Robert Rosenblum is partner and Amy Caiazza and Taylor Evenson are associates at Wilson Sonsini Goodrich & Rosati. This post is based on their Wilson Sonsini memorandum.

For many (if not all) companies developing blockchain-based technologies that involve digital assets (“tokens”), success is dependent on two critical issues: (1) the ability of a project sponsor (the “token issuer”) to distribute tokens broadly to its targeted users, often as rewards for contributing to a project’s development, and (2) free transferability of the tokens, without which the tokens are of limited use or value. These two elements together can encourage use and development of a new platform, which in turn can allow it to then achieve visibility and market saturation. In contrast, without these two features, it is unlikely that a token-based platform will be able to fully develop, much less achieve success.

The Problem

Throughout much of 2017 and 2018, many companies developing blockchain-based technologies (and their counsel) steadfastly took the position that tokens were not securities and that, as a result, the federal securities laws did not apply to limit a developer’s ability to distribute freely transferrable tokens broadly.

This ultimately did not serve the developer’s interests. The now well-known speech given by William Hinman, Director of the Securities and Exchange Commission’s (“SEC”) Division of Corporation Finance, in June 2018, confirmed that the SEC viewed virtually all tokens besides Bitcoin and Ether to be securities. Recently, the SEC has issued two no-action letters (the “token NALs”), to TurnKey Jet, Inc. and Pocketful of Quarters, Inc., that suggest that tokens under significantly constrained circumstances could also not be securities.

As described in these token NALs, for a developer to rely on the SEC’s relief, proceeds from the developer’s token sales cannot be used to build the platform, the tokens need to be immediately functional upon sale, transfers can only be allowed to wallets on the platform, tokens can only be sold at a fixed price, repurchases could only be at a discount to the fixed price, and the token cannot be marketed in a manner to suggest potential increases in market value.

Development Tip

If your token is not Bitcoin, Ether, or subject to the extensive restrictions described in the token NALs, there is a high likelihood it’s a security. There are thousands of outstanding tokens, and at least to date, the SEC has determined that exactly four can be treated as something other than a security. The federal courts that have considered whether a token is a security have agreed with the SEC.

Because most tokens are considered securities under the federal securities laws and the token NALs suggest most tokens will remain securities, token issuers cannot engage in broad distributions of freely transferable tokens without complying with those laws. Under the federal securities laws, any offering and sale of a security must be either registered with the SEC or comply with an exemption from registration. Most frequently, token issuers rely on exemptions for private offerings made only to “accredited investors” (generally, individuals with at least $1 million in net worth or annual income of $200,000, $300,000 with a spouse, or entities with $5 million in assets) or only to non-U.S. persons. This has meant that many intended users of a platform cannot receive the tokens. In addition, because securities offered in reliance on these exemptions are not tradable for at least a year and a day after their distribution, tokens distributed in this manner are not freely transferable. Even after the year-long holding period, token issuers cannot receive the tokens and re-distribute them without complying with the same restrictions.

Development Tip

We commonly hear a number of questions from developers who feel confident that their token is one of the special, few non-security tokens: “But wait! My platform is really decentralized. My tokens aren’t securities, are they?” and “I’m creating a stable coin…that’s not a security, is it?” The answers to all of these questions can be found in SEC v. W.J. Howey Company (1946), in which the Supreme Court found that an instrument meets the definition of an “investment contract” under the Securities Act if it involves “an investment of money in a common enterprise with profits to come solely from the efforts of others.” The fact that tokens involve new or different technologies does not mean that Howey is inapplicable. The new or different is precisely what Howey is designed to address. Remember that Howey involved orange groves, and the SEC has used the Howey analysis to take the position that interests involving concert tickets, golf club memberships, and ferrets can be securities. The Howey definition is far-reaching.

The Solution

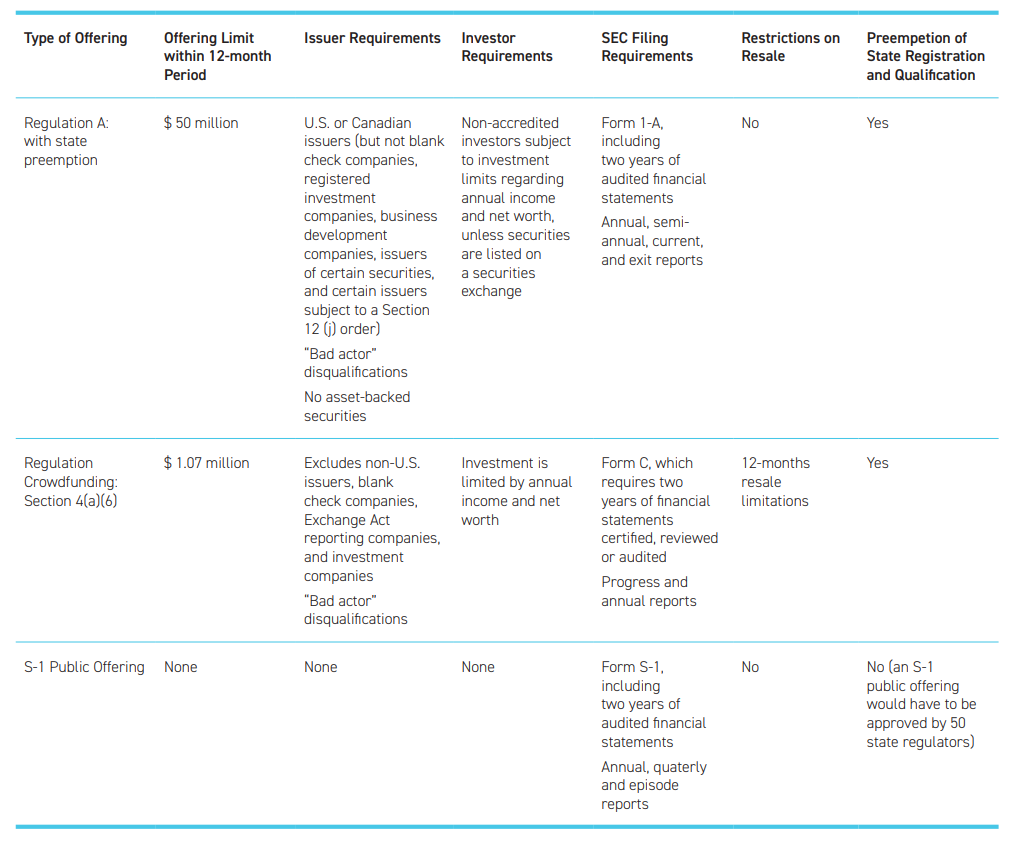

A “mini-IPO” under Regulation A, a traditional initial public offering, or a Regulation Crowdfunding offering each provide potential solutions to this problem. Each allows issuers to more freely distribute tokens that will be freely tradable—though with significantly different constraints.

With the latter two options, there are significant limitations that may make these options less attractive to token issuers. In a traditional initial public offering, issuers have significant flexibility with the number of tokens being offered under the S-1 registration statement, as well as how they’re offered. Issuers do, however, need to qualify issuances under state “blue sky” securities laws, which can be an expensive and time-consuming endeavor. In a Regulation Crowdfunding offering, issuers will only be able to issue up to $1,070,000 worth of tokens in a twelve month period.

Who Should Consider Regulation A

Some token issuers may not need Regulation A. If a token issuer doesn’t need an ongoing offering in which a broad range of users receive tokens over time, and/or there is no need to distribute freely tradeable tokens, then Regulation A may not be necessary. In these cases, traditional private placements may be the most efficient option.

Most token platforms we’ve seen, however, rely on an ongoing offering of freely transferable tokens to succeed. For these projects, developers should find counsel that is aware of the complexity of the issues developers face and can work with them through the entire process. These are not simple projects.

While the number and complexity of issues that token issuers must address for a Regulation A offering may seem daunting, an added benefit of addressing these issues is that developers may accelerate the process of achieving their goals for the company, the platform, and the tokens. This, in turn, could accelerate success. It may also speed decentralization where that is a company’s goal.

As a result, Regulation A may be the best option for many issuers. Regulation A is not restriction free—among other limitations, it only allows distributions of up to $50 million in tokens annually—and it may involve considerable legal and other costs. However, it provides a way to legally distribute tokens to the public without having to qualify the transaction under blue sky laws. Unlike a fully registered public offering, it can provide preemption of state-level registration or qualification of tokens. And it turns out to be a workable option, as shown by the recent success of the Blockstack and YouNow offerings.

Development Tip

It is important to keep in mind that Regulation A offerings are not solutions that can be achieved through rote copy-pasting of previous offering documents used by the token issuer or even copying other token issuers’ offering documents. Developers need to publicly and comprehensively disclose information about not only the company and the tokens, but also the platform on which the token will operate and how the company will develop that platform, including any plans it may have to foster sufficient decentralization so that it is no longer the issuer of the securities. Each of these matters are highly specific to the issuer, and can require significant effort and time to address. There also will likely be unique regulatory issues for each token issuer, and those regulatory issues will follow the precise functions and feature of each token.

Summary of the Regulation A Offering Process

Regulation A requires a token issuer to prepare an “Offering Statement” that is qualified by the SEC. Elsewhere in the complete publication, we describe key issues a developer should consider before launching this process. Below, we discuss the key steps of the qualification process and beyond.

1. Preparation of the Offering Statement

The Offering Statement is the disclosure document that must be prepared and filed with the SEC. The Offering Statement must include all the information requested on Form 1-A. In general, Form 1-A asks for disclosures about (among other things) the company, its business, its ownership, its financial statements, the terms of the securities being offered, and material risks related to purchasing and holding the securities.

A token offering under Regulation A is more complex than one for typical equity or debt. In order to describe all the material information related to a token distribution, issuers need to describe information about not only the company and the tokens, but the platform on which the token will operate and how the company will develop that platform, including any plans it may have to foster sufficient decentralization so that it is no longer the issuer of the securities. As a result, Offering Statements prepared by token issuers will look much more like the registration statements filed for full public offerings—and involve significant time to draft.

The Offering Statement must be written in “plain English,” which can be a challenge when communicating relatively complex terms and concepts (such as engineering features or cybersecurity risks).

The Offering Statement also requires an issuer to file a potentially extensive number of exhibits, including (for example) the company’s material contracts, the smart contracts governing the tokens, securities issued in previous offerings (such as “SAFT” or similar offerings), white papers and other marketing materials, and others.

Most typically, token issuers will file initial drafts of the Offering Statement confidentially, although at some point (usually, when qualification seems close at hand) a token issuer is required to file publicly. The SEC can qualify the statement on a date at least 21 days after this “public flip.”

2. Dialogue with the SEC

Once the Offering Statement has been filed with the SEC, token issuers can expect several rounds of comments on various issues and questions raised by the SEC staff. Issuers are required to respond to and resolve those comments through written answers and ongoing amendments to the Offering Statement.

Token developers will likely engage in several rounds of comments and need to respond to a significant number of SEC questions relative to Regulation A offerings of typical equity or debt. This can result in a more lengthy time period before qualification. For example, in the Blockstack and YouNow offerings, the SEC’s comments addressed issues such as the following:

3. Qualification and the Beginning of Offers and Sales

Once the token developer has responded to all SEC comments, the SEC may then notify the developer that its Offering Statement has been qualified. It’s only at this point that the developer may begin distributing tokens to users or others on its platform, and only in the ways described in the Offering Statement.

4. Updates to Offering Statement and Ongoing Reporting Requirements

To the extent that the developer is conducting an ongoing offering, it must update the Offering Statement on an ongoing basis, to ensure that the Offering Statement always contains all material information about the company, the platform, and the tokens. In some cases, where changes are relatively minor, there is no need for additional input from the SEC. In cases where there are fundamental changes to information in the qualified Offering Statement, the SEC will review and approve the amendment.

Regulation A issuers also have ongoing reporting requirements. Although these disclosure obligations are less burdensome than those required after a fully registered offering, they nonetheless result in ongoing costs to token issuers.

The complete publication, including footnotes, is available here.

Print

Print