Brian Scheiring is a Partner and Steve Pakela is a Managing Partner at Pay Governance LLC. This post is based on their Pay Governance memorandum.

The simplification of non-employee director pay programs over the past decade has resulted in a model that predominantly focuses on an annual cash retainer, an annual stock award, and additional board leadership retainers. As discussed in our March 23rd Viewpoint, the current COVID-19 pandemic has resulted in companies putting “Everything on the Table” regarding executive and non-employee director compensation. As companies look to reduce costs and better align executive and director compensation with their various constituents, an increasing number of companies are reducing base salaries of company executives and cash retainers for company directors. For the majority of calendar-year-end companies whose executive share grants were determined at a higher stock price prior to the COVID-19 crisis, careful consideration will need to be given to the determination of director equity awards in the coming months, given the decline in stock prices since early March.

During the Financial Crisis in 2008 and 2009, about 15% to 20% of companies reduced executive salaries and/or director cash retainers. Typically, companies who reduced executive salaries also reduced director cash retainers. So far through early April 2020, we have seen about 125 companies publicly announce reductions in director cash retainers. Many companies pay their director retainer on a quarterly basis. In some cases, we have seen companies suspend the payment, which equates to a 25% reduction in retainer; in other cases, the quarterly retainer is paid but at a reduced level. These reductions range from 10% to 50% of the full annual value. For a large majority of calendar-year-end companies, executives received 2020 long-term incentive award grants in January and February, prior to the crash of the public markets. While these awards are likely underwater and significantly below their grant value, the multi-year nature of long-term incentives provides some hope of retention and incentive value over the course of their performance or vesting period.

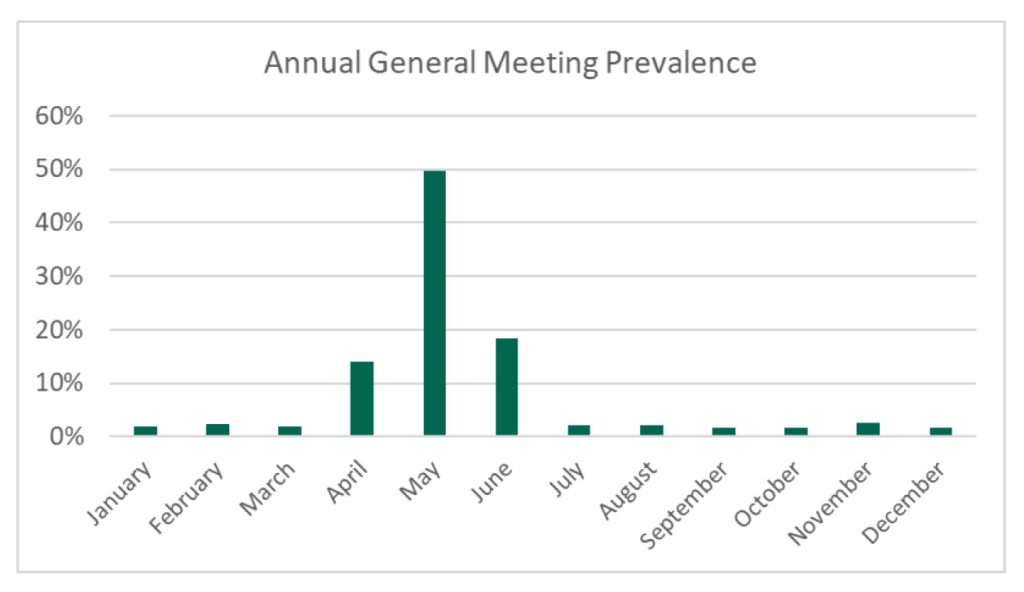

Director stock awards are most often granted annually at the time of a directors’ election/re-election to the board at the Annual General Meeting (AGM). As illustrated in the chart below, the preponderance of AGMs will be taking place in the second quarter for U.S. companies.

While the magnitude of stock price declines varies by industry and company, a very likely possibility for many companies is that the stock prices used to determine non-employee director equity awards will be 20% to 50% lower, if not more, as compared to the stock prices used to determine executive equity awards in January or February. Simply due to the timing of awards, using the current stock price would result in significantly more shares to non-employee directors: this would put directors in a much different economic position than company executives and other equity award participants. In some cases, director award share limits may be exceeded, or an unusually large amount of the director share reserve may be used. Additionally, companies may have external implications in possible shareholder and proxy advisor reactions.

Companies may approach this issue several ways, depending on their facts and circumstances. For companies that have already approved a reduction to their cash retainer, they may consider a similar reduction to their stock retainer. Another simple and effective approach that companies may consider is determining the share grants by using the same stock price that was used to determine executive awards earlier in the year. This will harmonize the executive and non-employee director grants and ensure that the circumstances and timing of COVID-19 do not create significant differences between cadres of grant recipients driven solely by the timing of the award.

Importantly, any reduction to the director compensation program should be clearly disclosed in next year’s proxy statement. This disclosure would include a narrative below the Director Compensation Table that clearly describes the rationale supporting the reduction and the process followed to determine equity awards as a communication to shareholders.

Print

Print