Richard Fields is a Director of Corporate Stakeholder Engagement and Elizabeth Morgan and Cal Smith are partners at King & Spalding LLP. This post is based on their King & Spalding memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here) and Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here).

Oversight of Political and Social Statements

Many companies have made public statements in the wake of George Floyd’s death, addressing complex social issues including racism and inequality. More than 200 S&P 500 companies issued public statements, and many others have sent company-wide internal messages.

Our analysis of these statements shows that companies have become more comfortable making pronouncements with pointed statements that may be polarizing among stakeholders. While a number of these statements sound “corporate” and are unlikely to inspire or offend any readers, many go further. Just a few months ago many companies would have shied away from the phrase “Black lives matter.” A dam has broken.

What a company says—and how it says it—can have dramatic affects on the how key stakeholders view the company. This can have significant reputational and financial consequences.

There is no simple standard of appropriate board involvement on these issues. We suggest boards and management teams discuss expectations about statements, pledges, and commitments on important social and political issues by the company or its leadership.

Key Questions for Boards

- Does the Board want to set any expectations on the types of statements that the Company or its leaders will (or will not) make?

- Does the Board want to set any process for reviewing a subset of the most socially-or politically-sensitive statements before they are made? If so, how will we create a workable process?

- Does the Board want to receive any summaries of reactions to statements that are made? If so, what types of summaries and how frequently?

HCM Disclosure Reaches Tipping Point

Many boards have devoted additional time to human resources in recent years as investors and other stakeholders have demanded greater board involvement with “human capital management” (“HCM”). HCM is a broad concept that encompasses a wide range of workforce issues, including talent development, employee retention, diversity and inclusion, and corporate culture, among other things.

Attention to these issues internally and externally has only grown this year, spurred first by COVID-19 and more recently by discussions of racism, diversity, and equality. Some stakeholders that had been reluctant to aggressively seek more information about HCM oversight—including some of the world’s largest asset managers—have left the sidelines.

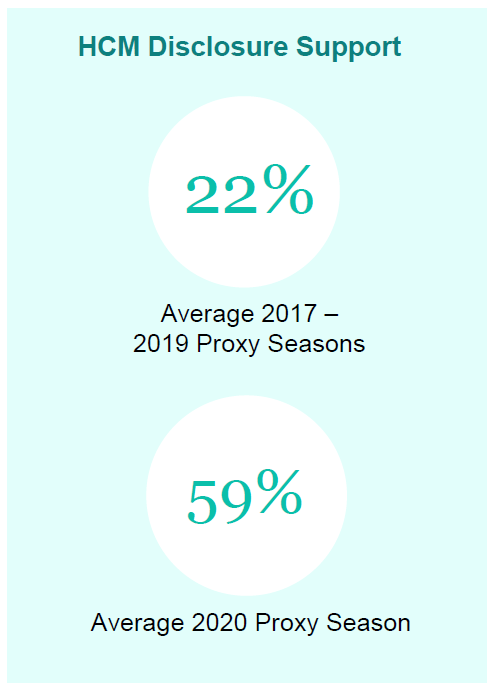

Voting results on HCM-related shareholder proposals demonstrate this shift. Until this year, there had been little success on those that went to a vote. Between July 1, 2016 and June 30, 2019, there were 63 such proposals at Russell 3000 companies, averaging roughly 22% support. In that period, only three passed.

This year has been different. Many HCM proposals this proxy season have settled, including at least seven focused on diversity and gender equality and two others requesting disclosure of metrics such as average hourly wages. In the last few weeks, shareholders voted on four proposals to disclose more HCM data. All passed with substantial support. Proposals for enhanced diversity reporting at Fortinet and Fastenal passed with 70% and 61% of votes in favor, respectively; two proposals seeking a wide range of HCM metrics as defined by SASB passed with overwhelming support at O’Reilly Automotive (66%) and at Genuine Parts Company (79%). Reports seeking diversity or broad HCM data received almost 60% support on average.

COVID-19 has thrown more fuel on an already roaring fire. Expect more pressure for disclosure of additional HCM-related data and for shareholders to devote more engagement time to workforce oversight issues.

Key Questions for Boards

- How often does our board currently review human capital management principles or metrics?

- Given the current focus on racial disparities, what are the current disparities in racial composition and compensation throughout our organization? In our leadership roles?

- If currently undisclosed HCM metrics were obtained by the media, what would the most critical headline be?

The Dramatic Rise of SASB and TCFD

The success of HCM proposals discussed above is one immediate, concrete effect of the rapid rise of the Sustainability Accounting Standards Board (SASB) reporting framework. Although SASB had momentum heading into 2020, it was catapulted forward by the actions of BlackRock and State Street Global Advisors (SSGA).

BlackRock took the initiative in January when the annual letter from CEO Larry Fink, this year titled “A Fundamental Reshaping of Finance,” demanded companies provide more detailed reports relating to environmental and social issue oversight with disclosures aligned to SASB and the Task Force on Climate-related Financial Disclosures (TCFD).

SSGA turned the pressure up further, requiring not just disclosure but also results. CEO Cyrus Taraporevala’s annual letter noted that it will begin voting against directors this year for inadequate progress against certain ESG metrics, as measured by its proprietary R-Factor scoring system, which is built in part on the SASB Framework.

SSGA says it may not vote against lagging companies if they disclose a compelling path to improve their scores now. Starting in 2022, however, disclosure will not be enough, and SSGA will vote against companies who consistently underperform their peers on R-Factor scores.

The other “Big Three” investor, Vanguard, has been less declarative on sustainability issues. Earlier this year Vanguard amended its voting policies to say they will support proposals to address shortcomings in disclosure “relative to market norms and key competitors’ practices.” As the market coalesces around SASB and TCFD-based reporting standards, expect more support from Vanguard and others for such disclosures in future years.

Key Questions for Boards

- Are we internally tracking all of the data that we would be required to report under SASB and TCFD? If not, what would it take to get that data? If so, when do we plan to disclose it?

- Have we received our R-Factor score and assessed what would be necessary to raise it?

ESG Teams Are Growing

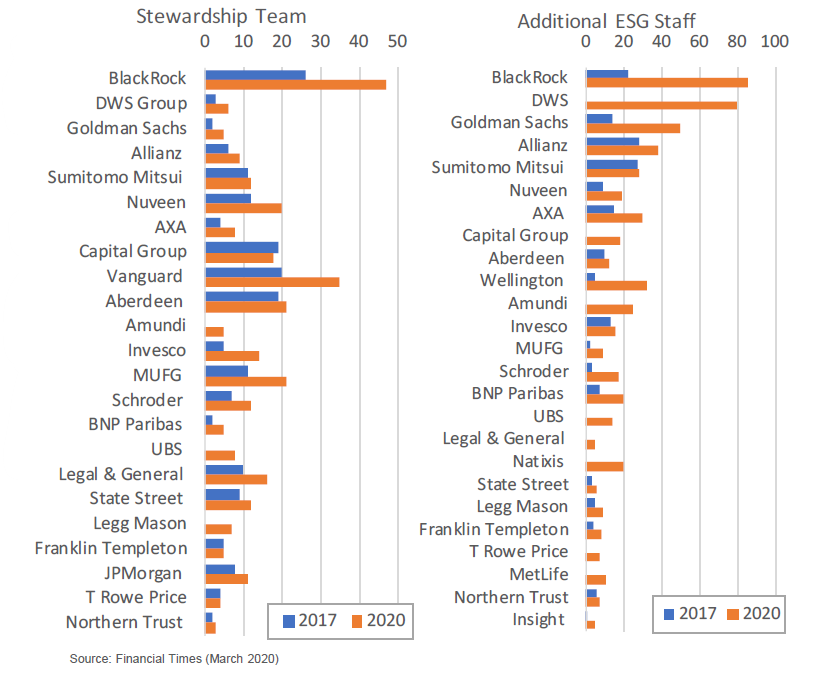

There are markedly more ESG professionals at asset managers according to a recent study by the Financial Times.

Dedicated stewardship teams responsible for overseeing ESG issues at portfolio companies doubled in the last three years. BlackRock and Vanguard, the world’s two largest asset managers, have the two largest teams, there are surprises when evaluating the numbers for others. For example, State Street Global Advisors is the world’s third largest asset manager but has fewer stewardship professionals than Capital Group, MUFG, Aberdeen, Nuveen, and Invesco.

A few major investors also created stewardship teams in the last three years, including Amundi, Legg Mason, and UBS.

Other ESG roles have grown even more quickly. Evaluating ESG issues as part of evaluating an investment decision has led to dramatic increases in teams at Goldman Sachs (14 to 50), Capital Group (0 to 18), and Wellington (5 to 32).

Even BlackRock, with it’s world-largest dedicated stewardship team, increased the number of other ESG professionals from 22 to 86.

Key Questions for Boards

- How do often do we discuss the ESG priorities and policies of our major investors?

- Who at the company is primarily responsible for engagement with governance professionals?

Print

Print