Sean J. Griffith is T.J. Maloney Chair and Professor of Law at Fordham Law School. This post is based on his recent paper, forthcoming in the Cambridge International Handbook of Class Actions.

2018 was another big year for shareholder suits challenging mergers and acquisitions. According to a recent study by Cornerstone, 82% of M&A deals valued over $100 million attracted litigation in 2018, only slightly down from the 90% of M&A deals that were challenged in the years 2009 through 2015, prior to the Delaware Court of Chancery’s 2016 decision in In re Trulia. Indeed, the Cornerstone study reveals that Trulia did not put an end to M&A lawsuits, but merely changed where they are brought. Instead of being litigated predominantly in Delaware under state corporate law, 91% of merger lawsuits in 2018 were brought in federal district courts under federal securities law.

Commenting on these findings in Law 360 one prominent plaintiffs’ lawyer compared the shift of merger suits from state to federal court to rats following a trail of scraps in an apartment building, concluding that “those same rats just moved to federal court.” But how has moving to federal court changed the conduct of merger litigation? What differences are there in claims and outcomes now that these cases are predominantly brought in federal rather than state court?

In Class Action Nuisance Suits: Evidence from Frequent Filer Shareholder Plaintiffs, I examine shifts in the patterns of merger litigation by collecting evidence from “frequent-filer” shareholder plaintiffs both before and after Trulia. Using an original, hand-collected dataset of litigation filed by seven “frequent filer” shareholder plaintiffs over a five year period, 2014 through 2018, I compile the substantive allegations, procedural form, identity of counsel, and outcomes of claims.

Here’s an overview of what I find:

- Over my five year sample period, these seven plaintiffs filed a total of 281 shareholder suits. Summary data concerning these cases appears in the table below.

Summary Data

| Year | ||||||

|---|---|---|---|---|---|---|

| 2018 | 2017 | 2016 | 2015 | 2014 | ||

| Type of Filing | Merger | 44 | 96 | 24 | 25 | 24 |

| Derivative | 2 | 4 | 4 | 8 | 2 | |

| Proxy | 13 | 15 | 8 | 0 | 0 | |

| Traditional Securities | 0 | 0 | 0 | 4 | 1 | |

| Other | 1 | 2 | 1 | 1 | 1 | |

| Forum | Federal | 52 | 112 | 23 | 12 | 5 |

| State | 7 | 5 | 14 | 26 | 23 | |

| Outcome | Settlement | 0 | 1 | 4 | 13 | 13 |

| Dismissal | 51 | 106 | 25 | 9 | 5 | |

| Motion | 0 | 2 | 3 | 5 | 1 | |

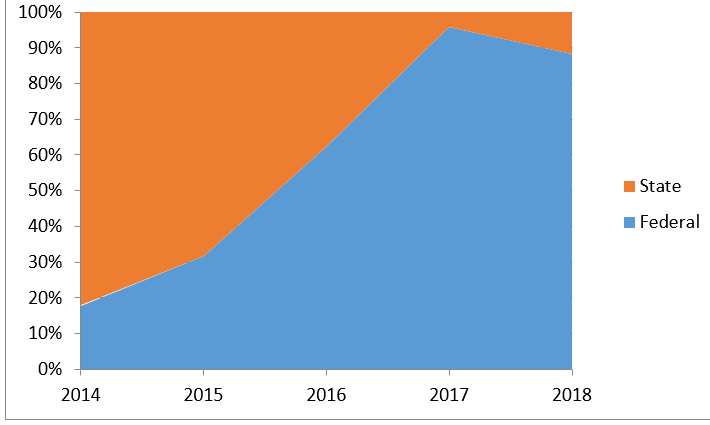

Over the sample period, these suits transformed from state court lawsuits based on corporate law to federal district court cases based on federal securities laws, as shown in the figure below.

Lawsuit Filings by Jurisdiction

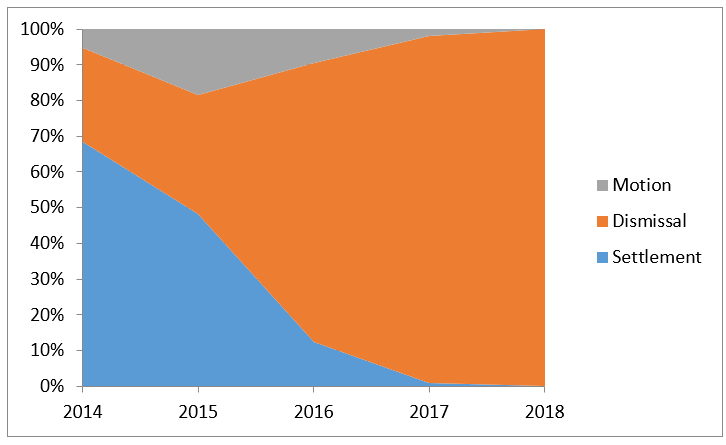

The outcomes of these suits transformed from class wide settlements based on supplemental disclosures (“disclosure settlements”) to mootness dismissals based on the defendant’s correction of the alleged deficiencies of disclosure (“mootness resolutions”). This change is captured in the figure below.

Lawsuit Outcomes

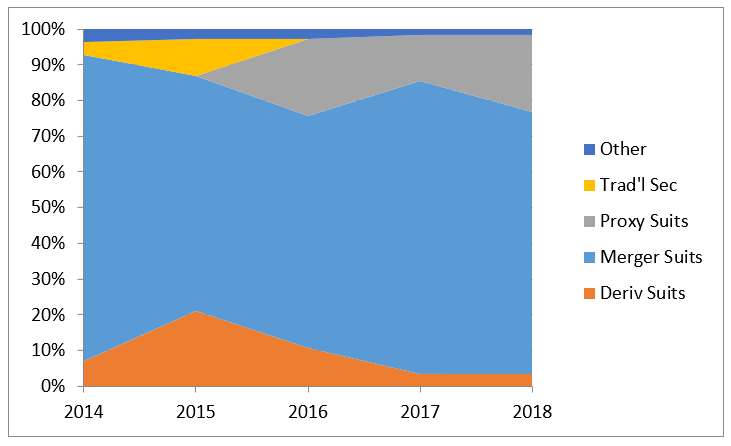

Analysis of frequent-filer litigation patterns reveals that federal disclosure-based claims have evolved still further. Plaintiffs have now begun to file disclosure-based claims against corporations in contexts other than M&A. This can be seen in the rise of non-M&A “Proxy Suits” depicted in the figure below.

Lawsuit Filings by Type of Claim

The transformation from disclosure settlements to mootness resolutions in federal court appears to have been motivated by a desire to avoid judicial scrutiny under the Private Securities Litigation Reform Act of 1995 (the “PSLRA”). Plaintiffs have also begun filing claims as individuals rather than as a class, apparently as a further precaution against application of the PSLRA.

In the article I argue that the metastatic growth of M&A litigation is encouraged by a coordination problem among federal district court judges. Consistent application of the PSLRA would contain these suits. Most notably, the PSLRA bars the award of attorneys’ fees for non-monetary recoveries. It also requires plaintiffs to meet a high standard of materiality at pleading, prevents plaintiffs from seeking to represent a class more than five times in three years, and requires a set of sworn undertakings by class action claimants. Consistent application of the PSLRA, however, requires judicial coordination which has so far been lacking among federal district courts.

I therefore offer several mechanisms through which the federal judiciary could coordinate to address the challenges posed by merger litigation in federal court. These include making class action merger litigation a focus of the Federal Judicial Conference and designing educational programming through the Federal Judicial Center. Coordinating the judicial approach to merger litigation in federal court might make it possible to address the excesses of this litigation without the need for further legislative intervention.

The complete article is available for download here.

Print

Print