Brad Freelan is a partner and Dana Gregoire is an associate at Fasken Martineau DuMoulin LLP. This post is based on their Fasken memorandum. Related research from the Program on Corporate Governance includes The Myth of the Shareholder Franchise by Lucian Bebchuk (discussed on the Forum here); Private Ordering and the Proxy Access Debate by Lucian Bebchuk and Scott Hirst (discussed on the Forum here); Universal Proxies by Scott Hirst (discussed on the Forum here); and Does Shareholder Proxy Access Improve Firm Value? Evidence from the Business Roundtable Challenge by Bo Becker, Daniel Bergstresser, and Guhan Subramanian (discussed on the Forum here).

The year 2019 saw a number of interesting developments in Canadian proxy contests. The volume of

board-related contests reached a low point. In formal contests, outcomes were split between management and dissidents, but dissidents fared much better in broadcast-only board-related contests. Unlike in previous years, most of the action occurred among mid/large cap companies, rather than primarily micro caps. The use of universal proxy cards also became more frequent, although they were used mostly by dissidents.

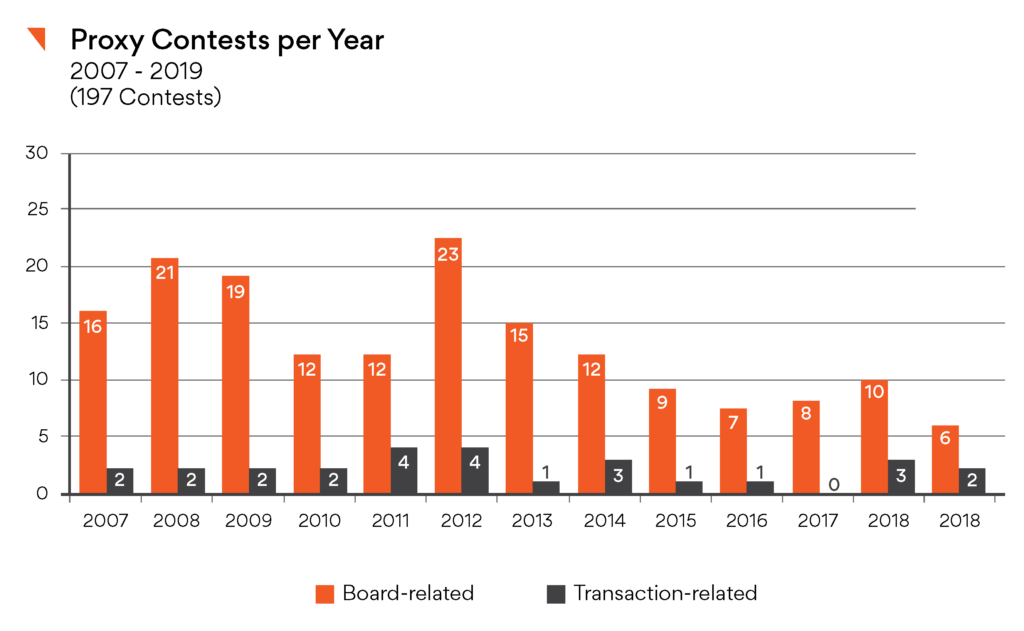

1. The volume of board-related contests reached a low point

After seeing a bump in the number of contests last year, 2019 saw just six board-related contests (the

lowest number since we began tracking in 2007) and two transaction-related contests. The downward

trend in the number of contests continues from the period of heightened public activity in 2007–2014.

A board-related contest involves an attempt by a dissident to have some of its own nominees elected to the target board, while a transaction-related contest involves a dissident that solicits shareholders to vote against a transaction proposed by the issuer.

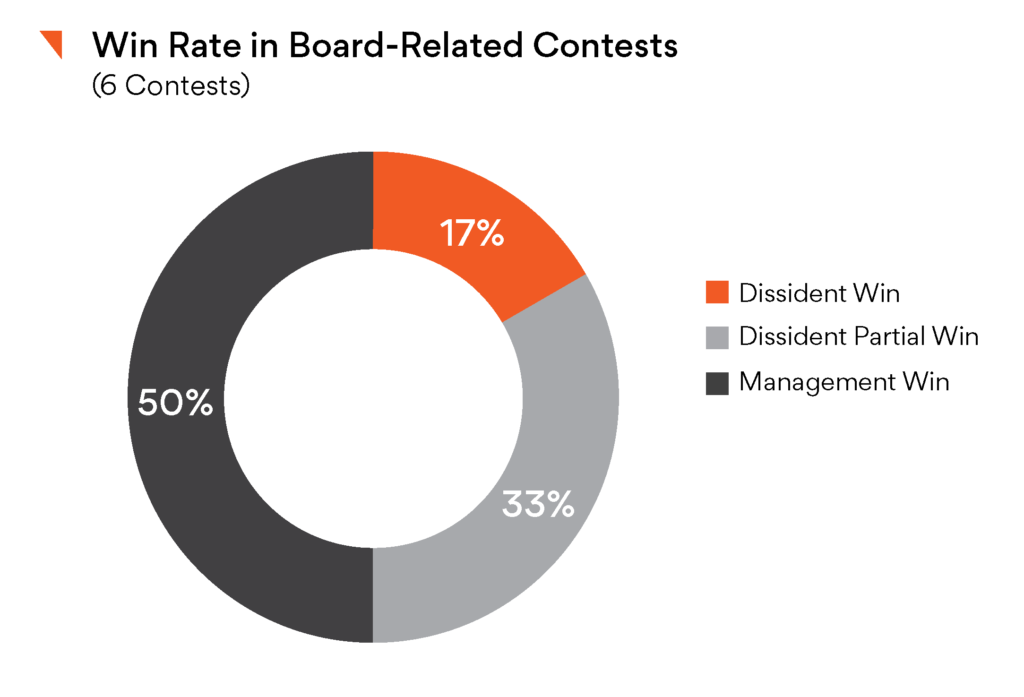

2. Contest outcomes were split evenly between management and dissidents

In half of the 2019 contests, management won outright, while in the other half dissidents achieved either full or partial wins. (In our methodology, a partial win occurs when the dissident achieves some, but not all, of their publicly disclosed substantive objectives in initiating and conducting the proxy contest.)

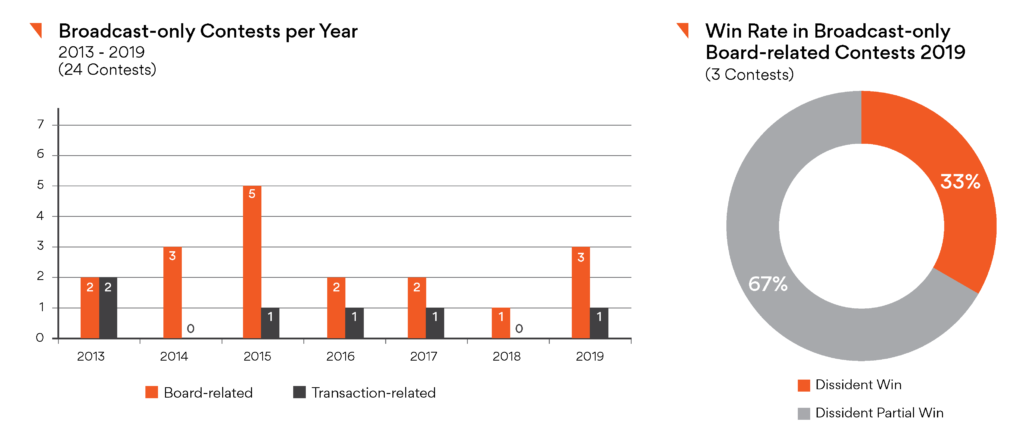

3. Dissidents had success with broadcast-only board-related contests

The number of contests where dissidents pushed out their message via public broadcast only (without filing an information circular) reached a four-year high and, once again, dissidents had success in broadcast-only board-related contests, winning all three such contests. The public broadcast exemption has only been available for use since 2013.

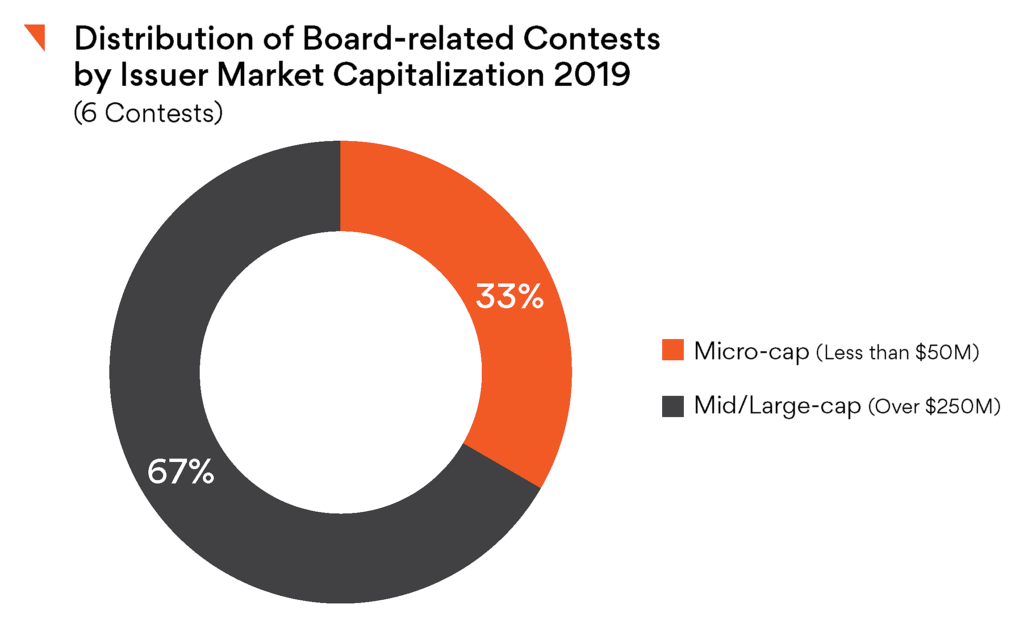

4. Mid/large cap issuers became the focus of attention

Board-related contests in 2019 were disproportionately fought over mid/large cap issuers. This marks a distinct shift from the past several years, when micro-cap issuers were most commonly involved (and, of course, micro-cap issuers are the overwhelming majority of issuers in Canada). There were no contests at all in 2019 involving issuers in the small cap range.

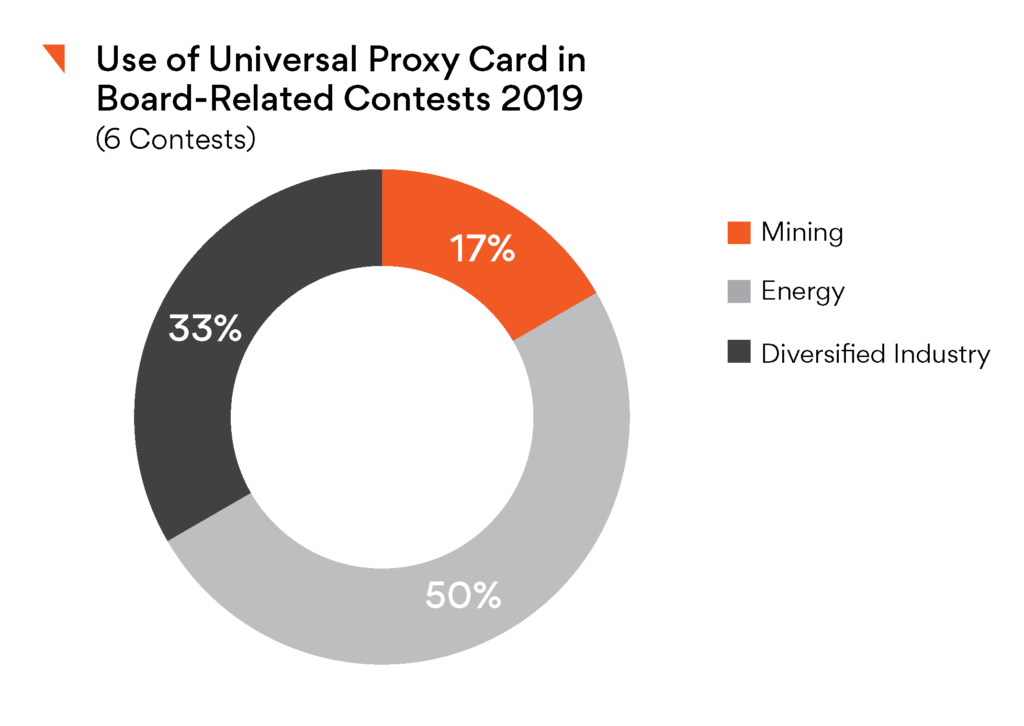

5. The universal proxy card became a more common tool

A universal proxy card was used in four of the six board-related contests in 2019, a significant increase from previous years. In each of the four contests where a universal proxy card was used, management began by publishing its own non-universal proxy, following which the dissident published a universal proxy; in only one of those four contests did the issuer then revise its proxy card to make it universal.

In a board-related contest, a universal proxy card is one where all nominees are set out—that is to say, nominees of both management and dissident—such that a shareholder may choose from among all nominees when directing their proxy on how to vote.

The complete publication, including appendix, is available here.

Print

Print