Stephen Charlebois is a principal, Phillip Pennell is a consultant, and Rachel Ki is an associate at Semler Brossy Consulting Group, LLC. This post is based on a Semler Brossy memorandum by Mr. Charlebois, Mr. Pennell, Ms. Ki, and Kathryn Neel. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The rapid global spread of COVID-19 has had incalculable impacts on society, taking both a serious economic and human toll. Many companies are faced with balancing competing responsibilities to various stakeholders. While the primary focus is on taking care of employees and ensuring business continuity, many companies are also facing new challenges in appropriately managing executive compensation.

Though businesses have managed executive pay programs through tough economic conditions before, they now must do so under an unprecedented confluence of external expectations and scrutiny, from the advent of Say on Pay to increased shareholder engagement to the beginning of an era of stakeholder primacy.

Though expectations are still evolving, companies are expected to develop cohesive responses. those making decisions need to consider their business and their stakeholders, while looking to continue to engage and motivate key talent.

Shareholders and proxy advisory firms alike have indicated a strong preference for decisions that are defensible to all stakeholders.

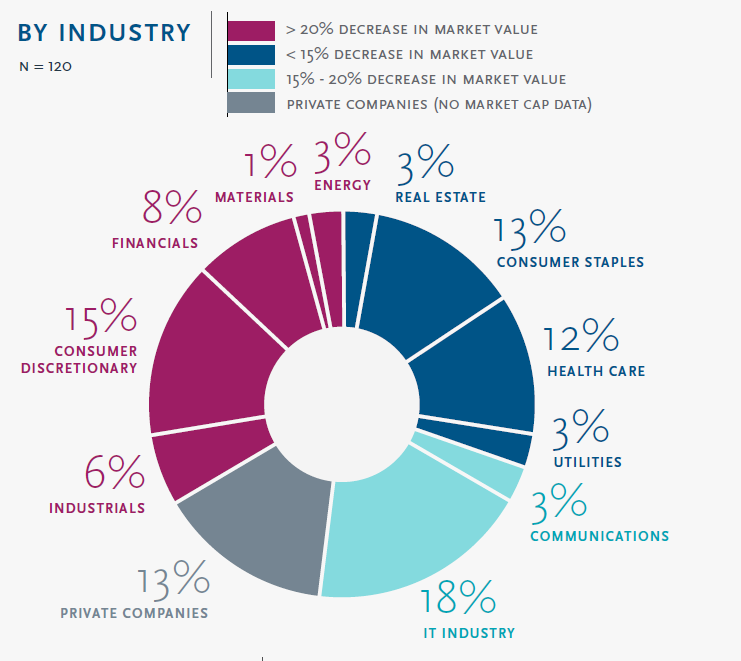

To support and guide companies in these decisions, we surveyed 120 companies across the United States on the actions they are taking today and the decisions they are considering making later in 2020. Although they represent a snapshot during a time of rapid change, our findings provide insight into addressing potential executive compensation challenges brought on by COVID-19.

Note: Survey responses were collected from March 27th to April 7th and represent point-in-time findings as provided by our respondents. Given the evolving nature of the COVID-19 pandemic, we expect the responses of companies to change over time.

Key Takeaways

While results vary across industries, findings indicate that a majority of U.S. corporations have not yet formulated a response to COVID-19 on executive pay but anticipate taking some form of action later in 2020.

What should you take away from the results of this survey?

- There is no universal response. Findings indicate a variety of approaches influenced by company outlook, industry dynamics and broader context

- That said, most companies are delaying action until there is greater clarity. Companies that already made pay decisions are generally waiting until payout determinations to see if adjustments are necessary, and those that have not yet made decisions in 2020 are delaying until the impact of COVID-19 is better understood

- Companies acting now are doing so out of necessity and are primarily in the hardest-hit industries where immediate cash preservation is a key priority

What are key considerations going forward?

- Timely, effective communication is key. Shareholders, employees and customers are all closely monitoring the actions companies are taking in response to the crisis; if decisions are made, transparent and honest communication can build positive alignment and strengthen relationships with key stakeholders

- Align executive pay with the stakeholder experience. Company actions are being closely monitored and the expectation is that shareholder experience should be reflected in compensation decisions (i.e., significant shareholder value losses or headcount reductions are accompanied by lower pay outcomes for executives)

- Establish objective principles for using discretion. While quantitative metrics may be difficult to rely on at this time, establishing a list of factors for Committees to consider if they decide to apply discretion at the end of the year will allow companies to demonstrate that decisions were made in ways that demonstrably tie back to business context

The Business Impact of COVID-19

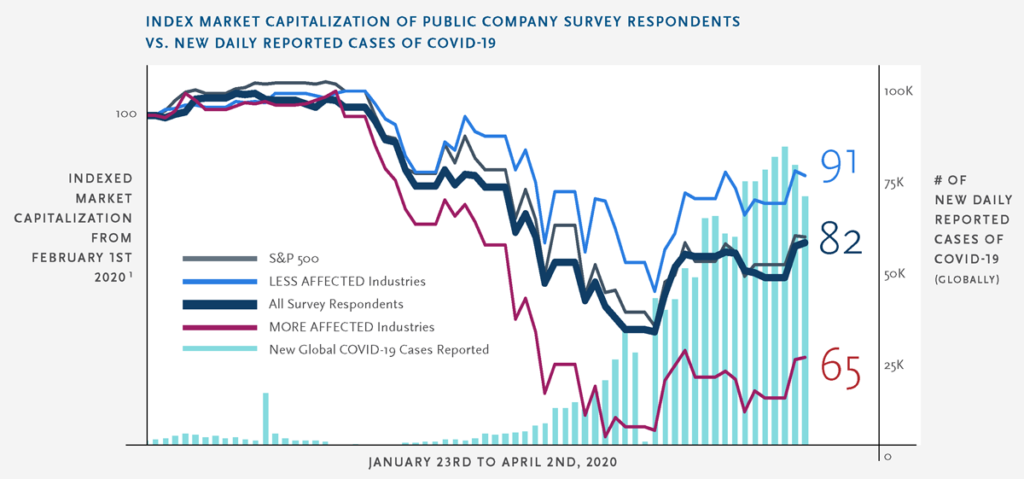

The spread of COVID-19 has led to substantial downward pressure on valuations for most public U.S. companies. The degree to which respondents have been impacted varies substantially by industry.

Source: Capital IQ, CDC, Statista.com. n=103

1. Weighted by each public company survey respondent’s market capitalization.

2. Average of each industry grouping’s indexed market capitalization.

The Breakdown of Survey Participants

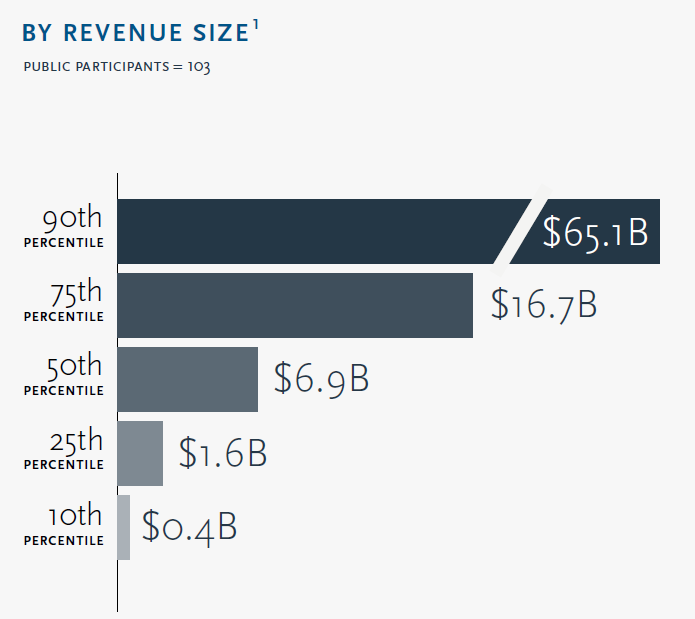

Source: S&P Global Capital IQ

1. Last twelve months reported revenue as of April 7th, 2020.

Executive Summary

- Companies have taken or are planning to take executive pay actions resulting from COVID-19, but most are not fundamentally reworking their programs as of yet

- Most companies that have already made 2020 pay decisions and set performance goals are not making changes today, but are monitoring and considering the use of discretion when certifying performance

- Those that have not yet made or have delayed pay decisions have more flexibility but are not making wholesale changes; companies are considering adding more discretionary or strategic elements to their annual bonuses and in some cases, introducing relative long-term measures

- Continue to expect executive pay actions to be scrutinized by shareholders, employees, proxy advisors and the broader public

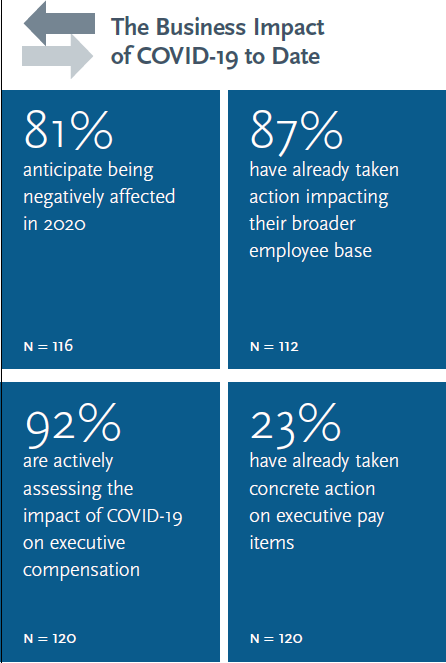

Almost all respondents reported COVID-19 having

at least some impact on their broader employee populations

- 81% indicated COVID-19 would have a negative impact in 2020

- of these:

- 40% of consumer staples respondents indicated some form of negative impact, the least of all industries surveyed

- 60% of consumer staples respondents anticipate a positive impact on their business at some point in the next two years

- At least 80% of respondents in all other industries indicated COVID-19 would have a negative impact on their business

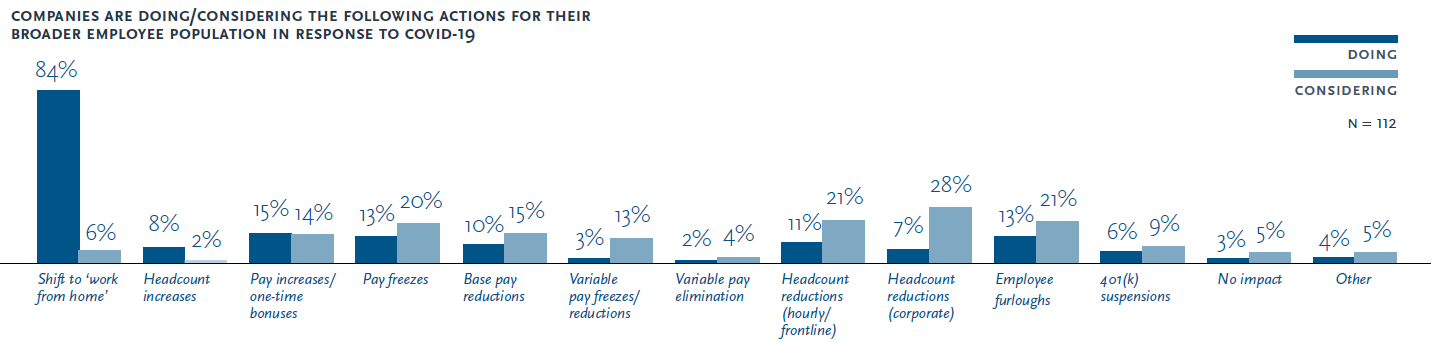

- 87% have taken actions affecting their broader employee base

- of these

- 84% have shifted to a “work from home” model

- 19% have taken actions to reduce broad-based pay

- 17% are reducing headcount or furloughing employees (including 44% of consumer discretionary respondents)

- 20% of respondents have either increased headcount or provided pay increases/one-time bonuses (or both)

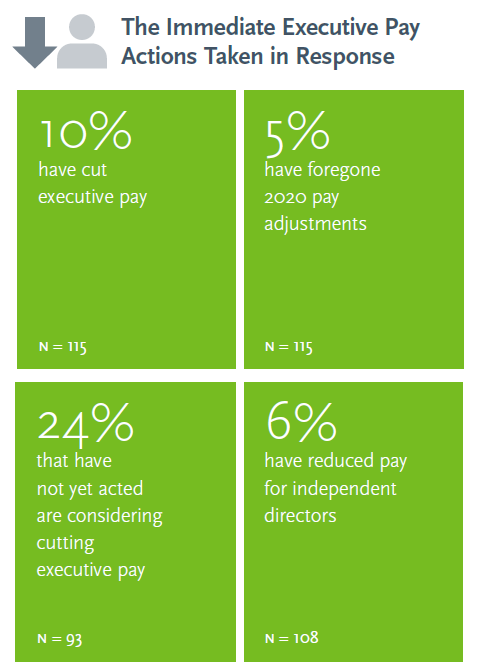

To-date, actions taken on executive pay levels have generally been

limited to the hardest-hit industries

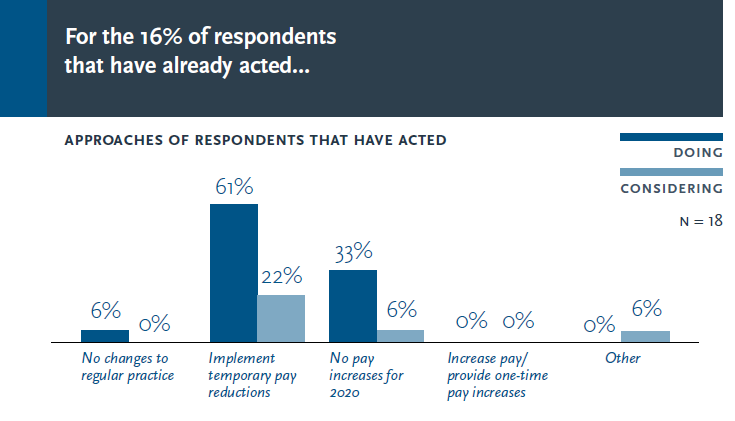

- 16% have already made decisions regarding executive pay levels in response to COVID-19

- of these:

- 61% have implemented pay reductions for executives

- 33% will not be increasing executive pay in 2020

- 40% indicated no changes to their regular practices

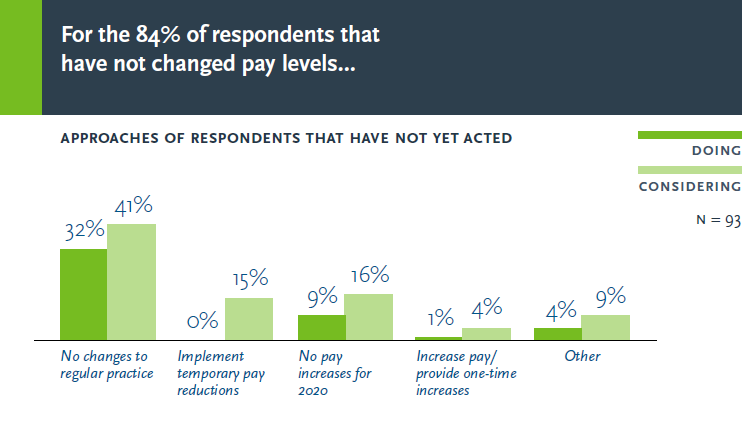

- 84% have not yet taken action at this time

- of these:

- 15% are considering pay reductions for executives

- 25% are (or are considering) foregoing 2020 pay increases

- 32% are not making changes to their regular practice (a further 41% are considering no changes)

The limited instances where changes to director pay levels have been made occurred in conjunction with changes to executive pay levels

- 44% indicated they have made at least some determinations for 2020 director pay

- of these:

- 80% are making no changes to pay levels or their standard director pay

- 13% are reducing director pay; of these, 100% have also already determined to reduce executive pay

- 4% are foregoing adjustments in 2020

- 59% are currently considering paths forward for director pay

- of these:

- 17% are considering reducing director pay or foregoing increases for 2020

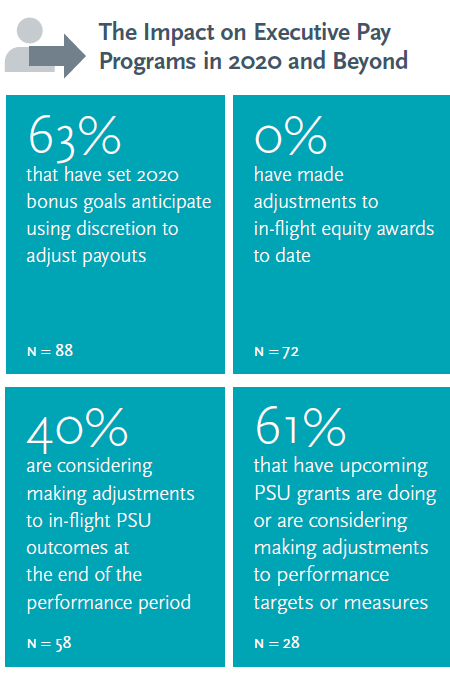

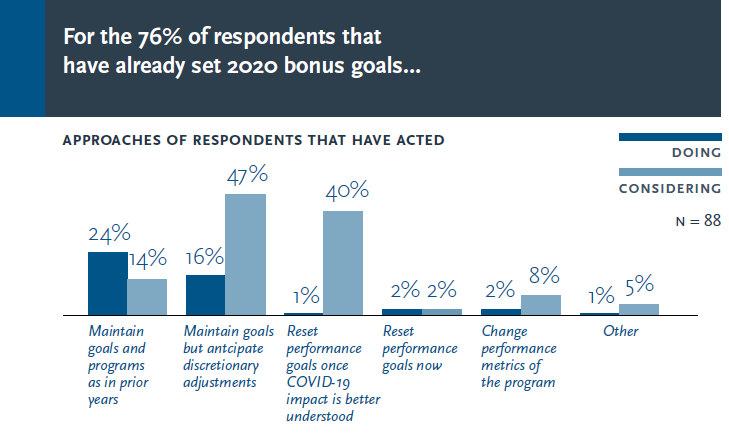

Most respondents set bonus goals prior to COVID-19; making

year-end decisions the focal point for addressing the impact of COVID-19

- 76% have already set goals for their 2020 bonuses

- of these:

- 63% are (or are considering) applying discretion when payouts are determined

- 40% are considering resetting goals partway through the year once the impact of COVID-19 is better understood

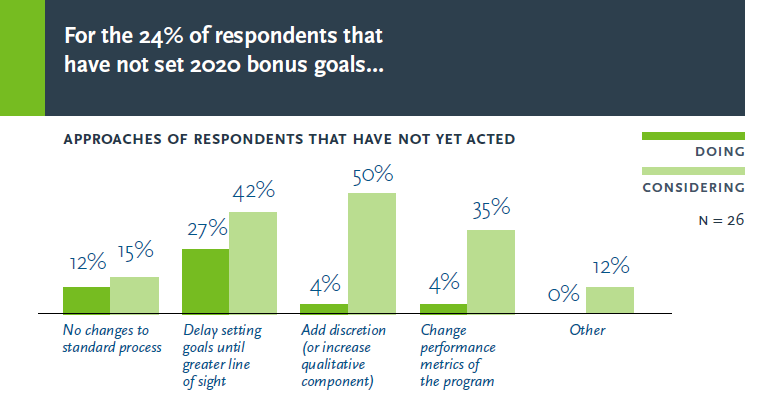

- 24% have not yet set goals for their 2020 bonuses

- of these:

- 69% are (or are considering) delaying goal-setting until the impact of COVID-19 is better understood

- 54% are (or are considering) increasing the weighting of discretion or the qualitative component in bonus design

- 39% are (or are considering) changes to measures in their 2020 bonuses

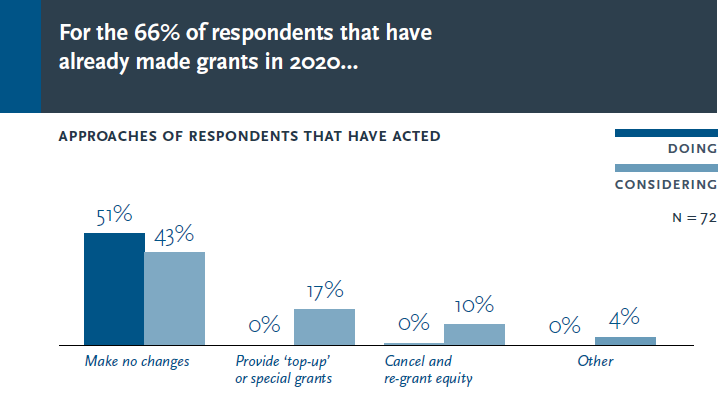

Most companies have granted 2020 equity and do not anticipate making changes to those awards at this stage

- 66% have already made equity grants in 2020

- of these:

- 94% are (or are considering) not making changes to in-flight awards

- 17% are considering special top-up awards

- 10% are considering canceling and re-granting equity

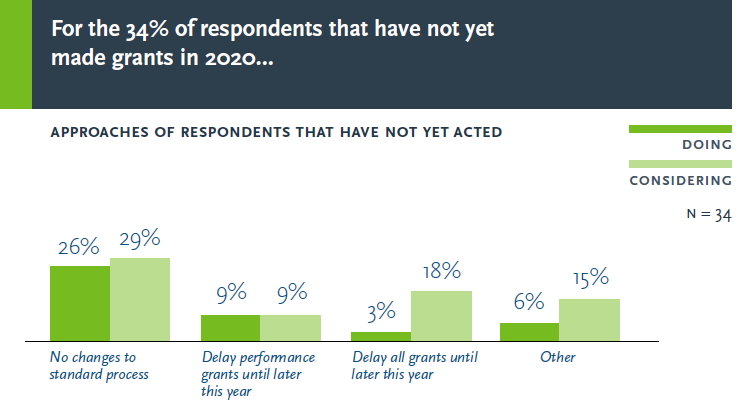

- 34% have not yet made equity grants in 2020

- of these:

- 55% are (or are considering) making no changes to their standard process

- 26% are (or are considering) delaying some or all their equity grants until later this year

- 26% are considering modifying grant practices if normal processes are overly dilutive

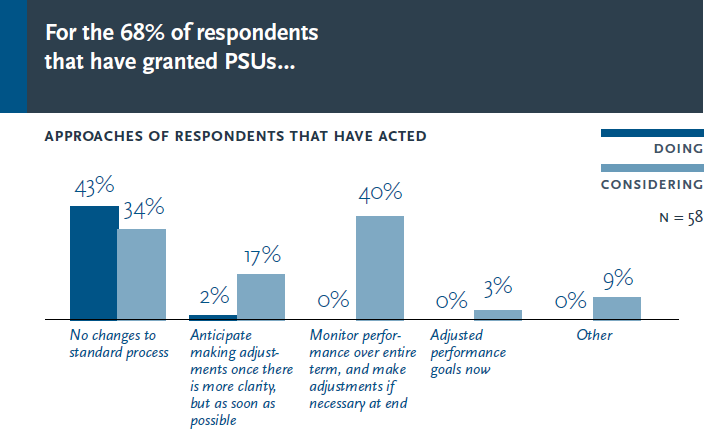

Respondents are leaving in-flight PSUs unchanged; those that have not yet made grants in 2020 are considering steps to manage the impact of COVID-19

- 68% have already granted their PSUs in 2020

- of these:

- 77% are (or are considering) making no changes to in-flight PSU award measurement/outcomes

- 19% are (or are considering) adjusting in-flight PSU goals once there is greater clarity on the impact of COVID-19

- 40% are considering making adjustments at the completion of the performance period, if appropriate

- Only 3% are considering adjusting goals now

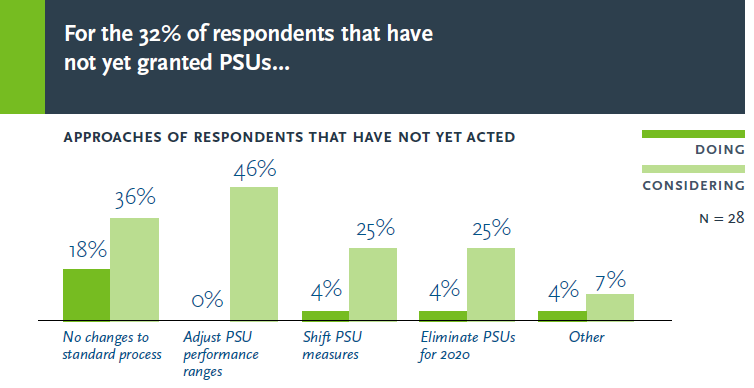

- 32% have not yet granted their 2020 PSUs

- of these:

- 54% are (or are considering) making no changes to their standard PSUs

- 46% are considering adjusting the performance targets of their upcoming 2020 PSU grants

- 29% are (or are considering) changes to PSU performance measures

- 29% are (or are considering) reducing or eliminating PSUs for 2020

Survey Responses: A look at the detail behind the findings

Understanding Survey Responses

Scope

To balance a broad set of industries and stages of company development, the survey was made available to all companies regardless of industry or size.

- 120 companies participated, including 103 public companies with median revenues of $6.9 billion

- The survey was open to respondents from March 27th to April 7th

Presentation of Data

The following section presents responses in a manner reflective of the survey provided to respondents. Findings are summarized in graphs and charts with narrative support where appropriate. As not all survey respondents responded to every question in the survey, the actual number of companies responding to each question is provided alongside relevant data. Each question should be viewed as the prevalence of companies responding to that specific question. Survey participants had the opportunity to select multiple choices to certain questions. In certain cases, the total responses may not equate to 100%; this occurs for questions where respondents could select multiple answers (e.g., when outlining which actions were being taken or considered).

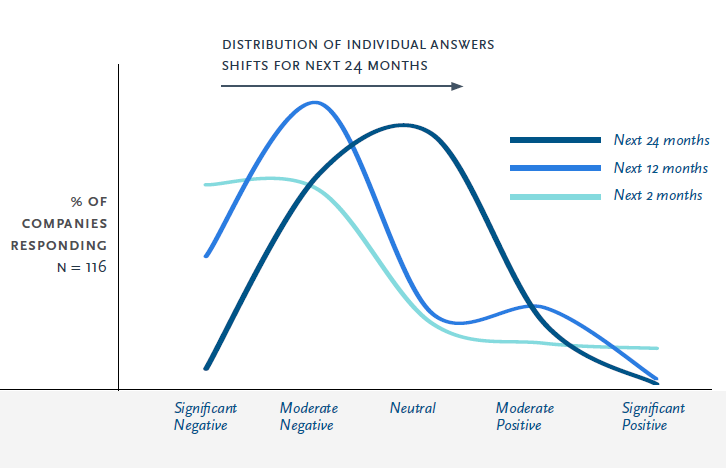

Participants generally expect the negative effects of COVID-19 to impact their business for at least a year but anticipate recovery to begin within the next 24 months

The majority of survey respondents anticipate COVID-19 to have a negative impact on their business; perceived impact becomes more positive 24 months out

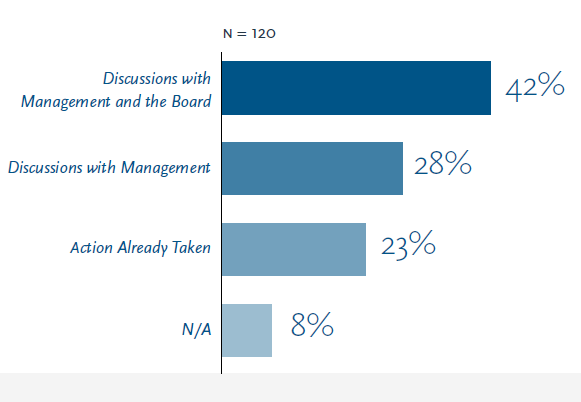

While most companies have delayed formal action for better clarity, the majority of respondents are actively engaged in discussions on how to respond to COVID-19

Impact of COVID-19 on the Broader Employee Population

Companies who have already initiated or are currently considering headcount and pay-related reductions are concentrated in the severely impacted industries such as consumer discretionary and industrials

- Nearly 50% of consumer discretionary and industrials who responded are currently considering headcount reductions for their corporate and hourly/front-line workers

- Pay increases, such as hazard pay, are more common for industries such as health care, consumer staples, and certain consumer

discretionary companies

Actions on Executive Pay Levels in Light of COVID-19

N = 115

Three industries (and private companies) indicated they have taken pay reduction actions:

- 56% of consumer discretionary companies

- 29% of industrial companies

- 9% of IT companies

- 27% of private companies

To-date, pay reductions have primarily been undertaken by companies in the hardest-hit industries where cash flow preservation is an immediate priority

- 57% of consumer discretionary companies that have not yet taken pay actions are considering doing so, compared to 15% of all survey respondents

- Health care and consumer staples respondents are most likely to continue with “business as usual,” as determined by 93% of health care and 86% of consumer staples companies (mix of doing and considering)

A majority of respondents did not determine or consider making pay adjustments at the time of this survey

Actions on Executive Pay Levels in Light of COVID-19—

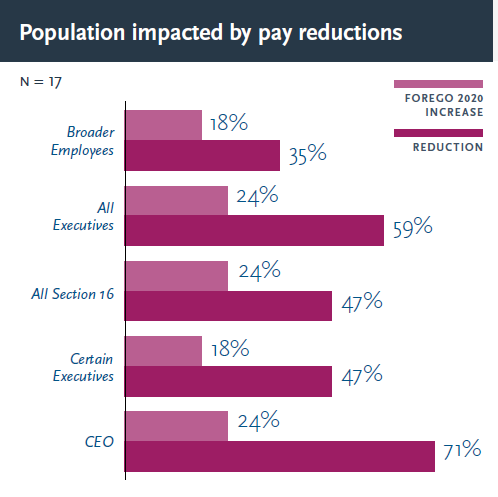

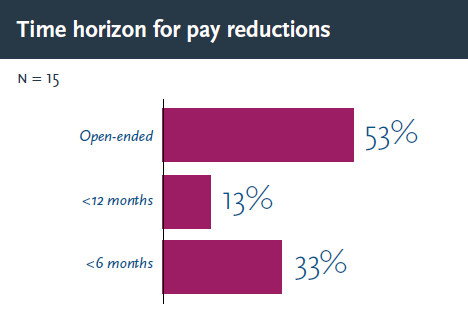

Detail on Pay Reductions

In most cases, pay reductions take a ‘top-down’ approach, with all employees at/or above the lowest employee level subject to reductions impacted by pay reductions

- Most companies that have already acted have not defined the time period of their pay reductions, indicating a longer-term impact is possible

- 60% of consumer discretionary companies have not established a time frame of returning to normal pay levels

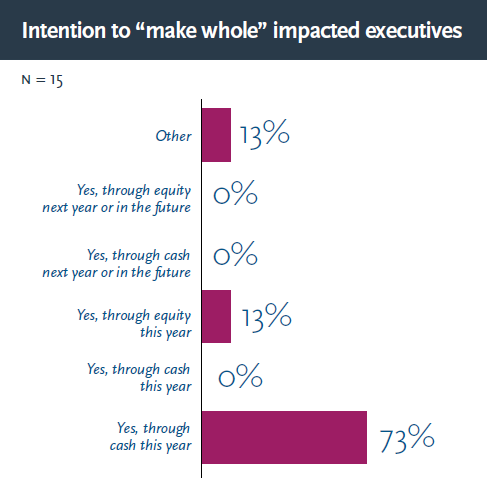

Few companies intend to “make whole” executives subject to pay reductions

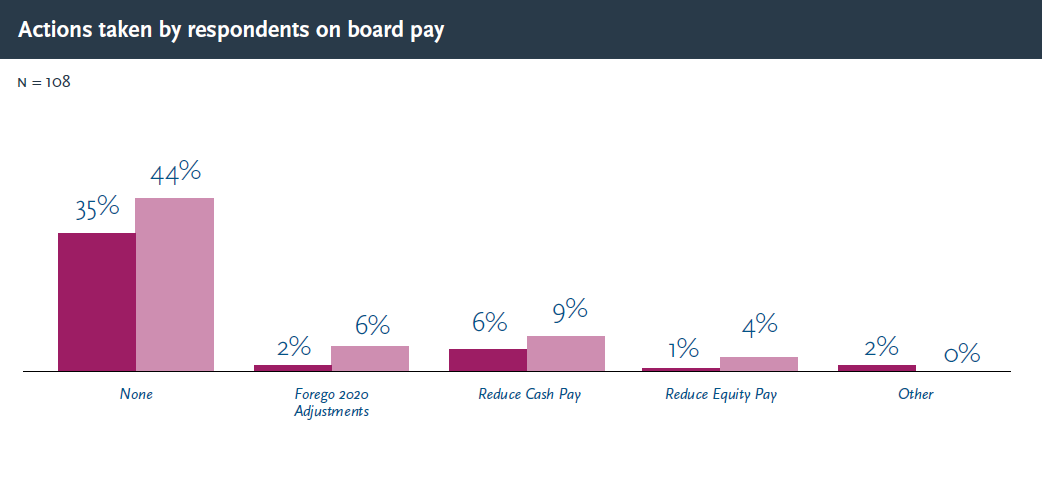

Actions on Board Pay Levels in Light of COVID-19

- Pay reductions were primarily undertaken by companies in the hardest-hit industries

- Consumer discretionary companies make up 67% of respondents who have already enacted board pay-reduction adjustments

- 100% of companies that reduced board pay also reduced executive pay

- Of those that reduced pay, 67% expect the reduction to last 12-months or less

- 33% have not defined a time frame

Impact of COVID-19 on 2020 Bonus Programs

N = 118

- Respondent answers were generally consistent across industries for public companies

- However, 80% of private companies indicated they were considering applying discretion at the end of the year, and 60% indicated they are considering resetting performance goals

Applying discretion at the end of the year, or resetting performance goals once the impact of COVID-19 is better understood are most common

40% of total respondents to this question were consumer discretionary companies; all indicated that they were making or considering a change to their 2020 bonus goals

Companies that have yet to set bonus goals have more flexibility to react, but many are choosing to wait until they have greater clarity

Impact of COVID-19 on 2020 Equity Grants

N = 118

The few companies who have indicated that they are considering changes to their equity program are concentrated in the information technology, consumer discretionary, and consumer staples industries

Respondents that already granted equity in 2020 are generally not making any changes

- Approximately 20% of total respondents were consumer discretionary companies; all indicated that they were considering some change to their standard process

- 75% of health care respondents indicated they do not anticipate making changes to their standard process

Respondents that have been significantly negatively impacted are more likely to consider changes to the timing of their 2020 equity grants

Impact of COVID-19 on 2020 PSU Grants

N = 118

Findings were consistent across industries—most companies regardless of the industry are erring towards maintaining the PSUs that have already been granted

Companies are generally not making changes; some are considering making adjustments to payouts at the end of the performance period, if appropriate

- Majority of companies that have not granted their PSUs have delayed action and are still considering what may be appropriate for their programs

- Of the companies who are considering changes to their standard process, approximately 1/3rd of respondents are consumer discretionary companies whose businesses are significantly impacted

Most are considering changes to their PSU program, likely in the form of adjustments to performance goals; some might eliminate PSUs for 2020

Print

Print