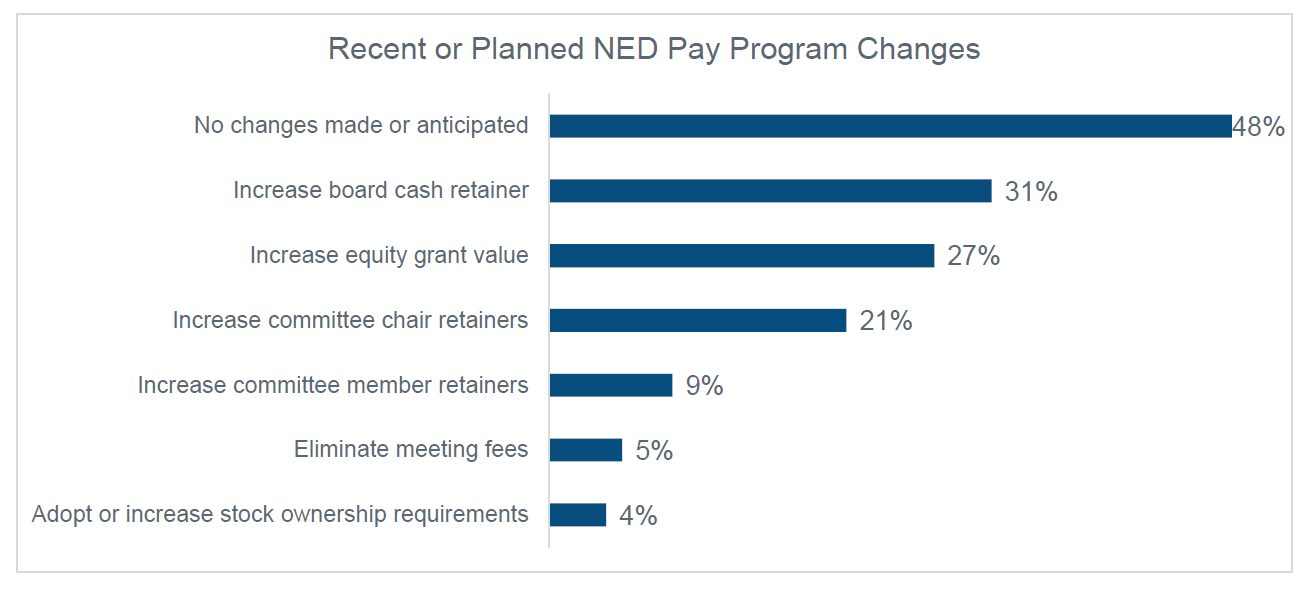

Pay Program Changes

- Slightly more than half of the total sample has recently made or is planning changes to the NED pay program in 2019, with increases to board cash retainers, equity grant values, and committee chair retainers most common.

- NED pay program changes were more common for public company respondents (58%) than for private for-profit respondents (44%).

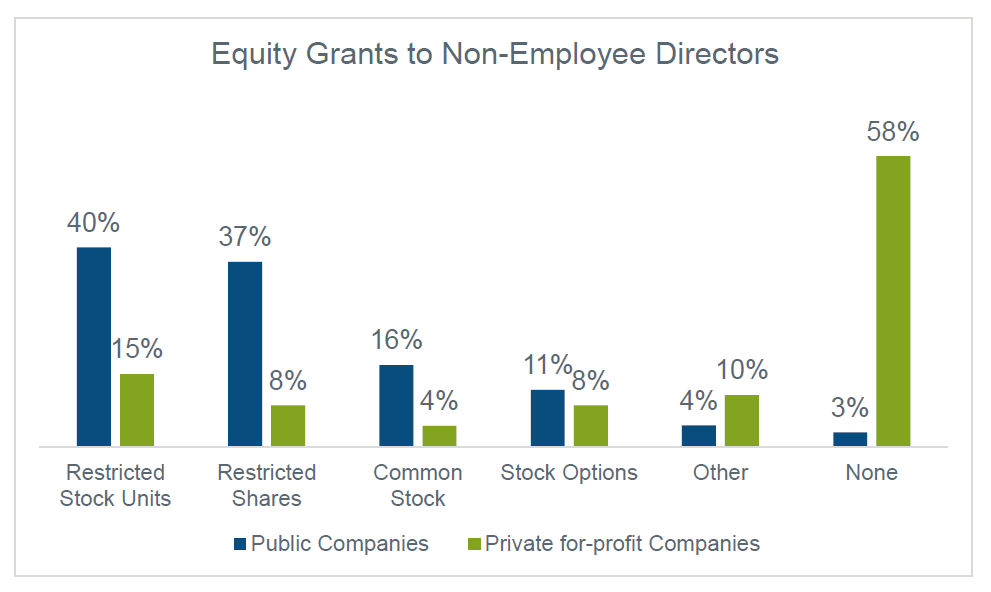

Equity Grant Practices

- Virtually all public company respondents provide equity grants to NEDs, typically in the form of restricted stock units or restricted shares, while most private for-profit respondents do not grant equity.

- For respondents providing equity grants, most (79%) use a fixed award value and 12% provide a fixed number of shares.

- Nearly half of public company respondents (47%) use 1-year vesting schedules and 26% provide immediately vested equity grants.

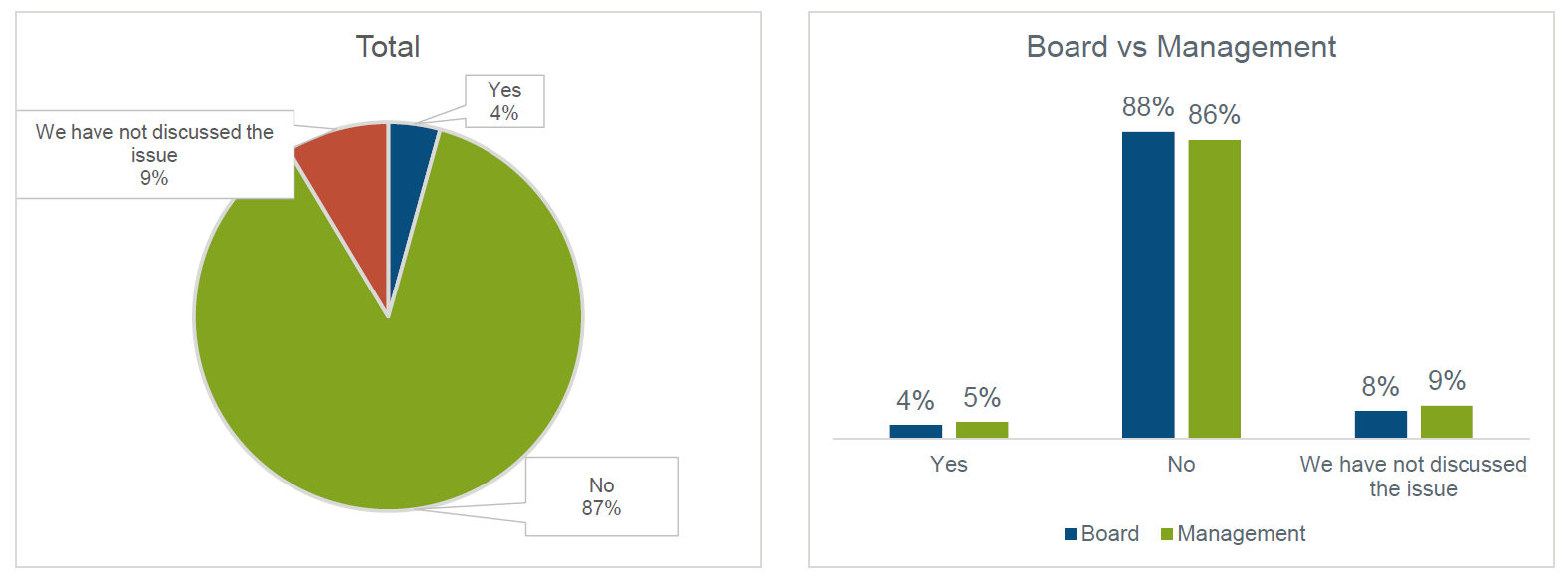

Public Company Responses to Enhanced External Scrutiny of NED Pay

- Enhanced external scrutiny of NED pay does not concern most respondents (87%), with only 4% indicating a concern and 9% saying the issue has not yet been discussed.

- Findings are remarkably similar for director versus management respondents.

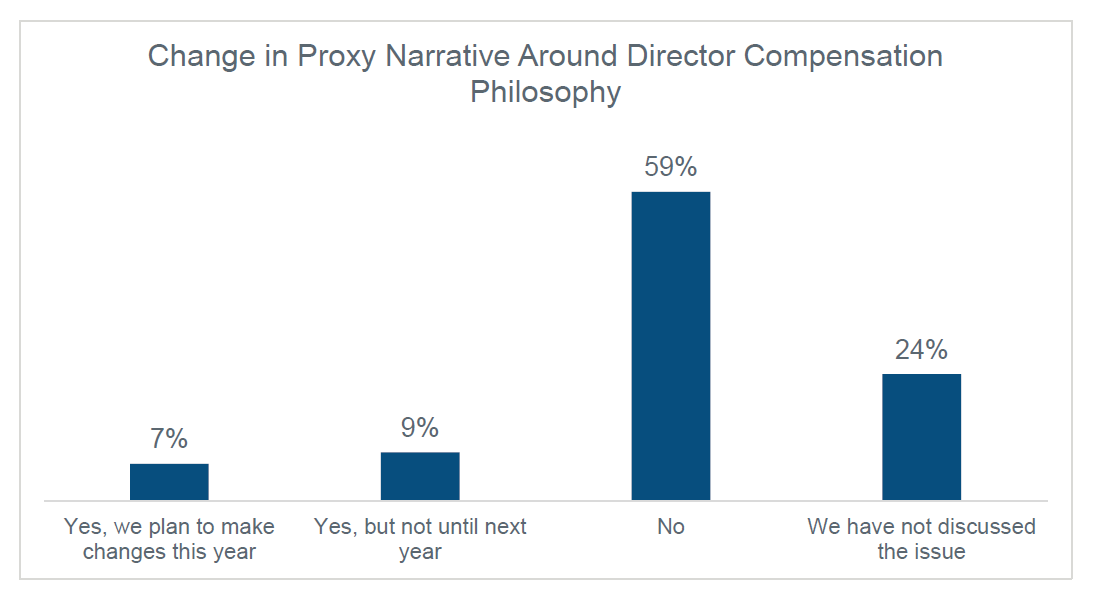

Changes in Proxy Narrative

- To date, just 16% of public company respondents have made or are planning proxy disclosure changes for NED pay.

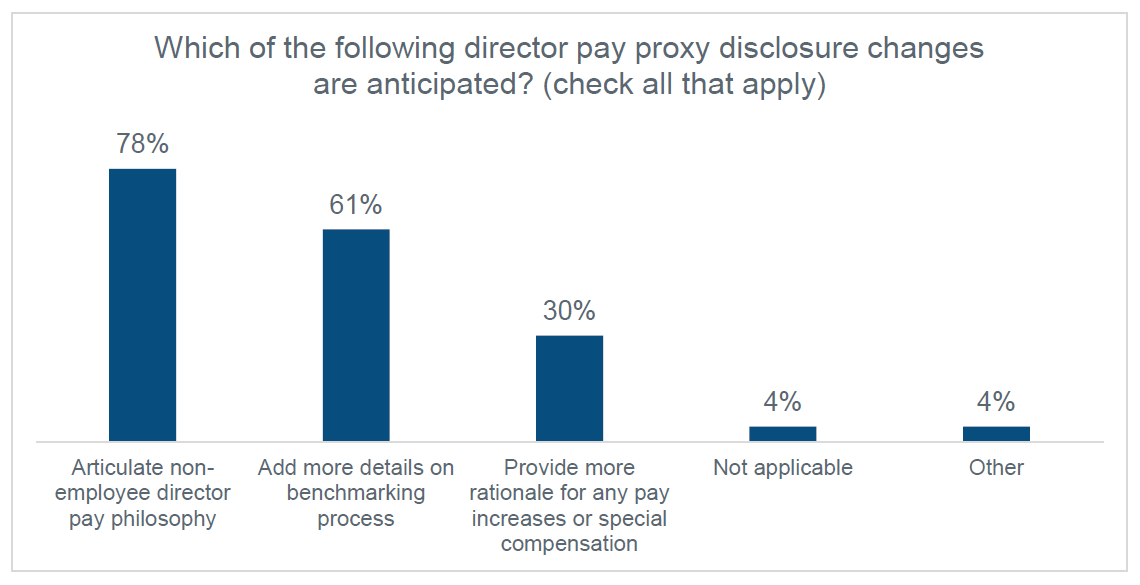

Anticipated Disclosure Change Topics

- For those respondents making or planning changes, the most commonly cited actions are enhanced discussion of director pay philosophy and outlining the benchmarking process.

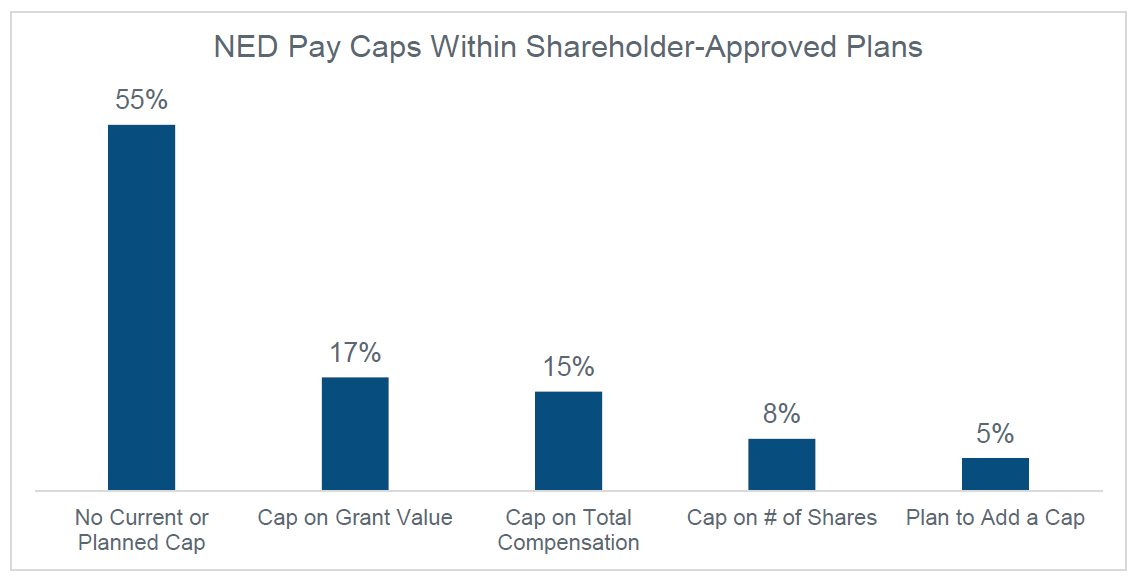

NED Pay Caps

- Slightly less than half (45%) of public company respondents have established NED pay caps within shareholder approved incentive plans, most commonly applying for equity grant values or total compensation.

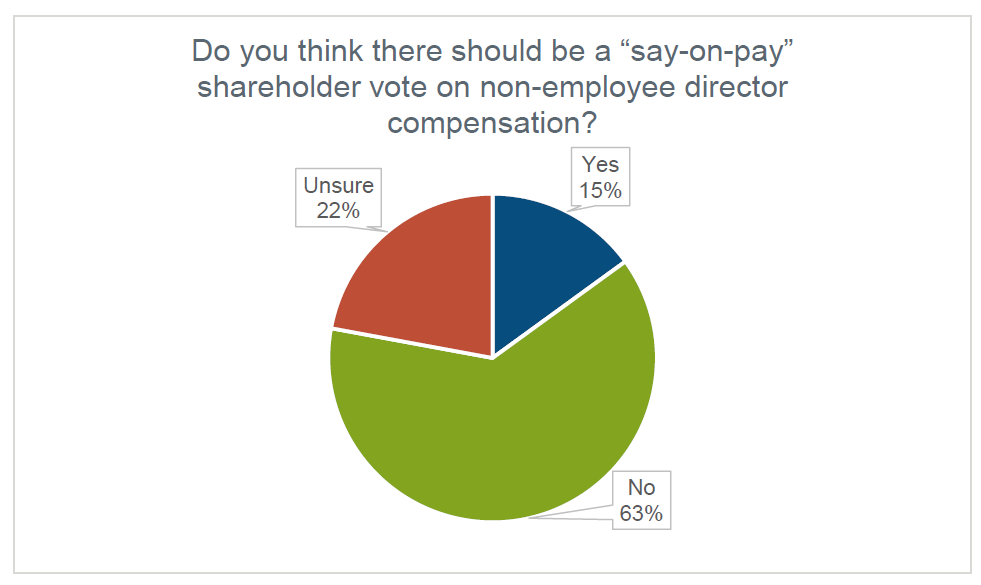

Say-on-Pay for Directors?

- Most respondents (63%) do not favor a “say-on-NED-pay” requirement, while 15% would support advisory votes, and 22% are undecided on their preference.

- The lack of support is consistent with broader market sentiment.

Summary Observations

- Director time commitments are likely to rise going forward as boards increase their focus on topics such as environmental, social, and governance (ESG) issues; cyber security and other risks; pay equity; and shareholder activism.

- We expect NED market values to continue to increase at modest levels going forward as companies look to refresh their boards with diverse, experienced directors.

- Details on broader market NED pay levels can be found in the NACD/Pearl Meyer Director Compensation Survey.

- Companies should ensure their NED pay programs are sufficiently competitive to attract highly qualified directors and to appropriately reward them for their efforts and contributions as well as any extraordinary time commitments.

- While most survey respondents are not currently concerned by the increased external scrutiny on NED pay, this will likely change over time, especially as Institutional Shareholder Services (ISS) begins to target high pay “outliers.”

- Going forward, we expect companies to enhance proxy disclosures on NED pay, including more discussion on compensation philosophy, benchmarking process, and rationale for any program adjustments or additional pay.

Print

Print