Stefano Ramelli is a PhD candidate in Finance at the University of Zurich. This post is based on a recent paper authored by Mr. Ramelli; Simon Glossner, Post-doctoral research associate at the University of Virginia Darden School of Business; Pedro Matos, John G. Macfarlane Family Chair and Professor of Business Administration and Academic Director of Richard A. Mayo Center for Asset Management at the University of Virginia Darden School of Business; and Alexander F. Wagner, Professor of Finance at the University of Zurich and Swiss Finance Institute.

Institutional investors increasingly play a central role in US stock markets, with institutional ownership rising from below 40% in 1980 to over 75% nowadays. In Glossner, Matos, Ramelli, and Wagner (2020), we examine the outbreak of the novel coronavirus (COVID-19) pandemic—a truly exogenous shock—as a powerful setting to learn more about their behavior. Did institutional investors run for the exits and sell equities, given the heightened level of uncertainty, or instead took a contrarian approach (buying when other market participants were selling, potentially seeing through the temporary nature of the pandemic)? Did institutions sell stocks indiscriminately or rebalance their equity portfolios in a “flight to quality”, favoring stocks perceived to be more “resilient”? And who took the other side of their trades?

We first looked at whether institutional ownership (IO) was a key explanatory variable for stock returns in the COVID-19 crash. Figure 1 shows that the IO level at the end of 2019 was associated with a significant stock underperformance during the COVID-19 market crash, net of the combined effects of other firm and industry characteristics. How did this vary across types of institutions? We find that stocks held more by active investors (vs. passive) investors, short-term investors (vs long-term), or those institutions that had previously experienced higher outflows during the Great Financial Crisis of 2007/2008 performed worse in the COVID-19 “Fever period” (from February 24 through March 20 of 2020, as defined by Ramelli and Wagner, 2020).

Figure 1: Stock Prices and Institutional Ownership

This graph shows the evolution of the coefficients on IO2019Q4 in regressions with Russell 3000 non-financial stocks’ cumulative returns from January 2, 2020, each day through March 31, 2020, as the dependent variable. IO2019Q4 is the percentage of a stock’s outstanding shares owned by institutional shareholders at the end of the fourth quarter of 2019. The regressions control for firm characteristics (Cash/assets, Leverage, Market beta, log(Market cap), Profitability, and Book-to-market) and industry fixed effects. The first red vertical line marks the beginning of the “Fever” period (from February 24 through March 20), when US stock prices experienced a historically fast and furious decline. The second red vertical line marks the announcement of the Fed interventions (on March 23). The dashed lines indicate 90% confidence intervals based on robust standard errors.

Why did IO amplify the COVID-19 stock crash? A possible interpretation is that this resulted from a “fire sale” (Coval and Stafford, 2007) particularly focused on companies with weak financials. We find that institutional investors sold more heavily the stocks of high-leverage or low-cash firms, especially when their equity portfolios had high prior exposures to this type of firms. These spillover effects on stock prices indicate that companies should be mindful not only of their financial policies, but also of the stock price fragility deriving from the broader portfolio positions of their investors.

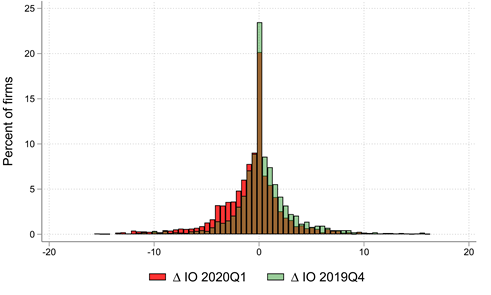

To shed more light on institutional investors’ preferences when disaster hits, we analyze how institutions rebalanced their equity portfolios in the first quarter of 2020. Figure 2 shows that firm-level IO changes in 2020-Q1 were more pronounced and skewed in the negative direction than the changes in IO in 2019-Q4. This is indicative of the intense selling activity by institutions with the outbreak of the virus.

Figure 2: Change in Institutional Ownership in 2020-Q1

This graph shows the difference in the distribution of Δ IO 2020Q1, the stock-level changes in institutional ownership of Russell 3000 non-financial constituents between 2019-Q4 and 2020-Q1, compared to Δ IO 2019Q4, the equivalent changes between 2019-Q3 and 2019-Q4. This result also holds when comparing to other quarters in 2019.

Notably, the IO sell-off was not indiscriminate. IO in 2020-Q1 fell more for highly-levered and low-cash firms, suggesting that institutions were the marginal investors pushing down the stock prices of the firms that were perceived to have less financial resiliency. Interestingly, IO changes were not associated with firms’ environmental and social (ES) performance, which recent studies indicated as a significant driver of stock prices during the Fever period (Albuquerque, Koskinen, Yang, and Zhang, 2020). We conclude that institutional investors expressed a preference for “hard” financial resiliency but not for “soft” corporate sustainability policies during the COVID-19 crash.

Interestingly, not all types of institutional investors behaved in the same way. The 2020-Q1 changes in holdings by hedge funds, for instance, were not associated with firms’ leverage, cash, or ES position. Thus, these investors engaged in more indiscriminate selling of their equity holdings to reduce their own leverage. Hedge funds had exhibited similar de-leveraging behavior during the Great Financial Crisis of 2007/2008 (Ben-David, Franzoni, and Moussawi, 2012). By contrast, investment companies and advisors rebalanced their portfolio away from stocks of companies with high leverage.

If institutions behaved (in aggregate) as net sellers, it begs the question: who took the opposite side of those trades? Individual investors are the most likely suspects. To investigate whether retail investors served as liquidity providers for the stocks sold by institutions, we adopt a newly available proxy: the changes in popularity on the retail-trading platform Robinhood Markets (RH). We find that the change in the number of RH investors in individual stocks over 2020-Q1 exhibited opposite patterns to changes in institutional ownership (see Figure 3). Retail interest substantially increased for stocks with high leverage and low cash holdings, which institutions were selling. RH investors acted as a (small but active) market-stabilizing force during the COVID market crash.

Figure 3: Change in Retail Investor Popularity (Robinhood) Against the Change in Institutional Ownership

This graph shows a binned scatter plot of the percentage change in the popularity of a stock with retail investors (proxied by the log of Robinhood users between 2019-Q4 and 2020-Q1, %Δ log(RHusers) 2020Q1) against the change in institutional ownership over the same time period (Δ IO 2020Q1).

With the Federal Reserve’s interventions in the credit markets paving the way to a stock market recovery in 2020-Q2, did institutional investors reinvest in the stocks they sold in the prior quarter? Our analysis indicates the opposite: Despite the market rally, institutional investors kept expressing preferences in 2020-Q2 for companies with strong financials (high-cash and low-debt firms) and did not revert their portfolios to their pre-COVID allocations. We interpret this finding as a signal of the still elevated concerns and uncertainty by institutional investors regarding the evolving COVID-19 crisis. Robinhood users continued expressing complementary preferences to their institutional counterparts.

Overall, the results suggest that when a tail risk realizes, institutional investors amplify price crashes by fire-selling and seek shelter in “hard” measures of corporate resilience. At the time of writing this note, the COVID-19 pandemic has not yet been contained. Understanding institutional investor preferences will likely continue to matter for stock prices as the situation evolves.

The full paper can be accessed here.

Print

Print