Josh Lerner is the Jacob H. Schiff Professor of Investment Banking at Harvard Business School. This post is based on a recent paper by Professor Lerner; Ufuk Akcigit, the Arnold C. Harberger Professor in Economics at the University of Chicago; Sina Ates, Economist at the Federal Reserve Board of Governors; Yulia Zhestkova, a Ph.D. Candidate in Economics at the University of Chicago; and Richard Townsend, Associate Professor of Finance at the UCSD Rady School of Management. Related research from the Program on Corporate Governance includes Carrots & Sticks: How VCs Induce Entrepreneurial Teams to Sell Startups, by Jesse Fried and Brian Broughman (discussed on the Forum here) and Do VCs Use Inside Rounds to Dilute Founders? Some Evidence from Silicon Valley by Jesse Fried and Brian Broughman (discussed on the Forum here).

One of the most contentious issues in public policy regarding U.S. entrepreneurship over the past four years has been the treatment of foreign investors. The military community has highlighted the extent of foreign venture investments in Silicon Valley, particularly from Chinese corporations, individuals, and financial institutions. These analysts have also emphasized that these investments are often in critical areas, such as artificial intelligence, fintech, robotics, and virtual reality, and expressed the fear that these activities may be leading to technology flows that, while legal, are nonetheless detrimental to U.S. economic and military interests. A particular concern is corporate venture investments, since these investors well-suited to gain insights from their interactions with the companies in their portfolios and to exploit these discoveries. Brown and Singh (2018) highlight, for instance, Alibaba’s and Enjoyor’s investment in Magic Leap, Baidu’s purchase of shares in Velodyne, and Lenovo and Tencent’s investments in Meta, companies that specialized in areas such as augmented reality, active remote sensing, and artificial intelligence.

The primary policy response to these concerns has been to strengthen the mandate of the Committee on Foreign Investment in the U.S. (CFIUS), which has existed since 1975. The Foreign Investment Risk Modernization Act of 2018 expanded the scope of CFIUS to include reviews of “non-controlling ’other investments’ that afford a foreign person an equity invest in and specified access to information. . . [about] certain critical technologies.” This legislation, and in particular the enabling regulations promulgated by the U.S. Department of Treasury (2020), raised substantial concerns about their consequences among the U.S. venture capital community (National Venture Capital Association, 2019). In response to this debate and the new rules, anecdotal accounts suggest that investments in new ventures by Chinese-based entities dropped sharply in recent years. Similar controversies have played out contemporaneously in, among other nations, Australia, Canada, Germany, and especially Israel (Klein, 2018).

Despite the intense controversy and substantial stakes, the attention of economists to these issues has been very modest. While academics have scrutinized numerous aspects of entrepreneurial finance, such as the mixture of securities employed (e.g., Kaplan and Stromberg, 2002) and the consequences of intensive monitoring by investors, the impact of cross-border capital flows on technology transfer have received almost no attention.

In our new work, we seek to address this gap, examining foreign corporate investment in Silicon Valley from a theoretical and empirical perspective. We begin with a stylized model of two countries. In each there are a variety of industries, with one incumbent in each nation. These firms differ in their labor productivity, and engage in Bertrand competition. In each nation, start-ups may appear that are potentially more productive, in which case, they will replace the incumbent firm. To be successful, however, these new firms must raise financing. In some cases, this financing may not be available domestically.

One option that entrants face is to seek money from foreign corporate investors. Such financing is “good news” for the entrant firm, as without financing it may not be able to put its superior technology into practice. But it may also lead to spillovers to the overseas firm providing the financing and the nation where it is based, as well as to the potential leakage of technology important to national security.

We posit that policymakers can raise the cost of foreign financing, whether through regulatory barriers or taxes. If these costs are high enough, these costs will choke off venture investments by foreign corporations. But start-ups with the potential to enhance domestic productivity may consequentially languish unfunded.

We explore the dynamics of the equilibrium in this model to differences in the relative technological positioning of the leader and follower incumbent firms. When the following incumbent is lagging far behind, it is more likely to engage in cross-border investments. As the two firms become more similar in their productivity, the probability of cross-border investment activity approaches zero. The probability of investment is also a probability of the baseline level of spillovers that would have occurred without any foreign venture investment. In particular, higher levels of baseline spillovers reduce the gains from the investment and dampen the incentive of foreign incumbents to invest abroad.

In a numerical example, we seek to explore the optimal response by policymakers. We depict the government in the country with technological leadership as being able to raise the cost of foreign corporate investments. We posit that in its deliberations, policymakers consider not only the impact of these investments on the prospects for domestic firms, but also the potential for an ”arms race” if a foreign nation has the potential to acquire leadership in a critical technology. The numerical examples suggest that the optimal cost will have an inverted U shape. As the threat of military competition grows, the exercise suggests that the optimal cost imposed on foreign corporate venture investors should increase. As the threat of military competition grows, the example suggests that the optimal cost imposed on foreign corporate venture investors should increase. It takes a threat that triggers a very substantial military investment, however, to justify increasing the cost of foreign investment. Therefore, such cost-raising interventions should not be undertaken casually.

We then seek to explore these ideas empirically, to see whether we find evidence supportive of the model. We begin acknowledging that this analysis by necessity presents correlations rather than casual relationships. In particular, a number of papers seeking to explore the impact of venture investments on innovation have sought to exploit exogenous shifts, such as pension fund reforms and changes in commercial flight schedules. Identifying similar shifts in foreign corporate investments that are uncorrelated with key dependent variables is exceedingly difficult. Thus, the results must be interpreted more as suggestive that the trade-offs illustrated in the model seem reasonable.

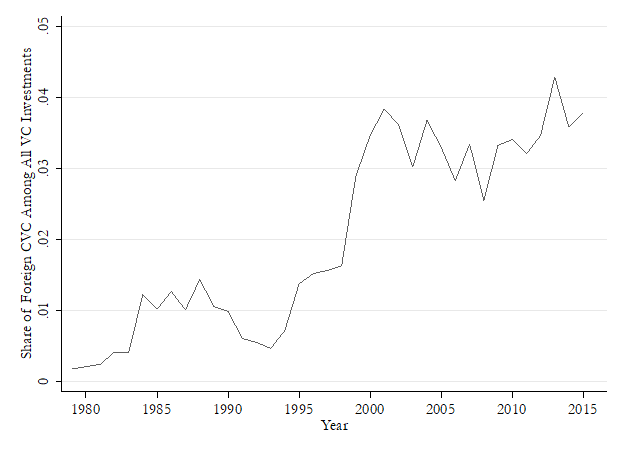

We build a data-set of venture investments that includes as comprehensive a sample of investments by non-U.S. corporate investors in U.S. start-ups as possible. We identify transactions involving 344 companies from 32 distinct countries between 1976 and 2015. The rapid increase in such transactions is shown in Figure 1. We identify the patents of the start-up firms, as well as patenting by the corporate investors specifically and by residents of the countries in which they are based.

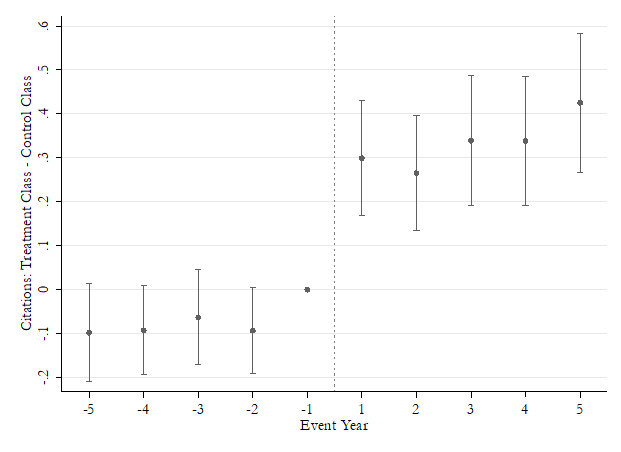

In our initial analysis, we examine patenting activity before and after the corporate investment. We show that around the time of investment, patent applications by entities in the country in which the investor is based increase in the patent classes that the start-up focuses on. In a follow-on analysis, we examine citations by organizations in that nation to the patents of U.S. start-ups. These also increase in the relevant patent classes after a foreign corporate investment, as illustrated in Figure 2. The results suggest that there are benefits from these investments in the form of knowledge spillovers.

The results are also heterogeneous in a way consistent with the theoretical framework. In particular, these effects are stronger in patent classes that are more basic, where catching up to the technological frontier without the benefit of the insights gained through a corporate venture investment is likely to be harder. Similarly, knowledge flows appear to be greater in classes that contain patents subject to a secrecy order from the Federal government. These patterns of patenting and citations suggest the real knowledge transfer is taking place.

We then look at where these investments are more frequent. We show these investments are more common when the nation in which the corporation is based is further behind the United States in the given technology, measured in various ways. The investments appear to be responses to address this technology gap, at least partially.

We finally turn to examine the consequences of these investments. While we cannot demonstrate causality, more foreign investments in firms specializing in a technology class are associated with greater subsequent patenting by U.S. start-ups in this class. These results are at least consistent with the hypothesized benefits of such investments in easing capital constraints.

Taken together, these empirical results seem to suggest the reasonableness of many of the assumptions behind the model. Corporate venture investments may allow companies and nations to catch up, at least when they are not too far behind the technological leaders.

Much remains to be understood about cross-border investing in venture capital. But given the growing importance of this sector, and the important national security issues at stake, we hope that this work stimulates more work on both the theoretical and empirical front.

University of Chicago and NBER; Federal Reserve Bank; Harvard and NBER; UC San Diego and NBER; and University of Chicago. The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System. Harvard Business School’s Division of Research provided financial support for this project. We thank Luting Chen, Patrick Clapp, Kathleen Ryan, James Zeitler, and Chris Zhao for excellent research assistance. We also thank James Mawson for corporate venture capital data. Akcigit gratefully acknowledges an NSF Career Award #1654719. Lerner has received compensation from advising institutional investors in venture capital funds, venture capital groups, and governments designing policies relevant to venture capital. All errors and omissions are our own.

Figure 1: Foreign corporate venture capital as a share of all U.S. venture capital investment, 1975-20

Figure 2: This figure examines how a foreign country’s patenting to a technology class evolves after a corporation based in that nation invests in a U.S. startup specializing in that technology. Observations are at the patent class by country by year level. The sample consists of the five years before and after a country’s first investment in a U.S. startup specializing in a particular technology class. The dependent variable in the analysis is the number of patents in the technology class filed in the year by entities in the foreign nation. Changes in the country’s innovative activity in that “treated” technology class are graphed relative to changes in the same country’s innovative activity in a similar “control” technology class, which it never invested in. Treated classes are matched to control classes based on two measures of innovative activity in a class during the five years prior to investment: (1) the country’s annual number of (eventually granted) patent applications in the class, and (2) the country’s annual number of citations to U.S. startup patents in the class. A country is classified as having invested in a U.S. startup specializing in a technology class if a corporation based in that country invested in a U.S. startup that had a majority patent applications in that class at the time of investment. The analysis includes country-by-class fixed effects. Standard errors are clustered at the treatment-control pair level.

The complete paper is available here.

Print

Print