Brendan Rudolph is a principal at Cornerstone Research and Christopher Harris is a partner at Latham & Watkins LLP. This post is based on their Cornerstone memorandum.

Securities class action filings have increased significantly over the past few years and continue to be filed at near-record rates. The majority of class actions end in a dismissal or a settlement, and putative class members have the ability to opt out of settlements in order to pursue their own cases.

Prior research has found that the most relevant predictor of opt-outs is the dollar amount recovered, and studies in the post-PSLRA period have found that the prevalence of opt-out cases—efforts to achieve a larger recovery through settlement or judgment outside the class—has increased relative to the pre-PSLRA period. The research in this and the previous reports has built on these findings by examining the prevalence of opt-out cases, year by year, and analyzing salient publicly available information related to these cases.

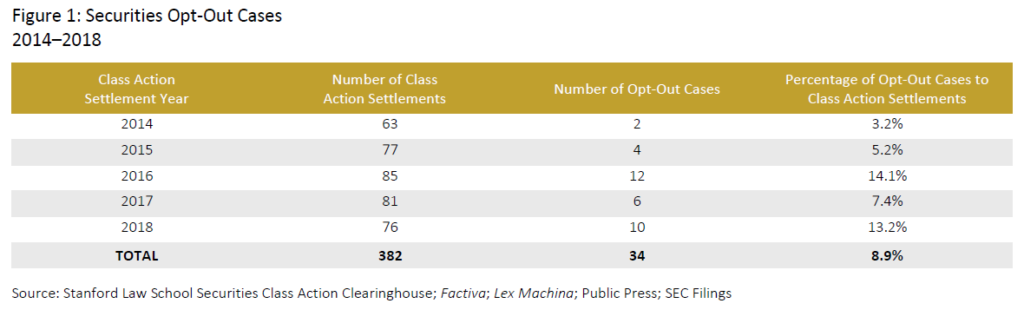

- Out of 382 securities class action settlements in 2014– 2018, based on publicly available data, there were 34 opt-out cases.

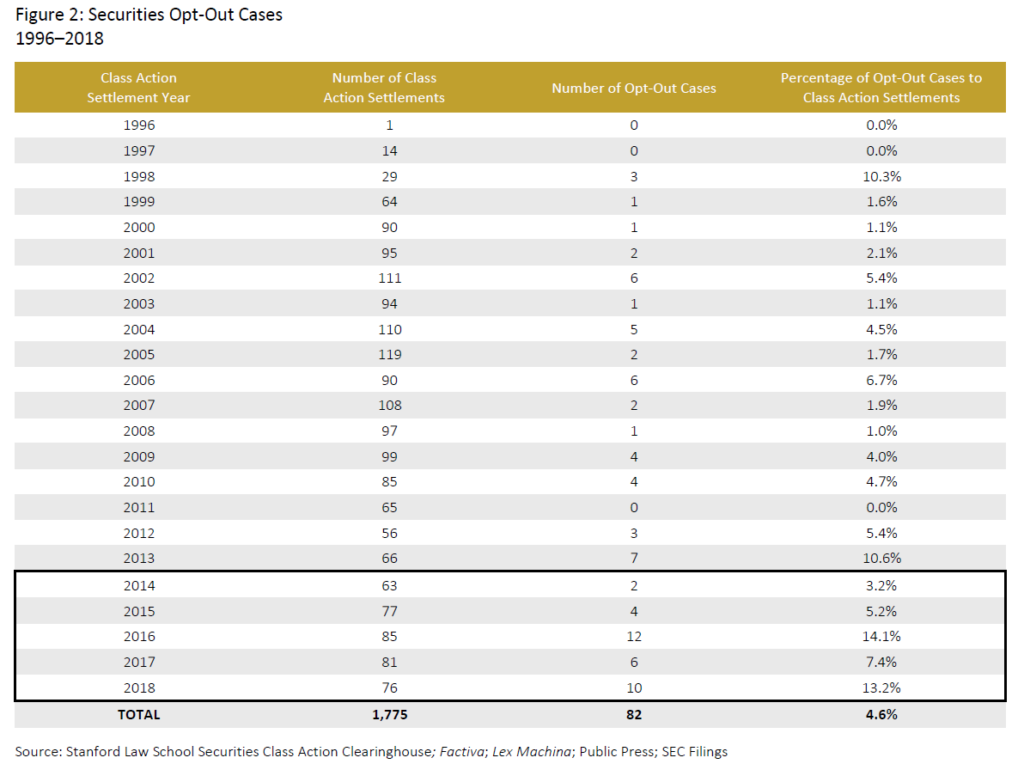

- Overall, out of 1,775 securities class action settlements in 1996–2018, there were 82 opt-out cases.

- The likelihood of defendants facing an opt-out may be increasing. Prior to 2014, the rate of opt-outs in class action settlements was 3.4 percent, compared to 8.9 percent between 2014 and 2018.

- Opt-outs remain more likely to occur in larger-dollar class action settlements.

- Institutional investors such as pension funds, sovereign wealth funds, and hedge funds remain frequent participants in opt-outs.

- Recent court rulings on tolling the statute of repose were expected to make it harder for investors to opt out of settlements. They may, however, have had the unintended effect of resulting in more preemptive opt-outs by large investors such as pension funds and investment firms, which are able to afford the additional fees involved in bringing a separate lawsuit.

- If opt-outs become filed more frequently, it may result in inefficiencies for all parties in the court system, as courts may struggle with a higher caseload, defendants may spend more on legal fees, and plaintiffs may face more uncertainty about the necessity of opting out or remaining in classes.

Opt-Out Securities Cases

This post identifies 82 cases from 1996 to 2018 in which at least one party from the class opted out, representing 4.6 percent of the sample of 1,775 cases.

A large portion of these opt-outs (34 out of 82) occurred between 2014 and 2018. Indeed, there are preliminary indications that the proportion of opt-outs may be increasing over recent years.

Prior to 2014, the rate of opt-outs in class action settlements had been around 3.4 percent, but between 2014 and 2018, 8.9 percent of class action settlements had opt-outs. The years 2016 and 2018, in particular, had large numbers of class action opt-outs, with opt-outs in a total of 22 cases representing almost 14 percent of all class settlements in those years.

Prevalence in Large Cases

Prior research has shown that, in general, as class action settlements increase in size, plaintiffs are more likely to opt out. Between 2014 and 2018, 28 percent of cases with class action settlements over $20 million had associated opt-outs. Conversely, for class action settlements below $20 million, the opt-out rate was only 2.1 percent. Over the entire 1996– 2018 period, the research shows that 15 percent of cases over $20 million had associated opt-outs, while for those under $20 million the rate was only 1.3 percent.

Because of this disparity, class actions that settle above $20 million represent a disproportionate amount of the cases that ultimately face an opt-out. While cases with settlements above $20 million account for 26 percent of the 2014–2018 settlements, they represent over 80 percent of the opt-out cases that were identified over that period.

A similar effect is also seen among the largest “mega” settlements, where 15 of 23 cases with settlements over $500 million in 1996–2018 had associated opt-outs. All four cases with settlements over $500 million in 2014–2018 had associated opt-outs, compared with 7.4 percent of class action settlements below $500 million.

Across all class action settlements between 1996 and 2018, 65 percent with settlements of $500 million or greater had at least one related opt-out, compared with less than 4 percent of settlements below $500 million.

Plaintiffs

While previous research had found pension funds to be the most common plaintiffs in opt-out cases, appearing in almost half of the pre-2014 opt-outs, they were less involved between 2014 and 2018, only appearing in four out of 34 opt-outs in which parties were able to be identified.

The higher number of pension funds observed previously may have been driven in part by numerous opt-outs pursued by the Florida State Board of Administration, which did not file any opt-out suits in 2014–2018.

Non-pension institutional investors, including mutual funds, hedge funds, and other investment management firms, played a significant role and were parties in 15 of the 34 opt-outs in 2014–2018.

Individuals, trusts, and other companies had involvement in 30 of the 34 opt-outs. Trusts were involved in 12 such opt-outs, and two involved insurance companies.

Settlement Amount

In 22 of the 82 class action settlements with opt-out cases in 1996–2018, the settlement or judgment amount for some or all of the opt-out cases was publicly available. The largest set of opt-out settlements related to a single case, in terms of total dollar value, remains AOL Time Warner Inc., where the $764 million of opt-out settlements was 30.6 percent of the size of the class action settlement.

The largest opt-out settlement amount as a percentage of the class action settlement was Qwest Communications International Inc., where the $411 million opt-out settlement was 92.4 percent of the final class action settlement. Opt-out cases in the period covering 2014–2018 had less publicly disclosed settlement information than the research had found for the previous period covering 1996–2014.

The complete publication, including footnotes, is available here.

Print

Print