Paul Schneider is Head of Corporate Governance at the Ontario Teachers’ Pension Plan. This post is based on a publication by the Ontario Teachers’ Pension Plan corporate governance group, led by Mr. Schneider.

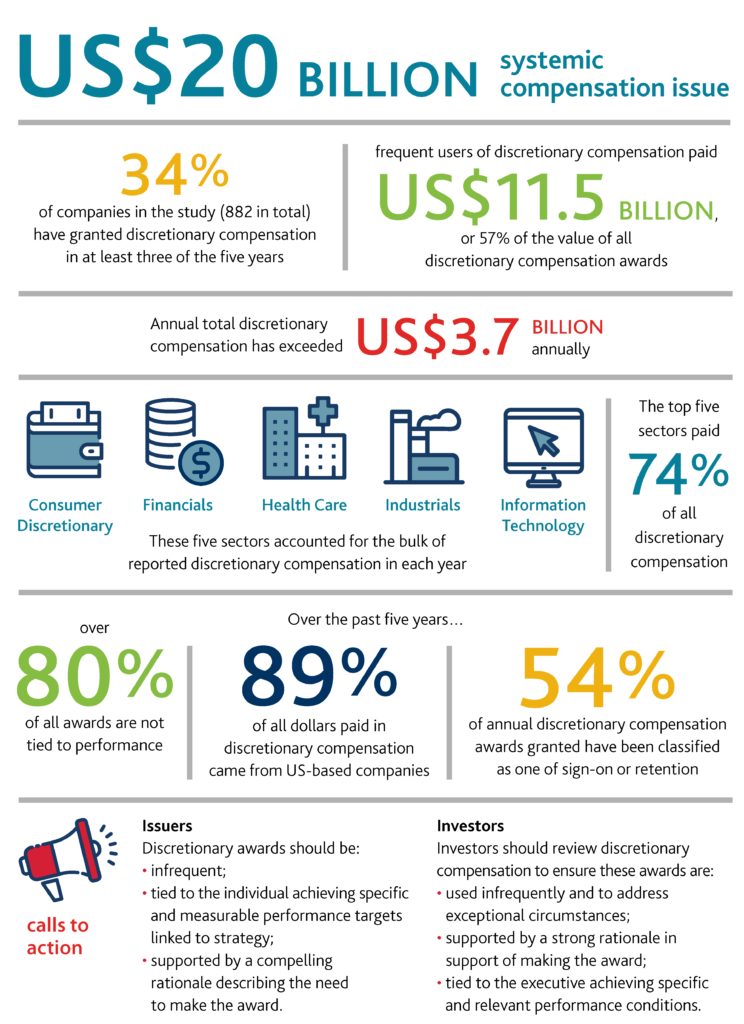

With over US$20 billion paid out in total over the past five years, discretionary compensation has become a systemic compensation issue that needs to be addressed.

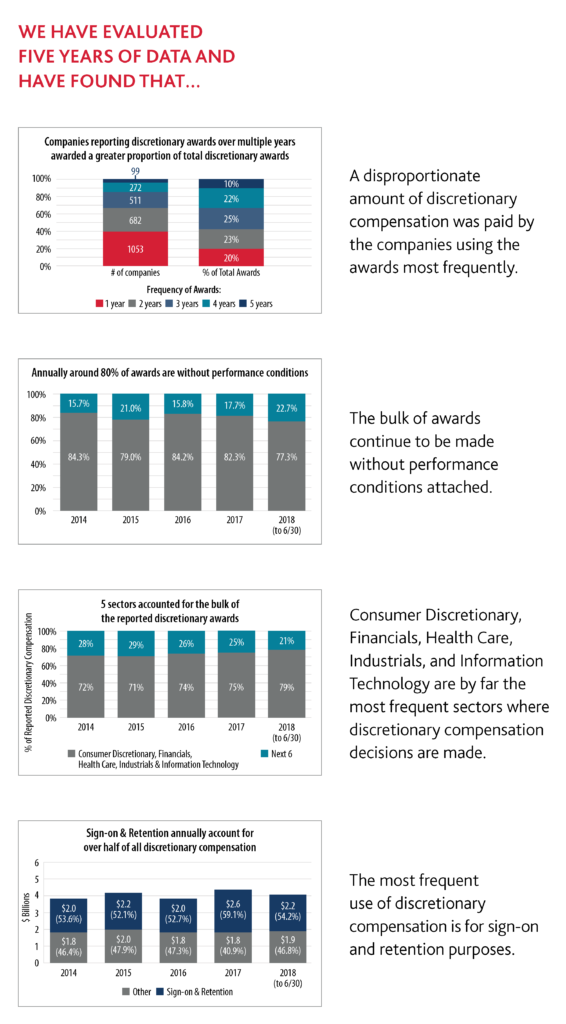

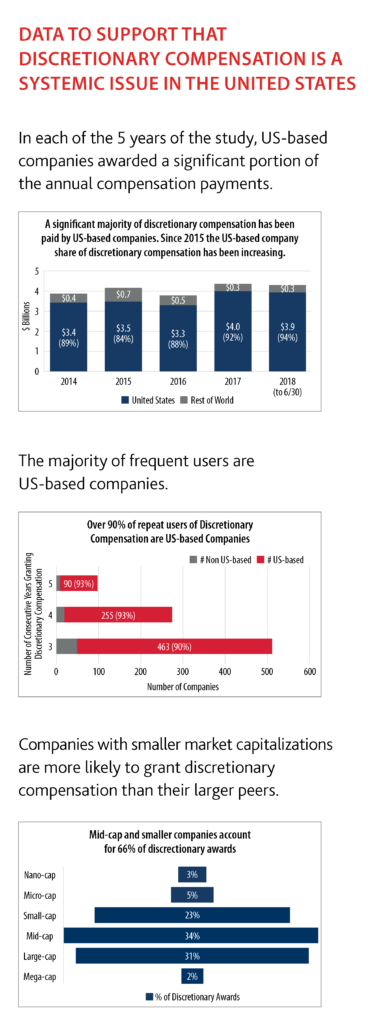

Since 2014, at least US$3.7 billion has been paid in discretionary compensation to executives in any given year. Not only are the amounts substantial, around 80% of all awards are not performance based. This means that for over US$16 billion of the discretionary awards there were no additional performance conditions required. We believe that given the exceptionality of these awards, it is appropriate they be conditional upon the executives achieving some specific performance objective that is tied to strategic objectives. The absence of performance conditions runs contrary to a pay-for-performance objective. Furthermore, discretionary awards fall outside the regular compensation program and may not be captured in a say-on-pay analysis.

For a number of companies it appears that discretionary compensation has become a regular compensation tool—the exceptional is becoming the acceptable. Finally, about 60% of all awards dollars are directed at sign-on and retention, raising questions about management of succession planning. Also, awarding discretionary compensation for retention purposes is at odds with the claim that the compensation program (i.e. salary, short- and long-term compensation components) is designed to attract and retain. We believe there is a place for discretionary compensation in a compensation program. However, the frequency, size, and structure we have observed raises concerns that discretionary compensation is not being used in a manner consistent with good compensation governance.

Print

Print