David Whissel is Executive Vice President and Director of Corporate Governance at MacKenzie Partners, Inc. This post is based on his MacKenzie Partners memorandum. Related research from the Program on Corporate Governance includes Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here).

The past four months have brought unprecedented change to the capital markets and the world at large. As the global COVID-19 pandemic spread throughout the world, the economic disruption was significant, and a decade-long bull market was transformed almost overnight. The proxy season that has followed has been unlike almost any other, but also reassuringly familiar. Despite predictions to the contrary, activism in the United States remained persistent; many large activists were limited in their activity, but the occasional and first-time activists that picked up the slack found considerable success in achieving their objectives. Further, an increase in overall market volatility saw the return of poison pills as a viable defense mechanism (at least temporarily) but has also created new opportunities for activists in what had previously been somewhat of a stagnant market.

Market Volatility Creates New Opportunities

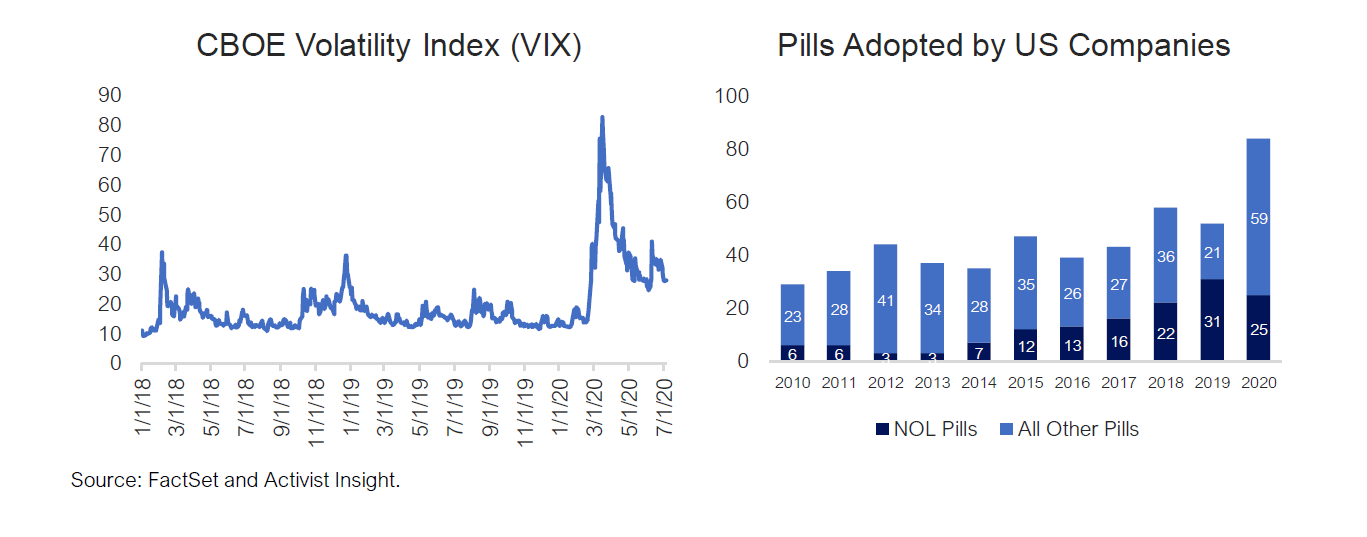

As we have written previously, the outbreak of the coronavirus pandemic in the US in March 2020 led to an immediate and dramatic increase in market volatility at levels that had not been seen since the previous major financial crises of 2008, 1987, and 1929. The spike in volatility persisted well into April before settling down to a more normalized (but still elevated) level. Relative to the pre- COVID market, in which valuations were stretched and true “value” opportunities were limited, this new paradigm created attractive new entry points for many activists—not just in distressed sectors, but also in high-quality, resilient businesses where there was a temporary value dislocation.

To protect against opportunistic buying from activists (and other investors) as prices were depressed, a record number of companies adopted poison pills in 2020, with many more left on the shelf. The first half of 2020 saw the adoption of 59 poison pills, nearly triple that of all of 2019, according to FactSet. An additional 25 NOL pills were adopted, which is also higher than the trailing five-year average of 19. The proxy advisory firms reacted quickly to this situation, releasing mid- season guidance clarifying their expectations regarding disclosure, triggering thresholds, and other issues. Issuers, in turn, adopted pills that mostly conformed to proxy advisory firm and investor standards, with relatively few pills having notably low triggering thresholds or other provisions that would have the effect of unduly restraining investors.

With the markets entering a period of seemingly prolonged volatility—at least relative to the last few years—and assuming continued dislocations from intrinsic value, activists and others will sense opportunity in equities. Additionally, we have seen some activists using the derivative market to their advantage, enabling them to establish a less capital-intensive foothold while also protecting against unforeseen exogenous risk (and potentially concealing their accumulation). With that in mind, some market participants are predicting that the second half of 2020 and 2021 could see a significant increase in shareholder activism activity. However, whether that prediction comes to fruition may depend on whether or not the marquee activists return to the market in the second quarter and beyond.

Many Large Activists Were on the Sidelines

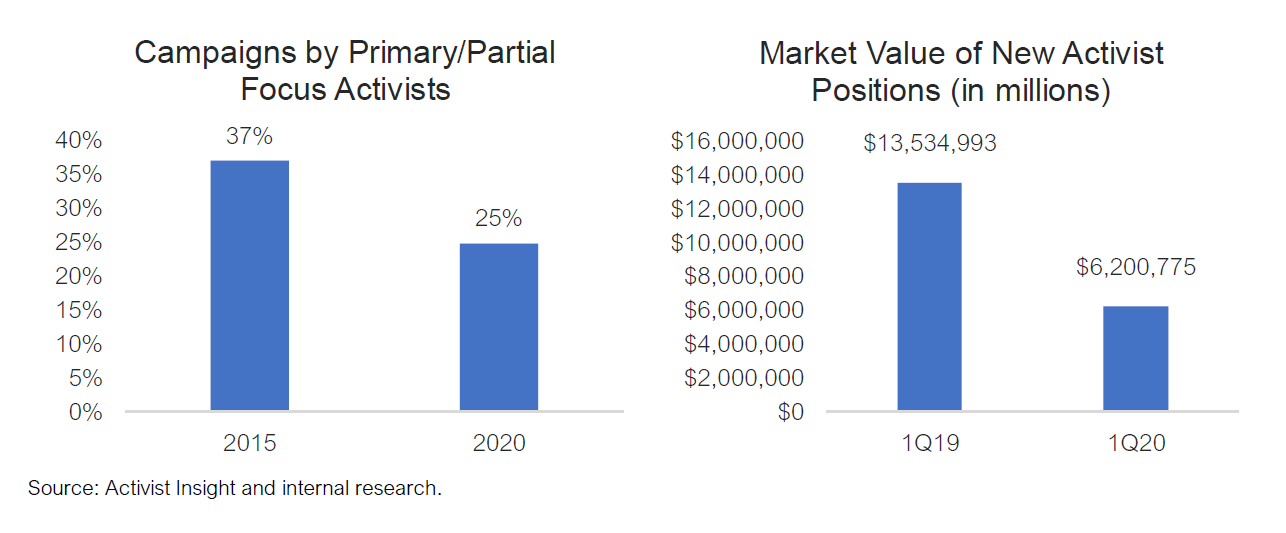

One of the most interesting, and surprising, findings of our research into the effects COVID-19 had on the 2020 proxy season was related to the level of activism activity involving some of the largest funds. Historically, we have seen nearly 40% of all US activism campaigns initiated by what Activist Insight refers to as either “Primary” or “Partial” focus activists. As the names themselves imply, primary focus activists allocate most of their assets to activist strategies, while partial focus activists may utilize other investment strategies, but frequently employ activism as a tool to drive value.

Some of these investors, which include funds like Starboard Value and Elliott Management, can be incredibly prolific and, in addition to driving campaign volume, they also account for much of the dollar value of activist investments in the United States.

Over the last few years, however, much of activism’s growth as an investment strategy has been driven by first-time or occasional activists: essentially, concerned shareholders that temporarily adopt an activist posture when they believe that doing so would be beneficial. In the first half of 2020, just 25% of all US activism campaigns were initiated by primary or partial focus activists, down from 37% in 2015, according to data from Activist Insight. The global pandemic served to exacerbate this trend, with many of the large activists significantly reducing their investment activity in the first quarter of 2020. Our analysis of the 1Q 2020 13F filings from a sample set of 23 of the largest activists indicates that the aggregate value of their investment declined by more than 50% in the first quarter, down to just $6.2 billion; in fact, many of these activists did not make a single new investment.

On the other hand, while overall activism activity may be constrained in the near-term, many are already looking ahead to next year and the possibility of a rebound in the number of campaigns. Activists themselves have been vocal about the possibility of returning to the market, with Bill Ackman noting in his most recent quarterly letter that elevated volatility has presented compelling opportunities to add to positions for which he has a high degree of conviction. There is also anecdotal evidence that, as the pandemic gained momentum in March, many activists withdrew nominations. With the market recovery potentially looking more secure now, some advisors have speculated that activists will simply defer these nominations until 2021 or may even seek to call special meetings or take action by written consent during the second half of 2020. If we do see an increase in the number of contested situations in the coming months, that is likely to bode well for activists, who were remarkably adept at navigating the challenges presented by the pandemic and achieving success in proxy contests in 2020.

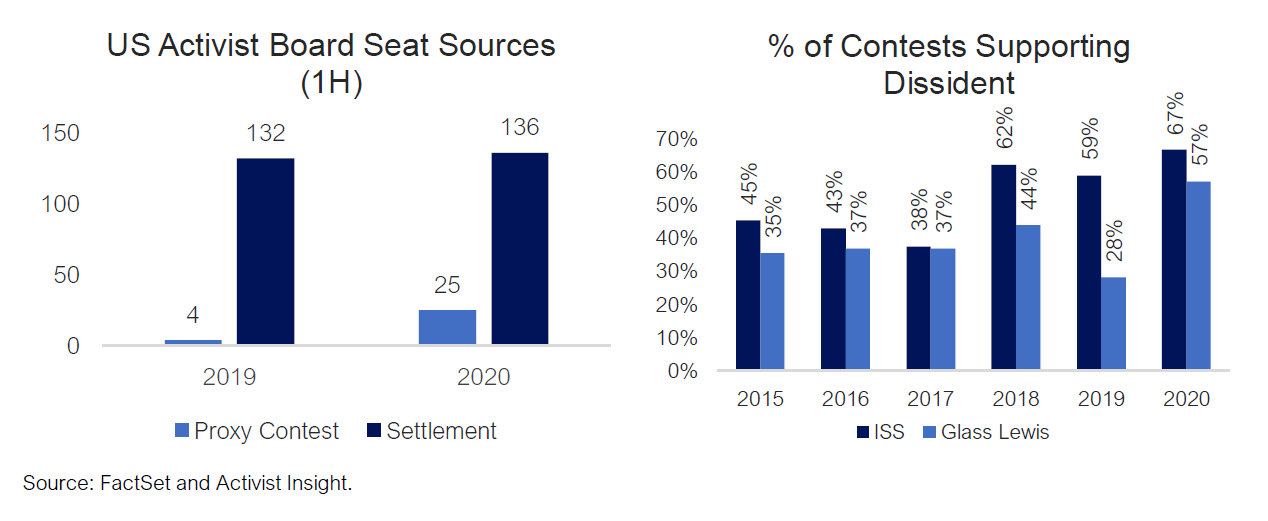

Activists Found Success in Proxy Contests

While the number of activism campaigns may have declined in the first half of 2020, the number of proxy contests proceeding to a vote in the US actually increased from 6 to 13 year-on-year, which is roughly consistent with historical levels. And while some speculated that activists could be subject to reputational risk for prosecuting proxy contests during a pandemic—with the theory being that doing so would be perceived as unacceptable opportunism—there was no apparent negative effect on investor perception. On the contrary, activists waging proxy contests found considerable success in 2020, with this route yielding 25 board seats, compared to just 4 in 2019, according to data from Activist Insight.

At least some of this success may be attributable to the influence of the proxy advisory firms, which recommended in favor of dissident slates at record levels in 2020. While we typically urge caution when examining historical proxy contest recommendation data, since small sample sizes and the unique nature of each campaign make drawing trends difficult, these results are consistent with what we have been observing for several years: that at least one of the proxy advisory firms will recommend in favor of the dissident slate approximately 50% of the time. And despite indications that many institutional investors (and particularly the large index funds) make proxy contest voting decisions independently, the influence of ISS and Glass Lewis in these situations remains significant, both as a direct driver of voting activity and as a barometer for likely shareholder sentiment.

Looking Ahead to 2021

Over the past several years, activism has continued to increase, despite conditions that might be considered unfavorable—namely, an unprecedented decade-long bull market combined with a prolonged period of low market volatility. With depressed valuations in certain sectors, elevated volatility, and general uncertainty, many are looking towards 2021 as potentially seeing historic levels of shareholder activism activity. Still, many questions remain: Will activists shy away from certain sectors where the economic outlook is less certain, or do the value dislocations in these sectors present more compelling upside opportunities for activists willing to assume additional risk? If companies continue to struggle with coronavirus-related underperformance into 2021, will investors be forgiving, or will the laggards that fail to capitalize on a potential economic recovery become easy targets for activists? And with M&A and share repurchase activity likely to be muted for the foreseeable future, what tools will activists turn to in order to unlock value? The upcoming US presidential election is also likely to have significant implications for shareholder activism (and M&A activity), and the effects of a change in the country’s leadership could be amplified if it is also accompanied by a change in Senate control.

Ultimately, it may be helpful to look to the past for an indication as to how 2021 will unfold. In the aftermath of the 2007-2008 global financial crisis, activism surged, and there was also a notable uptick in hostile M&A activity. Most companies are far more prepared for an activist than they were ten years ago, with the “Think like an activist” mantra being widely adopted in US boardrooms. That said, the economic shock created by COVID-19 is arguably on par with that of the financial crisis, and many of the ingredients that led to the previous activism boom are present today, and a recovery in M&A activity could provide even more of a catalyst for a rebound in 2021 and possibly even the second half of 2020.

Print

Print