Robert Merton is Professor of Finance at the MIT Sloan School of Management and Arun Muralidhar is co-founder of AlphaEngine Global Investment Solutions LLC. This post is based on their recent paper.

There is a looming retirement crisis, as individuals are increasingly being asked to take responsibility for their own retirement planning and a majority of these individuals are financially unsophisticated. Yet, these individuals are being tasked with the responsibility for three complex, interconnected decisions: how much to save, how to invest, and how to decumulate one’s portfolio at retirement.

A commonly-accepted retirement goal for a healthy pension is for it to sustain the relatively higher standard-of-living of the latter part of one’s working life throughout retirement (and that they do not outlive their assets). Compounding the earlier noted challenges, current financial instruments and products (e.g. T-Bills, TIPs, or Target Date Funds) are risky because they focus on the wrong goal —wealth at retirement, as opposed to how much retirement income can be guaranteed to support pre-retirement standard-of-living. Moreover, while annuities are an effective means for providing income in retirement with longevity protection for those not in a pension plan, they are too illiquid and inflexible to employ during the accumulation period. Financial innovation and a change in the metric for measuring retirement success could address some of these challenges and help individuals achieve their retirement goals—a financially and socially desirable outcome for any country.

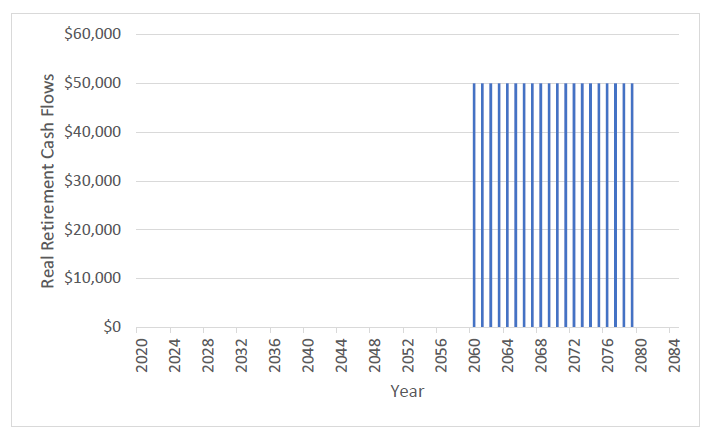

What is the desired retirement income stream or cash flow of an individual? A 25-year old in 2020 would typically plan to work for 40 years and would like to receive say $50,000 real/year for 20 years in retirement (assuming death is known). Figure 1 plots the likely real retirement cash flow of this 25-year old. It shows that the goal requires no cash flows for 40 years (through 2060) and then a steady stream of real income for 20 years. This is very different from a single wealth number that individuals are asked to think about as their “retirement number.”

Figure 1: Projected Real Retirement Cash Flows of a 25 year old in 2020—work 40 years; live for 20 years.

We recommend an easy, quick and efficient solution for countries to address all these challenges and improve retirement security by creating and issuing an innovative new bond—SeLFIES (Standard-of-Living indexed, Forward-starting, Income-only Securities). The SeLFIES bond is a single, liquid, low-cost, low-risk (government-issued) instrument, easy-to-understand for even the most financially unsophisticated individual, because it embeds accumulation, decumulation, compounding and inflation-adjustments.

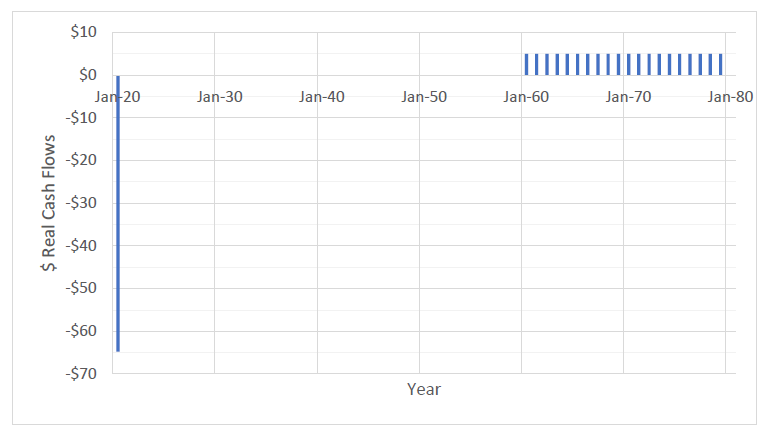

Since the safe asset in defined contribution plans (focused on target retirement income) does not exist, SeLFIES are designed to mimic pension payments in Figure 1. Governments can issue SeLFIES and they can be purchased directly by any individual (to create a type of “individual DB”) or institution. SeLFIES start paying investors upon retirement (i.e., forward-starting), and pay real income-only (e.g. $5 real/year), indexed to aggregate per capita consumption (to hedge standard-of-living risk), for a time period equal to a period linked to the average life expectancy at retirement (e.g., 20 years). Figure 2 shows a very simple cash flow chart of SeLFIES that start paying in 2060 for 20 years. The sharp negative bar in 2020 is the potential payment made today to acquire the desired retirement cash flow stream (i.e., the price of SeLFIES). SeLFIES are a purely market-based instrument and the market forces at the time of issuance will determine its issue price and its secondary market price. Most importantly, instead of current bonds that index solely to inflation, SeLFIES cover both the risk of inflation and standard-of-living improvements by indexing to per-capita consumption to ensure that retirees preserve their standard of living. This is critical especially since retirement planning is potentially a 60-year process and standard-of-living risk is a key unmanaged risk globally today.

Figure 2: Real Cash Flows of 2060 SeLFIES: Pay $5 real from retirement date (2060) for 20 years (2080)

SeLFIES are designed to pay people when they need it and how they need it, and greatly simplify retirement investing. A 55-year-old in 2020 would buy the 2030 bond, which would start paying coupons at age 65, and keep paying, for say 20 years, through 2050. SeLFIES caters to all individuals independent of retirement date. For example, if our 25-year old in 2020 wants to guarantee $50,000 annually, risk-free for 20 years in retirement as in Figure 1, to maintain their current standard of living, they would need to buy 10,000 SeLFIES ($50,000 divided by $5) over their working life. Periodic DC plan statements can easily inform individuals as to how much retirement income they can expect to receive based on current holdings of SeLFIES (and conversion of other assets into SeLFIES-equivalents), relative to the target (10,000), thereby allowing easy course corrections prior to retirement. In addition, SeLFIES can be bequeathed to heirs (who can then either continue to collect the coupons or sell the SeLFIES in the secondary market). If SeLFIES are well-designed, they can also ensure longevity risk protection.

SeLFIES require only the most basic information and offer choices for buyers of any educational strata. The two required inputs are anticipated date of retirement (i.e., the SeLFIES payment start date) and target income goal for a good retirement, which determines the number of SeLFIES needed to reach this goal. If they change their retirement date, they could easily sell/buy the relevant SeLFIES with little effort and cost. The three (current) complex decisions of saving, investing and decumulation are simply folded into an easy calculation of how many bonds to buy. Even the most financially illiterate individual can be self-reliant with respect to retirement planning. Since SeLFIES do not make payments until the retirement date, the buyer does not need to make any further transactions or decisions to reinvest coupon or principal payments during the entire accumulation period. One transaction, one time, for each SeLFIES purchased minimizes costs, decision effort and errors.

SeLFIES are a good deal for governments, too. In fact, governments are the biggest beneficiaries. SeLFIES not only improve retirement outcomes for all citizens saving for retirement (reducing the need for bailouts), but also have spill-over benefits, as the bond, improves balance sheet management (as governments with value-added taxes have a hedge against future SeLFIES payments), and funds infrastructure which is a major challenge globally (as the cash flows of SeLFIES are synergistic with these long-term investments). As a result, SeLFIES have been proposed for countries as diverse as the United States, France, Japan, India, Brazil and Turkey.

The paper concludes by demonstrating the universality of the SeLFIES design by showing how it serves a useful purpose by becoming the “currency of retirement.”; namely, a simple way to gauge the impact of changes in current economic policy on future retirement outcomes. For example, substantial monetary stimulus (as is being experienced in 2020) has potentially raised the cost of securing retirement income and had SeLFIES existed, this would have been transparent. Further, one of the challenges with inadequate savings is that other assets owned by individuals will need to be considered to bolster the retirement pot—with one asset in particular, one’s house—holding potentially the greatest promise. SeLFIES will allow individuals to clearly understand how much potential retirement income (and protection of pre-retirement standard of living), their current assets are likely to generate.

SeLFIES is a win-win for all. The time to act is NOW—the longer the delay, the higher the cost of ensuring retirement security for future generations and increasing the burden and cost to government.

The complete paper is available for download here.

Print

Print