Benjamin Colton and Robert Walker are Global Co-Heads of Asset Stewardship at State Street Global Advisors. This post is based on their SSgA memorandum.

This post covers our Stewardship Engagement Guidance to companies in response to COVID-19, the integration of R-Factor™ into our Proxy Voting and Engagement Guidelines, the enhancement of our Proxy Voting Guidelines on board quality and composition, the impact of our Fearless Girl Campaign following its third anniversary, the launch of our new Stewardship Platform to enhance operational efficiency and reporting, Q1 2020 engagement highlights, and regulatory submissions.

COVID-19 and ESG Implications

Stewardship-Engagement Guidance to Companies in Response to COVID-19

The outbreak and rapid spread of the COVID-19 pandemic in 2020 represents both a global health threat and a threat to our communities, our economies and the investment returns people depend on.

In light of these extraordinary circumstances, in a March publication we shared perspectives on our 2020 asset-stewardship agenda, recognizing that our portfolio companies are going through a challenging time and that their immediate priority is the safety and well-being of their employees and other stakeholders.

As a long-term shareholder, we assured companies that we stand ready to help them navigate existential financial threats and market volatility, and to provide guidance through our stewardship engagements.

We also recognized that our engagement conversations, at least in the short term, will likely shift from very specific, longer-term material sustainability matters to more immediate environmental, social and governance (ESG) issues such as employee health, serving and protecting customers and ensuring the overall safety of supply chains. Companies will also face a delicate balance in determining how to manage their short-term liquidity needs, in order to maintain their financial stability. With this in mind, we encouraged our portfolio companies to:

- Refrain from undertaking undue risks that are beneficial in the short term but harm longer-term financial stability and the sustainability of the business model.

- Communicate to investors COVID-19’s potential short- and medium-term impact to the business, overall operations and supply chains, including management preparedness and scenario-planning and analysis.

- Articulate how COVID-19 might impact or influence their approach to material ESG issues, as part of their long-term business strategy.

- Lastly, to continue to help stop the spread of the virus, we encouraged companies to follow guidance from government authorities to either postpone their shareholder annual general meetings (AGMs) or shift to virtual When conducting an AGM virtually, we expect companies to preserve all of the rights and opportunities afforded to shareholders in a physical meeting.

Insights from Company Engagements on COVID-19

The global health, social and economic impacts of COVID-19 intensified during the 2020 proxy season. As a result, many of our discussions with investee companies focused on immediate ESG issues, including employee health, human capital, serving and protecting customers and ensuring the overall safety of supply chains. We also focused on near-term survival issues such as business continuity and resilience (including C-suite succession planning), financial stability, capital allocation and liquidity. That being said, as long-term investors we continued to engage with our investee companies on long-term issues. To manage a crisis of this magnitude successfully we believe companies need to strike the right balance between managing short-term priorities and staying focused on long-term goals.

Since the outbreak of the pandemic we have engaged with 150 companies globally, across various markets and sectors, to understand how they have navigated the crisis and positioned their business for the future. Below we discuss our key takeaways and insights from these engagements.

What became apparent through these engagements is that very few companies had plans in place for responding to a pandemic before the COVID-19 outbreak. Many companies were forced to adapt quickly though managing their business remotely and making changes to their operations, supply chains and customer connectivity. The pandemic has thus accelerated trends that were already in place, such as digital transformation, remote working, online ordering and delivery and supply-chain diversification.

Social Issues in the Spotlight. The COVID-19 pandemic has shown how a global health crisis can become a profound social issue. As a result, we have amplified our focus on human capital, employee health, safety, equality, diversity and inclusion. In our engagements, we encouraged our investee companies to articulate how the pandemic might influence their approach to these material issues as part of their long-term business strategy.

We believe that companies should consider redeploying talent by reskilling and upskilling the workforce. Companies may also need to re-evaluate their purpose, culture and portfolios to deliver more sustainable business models in the post-pandemic era. We are confident that forward-looking companies with strong ESG practices will use this crisis as an opportunity to reinvent themselves.

Liquidity Management a Top Priority for Companies. As a consequence of the pandemic, many companies have been in greater need of capital and liquidity and have consequently suspended their dividend payments and share buy-back programs to preserve cash and ensure the ongoing viability of their business. In light of the current uncertainties, we understand that some companies have to take a prudent approach in assessing their ability to withstand financial stress. However, we are also mindful when companies unnecessarily suspend or reduce their return of capital to shareholders. We expect companies that decide to suspend dividend payments to resume them as soon it is prudent to do so.

Unsurprisingly, there was also a significant increase in the number of investee companies seeking to raise survival cash from shareholders during the 2020 proxy season. The number of capital-raising resolutions submitted for approval at shareholder meetings more than doubled compared to the same period last year. As we recognize that a global health and economic crisis of this magnitude presents extraordinary challenges for businesses, we have been supportive of well-thought-out capital-raising requests.

Supply-Chain Resilience Key to Lasting Recovery. In our discussions, it is clear that COVID-19 has accelerated the need for companies to embrace digital transformation and supply-chain optimization. The pandemic and the associated production stoppages across the globe have revealed the fragility of many companies’ centralized-production and supply-chain systems. Therefore, some companies are now reconsidering the benefits of their existing systems. We believe that companies may need to re-evaluate their supply chains and consider implementing more diverse sourcing, digitalization and robust supply-chain risk management processes. These factors will be key for companies to achieve resilience and ensure a lasting recovery from the pandemic.

Engagement Insights—Mylan N.V.’s Supply-Chain Resilience

In our engagement with global pharmaceutical company Mylan, we discussed the company’s decentralized global supply-chain system that has various production facilities across the globe. As COVID-19 hit different areas of the world at different times, Mylan was able to navigate and leverage the different aspects of its supply chain, allowing it to experience minimal disruptions and deliver critical medicines to patients.

Pandemic Highlights Need for Robust Succession Plans The potential impact of COVID-19 on the health of company senior executives and the risk of multiple concurrent absences highlight the need for robust succession plans in a time of crisis. Such leadership-continuity risk is a new experience for many boards. Therefore, we have placed additional focus on succession plans in our engagements with investee companies since the outbreak of the pandemic. Our engagements revealed that, even though many boards spend more time and effort on succession planning than ever before, some companies are still not fully prepared to handle multiple unexpected executive transitions.

Q2 2020 Sector Focus Insights: Airlines—The Road to Green Recovery

Identifying several “deep dive” sectors each year allows us to proactively monitor and engage with companies on performance and ESG issues. The transportation sector is one of the three key sectors we focus on in 2020. The following insights are drawn from our engagements with companies in the airline sector in Q2 2020.

The grounding of the majority of the world’s airlines in response to the COVID-19 pandemic has led to the deepest crisis ever in the history of the sector.

The International Air Transport Association (IATA) projects airlines will post their largest ever collective net loss this year, totalling $84.3 billion. IATA expects the industry’s recovery to be long and challenging, with passenger demand recovering to 2019 levels as late as 2023.

In an attempt to keep the industry on life support, various governments across the globe have agreed to provide $123 billion of financial aid in a variety of forms. While maintaining the size of the workforce is a common contingency attached to these bailout funds, only France and the Netherlands have set environmental conditions. Flying is one of the fastest-growing sources of greenhouse gas (GHG) emissions and the most carbon-intensive form of transport. Direct emissions from commercial aviation account for more than 2% of global carbon emissions. Therefore, this sector can play a key role in the global efforts to address climate change.

We find that airlines have comprehensive GHG-reduction programs and measures in place to improve fuel efficiency by optimizing their operational practices. However, few companies establish targets to support strategic initiatives that will help them adapt to the impacts that climate change may have on their business. As these companies strengthen their risk-management processes and further incorporate sustainability into business strategy, future targets should reflect this change. Modernizing fleets, improving operational efficiency and making investments in sustainable aviation fuels (which currently represent less than 1% of total jet-fuel demand) are key to reducing aviation’s carbon emissions.

In our engagements with Deutsche Lufthansa AG, Air France-KLM SA, Delta Air Lines Inc. and United Continental Holdings Inc. we discussed the unprecedented challenges that these companies face as well as their sustainability practices. We highlighted that the current crisis and state support are a unique opportunity for the airline sector to reset strategy and pursue a recovery that is consistent with a transition to a low-carbon economy.

2020 Proxy Season: A Heightened Focus on Climate Change

Climate change continues to be a core theme of State Street Global Advisors’ stewardship activities in 2020. Our climate stewardship approach is built upon a foundation of company engagement, proxy voting, thought leadership and policy and regulatory support at the market level. This is informed by our view that climate change is challenging companies across all industries from both a strategic and business operations perspective.

We have been engaging with companies on climate change related matters since 2014. In that time, we have held 586 climate-related engagements across a range of industries and markets.

We believe that the COVID-19 crisis accelerates the need for transformative change to address climate change as it shows the importance of being prepared and the huge cost of slow action.

Climate change will remain a core campaign until we are confident that portfolio companies are effectively addressing this issue.

During the first half of 2020, we continued to actively engage with companies on climate change, undertaking 72 climate-related engagements. We found that most companies are responding to the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD), which has become a widely accepted framework for companies to assess and report on climate risk. We view this as a positive development, and one that will, over time, help mitigate climate risk in a significant portion of our portfolio. While progress is being made, we feel that it is not happening at a pace commensurate with the challenge. Therefore, we continue to encourage companies to disclose how they are addressing both climate risks and opportunities through engagement and voting on shareholder proposals.

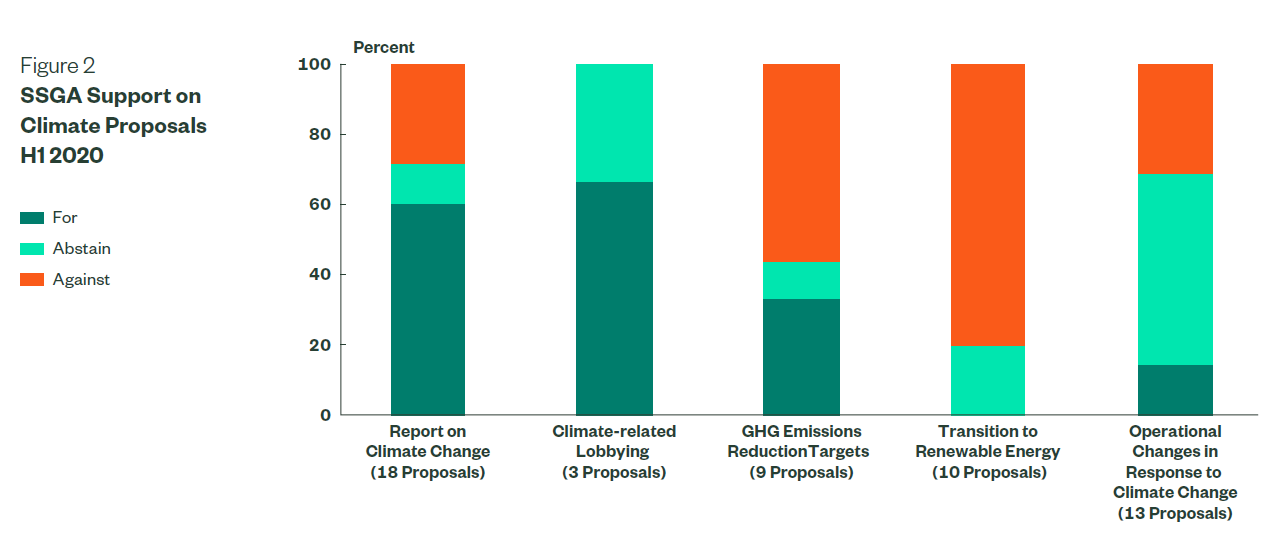

On the voting front, there was a significant increase in the number of climate-related shareholder proposals submitted at our investee companies during the 2020 proxy season (53 in total in H1 2020, compared to 37 in H1 2019). A breakdown of our votes per category of climate-related shareholder proposals is provided in Figure 2.

In line with our views on climate-related disclosure set out above, in the first half of 2020 we supported 61% of shareholder proposals requesting that companies report on the financial and physical risks of climate change to their business and their plans to reduce greenhouse gas emissions. We also supported 67% of the climate-related lobbying proposals, which are described in the next section of this post.

We found that most of the companies targeted with proposals asking them to establish GHG reduction targets already had ambitious GHG reductions goals, which explains the decrease in our support for such proposals—from 61% in H1 2018 and 44% in H1 2019 to 33% in H1 2020.

As Figure 2 illustrates, we were not generally supportive of resolutions that require companies to make specific operational changes such as a transition to renewable energy within a define timeframe or a phase out of a project, business or product. We found the actions requested by many of these shareholder proposals to be overly prescriptive.

While we give investee companies discretion to decide what climate-related goals are

appropriate for them, we will continue to monitor the rigor of such goals and engage with them to ensure that climate is meaningfully integrated into their long-term strategy.

High-Impact Sectors: Companies Respond to Our Call for Climate Risk Disclosure

In recent years, the number of companies receiving shareholder proposals that require them to “Assess Portfolio Impacts of Policies to Meet 2-Degree Scenario” has been in steady decline. Such proposals ask companies in high-impact sectors to report to investors on how a transition to a low-carbon economy could impact their strategy, business and assets. The 2020 proxy season was the first time in five years that there were no 2-degree scenario proposals submitted to our investee companies, dropping from a high of 15 in 2017.

State Street Global Advisors was one of the first large institutional investors to support such proposals in 2016. Since then, we have been actively voting and engaging to improve climate disclosure with our issuers across all industries, including the oil and gas, mining and utilities sectors, which are typically targeted by 2-degree proposals.

As a result of voting action, engagement and thought leadership from long-term investors, including State Street Global Advisors, climate risk disclosure under the 2-degree scenario has become standard market practice and therefore the need for 2-degree shareholder resolutions at companies has diminished.

Following the 2019 proxy season, we explored how such disclosures have evolved over time and what still needs to be improved. Our findings are outlined in our publication Climate-Related Disclosures in Oil and Gas, Mining, and Utilities: The Current State and Opportunities for Improvement.

United States: The Emergence of Climate-Related Lobbying Proposals

As highlighted in our Q3 2019 Stewardship Activity Report, we found that shareholder proposals related to political activities are evolving and bringing together both the issue of lobbying as well as climate change.

These “climate-related lobbying proposals” are asking for corporate membership in trade associations to be fully aligned with a company’s stated position on climate change. Where there are inconsistencies with a company’s position on climate and those of the company’s trade associations, the proposal asks companies to suspend their membership of such organizations.

State Street Global Advisors believes that a conflict in a company’s climate positions and the activities of its trade associations creates potential financial and reputational risks. We find that trade association disclosure is generally poor in the US and that few, if any, companies in this market currently disclose if they are performing a gap analysis of their stated positions on climate change and that of their trade associations.

As we expected, during the 2020 proxy season we saw these climate-related lobbying proposals go to vote in the US for the first time. The three companies that received such proposals and our final voting decisions are as follows:

| Company | SSGA Vote on Climate-Related Lobbying Shareholder Proposal | Overall Shareholder Support for Proposal (%) |

|---|---|---|

| Chevron Corporation | Abstain | 54 |

| Delta Air Lines, Inc. | For | 46 |

| United Airlines Holdings, Inc. | For | 31 |

We supported the climate-related lobbying submitted at Delta Air Lines, Inc. and United Airlines Holdings, Inc. as we believe that additional reporting on lobbying-related practices and policies would help us better understand the relevant risks.

In contrast, Chevron Corporation provides superior disclosure on its trade group, not only compared to its oil and gas peers, but also relative to the broader US market. However, the company lacks a gap analysis on its stated position on climate and that of its trade association. Therefore, we abstained on the climate-related lobbying proposal submitted at the company’s 2020 AGM.

Europe: Oil and Gas Majors Commit to Reach Net Zero Emissions by 2050

The last few months have seen an unprecedented wave of large European oil and gas companies voluntarily setting ambitious carbon neutrality goals; in contrast, their US peers have yet to make such commitments.

In December 2019, Spain-based Repsol SA became the first oil company to commit to becoming globally carbon neutral by 2050. Repsol not only pledged to achieve carbon neutrality on operational emissions (Scope 1 and 2) but also on indirect emissions that occur in the value chain from the use of its products (Scope 3). Following this announcement, other European oil and gas majors soon followed suit, pledging to reach net zero emissions by 2050. They included Equinor ASA, Royal Dutch Shell plc, BP plc, Total SE and Lundin Energy AB (by 2030). Most of these companies included Scope 3 emissions in their carbon neutrality ambitions.

We believe that such efforts are a fundamental component of moving toward a low-carbon economy and, through engagement, we aim to encourage other companies in the oil and gas sector to join this commitment.

However, while we welcome and applaud companies that voluntarily set and disclose Scope 3 emission targets, we recognize that this is still an evolving practice. During our engagements many oil and gas companies stated that the lack of direct control and difficulty collecting

high-quality data can create challenges to setting and disclosing Scope 3 emissions targets. For example, each of the European integrated oil and gas companies that have set a Scope 3 emissions target has developed its own metric, making it difficult for investors to draw comparisons and for the companies to benchmark against their peers. We aim to continue engaging with our investee companies on this topic in order to better understand how they are navigating these challenges.

Climate-Related Proposals at Financial Institutions

In the last few years the majority of climate-related shareholder resolutions were aimed at energy companies that are directly responsible for emissions themselves. In the 2020 proxy season we saw the emergence of a new trend of climate-related shareholder resolutions targeting financial institutions.

These climate-related shareholder proposals were not concentrated in a single region, but rather were spread out globally. This was partly due to the proponents of the proposals leveraging an analysis of the largest fossil fuel financers from the “Banking on Climate Change Report” first published by the Rainforest Action Network in 2018 and updated in 2020.

The three financial institutions that received such proposals were all featured in the report:

| Company | Country | SSGA Vote on Climate-Related Shareholder Proposal | Shareholder Support for Proposal (%) |

|---|---|---|---|

| JPMorgan Chase & Co | USA | For | 49% |

| Mizuho Financial | Japan | For | 35% |

| Barclays plc | UK | Abstain | 24% |

When analyzing the proposals above, State Street Global Advisors considered how these companies were managing climate-related risks. Specifically, we considered decision making regarding financing of fossil-fuel activities, as well as commitments the companies had made to address the issue of climate change.

At JPMorgan Chase & Co we supported a shareholder proposal requesting the company report on if and how it plans to reduce GHG emissions associated with its lending activities in alignment with the Paris Agreement. As long-term investors we would welcome additional information on the company’s strategy for reducing climate-related risks and its plans to align its operational, as well as financed, GHG emissions with the Paris Agreement goals. While the resolution was defeated at the company’s AGM in May, it received 49% of votes cast.

Mizuho Financial Group received a similar shareholder proposal asking the company to disclose a plan outlining their business strategy to align investments with the goals of the Paris Agreement. While Mizuho Financial Group has committed to the Paris Agreement, it has not provided any disclosure around its strategy or targets for accomplishing these goals. As a result, we supported this shareholder resolution.

Barclays plc also received a climate-related shareholder resolution that sought to direct the company to phase out of the provision of financial services to companies within the energy and utilities sectors that are not aligned with the Paris Agreement. Our decision to abstain on this resolution is described in detail in a case study.

Engagement Insights—Barclays Sets Net-Zero Carbon-Emissions Target for 2050

In January 2020, the UK charity and campaigning organization ShareAction filed a climate-related shareholder resolution at Barclays plc to be voted on by investors at the company’s 7th of May annual meeting. The resolution sought to direct Barclays to “phase out of the provision of financial services to companies within the energy and utilities sectors that are not aligned with the Paris Agreement.” This vote was especially high profile as it marked the first time a European bank faced such a climate-related shareholder proposal.

Following engagements with shareholders and ShareAction, Barclays announced on the 30th of March a plan to reach net-zero carbon emissions by 2050 and a commitment to align all of its financing activities with the goals and timelines of the Paris Agreement. The company also submitted a management resolution at the AGM asking shareholders to endorse its plan and commitment. The alignment of Barclays’ portfolio will first focus on the energy and power sectors, and will cover all sectors over time. Progress against its plan will be reported annually, starting from 2021. In our April 2020 engagement with the chairman of the board of Barclays, we communicated our support of the firm’s updated climate strategy, which sets a new benchmark in the banking sector.

Although the climate-related resolutions submitted by Barclays and ShareAction broadly shared the same spirit we opted to support Barclays’ resolution and abstain from the resolution submitted by ShareAction for the following reasons:

- We believe Barclays’ proposal was the more ambitious of the Further, Barclays’ ambition to achieve net-zero emissions by 2050 covers all of its portfolio, not just lending, as proposed by ShareAction’s resolution.

- The resolution submitted by Barclays sought to transition its provision of financial services across all sectors to align with the Paris Agreement, whereas ShareAction’s resolution was too narrowly focused on the “phase out” of specific financial services in the energy and power In our view, such a narrow focus could have limited the flexibility of the company to deliver a more broad transition strategy to a lower-carbon economy. The passing of both resolutions could have created legal uncertainties, as they are both binding.

ShareAction’s resolution was defeated at the AGM, receiving 24% of votes cast, whereas Barclays’ resolution was adopted, receiving more than 99% support.

Integrating R-FactorTM into Our Proxy Voting and Engagement Guidelines

We have long believed that ESG issues can pose long-term risks and opportunities to portfolio companies and should be managed as such, including through oversight by a company’s board of directors. Reflecting that belief, in our January 2020 CEO letter to portfolio companies, we outlined a new engagement and voting policy which went into effect this year. We created an engagement-and-voting screen that leverages R-Factor, our proprietary scoring system which measures the performance of a company’s business operations and governance as it relates to financially material and industry-specific ESG risk factors as defined by the Sustainability Accounting Standards Board (SASB).

Beginning in the 2020 proxy season, we started taking action against board members at companies in the S&P 500, FTSE 350, ASX 100, TOPIX 100, DAX 30 and CAC 40 indices that are laggards based on their R-Factor scores and that cannot articulate how they plan to improve their score. In the event that we feel a company is not committed to engaging with us or improving their disclosure or performance related to financially material ESG matters, we do not support the re-election of the board’s independent leader.

During the second quarter of 2020, 14 issuers that were laggards in the R-Factor universe held shareholder meetings. We requested engagement with all identified laggards and engaged with those companies that expressed a willingness to do so. We subsequently voted against directors at nine of the 14 meetings (64%). Of these, five companies (55%) were in the United States and four companies (45%) were in the United Kingdom.

Beginning in 2022, we will expand our screen to include those companies that have been consistently underperforming their peers on their R-Factor scores for multiple years, and may take voting action unless we see meaningful change.

Companies interested in receiving their R-Factor scores should submit an email request to [email protected] including the following information:

- Company’s legal name

- Ticker

- ISIN

- Company’s headquarter location

- Contact name

- Contact’s Title at Company

- Contact email address (must be an official company email address)

- Contact phone#

Please note that R-Factor scores will be provided only to employees affiliated with a company’s investor relations, chief financial officer, ESG/sustainability leadership or general secretary’s organizations. Please include attestation in your email stating that you are affiliated with one of these functions.

Impact of Our Fearless Girl Campaign Following its Third Anniversary

In March 2020, we celebrated the third anniversary of our Fearless Girl campaign and International Women’s Day by creating a “Living Wall” that highlighted the number of companies which have added their first female director to their boards since we began our campaign in March 2017. The campaign began with us placing a statue of a girl near Wall Street and calling on companies to have at least one woman on their boards, failing which, we would take voting action against directors on the board. We built on the strong momentum from our efforts in the US, UK and Australia in 2017 and expanded our gender-diversity voting guideline to Europe, Canada and Japan in 2018.

After three years of productive engagements and voting, we are pleased to report that, since the introduction of Fearless Girl in 2017, 789 companies, or approximately 54% of companies identified by State Street Global Advisors, responded to our call by adding a female director.

| Market | Number of Companies Identified

(Since March 2017) |

Number of Companies Adding a Female Director | % of Identified Companies Adding a Female Director (%) | Number of Companies Where State Street Global Advisors Voted Against a Director for Lack of Board Diversity (Q2) |

|---|---|---|---|---|

| Global | 1,463 | 789 | 54 | 234 |

| US | 973 | 568 | 58 | 122 |

| UK | 18 | 14 | 78 | 2 |

| Australia | 61 | 37 | 61 | 0 |

| Japan | 298 | 120 | 40 | 82 |

| Canada | 81 | 38 | 47 | 16 |

| Europe | 14 | 10 | 71 | 1 |

| Singapore | 6 | 0 | 0 | 4 |

| Hong Kong | 12 | 2 | 17 | 7 |

Executive Compensation in the 2020 US Proxy Season

Voting on executive compensation during the 2020 proxy season presented a unique challenge against the backdrop of COVID-19. Compensation committees generally review the prior year’s performance and approve incentive awards in the first quarter of the year, while AGMs for shareholders to approve these decisions are held in the second quarter. Therefore, during the proxy season in Q2 2020 shareholders were evaluating compensation decisions that were made before the outbreak of the pandemic and based on pre-pandemic performance. In many cases the financial performance of the companies we reviewed had been negatively impacted by the pandemic and misrepresented the performance context in which compensation decisions were made. Recognizing that these decisions for the year under review had been made before the outbreak of the pandemic, we evaluated 2020 executive compensation proposals in the context of pre-pandemic performance.

Through voting and engagement with US companies we have found:

- Executives are taking temporary paycuts in light of COVID-19 Many CEOs and senior executives in the companies hardest hit by the pandemic have announced that they will voluntarily reduce their pay until COVID-19 has However, most companies refrained from fundamentally restructuring schemes as they are still actively trying to assess the impact of the pandemic.

- Discretion to be a key consideration going forward In light of the pandemic’s impact on executives’ annual and long-term incentives, many companies are considering using discretion to determine any awards to be earned for In our view, compensation committees should be clear about the discretionary powers available to them. We expect committees using discretion to adjust payouts to ensure the outcomes will reflect company and executive performance and align with shareholders.

- Increased complexity We have observed annual plans becoming overly complex, using numerous metrics with differentiated Complex plans make it difficult for us to determine what the executive is being incentivized to focus on and how business results translate into awards. We encourage companies to simplify bonus plans and to ensure they have clear linkage to strategy.

- Performance-based equity plans continue to increase There has been a further shift away from time-vested awards without performance conditions attached to performance-based equity in long-term incentive We view this as a positive trend creating a stronger alignment among executive rewards, company performance and shareholder value.

- Overreliance on relative TSR We have also observed relative total shareholder return (TSR) increasingly becoming the metric of choice for performance-based equity While relative TSR shows a company’s commitment to creating long-term value for shareholders relative to competitors, it should not be used as the sole performance metric. Rather, we encourage companies to take a more holistic approach using a blend of relative TSR and long-term operational metrics that aligns with the company’s strategy.

Overall, we voted against 6%, or 132, of the 2,307 executive-compensation proposals in the US through the first half of the year. This proportion is consistent with our voting record on executive-compensation proposals in 2019. The dissent is largely driven by pay-for-performance misalignment and overall quantum concerns.

Engagement Insights: Cigna Addresses Gender Pay-Gap Concerns

As a long-term investor of the constituents of the world’s primary indices, State Street Global Advisors has long appreciated the connection between diversity and financial performance. One area of diversity we have been focusing on is the action companies are taking to close the pay differentials between men and women.

Following an engagement State Street Global Advisors had on diversity with global health services organization Cigna, the company has released a goal this year to raise representation of women in director and senior director levels from 45% to 50% by 2024, as a step to address median gender pay-gap concerns.

The complete publication, including footnotes, is available here.

Print

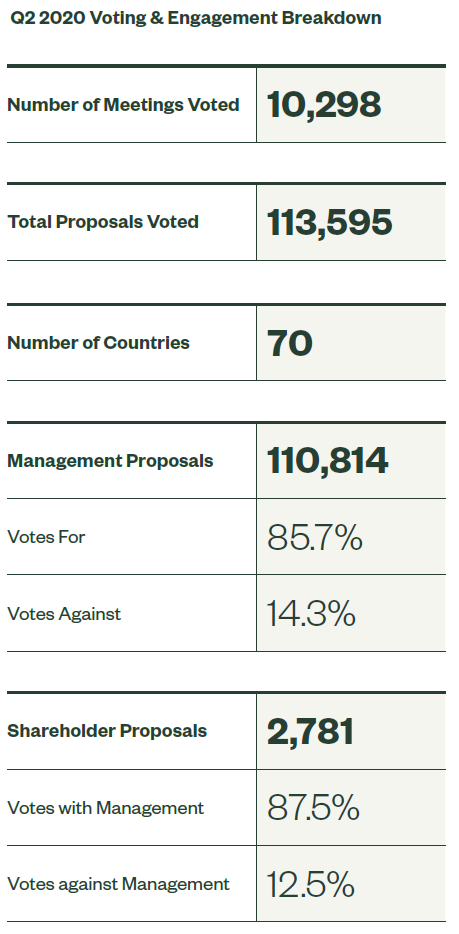

Print