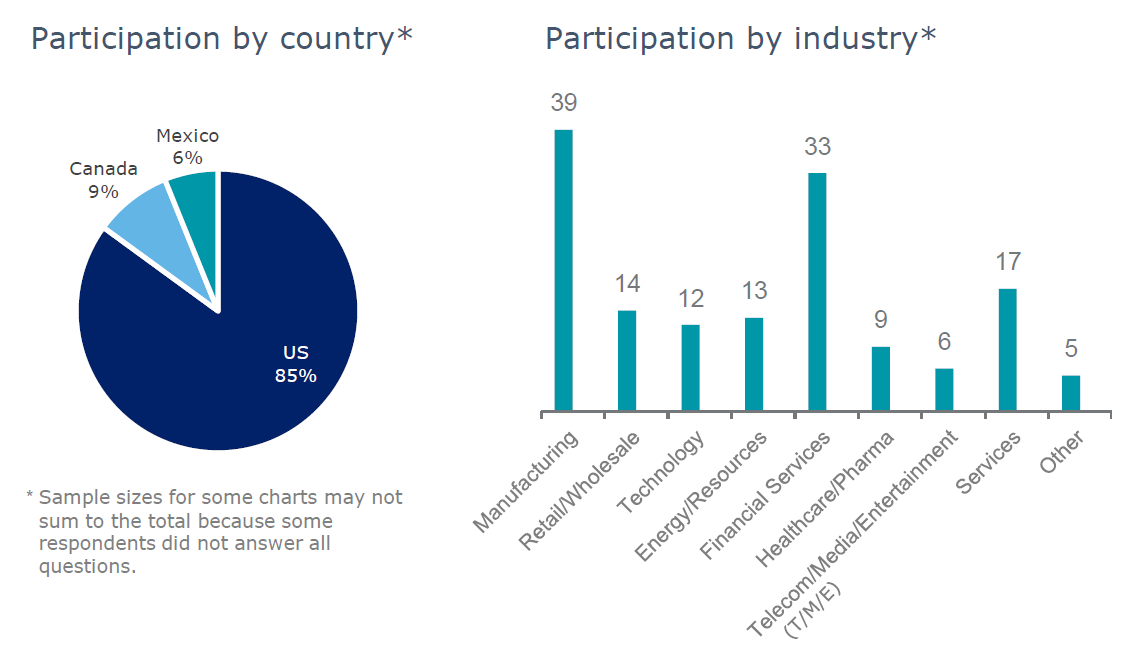

Greg Dickinson is Managing Director of CFO Signals and Lori Calabro is Editor of Global CFO Signals at Deloitte LLP. This post is based on their Deloitte memorandum.

Each quarter (since 2Q10), CFO Signals has tracked the thinking and actions of CFOs representing many of North America’s largest and most influential companies.

All respondents are CFOs from the US, Canada, and Mexico, and the vast majority are from companies with more than $1 billion in annual revenue.

Survey responses

- Survey period: 11/9-11/13

- Total responses: 148

- CFO proportion: 100%

- Revenue >$1B: 75%

- Public/private: 71%/29%

Summary and context

Optimism entering 2021, but near normal operations mostly expected second half or later.

It is difficult to imagine a more eventful time to be asking CFOs about their sentiment and expectations going into a new year. And with a broad range of factors layering uncertainty on top of uncertainty, there may have never been a more “unfair” time to do so. Still, companies cannot escape the need to formulate, adapt, and communicate their plans, and CFOs have already been helping them do it through nine of the toughest months in recent history.

Back in 2Q20, CFOs expressed escalating worries about the economic impacts of COVID-19, but confidence in their ability to manage risks as the US economy began to reopen. In our mid-cycle poll, having executed a substantial reopening, they were still mostly expecting safe, profitable operations as the process continued. At the same time, though, they cited sharply rising pessimism about how quickly economic activity and their own revenue could return to pre-crisis levels.

Last quarter, with the virus continuing to spread, US elections on the horizon, and Congress failing to reach a second stimulus deal, perceptions of the North American economy faltered and fell behind those of the Chinese economy for the first time in survey history.

Since then, the pandemic has accelerated into the fall, US GDP has grown strongly (but not to its pre-pandemic level), and Congress still has not agreed on a new stimulus package. Adding to the volatility, and right before this quarter’s survey opened, Joe Biden was projected to have defeated Donald Trump in the US presidential election, and an effective COVID-19 vaccine was announced.

So where does this leave CFOs as they look toward 2021? The short answer is “concerned about the first half, but optimistic about the second half onward.” News of an effective vaccine seems to be driving a general belief that, despite a grim outlook for winter virus infections, broader vaccine availability later in the year provides a light at the end of the proverbial tunnel.

Finishing out a difficult 2020, just over 40% of CFOs expect to achieve 95% or more of their originally budgeted 2020 revenue, with the average expecting 88% (Retail/Wholesale is lowest at 69%). Consistent with their near term COVID-19 worries and hopes for a broadly available vaccine later next year, nearly two-thirds do not expect pre-crisis operating levels until at least the second half of 2021, and 26% do not expect to get there until 1Q22 or later (especially in Retail/Wholesale, Manufacturing, and Services).

CFOs mostly say their companies’ 2021 strategies will not be substantially different from pre-pandemic. There are predictably strong industry differences, but there seems to be a general trend toward M&A-driven growth, broader offerings, a smaller real estate footprint, and more diversified supply chains.

From an economic standpoint, about three quarters of CFOs expect the US economy to improve in 2021, with the outlooks for Canada and Mexico also mostly positive. Still, few expect their economies to grow faster over the next five years than they were pre-pandemic.

From a capital markets standpoint, CFOs mostly expect rates to stay low (but are fairly split) and for bond yields to remain below 2%. They expect the renminbi to appreciate against the US dollar (and for its use as a trading currency to rise substantially) and for use of digital currencies for business transactions to rise. With the S&P 500 above 3,500, nearly 60% expect it to be higher by the end of the year even though 80% also say it is overvalued.

Finally, in expressing their policy views as a new administration takes over, CFOs overwhelmingly support a new stimulus package, infrastructure investment, de-escalating US China trade tensions, less protectionist trade, and the federal government leading a COVID-19 response. Although there are industry differences, CFOs’ hopes for Washington center largely on improved bipartisanship and cooperation in getting important things done, and on unifying the country with more “moderation,” “transparency,” and “decency.”

Key developments since the 3Q20 survey

- Joe Biden was projected the winner of the US presidential election, and the Trump administration filed court challenges to the results; Democrats held the House (but lost seats), and the Senate balance will depend on a January run off election in Georgia.

- COVID-19 infections accelerated, with 52m global cases and 1.3m deaths as of 11/11 (up from 18m and 0.7m as of 8/5, respectively); an effective vaccine was announced, and stock prices soared.

- Third quarter US GDP grew at the fastest pace ever, but remained below pre-pandemic levels; personal income fell with the expiration of government stim ulus, but savings enabled higher consumer spending.

- Congress again did not agree on a second stimulus package.

- Having sharply cut rates and raised asset purchases in March, the US Fed left rates unchanged in July and November; Chairman Powell again warned that the current outbreak of the virus threatens the economy.

- The S&P 500 rose 7% between surveys, hitting new highs in September and during the survey period.

- Europe’s GDP grew strongly in the third quarter, but remained below the level from a year ago.

- Mexican economic growth slowed in August following a stronger July, consistent with other signals of a moderation in the pace of the recovery.

- Canada’s GDP continued to recover, but the pace slowed; employment grew faster than expected.

- Third quarter Chinese GDP grew strongly, but slower than expected; exports grew strongly, especially to the US; imports from the US fell, while imports from the rest of the world accelerated.

Perceptions

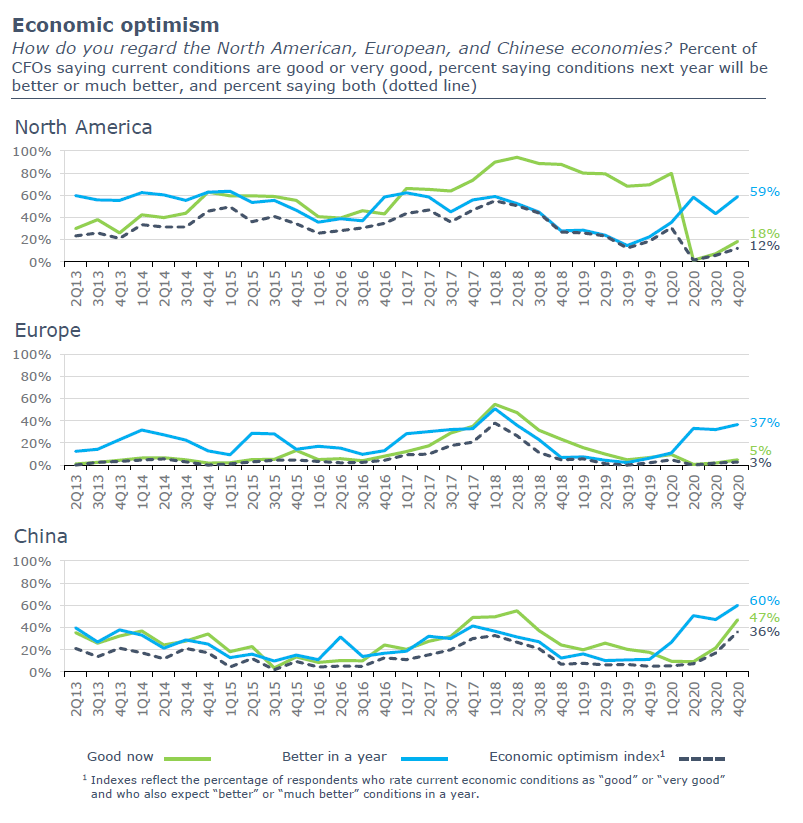

Assessments of regional economies

Perceptions of the North American economy improved, but still appear constrained by worries about continuing COVID-19 impacts—especially through the first half of 2021. Perceptions of China’s economy exceeded those of North America for the first time last quarter, and the gap widened this quarter.

Assessments of the North American economy were declining through 2019, but rose in 1Q20 (possibly influenced by a new US China trade deal). Then COVID-19 struck—leading just 1% of CFOs to rate the economy as good and only 58% to expect better conditions in a year.

Last quarter, the proportion citing good current conditions was just 7%, and the proportion expecting improvement in a year slid to 43%. This quarter’s numbers rose to 18% and 59%—better, but not markedly so. Based on other survey findings, the trepidation seems to stem from expectations of a slow first half of 2021 due to the path of COVID-19.

Perceptions of Europe’s economy had been receding since 1Q18, but rebounded in the first quarter on the heels of Brexit’s completion. Last quarter, though, current assessments dropped to 2%, with 32% expecting better conditions in a year. This quarter’s numbers came in only slightly better at 5% and 37%.

Perceptions of China’s economy were poor early in the pandemic, but they are now the relative bright spot. Nearly half cite good conditions now, and 60% expect better conditions in a year.

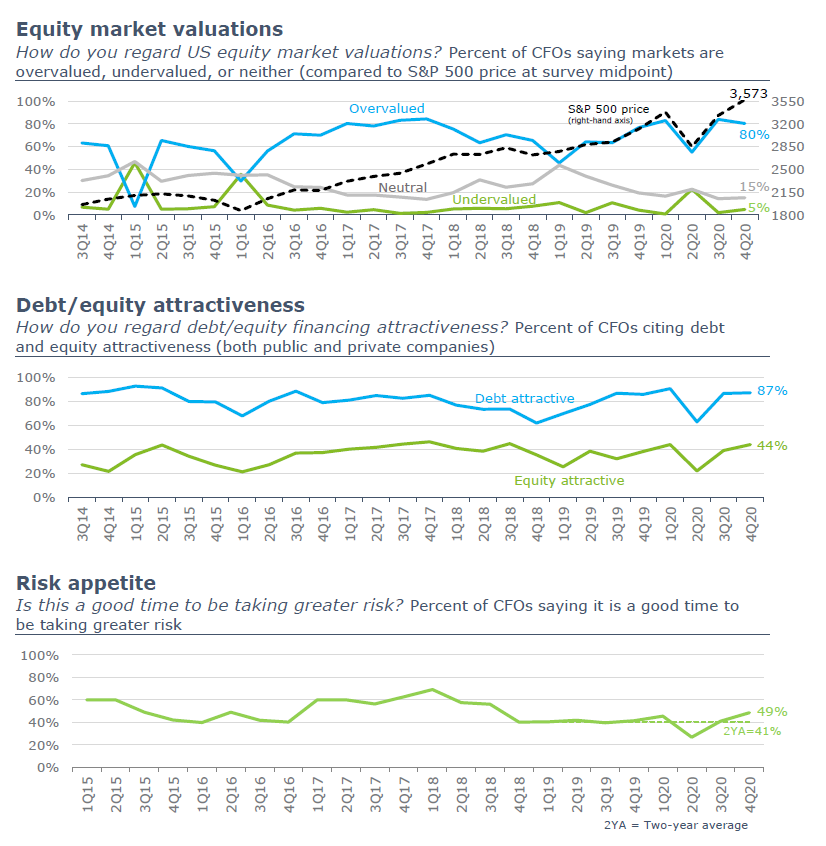

Assessments of markets and risk

Equities regarded as overvalued following a sharp recovery and historic highs. The S&P 500 fell nearly 30% in March, then recovered strongly in April and May—netting a 16% decline between our 1Q20 and 2Q20 surveys. The index has since continued its steep climb, rising 17% between our 2Q20 and 3Q20 surveys, and another 7% between last quarter and this one hitting historic highs along the way. Eighty percent of CFOs now say equity markets are overvalued (the fifth highest level in survey history), and just 5% say they are undervalued.

Attractiveness of both debt and equity financing near survey highs. With continuing low interest rates (the US Fed again held the target rate range at 0%-0.25% in November), debt attractiveness held steady at 87%. With equity markets near historic highs, equity financing attractiveness rose from 39% to 44% (39% to 46% for public company CFOs and 38% to 41% for private company CFOs).

Recovering appetite for risk-taking. The proportion of CFOs saying it is a good time to be taking greater risk flatlined around 40% through 2019. With the emergence of the pandemic, it dipped to just 27% in 2Q20. Since then, however, it has risen to 49%—back in line with the five year average.

Sentiment

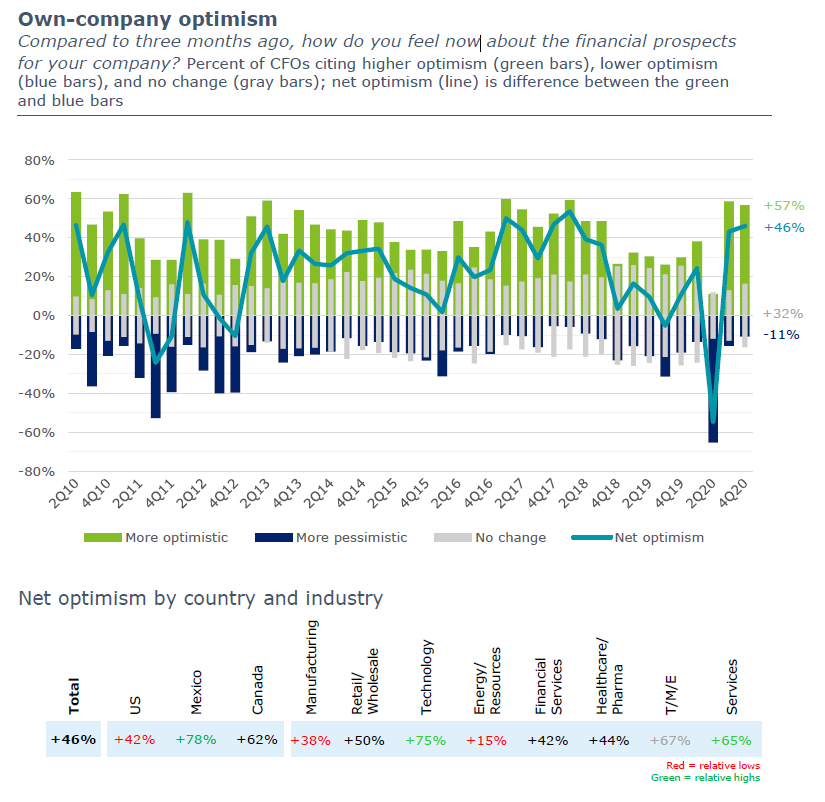

Optimism regarding own-company prospects

In the immediate aftermath of US elections and the announcement of an effective COVID-19 vaccine, nearly 60% of CFOs say they are more optimistic about their company’s prospects now than they were three months ago.

Last quarter’s net optimism rebounded sharply to +43 from a second quarter survey low of 54. This quarter’s reading rose slightly to +46, with 57% of CFOs expressing rising optimism and just 11% citing declining optimism.

Net optimism for the US held steady at +42. Canada declined slightly from +64 to +62, while Mexico climbed sharply from +33 to +78.

Energy/Resources was the most pessimistic at +15. All other industries were above +35, with Technology and Services both at or above +65.

Note that industry sample sizes vary markedly and that the means are most volatile for the least represented. Due to a very small sample size, T/M/E was not used as a comparison point this quarter.

Expectations

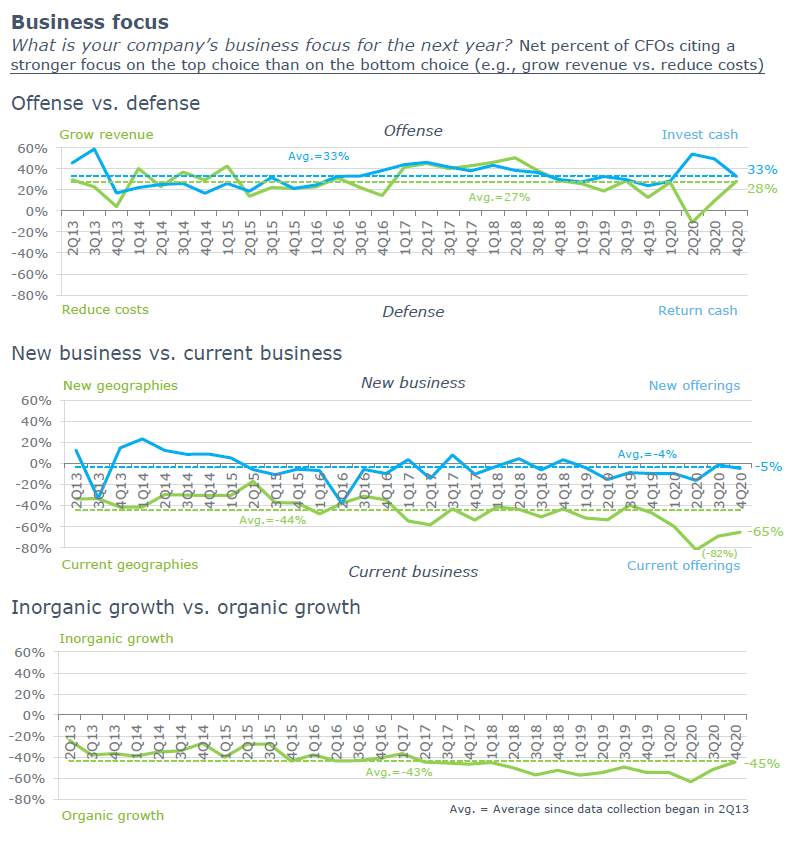

Business focus for next year

Companies’ heightened, pandemic-driven focus on costs and investment has subsided; the shift toward current geographies over new ones continued. Having shifted toward a cost reduction over revenue growth focus when the pandemic emerged in 2Q20, companies have since shifted back toward revenue growth (54% vs. 26%, for a net of +28%, up from +10% last quarter).

Similarly, having shifted strongly toward investing cash over returning it, companies have since shifted back to a more typical level of investment bias (54% vs. 21%, for a net of +33%, down from +49% last

The focus on current offerings over new ones remains relatively split (37% vs. 32%, for a net of 5%). Last quarter’s heavy bias toward current geographies over new ones continued, but was less severe (73% vs. 8%, for a net of -65%).

The bias toward organic growth over inorganic growth strengthened through 2018 and 2019, but there has been somewhat of a shift back toward inorganic growth since 2Q20 (58% vs 13%, for a net of -45%).

Expectations

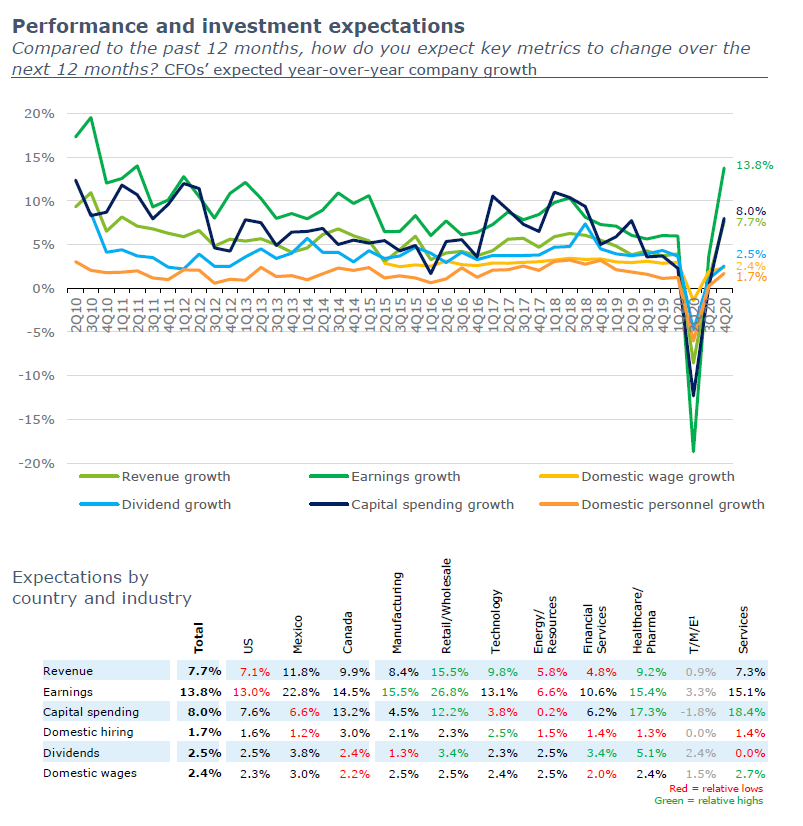

Growth in key metrics, year over year

Consistent with strong growth out of pandemic-driven lows, expectations for all metrics except dividends accelerated substantially several to multi-year highs.

Revenue growth rose sharply from last quarter’s 1.0% to 7.7%—the highest reading in a decade. The US trailed Canada and Mexico. Retail/ Wholesale continued to bounce back, reaching a whopping 15.5%. Services, Energy/Resources, and Financial Services turned positive, but trailed.

Earnings growth skyrocketed from last quarter’s 3.7% to 13.8%—the highest level in nine years. Canada and Mexico turned positive and led the US. Retail/Wholesale led at a remarkable 26.8%, with Manufacturing, Healthcare/Pharma, and Services all above 15%. Energy/Resources trailed.

Capital spending growth rose sharply from last quarter’s 0.2% to 8.0%—the highest level since 2018. Canada was relatively strong. Services and Healthcare/Pharma were both above 17%, with Retail/Wholesale also strong at about 12%. Energy/Resources and Technology trailed.

Domestic hiring growth bounced back from last quarter’s 0.2% to 1.7%, closer to the levels from 2019. Canada led, with Mexico weakest. Industries were split, and either in the 1.3%-1.5% range or above 2% (led by Technology at 2.5%).

Dividend growth rose from last quarter’s 1.1% to 2.5%—better, but still well below the long-term survey average of about 4%.

Note that industry sample sizes vary markedly and that the means are most volatile for the least represented. Due to a very small sample size, T/M/E was not used as a comparison point this quarter.

Special topic: Company-level recovery

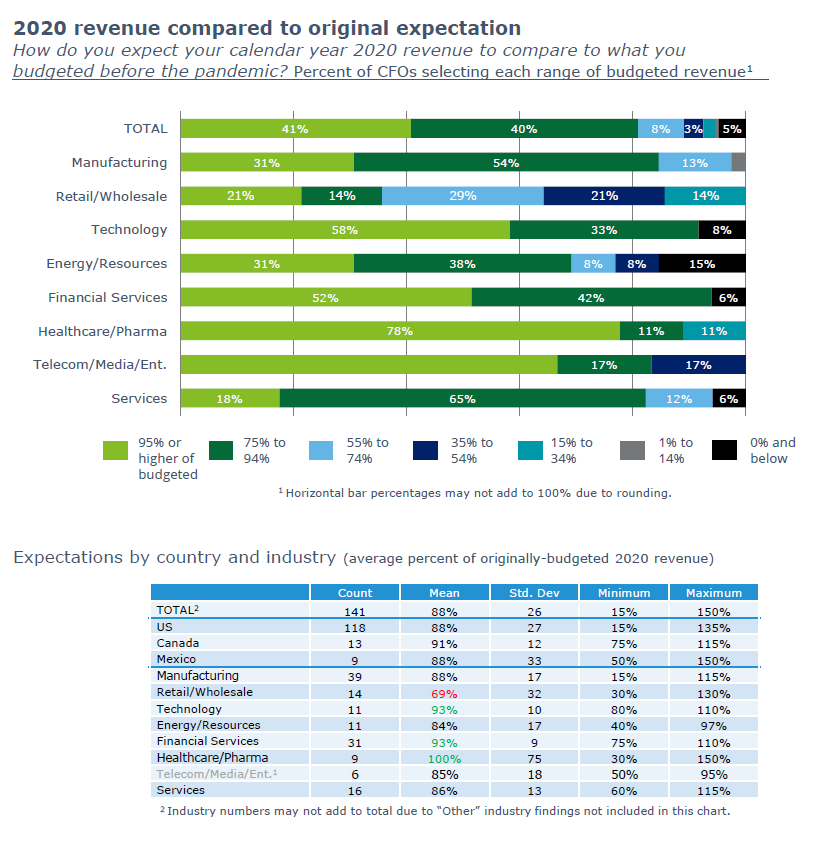

Revenue for 2020 calendar year

Just over 40% of CFOs say they expect to achieve 95% or more of their originally budgeted 2020 revenue, with the average CFO expecting 88% of their target. Healthcare/Pharma, Technology, and Financial Services are the most optimistic; Retail/Wholesale is by far the least.

Forty-one percent of CFOs say they expect to achieve 95% or more of their originally budgeted 2020 revenue. Healthcare/Pharma, Technology, and Financial Services are the most likely to expect 95% or higher (78%, 58%, and 52%, respectively), with Services and Retail/Wholesale lowest (18% and 21%, respectively).

Overall, companies expect an average of 88% of their originally budgeted revenue. Healthcare/ Pharma is highest at 100%, with Financial Services and Technology next at 93%. Retail/Wholesale is, by far, the most likely to expect less than 75% of their original target and has an average expectation of just 69%. Note that about one third of companies in this industry are from the Travel

and Hospitality sector.

There are minor differences from a country standpoint, with Canada highest at 91% and the US and Mexico tied at 88%. Please note: Industry sample sizes vary markedly and the means are most volatile for the least represented industries. Due to a very small sample size, T/M/E was not used as a comparison point this quarter.

Please note: Industry sample sizes vary markedly and the means are most volatile for the least represented industries. Due to a very small sample size, T/M/E was not used as a comparison point this quarter.

Special topic: Company-level recovery

Return to normal operations

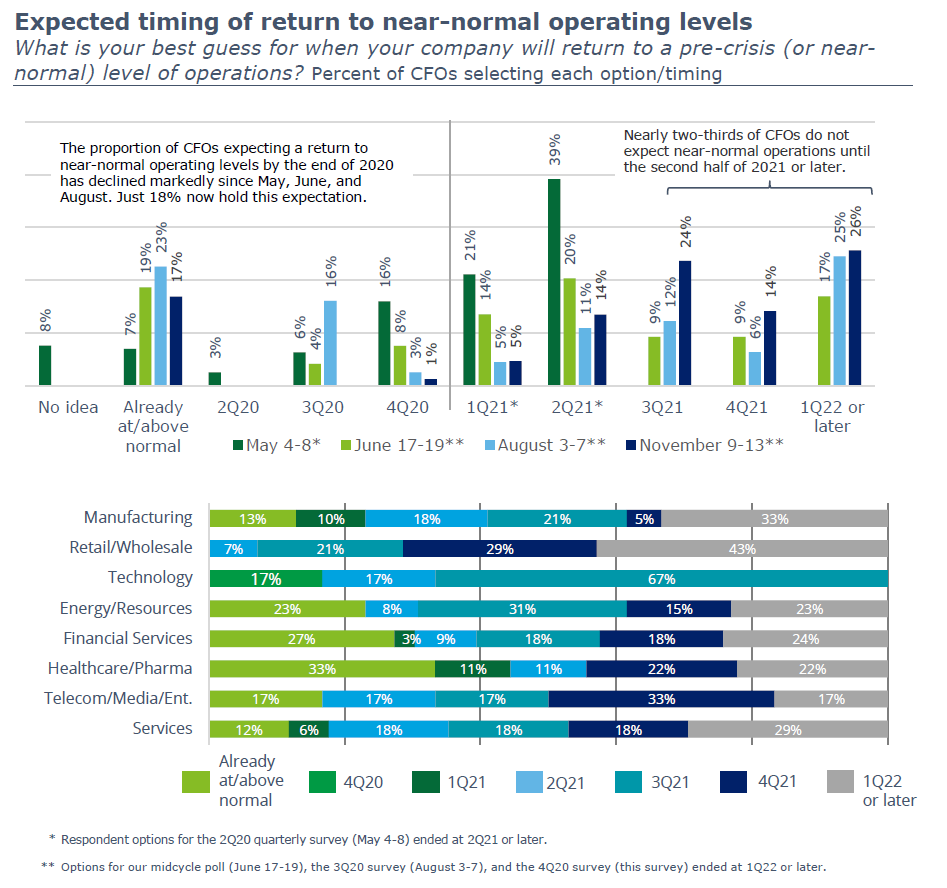

Nearly two-thirds of CFOs say they do not expect to return to pre-crisis operating levels until the second half of 2021 or later, and 26% do not expect to get there until 1Q22 or later (mostly Retail/Wholesale, Manufacturing, and Services).

Back in May, 32% of CFOs expected to be back to a pre-crisis level of operations by the end of 2020, and 42% said so in August. Now, just 18% say so. Fifty-seven percent expect to reach the milestone in 2021 (mostly in the second half of the year), and 26% say 2022 or later.

Healthcare/Pharma, Financial Services, and Energy/Resources were the most likely to expect normal or higher operating levels by the end of this year. Technology was notable for all CFOs expecting a return to normal by 3Q21.

On the other hand, 43% of Retail/Wholesale CFOs do not expect pre-crisis levels until 2022 or later. Manufacturing and Services were also relatively pessimistic at 33% and 29%, respectively.

Please note: Industry sample sizes vary markedly and the means are most volatile for the least represented industries. Due to a very small sample size, T/M/E was not used as a comparison point this quarter.

Special topic: 2021 expectations

Company expectations

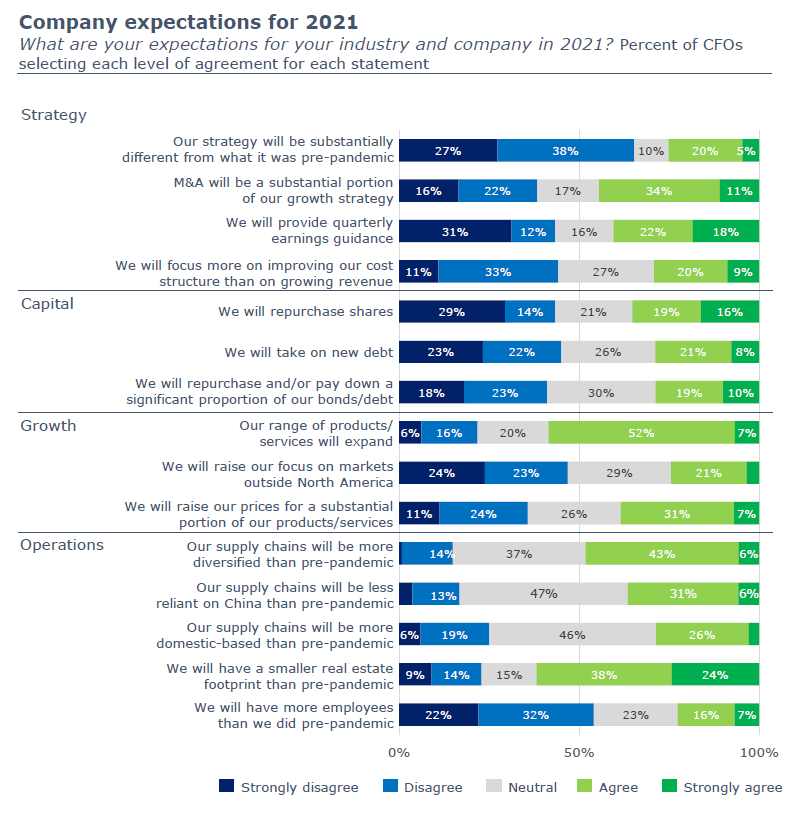

CFOs mostly say their companies’ 2021 strategies will not be substantially different from pre-pandemic, but there is a general trend toward M&A, broader offerings, a smaller real estate footprint, and more diversified supply chains. Other expectations vary greatly by industry.

Just 25% of CFOs say their 2021 strategy will be substantially different (Retail/ Wholesale is highest), and most cite a focus on revenue over costs (Energy/Resources is the exception). Forty five percent say M&A will be a key strategy (led by Healthcare/Pharma), and more expect not to provide quarterly earnings guidance than to do so (Technology is the most notable exception).

When it comes to growth, CFOs overwhelmingly say their range of offerings will expand, and relatively few say they will focus more on markets outside North America. Industries are largely split on raising prices.

From a capital perspective, CFOs mostly say they will not repurchase shares, take on new debt, or reduce debt (Technology is the main exception for repurchases and reducing debt). When it comes to operations, CFOs mostly say their supply chains will become more diversified and less reliant on China but they are largely split on becoming more domestic based. They overwhelmingly expect a smaller real estate footprint and to not have more employees.

Note that industry sample sizes vary and that results are volatile for the smallest. Due to a small sample size, T/M/E was not used as a comparison point.

Special topic: 2021 expectations

Macroeconomic expectations

About three quarters of CFOs expect the US economy to improve in 2021, with high expectations that a COVID-19 vaccine will bolster it by mid year; the outlooks for Canada and Mexico are also positive, but few expect economies to grow faster over the next five years than pre-pandemic.

On the plus side, 76% of CFOs expect the US economy to improve in 2021—reassuring but not surprising given how it fared in 2020. Nearly 70% expect a vaccine to bolster the economy by mid year. The less good news is that only 19% expect the economy to grow faster over the next five years than pre-pandemic—when the economy was slowing.

Perceptions of Canada are similar, with 62% expecting improvement in 2021, 15% expecting faster than pre-pandemic growth, and 69% expecting a vaccine to bolster the economy by mid-year. As for Mexico, 47% expect improvement, 22% expect faster growth, and 55% expect mid year vaccine benefits.

Two thirds expect strong consumer spending in 2021 (43% last year), and 63% expect strong business spending (22% last year). Only 54% of CFOs expect labor costs to rise in 2021 (84% a year ago), but 47% expect oil/fuel prices to increase (up from 25%). Only about one quarter expect inflation to be substantially higher.

Note that industry sample sizes vary and that results are volatile for the smallest. Due to a small sample size, T/M/E was not used as a comparison point.

Special topic: 2021 expectations

Capital markets expectations

CFOs mostly expect rates to stay low (but are fairly split ) and expect bond yields below 2%. They expect the renminbi to gain on the US dollar and for its use as a trading currency to rise substantially; expectations for the euro and digital currencies rose as well.

CFOs were right last year when they did not expect the federal funds rate (then 1.5%) to end higher in 2020, and also when few expected negative rates. With the rate now just 0.25%, they mostly still do not expect higher rates (although there is substantial proportion who do) and just 6% expect negative rates. They were also right about bond yield/s. With the 10-year bond yield at 1.8% a year ago, 67% expected rates to remain below 2%. Now, with the yield having slid to about 0.8%, 60% expect rates to stay below 2%.

CFOs were not as right about the S&P 500 when they were split on whether or not it would go above 3,000. With the index now above 3,500, nearly 60% expect it to be higher by the end of the year—even though 80% also say it is currently overvalued.

In a shift from a year ago, CFOs have become more likely to expect the euro and renminbi to strengthen against the US dollar. They also mostly expect the renminbi’s use as a trading currency to increase, and for use of digital currencies for business transactions to rise.

Note that industry sample sizes vary and that results are volatile for the smallest. Due to a small sample size, T/M/E was not used as a comparison point.

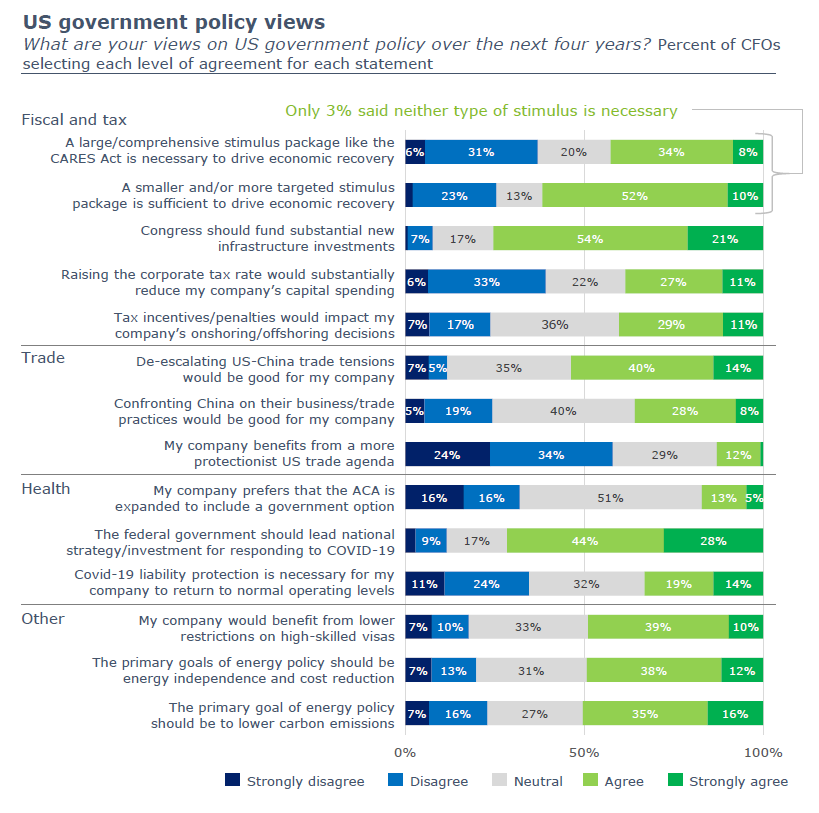

Special topic: Government policy views

Views on possible government policy changes over the next four years

CFOs overwhelmingly support a stimulus package, infrastructure investment, de escalating US-China trade tensions, less protectionist trade, and the federal government leading a COVID-19 response. Industry differences are substantial.

CFOs indicate a bias toward a smaller, targeted stimulus package over a large, comprehensive package like the CARES Act. They are largely mixed on whether higher corporate tax rates would reduce their capital spending and on whether tax incentives would influence their on/off shoring decisions. They overwhelmingly support funding of infrastructure investments.

When it comes to trade, the vast majority of CFOs say protectionist policy is not beneficial, and most prefer de escalation of US China trade tensions. More than one third, however, say confronting China on their trade practices would be good for their company.

CFOs overwhelmingly say the federal government should lead strategy and investment in response to COVID-19. They are mixed on the need for liability protection, and more do not support expansion of the ACA to include a government option than do support it (but more than half are neutral).

When it comes to energy policy, CFOs are split on whether its purpose should be energy independence and cost reduction, or lower carbon emissions even within industries. Nearly half say their company would benefit from lower restrictions on high skilled visas.

Special topic: Hopes for Washington

Hopes for Washington over the next four years

CFOs’ hopes for Washington center largely on cooperating to get important things done and unifying the country with moderation, transparency, and decency.

CFOs voiced very strong hopes for improvement in Washington’s accomplishments and tone. Nearly two thirds mentioned hopes related to bipartisanship, cooperation, and compromise—with a heavy focus on the desire to get important things done for the good of the country and economy. More than half expressed hopes for strong leadership and unification, with less divisiveness, more transparency and stability, more civility, and more moderation.

As for specific policy hopes, CFOs voiced strong concerns about possible anti business policy (including tax hikes and new regulation) and hopes that divided government would prevent it. They also mentioned desires for better policy consistency and clarity—especially around international relations and trade policy.

Some also mentioned the hope that Washington would manage longer term issues like fiscal policy, the national debt, entitlements, and infrastructure. Some also mentioned hopes for addressing climate issues, international relations, and immigration.

The complete publication, including appendix, is available here.

Print

Print